John Reade

@JReade_WGC

Followers

11,289

Following

1,234

Media

3,562

Statuses

11,000

Market Strategist at the World Gold Council

City of London, London

Joined August 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 514537 Tweets

Baba

• 116859 Tweets

Valencia

• 80399 Tweets

Abeg

• 77510 Tweets

Peruzzi

• 76169 Tweets

Nancy

• 69103 Tweets

Madonna

• 59256 Tweets

Wetin

• 58105 Tweets

Francis

• 53659 Tweets

Burna

• 49641 Tweets

Lewandowski

• 49185 Tweets

Rock in Rio

• 48120 Tweets

Araujo

• 46143 Tweets

Seinfeld

• 42040 Tweets

Jesus is King

• 39713 Tweets

Katy Tur

• 30231 Tweets

#WWERaw

• 26600 Tweets

Grammy

• 25632 Tweets

Luciano

• 16755 Tweets

ANA CASTELA NO RIR

• 14944 Tweets

PRE SAVE FOI INTENSO

• 14691 Tweets

#WWEDraft

• 10555 Tweets

カレンダー通り

• 10362 Tweets

Last Seen Profiles

In case you missed it, our Full Year 2017 gold demand trends report was released yesterday

#GDT

10

75

2K

China

#gold

The SGE 9999 premium has widened out even further overnight and is now above 6%.

I've never seen moves like this and I've been tracking the Shanghai Gold Exchange since it started...

75

335

1K

Something is up with

#gold

in China.

This chart shows the international gold price denominated in CNY compared to the domestic price of the 9999 contract on the Shanghai gold exchange.

This divergence is unusual.

38

108

468

India is expected to be one of the fastest-growing countries in the world in regards to economy in 2018, expanding at an even faster rate than it did between 2012-2014. Read more of my latest

#GoldInvestor

piece here:

11

65

226

Great chart from the Financial Times on inflows into

#Silver

ETFs. Unprecendented inflows on Friday and following on from large inflows on Thursday.

15

64

216

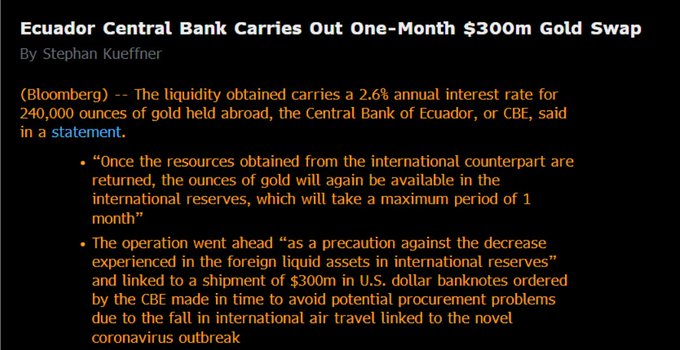

Despite the apparent quiet in the global OTC

#gold

market, THIS is interesting.

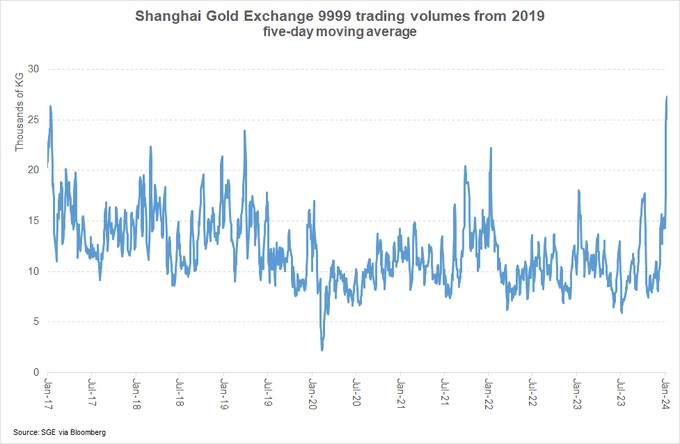

Turnover on the 9999 gold contract of the Shanghai Gold Exchange just hit a seven year high.

8

54

187

Gold at $1800/oz: a short thread.

Gold is trading just above $1800/oz after hitting a fresh 8-year high this week. Not much appears to stand in the way of

#gold

challenging the all-time high of $1921/oz set in September 2011.

