Garic Moran

@GaricMoran

Followers

13,652

Following

504

Media

956

Statuses

5,548

Moran Tice Cap Mgmt - RIA - Precious Metals Equities Specialists. Tweets are not investment advice: do your own due diligence. 37 years of macro investing!

Highlands, NC

Joined March 2016

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mourinho

• 155305 Tweets

Eminem

• 130967 Tweets

田中さん

• 78301 Tweets

#2024BTSFESTA

• 76027 Tweets

マギレコ

• 75440 Tweets

WE MISS ONGSASUN

• 68365 Tweets

#BTS11thAnniversary

• 66317 Tweets

BEGIN AGAIN

• 40421 Tweets

IRIAM

• 38250 Tweets

ロケットランチャー

• 33577 Tweets

Qoo10

• 29399 Tweets

Polizist

• 25724 Tweets

#ساعه_استجابه

• 23569 Tweets

フュリオサ

• 21166 Tweets

マッドマックス

• 21005 Tweets

#西洸人くん_27歳も拾っとくよ

• 16446 Tweets

BTS FESTA IS COMING

• 15652 Tweets

フランコ

• 13110 Tweets

オースティン

• 11435 Tweets

本橋由香さん

• 11165 Tweets

Last Seen Profiles

Pinned Tweet

1000 PHD's in economics went to Jackson Hole to figure out how to fix the world economy; yet, not one pointed out the historical fact that the USA grew twice as fast under a Gold standard when 0 PHD's in economics set interest rates and instead free market capitalism set rates!

100

570

2K

My friend Nassim thinks if everyone wears a mask, there is a chance we could solve the pandemic. Please everyone cover your face in public, what is the downside?

@nntaleb

88

231

2K

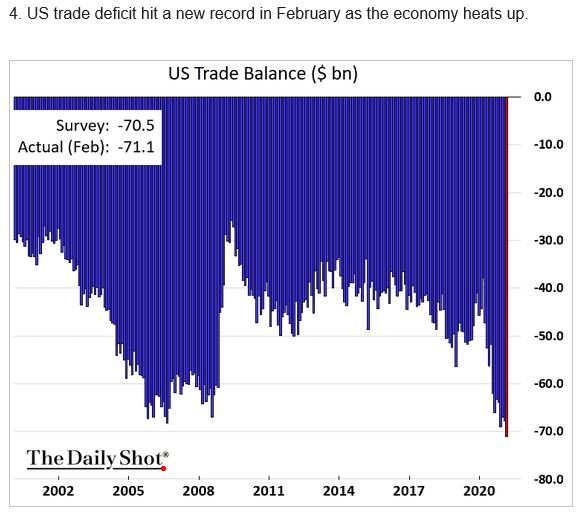

@elerianm

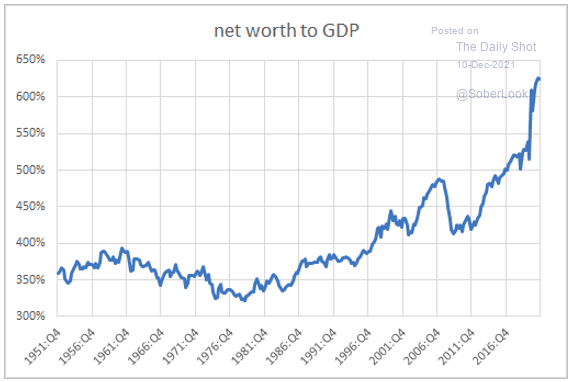

8.3% budget deficit with 124% debt to GDP & massive unfunded liabilities does not deserve downgrade?

Then what does?

27

33

714

WOWWWWW! The FED has stopped reporting weekly money supply figures! This is beyond messed up; Congress needs to impeach Jerome Powell immediately!

