Constance L Hunter

@ConstanceHunter

Followers

9K

Following

49K

Media

2K

Statuses

13K

Macroeconomist|Triangulating Data|@nberpubs Board|Data Junkie|Policy Wonk|my own views| #Econ101 #SecretLivesOfEconomists

Earth

Joined November 2011

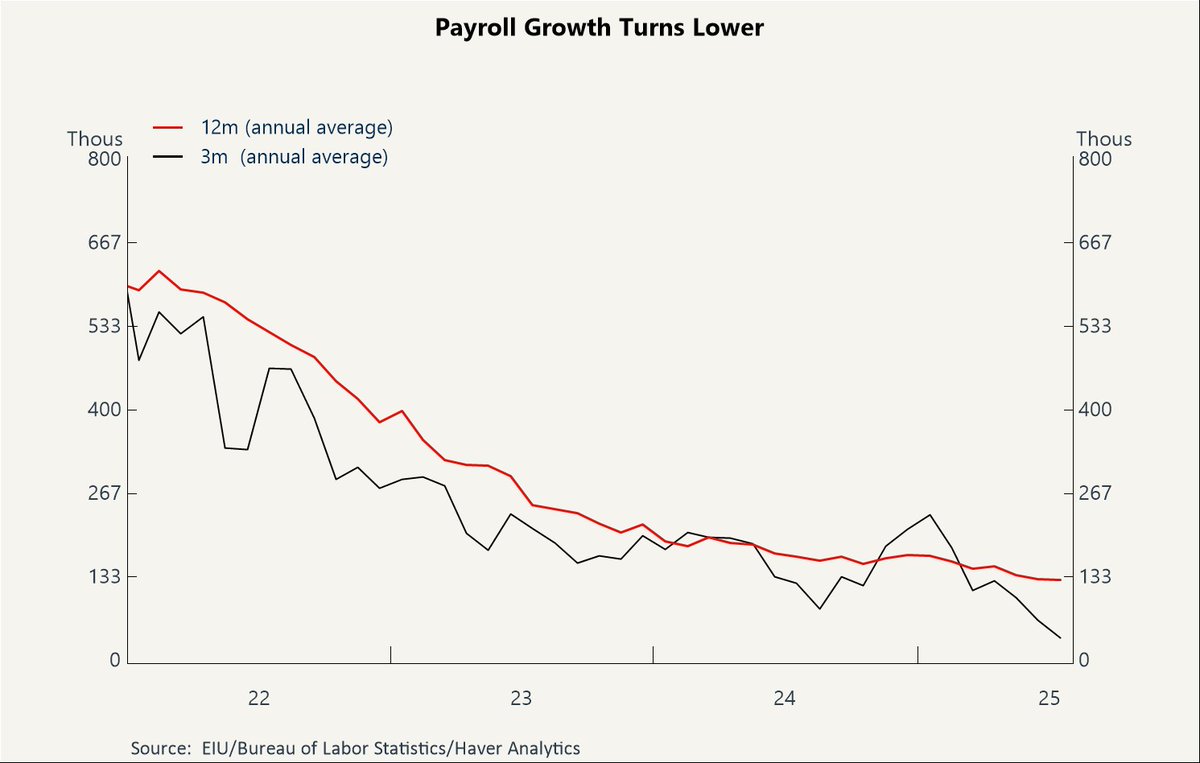

This week's data spells one word, stagflation. *Consumption grew 0.9% SAAR for H1. This is recession level consumption growth. *PCE rose because services are sticky and goods prices⬆️. *Jobs growth stalled. We still see scope for 3 rate cuts this year. @TheEIU

1

1

8

#jobs day data comes out momentarily. Here are 3 things to keep in mind. 1. Consumption is running at 0.9% H1 2025.2. Inflation is edging higher b/c goods prices are rising and services is sticky.3. Watch the diffusion index, wages, & breadth in addition to the headline number.

0

0

0

.@TheStalwart I am skeptical too! . I want someone else to do the work of creating a compelling story and delivering a good production of said story. My prediction, DIY entertainment will be as popular as AI help-desk bots. AKA, not popular.

Netflix is investing in an AI service that will let viewers create their own stories with the characters. I'm. skeptical. But the general trend is clear that all forms of passive media consumption are dying. Everything is some kind of conversation.

