Haonan Zhou

@Haonan_Zhou

Followers

895

Following

1,322

Media

23

Statuses

403

Econ at Princeton, HK soon. International finance & macro. Baseball.

Princeton, NJ

Joined April 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Arsenal

• 431716 Tweets

#PLdaGloboNão

• 384508 Tweets

Tottenham

• 292257 Tweets

Spurs

• 217699 Tweets

Man City

• 173182 Tweets

Premier League

• 146204 Tweets

Manchester City

• 102111 Tweets

Maynez

• 88751 Tweets

Champions League

• 85753 Tweets

Guardiola

• 78416 Tweets

#TOTMCI

• 75323 Tweets

Haaland

• 73810 Tweets

Ortega

• 73582 Tweets

WNBA

• 65111 Tweets

Aston Villa

• 58639 Tweets

#ابراهيم_المهيدب

• 52919 Tweets

Ange

• 49008 Tweets

Alito

• 48425 Tweets

Menem

• 43507 Tweets

Arda Güler

• 35002 Tweets

توتنهام

• 30457 Tweets

Foden

• 27240 Tweets

Harrison Butker

• 27071 Tweets

Arteta

• 26212 Tweets

Everton

• 23865 Tweets

Ederson

• 23174 Tweets

Doku

• 19998 Tweets

السيتي

• 19281 Tweets

#TierraDeNadie10

• 18946 Tweets

Alice Munro

• 18381 Tweets

ارسنال

• 17646 Tweets

Courtois

• 17553 Tweets

Valverde

• 15454 Tweets

Agatha All Along

• 15382 Tweets

Unai Emery

• 15107 Tweets

Rodrygo

• 13934 Tweets

Lunin

• 13928 Tweets

4 ANOS DE BOIADEIRA

• 12580 Tweets

Akanji

• 11293 Tweets

West Ham

• 10933 Tweets

Etihad

• 10298 Tweets

Last Seen Profiles

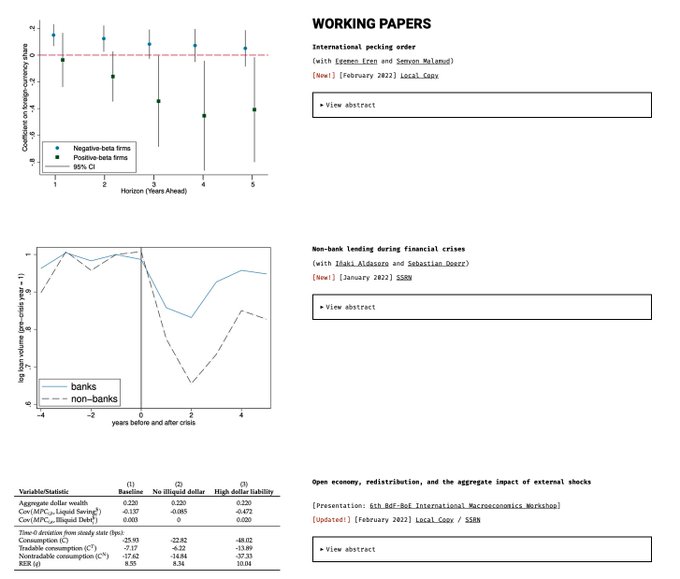

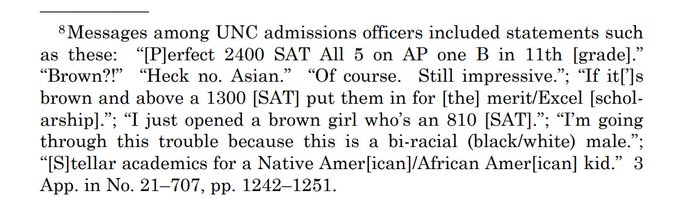

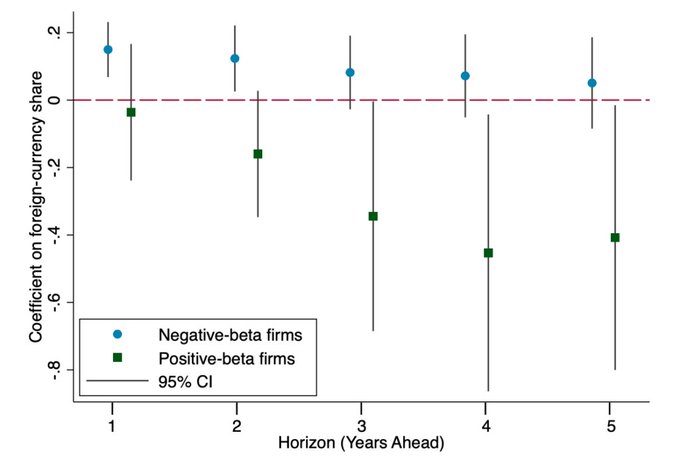

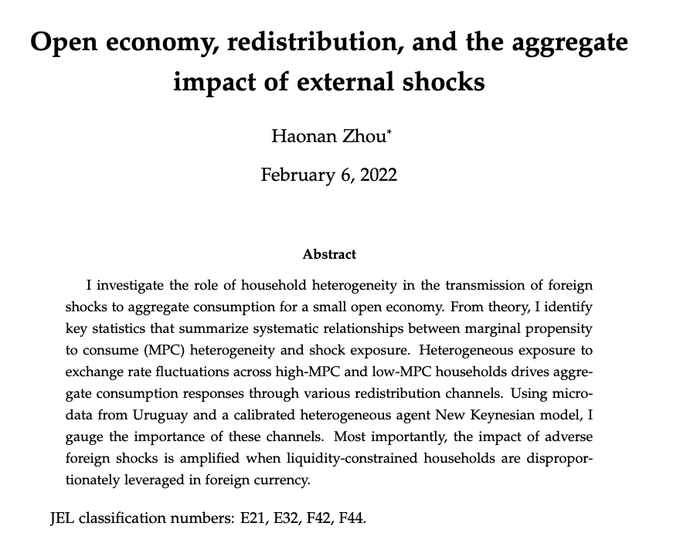

