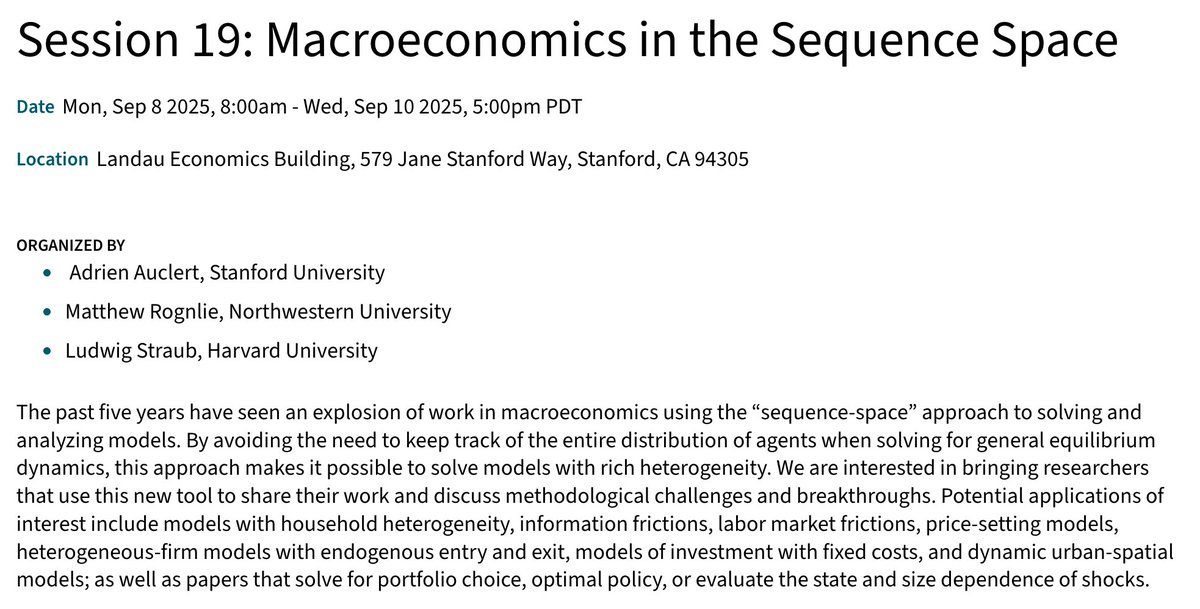

Adrien Auclert

@a_auclert

Followers

5K

Following

1K

Media

19

Statuses

352

Macroeconomist at @Stanford

Stanford, CA

Joined April 2016

🚨If you are a macroeconomist using the “sequence-space” to solve your models, come share your work at this SITE conference, September 8-10! . Both substantive and methodological contributions are welcome. The deadline is this Monday, June 16!. with @ludwigstraub and Matt Rognlie

1

24

124

RT @a_auclert: 🚨If you are a macroeconomist using the “sequence-space” to solve your models, come share your work at this SITE conference,….

0

24

0

RT @SorryToBeKurt: Any Econ PhD students at Harvard (or elsewhere in the U.S.) worried about visa status, the @IIES_Sthlm has openings for….

0

63

0

RT @nberpubs: Tariff shocks can lead to short-run recessions, as consumers both at home and abroad postpone purchases. These recessions out….

0

48

0

RT @stevehou0: Great thread aligning a macro model with the latest GDP data! Times like this make you appreciate that data isn’t necessaril….

0

2

0

And this is just the case without retaliation. As our paper shows, typically when other countries retaliate, GDP declines a lot more and the trade balance may not even improve going forward. More on the paper in this excellent thread by @ludwigstraub .

New paper on recent US tariffs with Matt Rognlie and @a_auclert. Our focus: effects of temporary increases in tariffs (“tariff shocks"). Three Qs:.1 Will tariffs lead to a recession?.2 Will they reduce the trade deficit?.3 Why are they not appreciating USD? (as in std theory). 🧵

1

1

6

It is possible that the inventory investment numbers in the BEA release are underestimated. @ChrisGiles has also pointed out that these is a lot of guesswork involved in estimating inventories (while the trade data is probably comparably more reliable).

Before getting too excited about US GDP contracting at an annual pace of 0.3% in the first quarter. Remember that much of the data is guessed. In particular the rise in inventories in March is just an estimate. So US GDP might be up or down a bit or a lot

1

1

3

In our model, this is because businesses rush to import to increase their inventories before tariffs come online. This means that the rise in imports is offset by an increase in inventory investment for GDP. As @axios described in a recent macro newsletter:

1

1

4

In our new paper with Matt Rognlie and @ludwigstraub , we look at what a standard macro model with inventories implies for macro aggregates ahead of expected tariffs (assumed=10%). Our model does predict a trade balance deterioration! But GDP seems inconsistent with the data?

1

0

4

RT @cepr_org: New CEPR Discussion Paper - DP20165.The Macroeconomics of Tariff Shocks.@a_auclert @StanfordEcon, Matthew Rognlie @NUEconomic….

0

5

0

RT @mtkonczal: Obviously technical, but this equation (1) on the push-and-pull of relevant variables determining whether tariffs cause a re….

0

5

0

RT @int_mon_econ: Another super relevant paper on tariffs!. "The Macroeconomics of Tariff Shocks" by Adrien Auclert, Matthew Rognlie, and L….

0

50

0

RT @ludwigstraub: New paper on recent US tariffs with Matt Rognlie and @a_auclert. Our focus: effects of temporary increases in tariffs (“t….

0

183

0

RT @SorryToBeKurt: 🚨 Call for Papers 🚨.Now accepting submissions for the 17th Annual Normac conference.Keynote @a_auclert .Juniors in macro….

0

26

0

RT @AmbrogioCB: 🚨 We're organizing a one-day workshop on the use of heterogeneous agent models in central banking 🚨. The keynote speaker wi….

bankofengland.co.uk

London, 22 September 2025

0

24

0