0

0

1

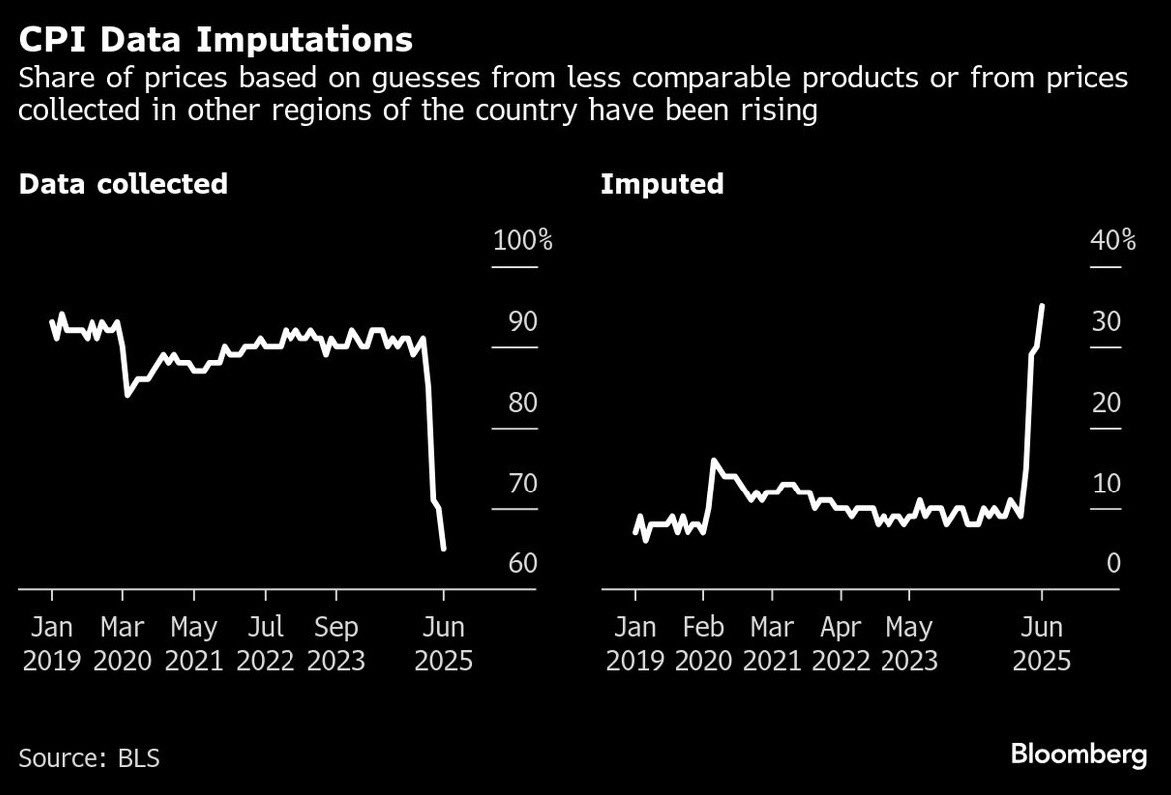

"Just estimating" is not always as bad as it sounds if one uses the correct guardrails. The @BLS back tested the methodology from Jan 2019 to May 2025. The difference btwn the test and actual was by less than 1/100th of a percentage point on average. @SpencerHakimian.

The government is literally not collecting actual inflation data anymore. They’re just estimating what they think inflation is. They “suddenly” changed this in May 2025. Right before the tariffs started getting collected. How much more obvious can they make it for you guys?