10

47

174

With pleasure,

@JanGold_

@JReade_WGC

Can you make a chart showing the difference in price between gold traded on the SGE and SGEI (Au9999 vs iAu9999)?

0

2

14

8

35

175

Someone pointed out this to me over the weekend.

"

#Gold

on course for fifth red month in a row. The only worse streak over the last ten years was the six months down in a row that started April 2018. Post that down move gold went on an extended rally"

22

27

144

Despite the weakness in

#gold

over the past twenty-four hours, inflows into physically-backed gold ETFs continued yesterday.

2

20

122

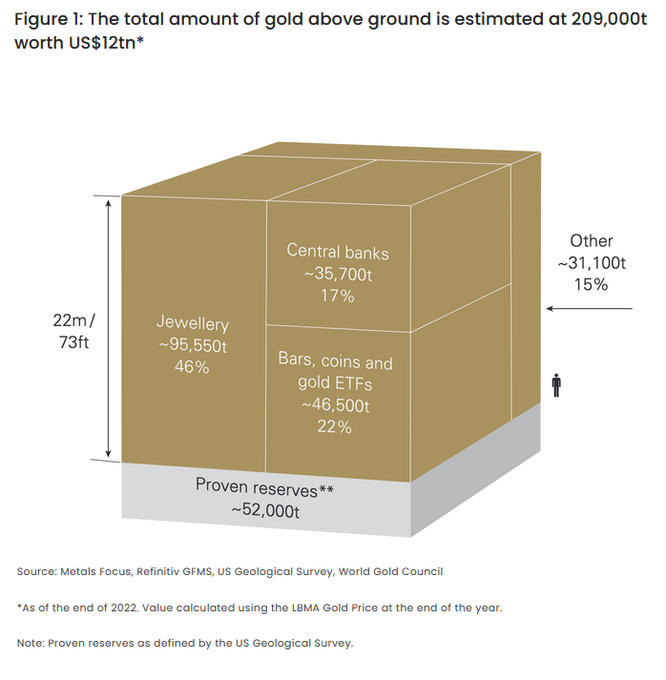

We published a new primer on

#gold

last week at the same time as

#golddemandtrends

"Gold Market Size and Structure"

3

45

121

This is a great 2 minute video about the gold in the Bank of England's vaults featuring comments on the enduring value of

#gold

from Victoria Cleland, Executive Director at the BoE and on bar details from Andrew Grice, Senior Manager Operations.

8

59

111

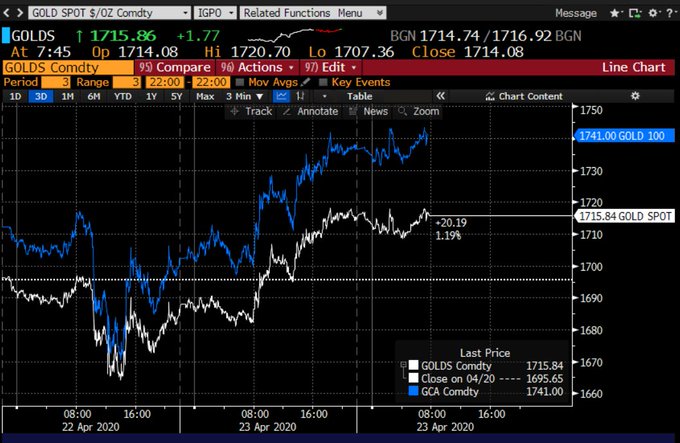

Comex

#gold

premium to OTC gold has climbed sharply as this chart from Bloomberg shows.

On 23/03 at 6am the EFP stood at about $6/oz. A day later, this has blown out ot more than $20/oz.

Due to shortages of investment gold and difficulties in shipping metal around.

13

49

103

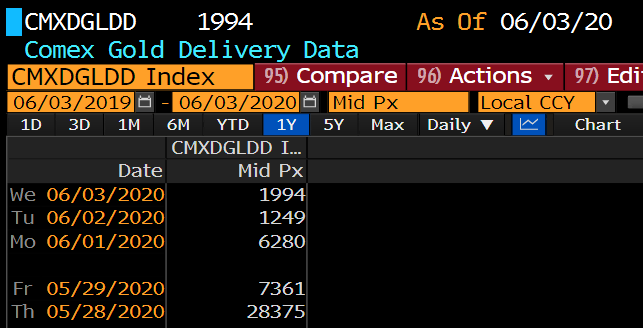

Its first notice day for GCQ0, the August Comex

#gold

future. Delivery notices for a record 32,732 lots were posted.