@RandPaul

22

81

348

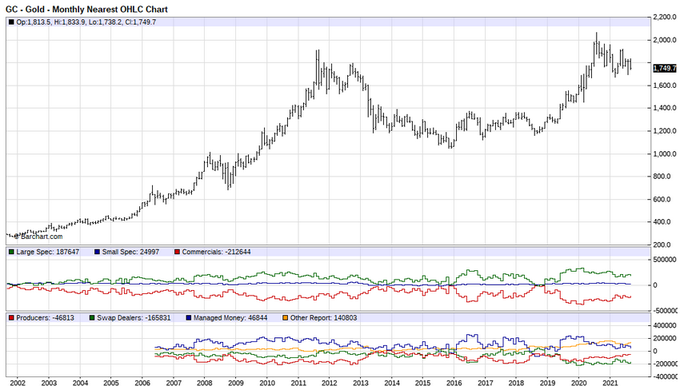

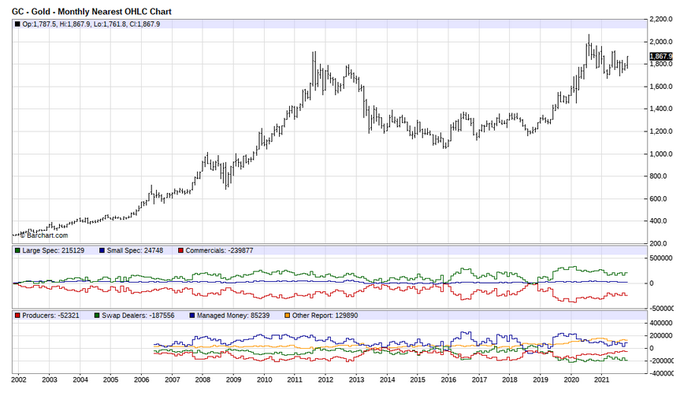

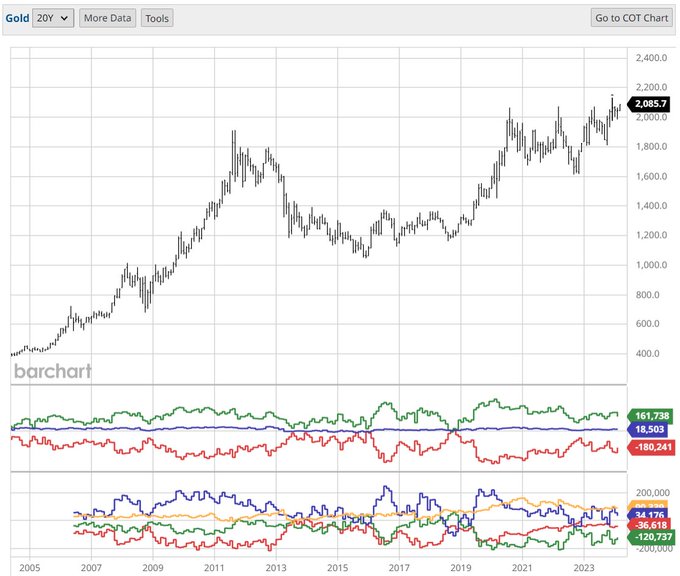

..Welcome to the Precious Metals Sector. Wall Street & Washington's public enemy

#1

. If you can't handle the volatility, you are positioned wrong. As I have been saying for the past 2 years, the commercials control the offer. The Rest of the World controls the bid!

10

24

313

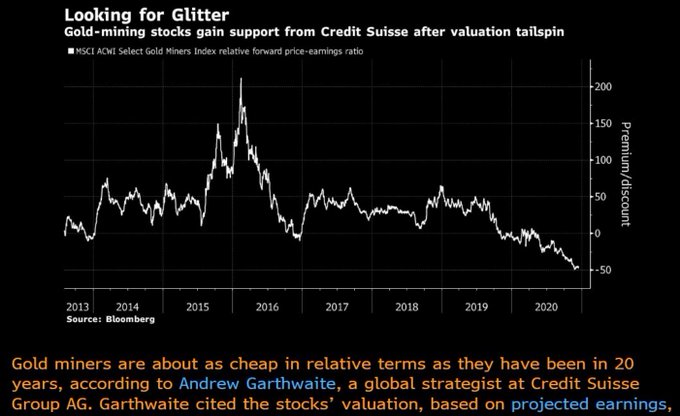

Barbaric relic, pet rock, public enemy

#1

> Gold has begun a major transition> Buffett is attracted to enormous cash flow & dividend potential of Barrick, then Reserve Bank of India signals higher allocation, and now OHIO Police & Fire Pension approves a 5% allocation.