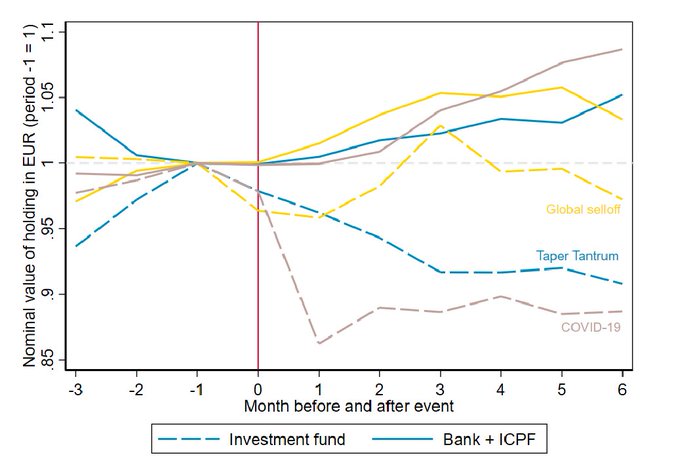

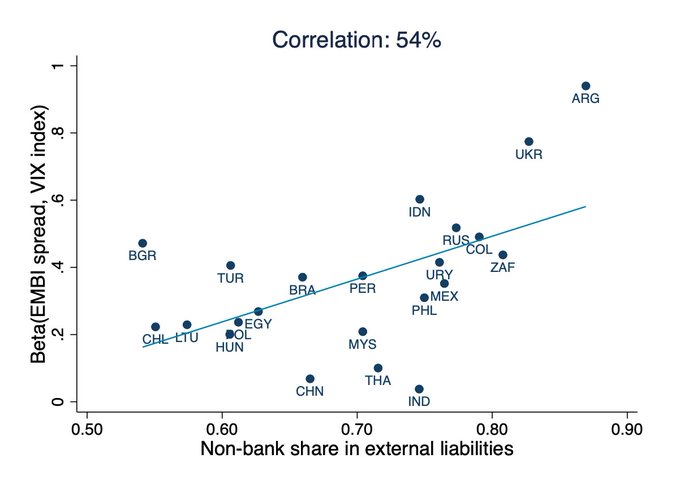

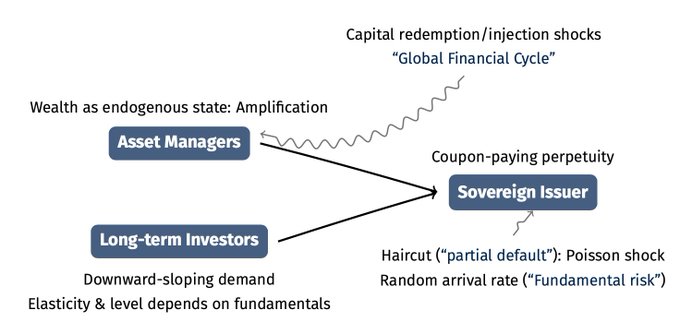

Yes, I have a paper for the job market and I want to talk about it (a long 🧵 follows). tl;dr: foreign investor composition is a useful metric when we think about emerging markets' (EM) resilience against global financial shocks. Happy to chat more :)

.

@Haonan_Zhou

’s job market paper studies the role of foreign investor composition in explaining emerging market economies’ sensitivity to shifts in global risk factors.

2

10

52

2

27

99

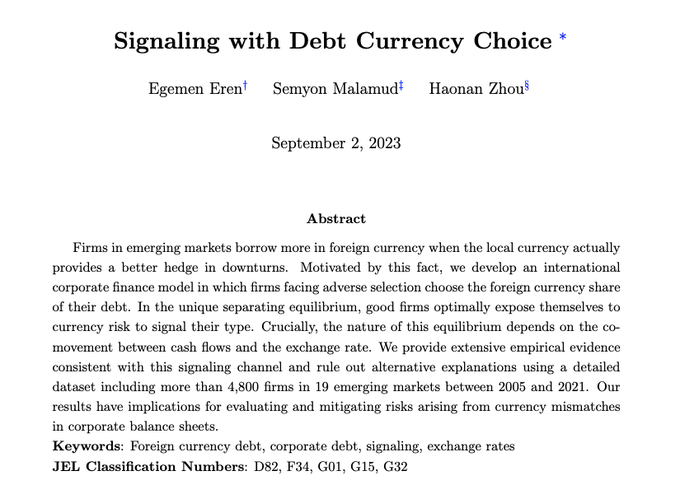

We've won a thing! Thanks to the award committee at CICF 2023 for recognizing our paper with

@egemeneren87

and Semyon as one of recipients for the Best Paper Award.