5

39

102

Gold: Last night Russian legislators submitted a draft bill to the Duma, the Russian Parliament, to remove the 20% VAT on investment

#gold

.

(The highest VAT on investment gold in the world)

If passed, we expect this to lead to a structural change in the Russian Gold Market.

4

48

100

Gold trading on the Shanghai

#Gold

Exchange has moved to a large premium to the international gold price. We've seen premiums before, but the current percentage premium is unprecedented.

5

11

96

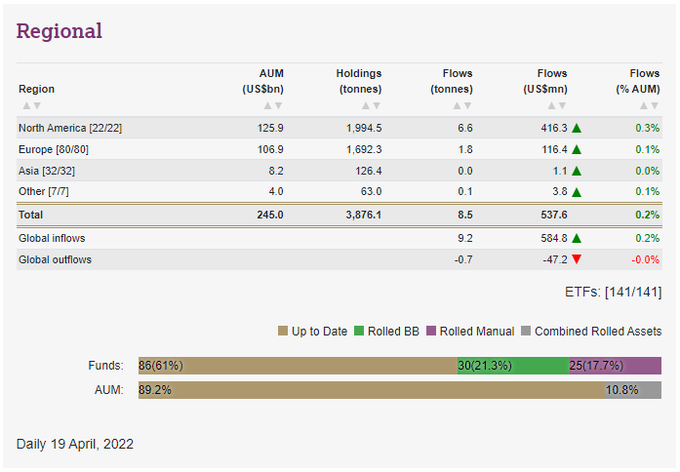

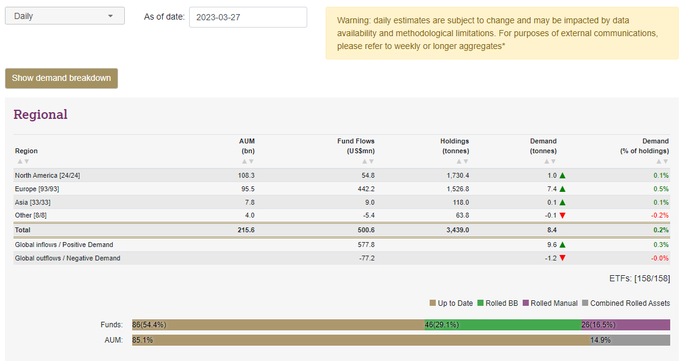

Physically-backed

#gold

ETFs saw inflows across almost all regions yesterday, with 8.4 tonnes of net inflows more than offsetting the small outflow I reporte d yesterday.

4

23

93

After two months of outflows,

#gold

-backed ETFs saw strong inflows yesterday, the first trading day of the year.

I meant to tweet this out earlier today but got distracted. Sorry.

5

20

90

I've been looking a bit more at the move in

#gold

in Asia on Monday morning.

Between 23:30 and 23:45 BST 17,538 contracts traded on Comex, low was $1677.90.

Between 23:45 to Midnight a further 7,825 contracts traded and 5,705 in the 15 minutes that followed.

13

30

87

Looking at the Comex futures price of

#gold

during today's plunge, volumes were high (for the less liquid time of the day).

The Comex low of $1677/oz was much below the OTC low reported by Bloomberg, suggesting that Comex futures liquidation was behind the quick move lower.

7

27

86

#Gold

has surmounted $1800/oz this morning with few fireworks (but a lot of excited tweets).