12

46

262

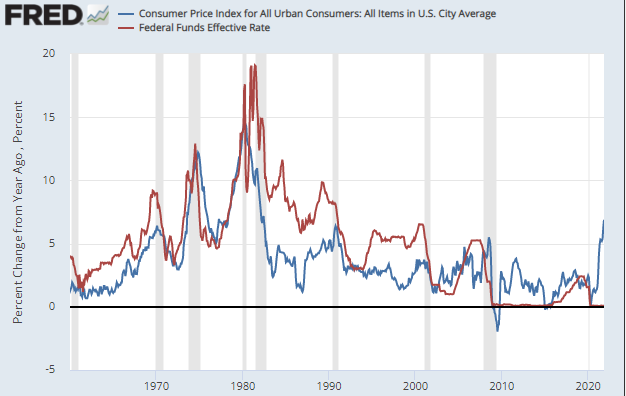

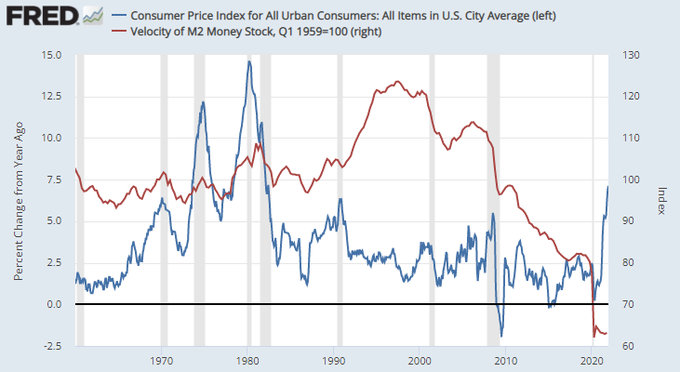

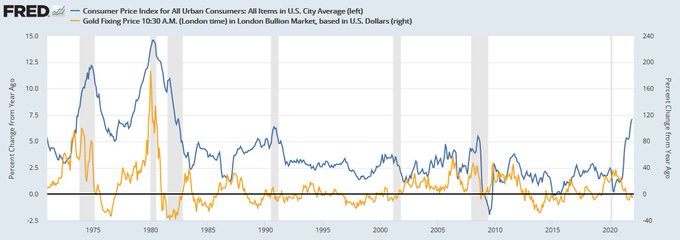

For 2 years my feed said there couldn't be inflation without velocity: I disagreed. Today every major commodity is in a shortage & prices are soaring. Does anyone know 1 economist (including Hunt & Rosenberg) who admitted they were wrong about velocity?

@DiMartinoBooth

@MishGEA

28

45

207

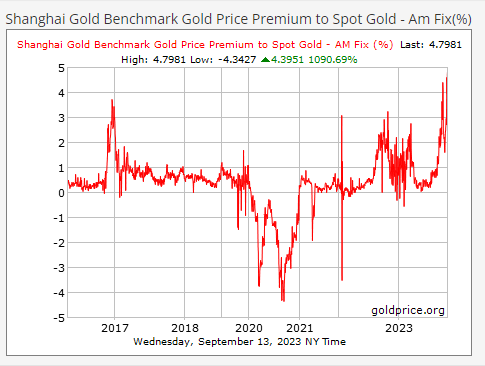

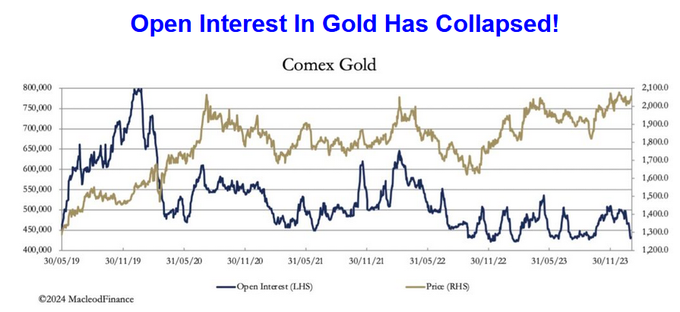

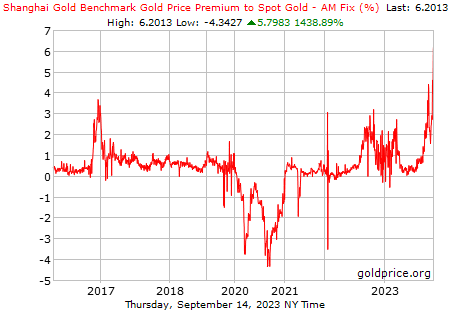

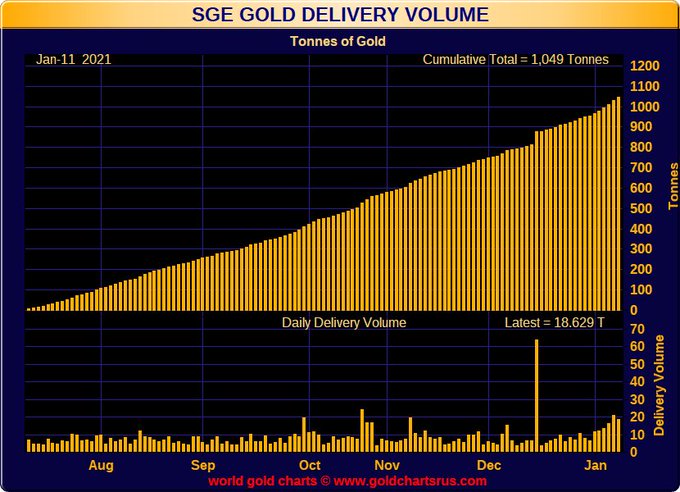

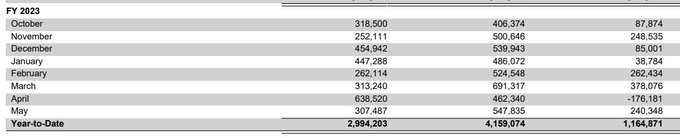

Another clue that the worlds largest consumer of physical Gold has returned to the bid of Gold, they have been absent since the bull market began 18 months ago, after buying 1000s of tons between $1100 & $1350, this is great news for miners: dont tell the algos!