3

2

34

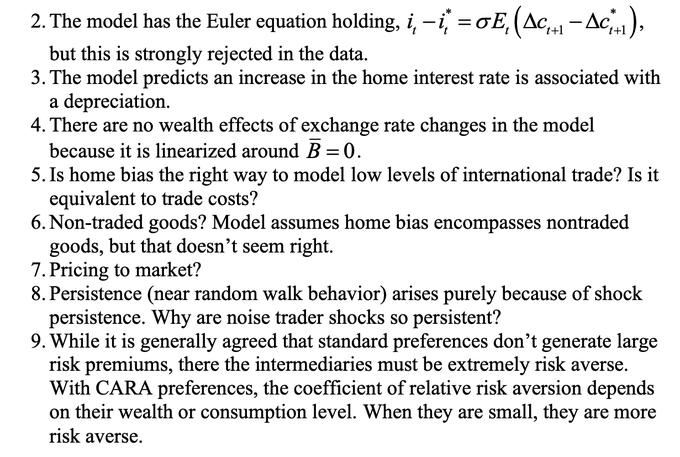

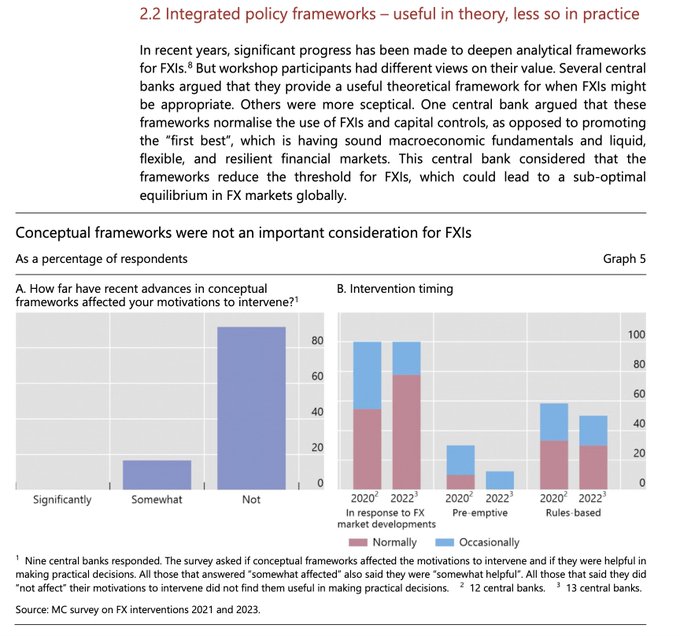

What a wonderful talk! We've really made a lot of progress since Mundell-Fleming, and there's so much more to do in this field. Some topics of personal interest (which I think deserve their places in the IPF):

It is time for "New Foundations for International Macro Policy" & to update our textbooks. You can watch my lecture here:

@Susan_Athey

's kind introduction starts at minute 34 & my lecture at minute 40.

21

124

815

1

3

23

Super happy to start the day with this great news. Congrats to one of the nicest in the profession

@itskhoki

!

0

0

8

Oh no… Alesina-Dollar and Burnside-Dollar 2000 were among the first batch of papers that brought me to the discipline.