6

21

83

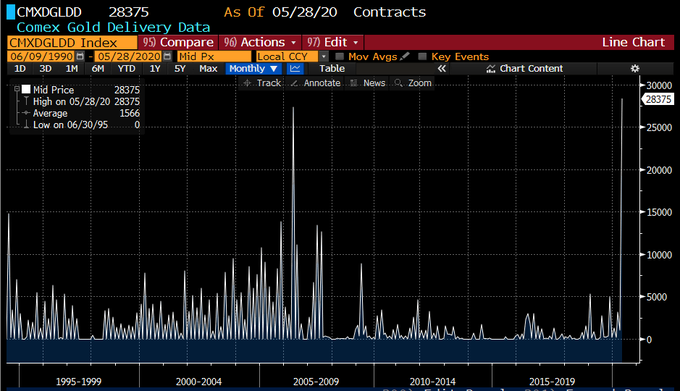

A stunning 28,375 lots of Comex Jun futures, representing 2.8 million ounces of

#gold

, were delivered into on Friday.

This appears to be the largest ever from what I can see on Bloomberg.

6

29

80

@sailorrooscout

And you’ve also been one of the most helpful, generous sources of science and empathy during the pandemic. Thank you for all you’ve done.

2

0

82

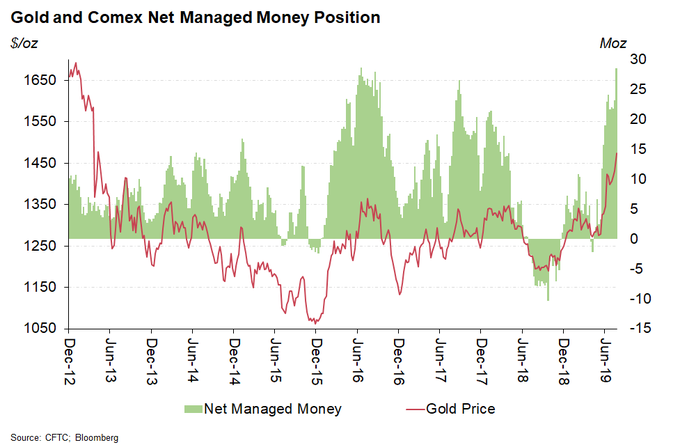

Bigger news today is the changes in Comex

#Gold

futures positioning reported late on Friday.

Net Managed Money long positions increased 176t or by 5.7 moz last week, moving from net short 36t to net long 176t.

5

24

81

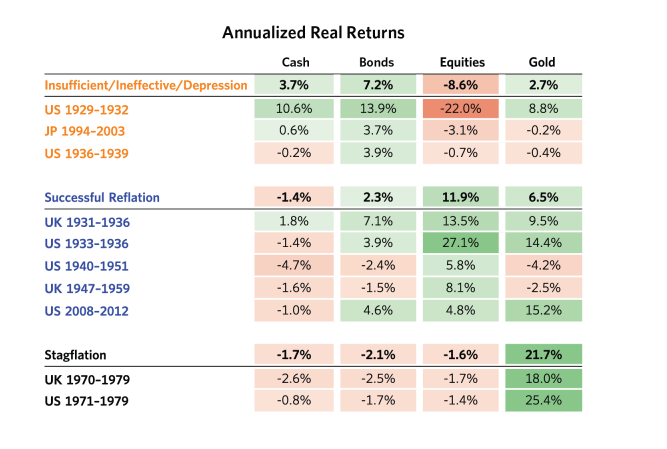

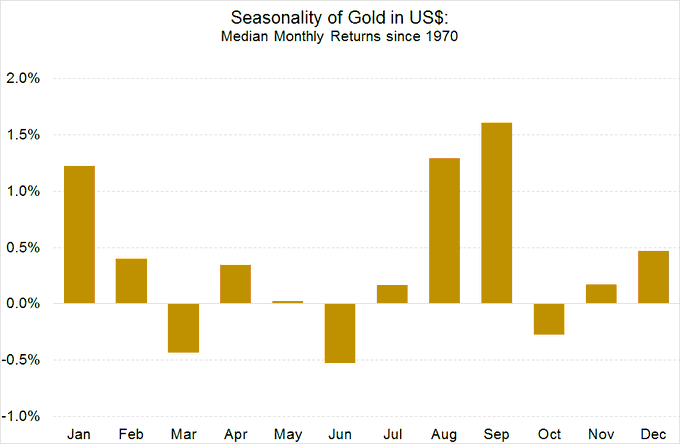

Some great charts in this paper on

#gold

from Bridgewater. Well worth a look.

