Ziang Li

@ZiangLi_

Followers

701

Following

879

Media

7

Statuses

46

🔜 Finance Assistant Professor @ImperialBiz | PhD @PrincetonEcon | Financial Intermediation, Asset Pricing, Macro-Finance, Behavioral Economics & Finance | 李子昂

Princeton, NJ

Joined August 2019

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

ALL EYES ON RAFAH

• 796778 Tweets

De Niro

• 387631 Tweets

Palestino

• 103996 Tweets

Fernando

• 92116 Tweets

#WWENXT

• 56714 Tweets

Thomsen

• 54044 Tweets

#خادم_الحرمين_الشريفين

• 50758 Tweets

Millonarios

• 38365 Tweets

Lali

• 37777 Tweets

Lali

• 37777 Tweets

Coronado

• 36152 Tweets

Lala

• 35490 Tweets

Renê

• 34261 Tweets

DAME MIL FURIAS

• 34159 Tweets

Paulinho

• 33737 Tweets

Peñarol

• 30256 Tweets

$BOOST

• 26582 Tweets

Wesley

• 18251 Tweets

Sudamericana

• 16133 Tweets

Josh Gibson

• 14829 Tweets

Jordynne Grace

• 13047 Tweets

#PumpRules

• 11494 Tweets

Last Seen Profiles

Pinned Tweet

Finally a PhD! Huge thanks to my advisors

@MarkusEconomist

,

@MoritzLenel

, Jonathan Payne, Wei Xiong, and

@motoyogo

for the past 6 years.

Looking forward to the next chapter at

@ImperialBiz

. See you in London!

8

2

140

Thank you

@PrincetonBCF

for the Ben Bernanke Prize! Check out the paper here

Congratulations to Ph.D. candidate

@ZiangLi_

on his outstanding job market paper and subsequent award of the 2023 Ben Bernanke Prize in Financial and Monetary Economics!

Learn more about this award and Li's research:

@MarkusEconomist

1

0

58

2

5

93

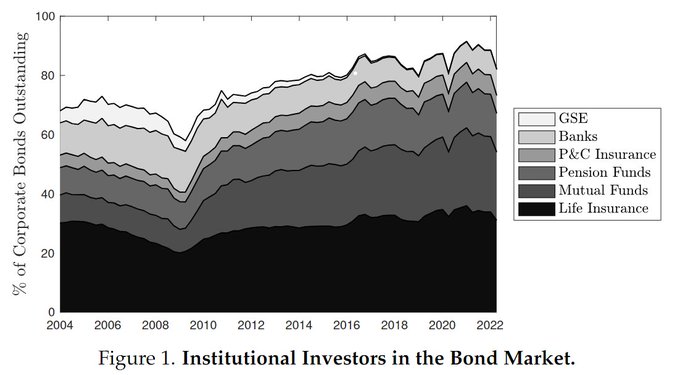

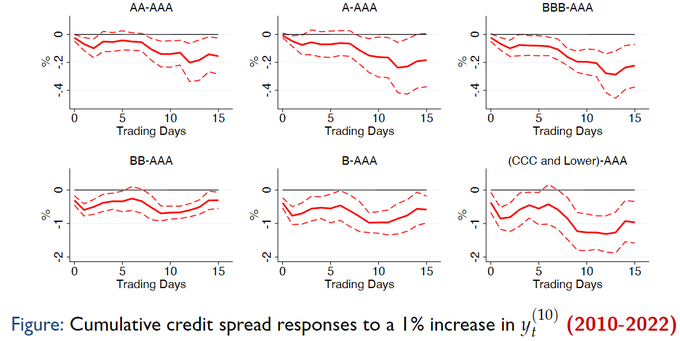

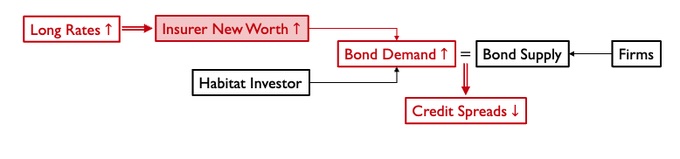

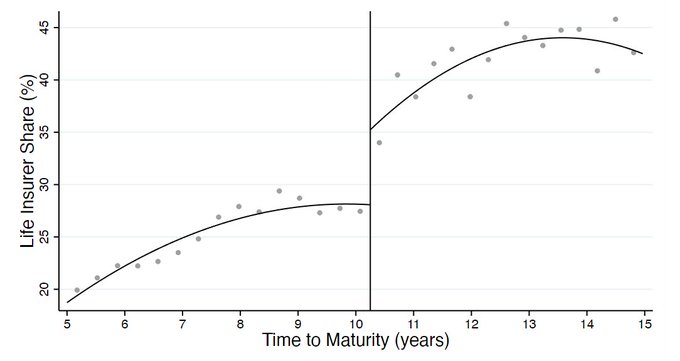

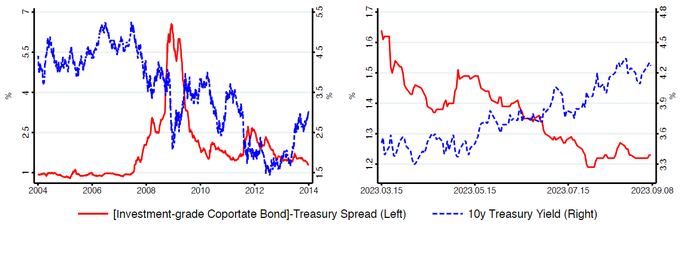

I’m on the job market! Here is a thread on my job market paper, which looks at how long-term interest rates (e.g., 10-year Treasury yields) affect the corporate bond market.

Ziang Li’s (

@ZiangLi_

) job market paper examines how long-term interest rates affect corporate bond credit spreads. He finds that increases in long rates have led to declines in credit spreads after the 2007-2008 Financial Crisis.

1

7

36

1

10

95