0

0

9

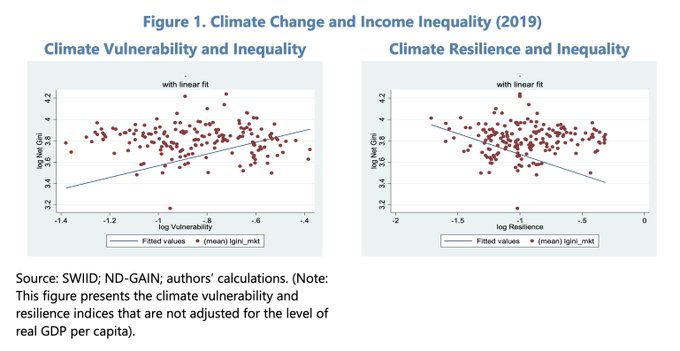

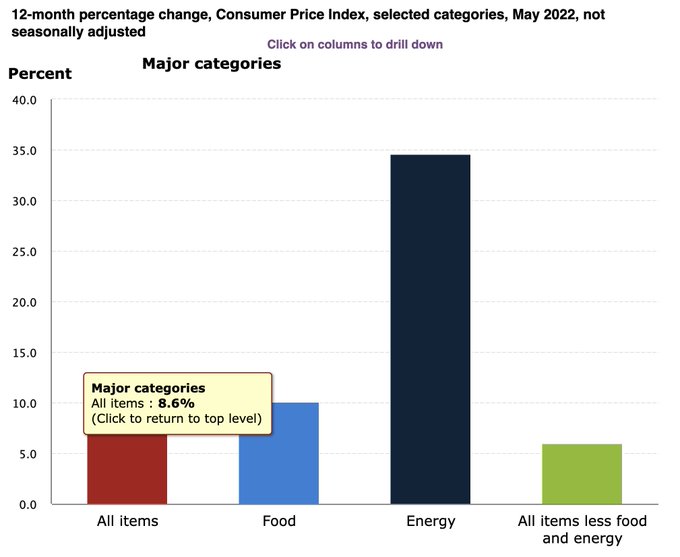

I know it's a trendy topic and you are supposed to say nice things about it blah blah blah. But I just don't get it from this graph...

0

0

8

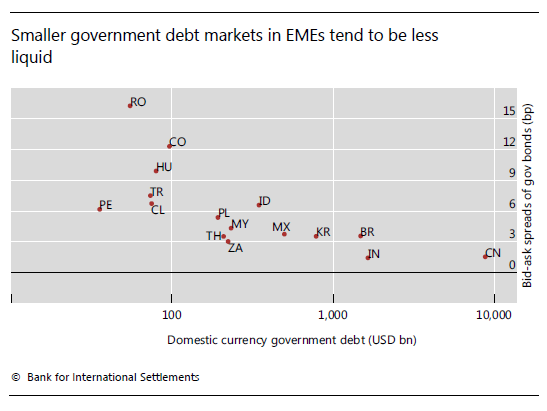

Great chapter!

Smaller

#EmergingMarket

government debt markets tend to be less liquid. Developing liquid and resilient markets for government debt is a key policy objective

#BISQuarterly

0

6

28

0

1

7

Congrats! :)

Congratulations to Ph.D. candidate

@ZiangLi_

on his outstanding job market paper and subsequent award of the 2023 Ben Bernanke Prize in Financial and Monetary Economics!

Learn more about this award and Li's research:

@MarkusEconomist

1

0

58

0

0

7

great paper!

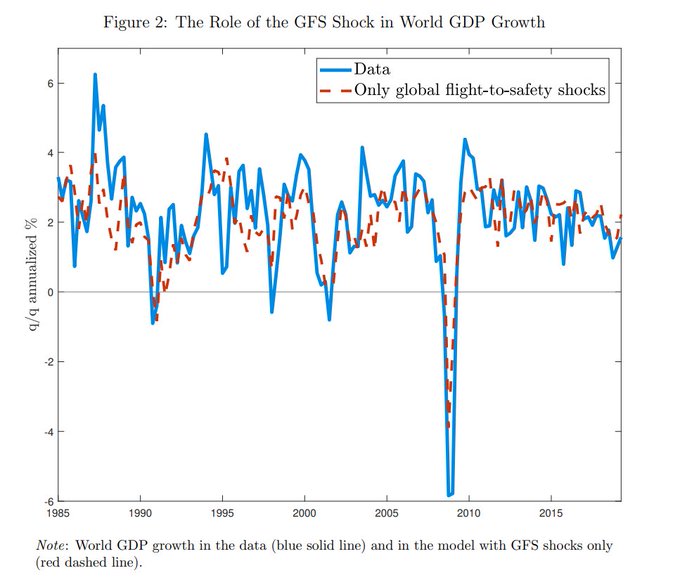

Global flight-to-safety shocks are the most important shocks driving world GDP growth in an estimated DSGE model:

#IFDPPapers

0

14

44

0

2

5

Here's my podcast debut. Thanks for listening :)