(Thanks

@JGCCrawley

for flagging)

4

22

78

I hate it when I see a post or article on gold and its illustrated with a fake gold bar photo. Here is a great image of a 1kg gold bar from

@VoimaGold

which

@SamLaakso

shared with me.

Real images are so much more powerful. Thanks

7

15

79

#Gold

at an all-time high today in USD terms?

Or not?

Gold has traded much higher today and you may see headlines that it hit an all-time high in US dollars.

Although the active Comex future price hit an all-time high this morning, the spot (OTC) price did not.

7

14

76

Gold: After the news earlier that the National Bank of Poland bought a further 13 tonnes of

#gold

in October taking their purchases to 25t for the year, I thought I would refresh the list of central banks that had bought gold since the start of 2017:

(long-ish thread)

8

37

69

Another 1.1 million ounces of gold added to Comex

#gold

stocks yesterday.

Total now 17.04 million ounces.

16

22

67

I spent a couple of years on the spot FX desk at a bank and the trader I sat next to gave me one piece of advice about important economic numbers that has always stuck with me.

The first move is very often wrong and fairly quickly reversed.

#gold

6

16

72

The fact that banks still make comments like these show that they still use stupid models. A 15 sigma event is expected only once in 1.09e48 years, assuming a normal distribution. Which shows that returns aren't normally distributed, and the model is wrong.

4

25

70

@RobinWigg

Alternative interpretation: Over the past 50 years newspapers and journalists are responsible for making us all feel miserable.

Semi-serious question - could this be true because of the devastation the industry has faced through retrenchment.

2

2

71

@PayToPlayy

volumes are ok but not great on SGE, so there is evidently a shortage of metal to buy, which probably means that imports are being restricted.

But the enthusiasm of the buyers, prepared to pay so much for gold has really surprised me.

4

6

70

#Gold

ignored the tech sell-off yesterday, probably indicating that this was a stock / sector specific event, rather than anything more systemic.

Last around $1936/oz with a $0.75/oz bid-ask spread.

5

18

66

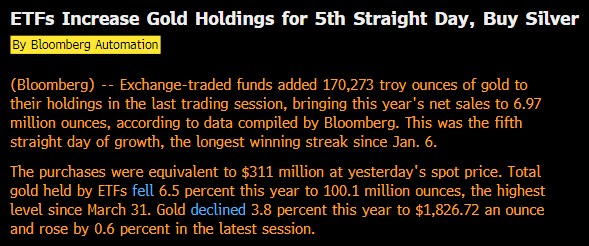

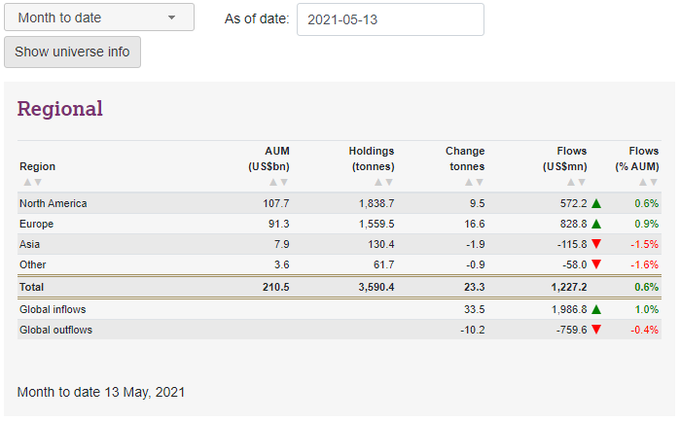

Sentiment towards

#gold

has changed of late, with Bloomberg's robots reporting 5 straight days of inflows into physically-backed gold ETFs.

Our mtd data shows inflows into European and US -listed products, with smaller outflows from Asian and Other instruments.

6

15

65

Gold: China PBOC adds

#gold

to its reserves for 4th successive month - Bloomberg.

Thanks to my colleague Mukesh Kumar for drawing this to my attention.

2

36

57

Shanghai Gold Exchange T+D turnover in August - literally off the charts (with 2 more trading days to go)!

Amazing how this contract has grown over the past 5 years and now a really important part of the global

#gold

marekt.