0

0

5

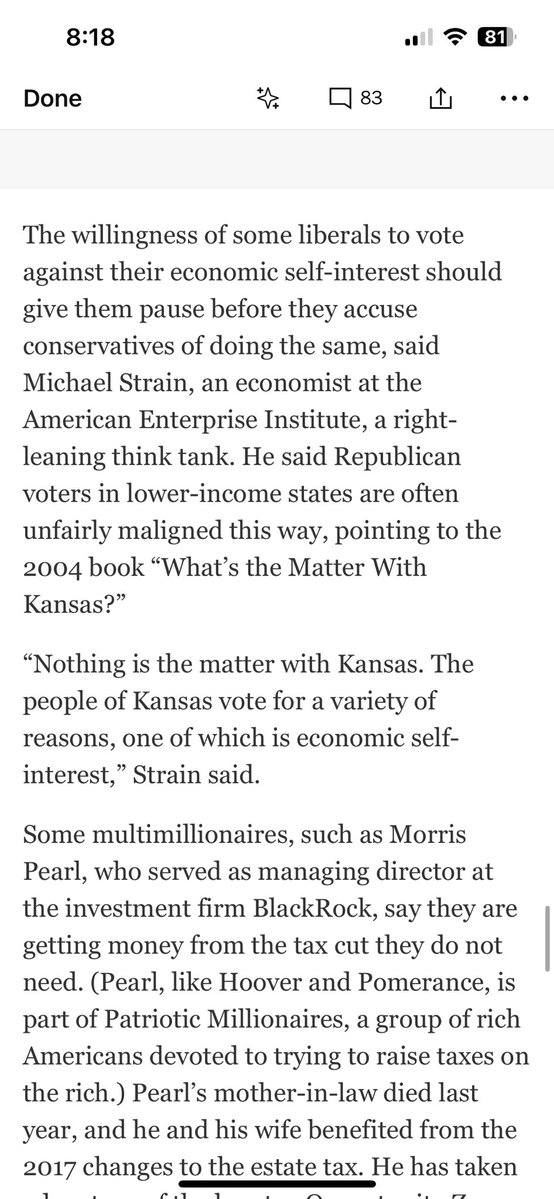

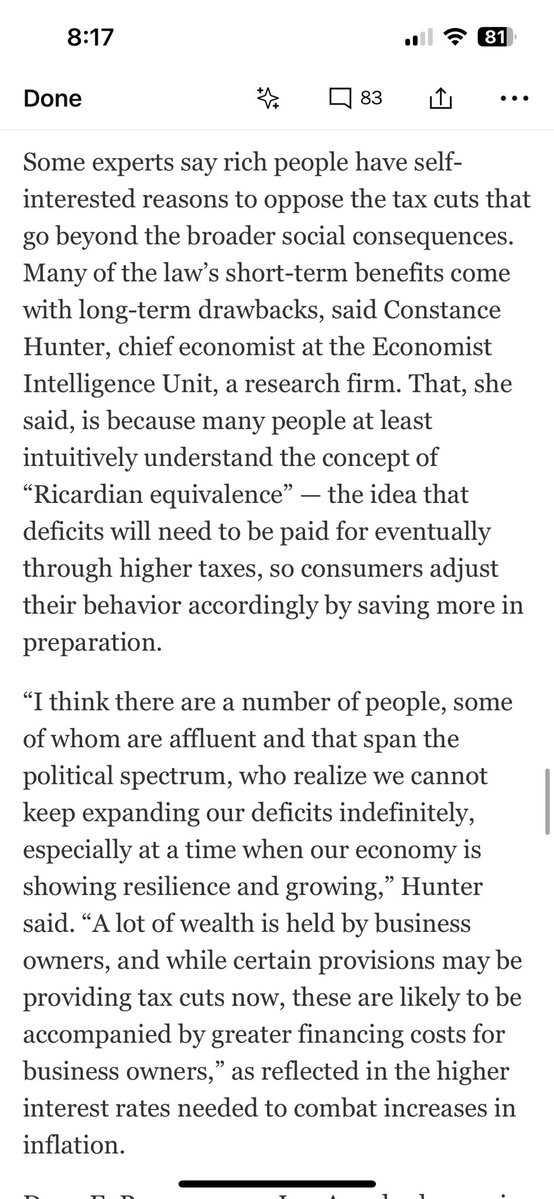

Thank you @JStein_WaPo for reporting on this nuance of economic policy and what benefits people in the medium to long term. Always an honor to be quoted alongside fellow economists like @MichaelRStrain. @TheEIU @washingtonpost.

.@MichaelRStrain thinks there’s something of an irony in how rich liberals who for years have griped “What’s the Matter With Kansas?” are now in some ways voting against their own economic self interest. @ConstanceHunter says that actually it’s perfectly rational for rich people

0

1

1

This is an extremely prescient and important question @cesifoti poses. I would add that at the moment AI actually returns false answers a material number of times and I often ask for and check source material. But my brand depends on accuracy, not all will take as much care.

There used to be two sources of traffic on the web: search and social. Social disappeared as social networks mutated into TV channels and discouraged links. Now search is on the decline because of AI. AI is swallowing search traffic, but it is different from search in one.