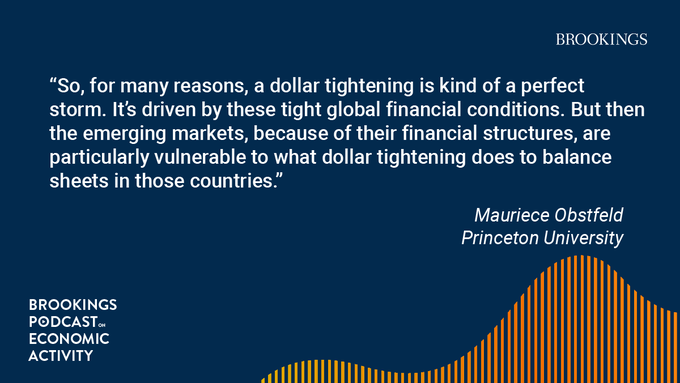

A strong dollar can lead to global risk aversion and increased liabilities for emerging markets who hold debt in dollars.

“It’s kind of a double whammy for them,” says Mauriece Obstfeld on the latest

#BPEApodcast

->

0

1

4

0

1

7

Yes! Great work! Congrats

@rafaguntin

!

1

0

6

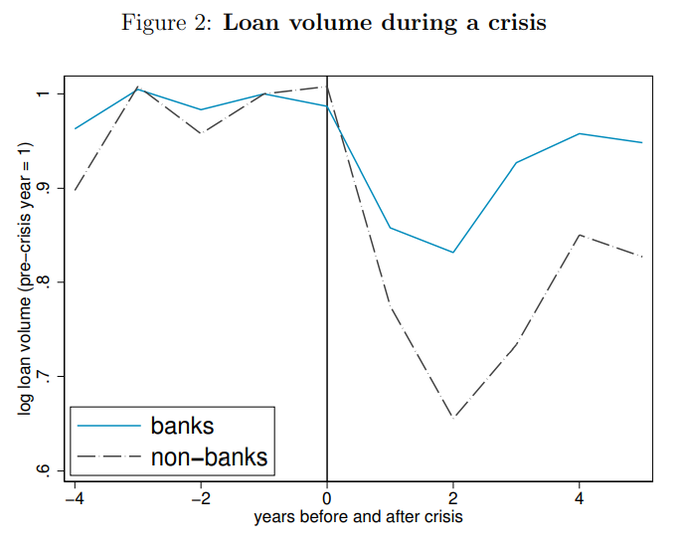

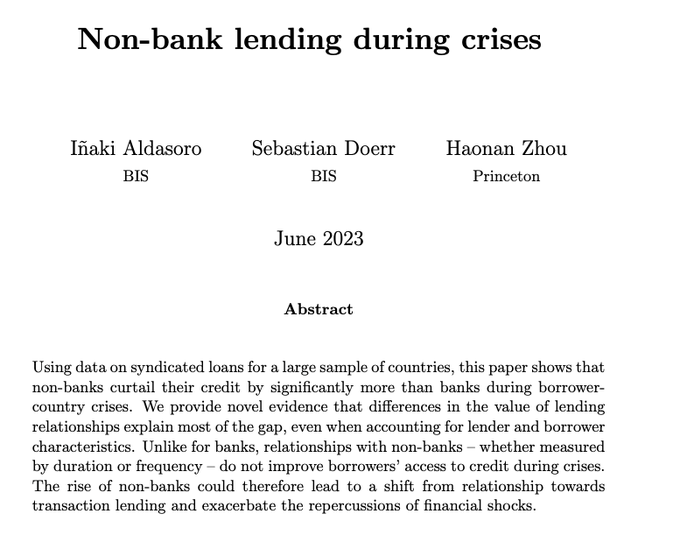

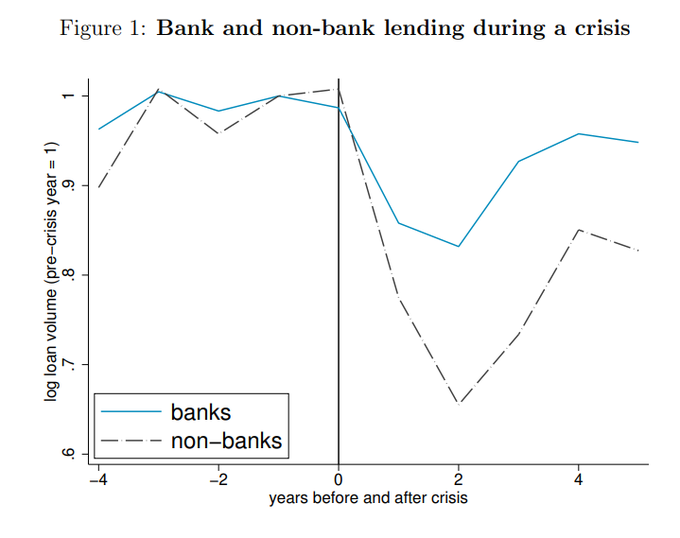

Paper 1: With my wonderful coauthor

@i_aldasoro

and Sebastian Doerr, we look at how non-banks act as significant shock amplifier in the syndicated lending market:

New paper alert!!

**Non-bank lending during financial crisis**

(joint w/ S Doerr &

@Haonan_Zhou

)

A large literature studies how bank lending contracts around crises; we show that non-banks contract their syndicated lending by over 50% more than banks

Comments welcome!

1/

8

25

135

1

1

6

Come to

#SFSCavalcade

to hear my coauthor talk about signaling of emerging market firms through currency choice this afternoon (Capital Structure track), and me discussing China's internationalization of the bond market tomorrow afternoon (IAP track), both starting at 1:30!

0

0

6

I struggle to understand this. Is this suggesting: 1) classic macro topics like inflation / growth affect only the very rich? 2) Those omitted from this year’s P&P (trade etc) aren’t relevant to 95% of the ppl? I’m not an old guard, not even a newbie. Just sincerely curious.

1

1

4

Had a lot of conversations on this issue during last week's BPEA meeting. Make sure to read this great piece by Maury.

0

0

4

@p_ganong

I guess it depends on the inputs and the underlying model, but in a different context Yacine has a suite of Matlab tools for estimating diffusion processes via MLE: . Obviously not applicable to KMV's estimation but might be useful.

1

0

3

@MoritzLenel