8

40

185

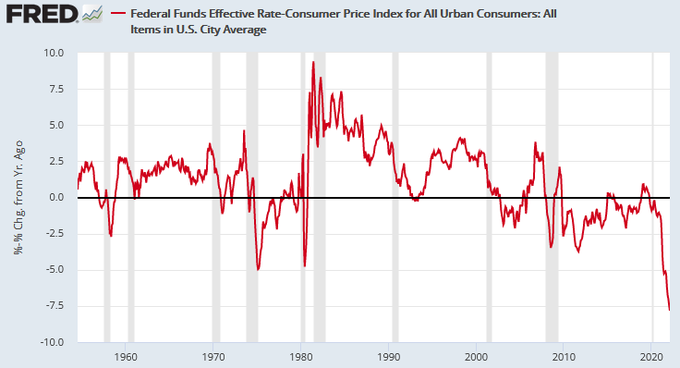

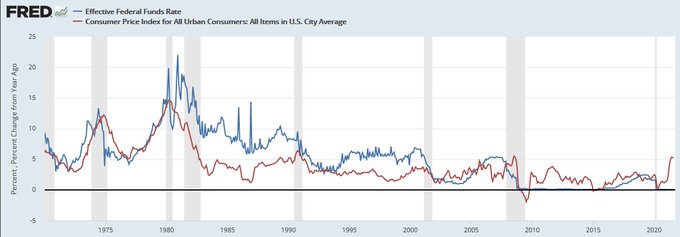

If the FED actually does what J. Powell says they are going to do, we will be in a Depression by fall. FED has not tightened into popping of equity bubble since 1929. The FED will pivot this summer. All western currencies are worthless:

#gotgold

?

8

30

167

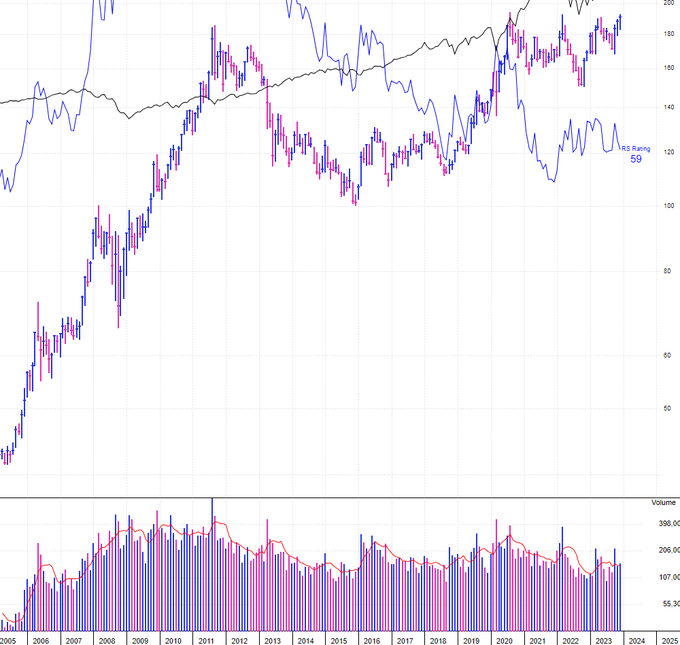

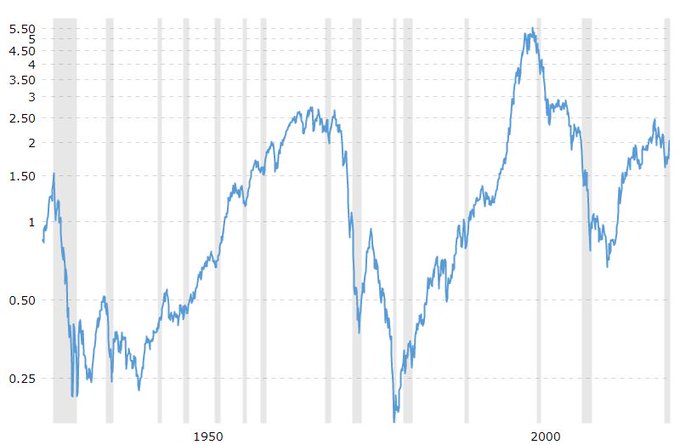

Below is the ratio of the S&P 500/Gold. Knowing when to own Gold and when to own comon stocks has preserved & created wealth.

@KeithMcCullough

says sell your Gold because we are in a Quad something or other. We believe Gold will outperform common stocks for the next decade:

15

8

143