0

0

2

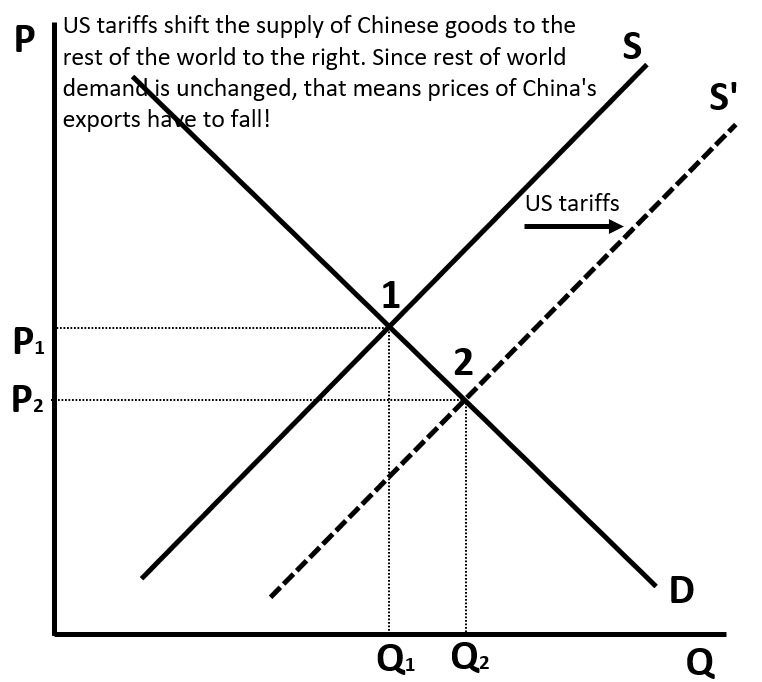

I vigorously agree with @robin_j_brooks and we have been showing this at @TheEIU in great detail via our Archimedean Trade Index. DM me for more information.

Macro 101 on China tariffs. If China doesn't transship goods to the US, it must export them to the rest of the world (ROW)). Supply of goods to ROW goes up. Since ROW demand is unchanged, prices must fall to generate demand. US tariffs are a deflationary shock for China and ROW.

4

3

23

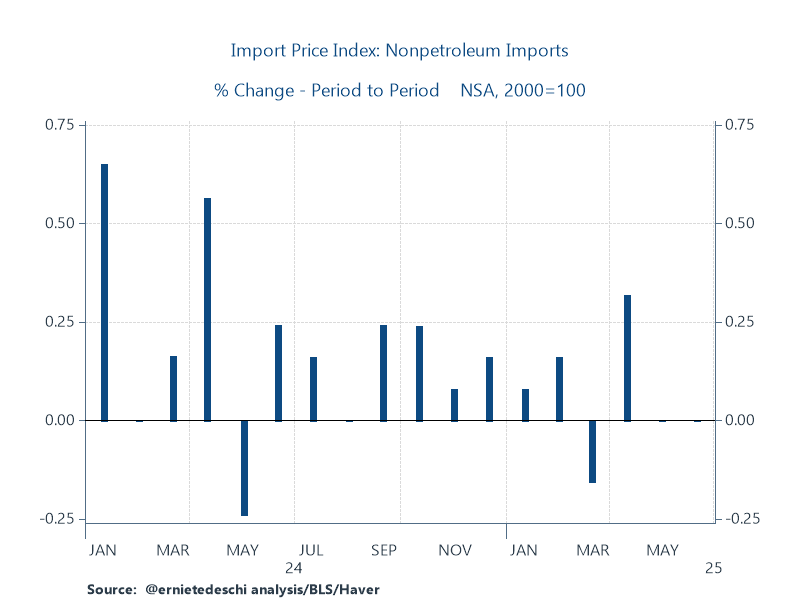

.@ernietedeschi 👏🏻💯.

Nonpetroleum import prices are an even better series to look at here as it excludes volatile oil prices. They show a large price *increase* in April and functionally no change in May & June; again, a sign foreign producers are not bearing much of US tariffs. 2/2