6

34

56

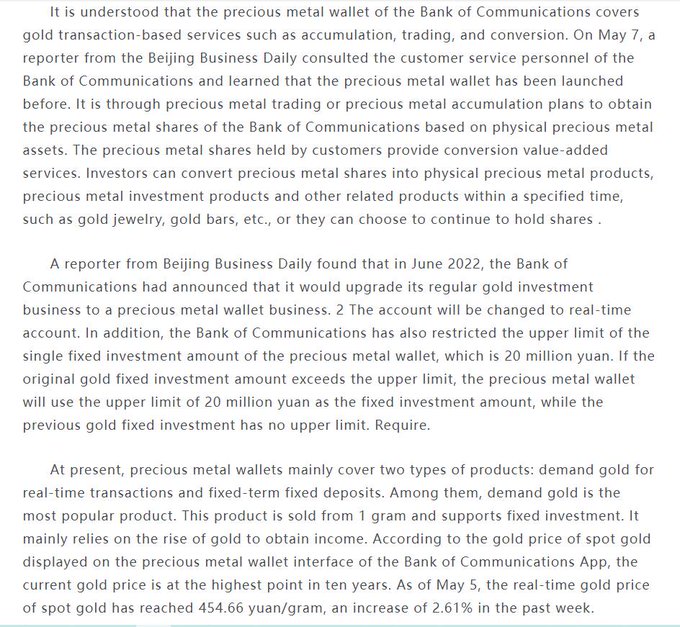

Interesting story about the recent (?) launch of RMB

#gold

accounts from large onshore Chinese banks.

@RayJiaGold

any thoughts?

11

11

57

Bloomberg's robots report that physically-backed

#gold

exchange-traded funds cut long positions by about 3 tonnes yesterday.

Contrast this with volumes traded on Comex yesterday, 62 million ounces or more than 1800t.

8

22

59

Investors make big bets on silver closing giant gap with gold.

@GrantMBeasley

featuring heavily in the

@hjesanderson

article on silver.

Known as The Devil’s Metal by some who trade it :-)

5

11

60

Although this article is short on details, it would appear that the Xiling mine already represented one of the biggest

#gold

discoveries of the past decade and it's just got about 200t bigger (in resources).

9

19

59

Comex

#gold

inventories, which recently broke through 30 million ounces, are at an all-time high (I only have data back to 1992,but I am confident they were much smaller before then).

I do wonder what's going to happen to all this gold: these NY stock levels are unprecedented.

6

23

61

@michaelmina_lab

Michael, am I right in saying these tests aren't generally available in the US?

Here in the UK they are free - either via post or from drugstores. Amazed the US isn't doing the same.

12

3

60

Gold: So here's something that caught my attention - a bit of a stealth rally in XAUEUR - gold denominated in euro - over the past few weeks, to take it to the highs of the year. A sign of underlying stength in

#Gold

?

7

26

57

Gold: Central bank buying of gold is becoming more and more diversified as this story about Hungary demonstrates. Thanks

@PopescuCo

for highlighting this.

1

24

54

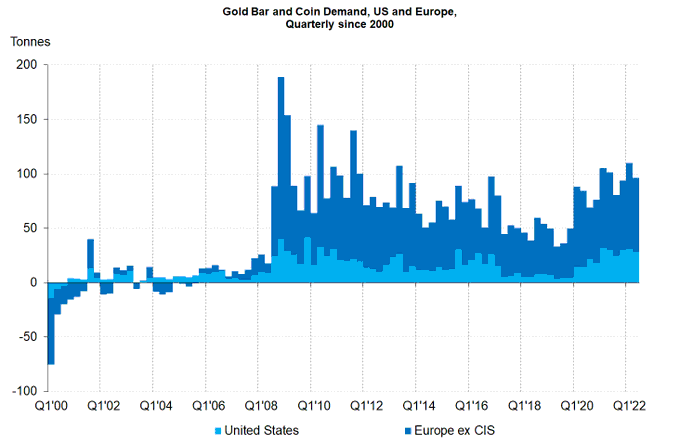

Tough quarter for

#gold

explained in GDT Q3-17. Drop in ETF inflows only partly offset by better bar & coin demand. 1/3