Will missing our meeting and the reading group! Thanks Moritz, for so many things…

1

0

4

Mark in a suit and looking good!

Mark Aguiar’s plenary

@SEDmeeting

, finding policies that are Pareto improving in the presence of the empirically rich micro heterogeneity

1

9

103

1

0

3

Well. Technical issues aside (per my discussion with others the model’s not solved properly), what bothers me the most is: Twitter is the perfect place to make a fuss, but it’s super distracting because the real place for having these conversations is the peer review process.

1

1

3

Check out the thread, as well as the QR piece —

🚨New

@bis_org

WP out!🚨

*Non-bank lending during crises*, joint with Sebastian Doerr and

@Haonan_Zhou

tl;dr: non-banks curtail credit by significantly more than banks during crises & the value of lending relationships explains most of the gap

👇thread

7

24

101

0

0

3

A couple of non-technical summaries of our recent works (1/2) --

#SUERFpolicybrief

"A friend in need is a friend indeed? Nonbanks and lending relationships during crises" by

@i_aldasoro

(

@BIS_org

), Sebastian Doerr (BIS), and

@Haonan_Zhou

(

@Princeton

)

#NonBanks

#SyndicatedLoans

#FinancialCrises

#FinancialStability

#RelationshipLending

0

1

2

2

0

2

@momin_rayhan

@MarkusEconomist

It's incorporated in the loss function you give to the network. Say you want to impose a Dirichlet condition. You just pick some points on the boundary and tell the neural network to minimize the distance between the solution and the boundary condition you specify.

1

0

2

Adding some reactions to a thought-provoking piece by

@pogourinchas

and Chang-Tai Hsieh on

@ProSyn

: 1/n

1

0

1

The comments in Luis' tween simply miss the point. It's a second-order issue that a labor paper is categorized as gender-related (hey, even the P&P thinks that way!). It's a first-order thing when topics relevant to the economy are simply missing. Period.