0

0

1

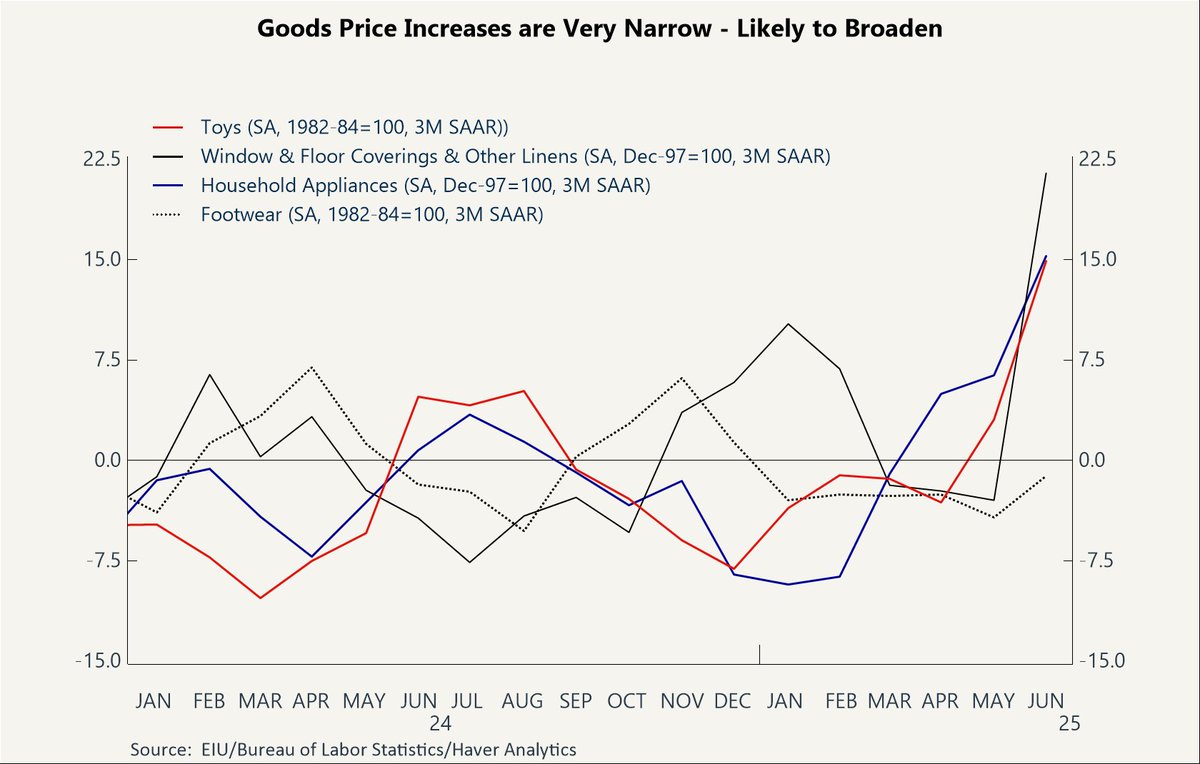

One had to look hard to find the fingerprints of the tariffs in today's #CPI data. Clearly there, but these components make up 1.3% of the total index. Companies are nothing if not agile after the 2018 tariffs and Covid. @tomkeene & @pdsweeney thank you for having me on!

Looking forward to discussing CPI with @tomkeene and @pdsweeney. Tariffs have only barely crept into the data; we don’t expect a big upward spike in goods prices tomorrow. For that you will need to look under the hood! To help @TheEIU Archimedean Trade Index provides details.

1

1

3

Looking forward to discussing CPI with @tomkeene and @pdsweeney. Tariffs have only barely crept into the data; we don’t expect a big upward spike in goods prices tomorrow. For that you will need to look under the hood! To help @TheEIU Archimedean Trade Index provides details.

0

2

6

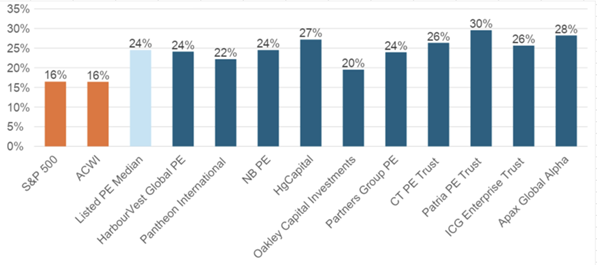

TDLLDR: @CliffordAsness is right.

Since 1987, private equity funds have been publicly listed and traded on the LSE. We can compare directly the volatility of the traded funds to the listed NAVs, and get a real-life example of just how private equity assets trade when they are listed publicly.

0

5

30

.@michaelxpettis is correct about this. It might be worth looking at @JesusFerna7026 work on the debt financed growth period of Latin America. Could be a preview movie for China.

4/12.The real problem is that for over a decade local governments have had to generate enough economic activity to meet an unrealistic GDP growth target, and the only way they could do so was to engage in massive amounts of non-productive investment.

0

0

0

They do not forecast the same thing. @ADP no longer tries to pre-forecast the payroll data. So yes, the different data sets and methodologies can yield this difference. With that said, seasonality probably boosted the @BLS_gov data and I will watch for any revisions.

0

0

2

If the general public owns part of a “private” company, is it still private? . Furthermore, if the general public owns companies with no formal or enforce rights, how many people will enter into those deals? Perhaps more than one might think. Please everyone: caveat emptor!.

This is really good from @matt_levine on tokenization. If we're totally cool with people trading equity in "private" companies, because it's on-chain, then eventually it seems possible that in the future we don't have IPOs or even standardized disclosure for any company at all.

1

0

0

Really important point by Jed.

Ahead of tomorrow's jobs report:. The breakeven job level needed to keep employment steady is 87k and falling, down from 165k in 2024. The immigration surge is over, and peak boomers are aging into retirement. The bar for a "good" payroll number today is lower than last year.

0

0

0