3

10

57

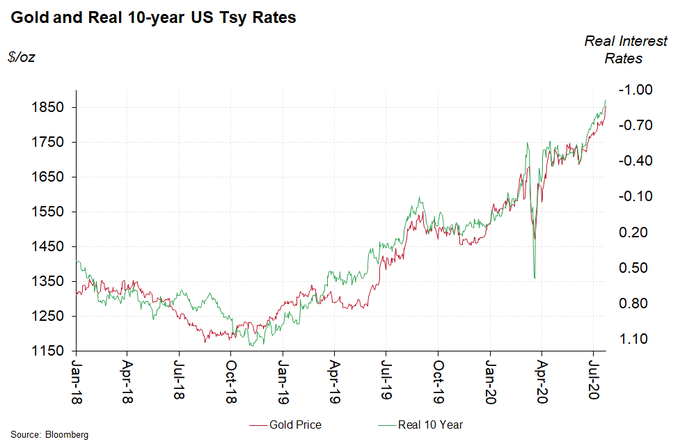

We can confirm, based on conversations with institutional investors, that very low - in some cases negative - government bond yields have triggered some long-term investment in gold.

Thanks,

@elerianm

Some signs that the rally in

#gold

reflects more than the usual drivers... e.g., a gradual structural shift among

#investors

re the role of gold in long-term asset allocations as a result of the very low yields on government bonds associated with central bank market interventions

43

204

651

3

13

56

@GrahamKritzer

Hopefully an email thanking you for teaching him and his class an invaluable lesson in personal finance.

😂😂😀

0

0

55

@BrynnTannehill

Born in 1965.

Traumatised when I was 4 or 5 by The Child Carcher from Chitty Chitty Bang Bang.

3

0

56

Gold: We look back to the failure of Lehman and how

#gold

performed around that time and in the years that followed.

5

15

52

Gold: I said earlier this year I wouldn't comment on every day of

#gold

ETF flows, but five days in a row of inflows is worth highlighting....

1

18

52

#Gold

hits another all-time nominal high ($2037/oz) but is well short of its real all-time high of about $2800/oz from 1980.

Read more in this investment update, released last week.

1

19

53

Gold: The National Bank of Poland bought 100t of

#gold

so far in 2019, according to this press release.

This is a BIG increase and compares to the 25.7t bought in 2018, which in itself was big news.

3

18

50

Real US Bond yields have headed lower (i.e. more negative) over the past 24 hours, helping

#gold

stabilise I believe.

3

18

53

Gold: Indian households own 24-25'000 tonnes of gold, accoring to work from

@GOLDCOUNCIL

quoted by our head of India

@SomPR_WGC

4

26

49

Russia’s central bank announced yesterday that it will suspend domestic

#gold

purchases on 1 April, with further decisions on gold to be made depending on market circumstances.

3

21

45

Gold: The PBOC has just announced that it added

#gold

to its holdings in February, marking the third month running.

3

31

48

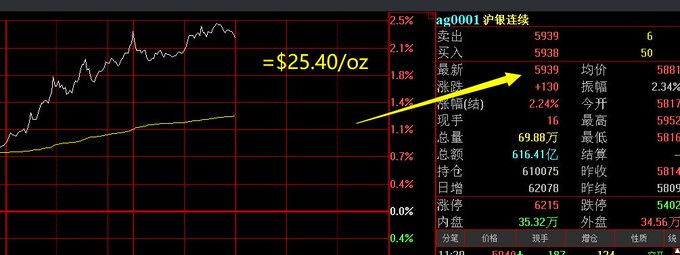

The active Comex

#gold

futures is trading at about $25/oz above the spot gold price. This is wider than yesterday after the move higher in gold.

2

15

48

For those tracking the SGE / China

#gold

(and silver) markets,

@oriental_ghost

is a great follow.

3

5

50

In fact, 2018 saw the highest level of annual net purchases since the suspension of dollar convertibility into

#gold

in 1971, and the second highest annual total on record.

2

19

46

GCQ0, the active Comex

#gold

future is trading at a premium of $17-18/oz to the spot (OTC loco London) gold price.

2

11

48

H1 net inflows into

#gold

-backed ETFs totalled 734t, more than the the largest annual inflows of 646t in 2009.

More than the record annual central bank buying seen in 2018 and 2019.

Equivalent to about 45% of H1-2020 mine supply.

ETFs now hold more gold than the Bundesbank.

3

19

49