1

0

1

First Libra and now this. Let’s admit one thing: some people get lucky and get licensed to throw around money achieving nothing. What does this inform us on optimal policy design against misallocation, inequality and the macroeconomy?

I wanted to share that we are starting a new company called

@lightspark

to explore, build and extend the capabilities and utility of

#Bitcoin

. As a first step, we’re actively assembling a team to dive deeper into the Lightning Network. (1/3)

671

607

5K

0

0

1

With all respect, I don’t understand this logic. Give me a primitive shock that the central bank is responding to. Simply calling shocks demand or supply fluctuations is not structural at all…

2

0

2

@momin_rayhan

@MarkusEconomist

Also in practice I find for highly nonlinear problems you need a very small timestep (potentially lower accuracy) for finite diff (this could also apply to MCA and Hansen-Khorami-Tourre). Handling boundary conditions in two dimensions or more is also tricky for finine diff.

1

0

2

Wow this is bold and I’m amazed at one’s courage to tweet something like this. I don’t understand banking, but I’ve at least read something published less than 40 years ago and I know Brunnermeier-Pedersen and Brunnermeier-Sannikov…

0

0

2

@momin_rayhan

@MarkusEconomist

Here the prereq would be methods applicable to high-dimensional problems. You can do finite difference on adaptive sparse grids (but then the naive upwinding still violates Barles-Souganidis. See Schaab-Zhang paper)

1

0

2

@momin_rayhan

@MarkusEconomist

re: timestep -- you want your algorithm to converge fast, so you can't really pick a dt that's too tiny. On boundary conditions: most off-the-shelf algorithms for 2d problems (like d'Avernas-Vandeweyer) assume away boundary conditions.

2

0

1

My question is simply what was driving this institution (disclaimer: where I used to work) to come up with such a paper. It's not like they are bad economists and it's not like it's the official position... but still I find it absurd.

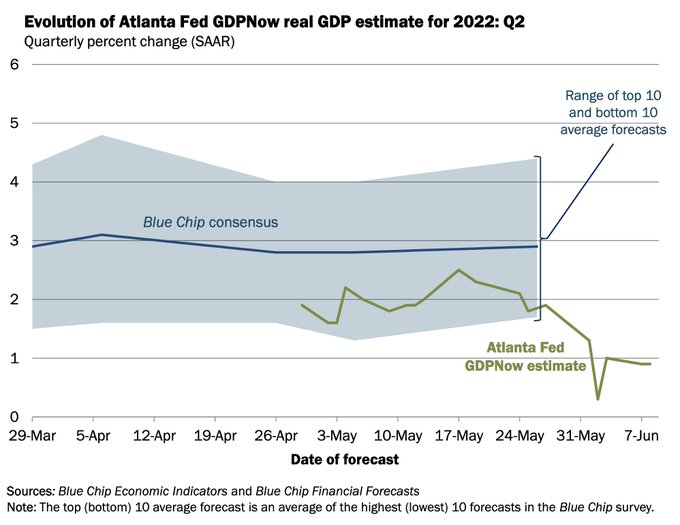

The first question you should ask when you see something like this is: "If increasing interest rates work by cooling demand, how much of inflation is caused by demand?". If "demand" is not an option, you should not pass Go and proceed directly to causality jail. 1/2

#econtwitter

7

39

171

0

0

1

@MissChangHe

@PrincetonEcon

Thanks Chang! Really enjoyed reading your great JMP. Look forward to meeting you soon after the market :)

1

0

1

@stevehouf

Agree, although I guess if you’re a producer of the literature it’s quite hard to use it well if you only know the tool but not where it comes from

1

0

1

After reading this I’m more convinced: this kind of wallet should just do fiat because apparently the guy running this doesn’t know what he’s talking about

0

0

1