Deribit Insights

@DeribitInsights

Followers

27,892

Following

32

Media

1,469

Statuses

2,685

The best resource for Crypto Derivatives trading. Telegram 24/7: Deribit is not available in the United States or other restricted countries.

Panama City, Panama

Joined October 2019

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#getoutofrafah

• 1895340 Tweets

Dortmund

• 428152 Tweets

Stormy

• 410011 Tweets

Mbappe

• 321836 Tweets

#Eurovision2024

• 171476 Tweets

#PSGBVB

• 157464 Tweets

Judge Cannon

• 109788 Tweets

Wembley

• 100158 Tweets

Reus

• 96693 Tweets

Le PSG

• 95135 Tweets

iPad Pro

• 80106 Tweets

Dembele

• 79740 Tweets

Hummels

• 75312 Tweets

Palestino

• 74053 Tweets

Olón

• 68497 Tweets

Grok

• 63948 Tweets

El PSG

• 63909 Tweets

باريس

• 48437 Tweets

دورتموند

• 43227 Tweets

Vitinha

• 41998 Tweets

YAIBA

• 41927 Tweets

Luis Enrique

• 28363 Tweets

Wemby

• 25659 Tweets

月9主演

• 23935 Tweets

DPOY

• 18663 Tweets

backnumber

• 16228 Tweets

flora matos

• 14200 Tweets

ドルトムント

• 10842 Tweets

Yuri Alberto

• 10122 Tweets

Last Seen Profiles

Welcome new writer Markus Thielen

@DeFiOnTarget

!

Recent events point to a year-end rally in stocks & crypto. Higher beta cryptos outperforming Bitcoin may signal a big rally. Check your exposure. Bitcoin tends to rally +23% pre-Christmas.

Read more ⬇

15

37

110

Check out the

#Deribit

Option Block Tracker flows on GitHub! 🔍

Big shoutout to

@samchepal

for this insightful contribution.

Dive into the details ⬇

7

17

100

#Bitcoin

is overbought! Should traders take profit?

Anticipation led to a +288% surge when futures were announced in 2017.

Despite being overbought, historical trends suggest a potential +52% rise over the next 60 days.

The Bitcoin rally continues!

39

67

91

Anticipating a Bitcoin Spot ETF decision in early 2024!

🚀 Traders eye the January 12 options expiry as expectations rise for

#BTC

to break $50,000.

Market buzzing with potential swings, +/- 11% in play.

Check out article by

@10x_Research

below ⬇

2

22

54

#BTC

likely range-bound till year-end; no rally despite expected dovish Fed tone.

Halt in Tether minting affects bullish momentum.

Anticipating Bitcoin Spot ETF delay till March; CME Bitcoin futures premiums adjusting.

Read article from

@10x_Research

⬇

4

34

57

"📉 Can a 1987-style crash happen this month?

🤔 The possibility looms, raising questions about its impact on digital assets like

#Bitcoin

. Will history repeat itself or will the

#cryptocurrency

market find resilience amid volatility? 🚀

51

55

71

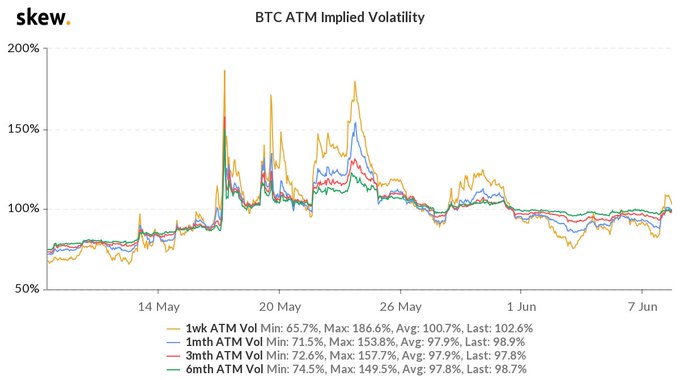

Despite

#Bitcoin

's +125% YtD rally, options interest lags due to low volatility.

Institutional entry may further dampen implied volatility.

Selling strangles, profitable in 2 of 9 trades, could be a final chance post-ETF approval.

Read more ⬇

3

16

74

#Bitcoin

consolidation forecasted within 40k to 45k range.

Seasonal trends, institutional involvement contribute to potential year-end decline.

Unwinding observed in spot and TradeFi futures, not in crypto native perpetual futures market.

Read more:

1

24

59

🍾🍾🍾The word is on the block! 🍾🍾🍾

We'll be launching Solana options and futures soon. Solana is already live on our testnet. Go visit .

#solana

3

11

65

Learning how to price Options and Delta hedge can seem like a daunting task, but if you are interested

@NaasCap

from

@laevitas1

has written an excellent article that breaks it down into something digestible.

Enjoy & share!

1

19

59

Impending squeeze looms from key macro shifts: lower CPI, likely peak in rates, potential

#Bitcoin

ETF, Santa Claus rally, and Fed pause.

$3B via

#Tether

and

@BlackRock

's

#Ethereum

#ETF

indicate golden times for crypto hedge funds. 🚀

Read more⬇

4

13

51

In

@DeribitInsights

this week,

@zhusu

is introducing the reader to basic options strategies, their mechanics, and when you might want to consider them as part of your toolkit.

As the markets continue to be volatile, opportunities proliferate.

0

5

50