Geoffrey Fouvry

@GraphFinancials

Followers

6,175

Following

165

Media

2,816

Statuses

25,158

Connect the Financial dots Docs, Imgs, texts, Vids linked by big-data Present, reply in augmented media US Patent approved. ex hedgie 👇 get your free account

New York - Rio de Janeiro

Joined August 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Barca

• 513138 Tweets

Barcelona

• 485601 Tweets

Champions

• 407221 Tweets

Mbappe

• 300731 Tweets

Dembele

• 271425 Tweets

Araujo

• 263314 Tweets

Dortmund

• 180862 Tweets

WNBA

• 178126 Tweets

Xavi

• 170866 Tweets

برشلونة

• 108062 Tweets

Glauber

• 104987 Tweets

Lebron

• 72790 Tweets

Lakers

• 68260 Tweets

FERNANDA FEZ HISTORIA

• 57989 Tweets

Harlem

• 52412 Tweets

Racing

• 44509 Tweets

MORTO

• 39059 Tweets

Zion

• 29473 Tweets

#TierraDeNadie6

• 27275 Tweets

Pelicans

• 26180 Tweets

#BARPSG

• 25708 Tweets

FUERZAS FURIA

• 23776 Tweets

meredith

• 23137 Tweets

Medina

• 23008 Tweets

Rio de Janeiro

• 20378 Tweets

Cavani

• 20291 Tweets

チキンタツタ

• 18406 Tweets

Anthony Davis

• 15836 Tweets

#TTPDTimetable

• 15553 Tweets

#WWENXT

• 15154 Tweets

Godoy Cruz

• 14824 Tweets

Pels

• 10647 Tweets

tiago

• 10591 Tweets

Last Seen Profiles

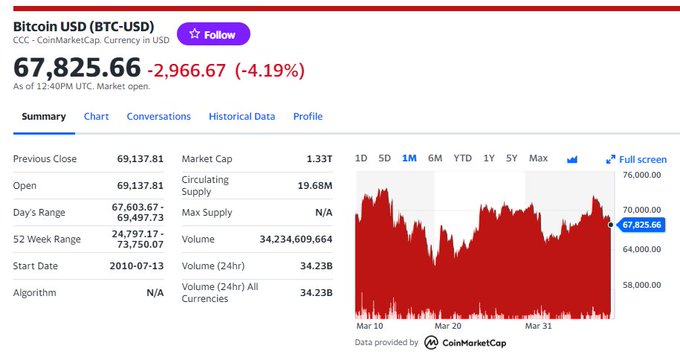

So CPI Hot and

#BTC

? Hedge for what exactly?

The most stupid "asset" EVER. beats tulips 🙄

549

37

436

@OCanonist

D'Artagnan was written by Alexandre Dumas whose father was general Dumas whose name is on Arc de Triomphe for his incredible service notably for his accomplishment in holding a bridge against Austria. General Dumas was creole. Education is a good, it can prevent stupid remarks

51

12

179

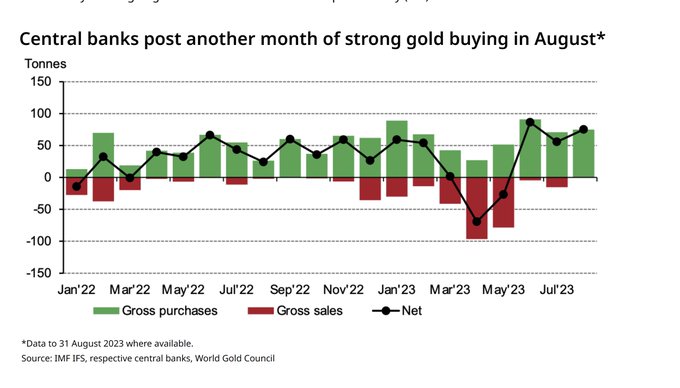

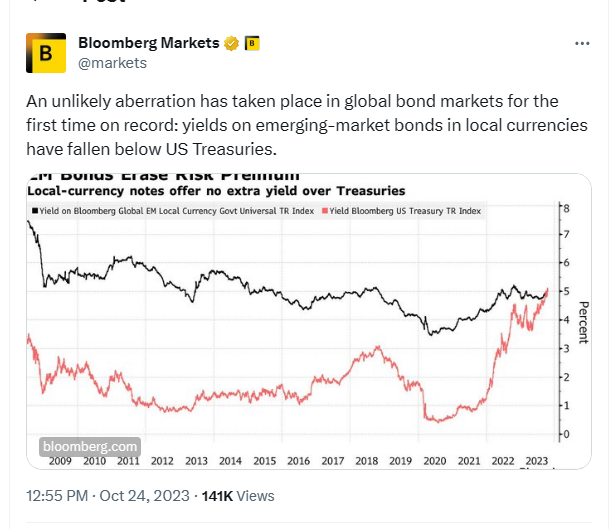

Something is about to break.

6% is absolute pure LUNACY.🤕

On the most central asset on the planet.

China

#gold

The SGE 9999 premium has widened out even further overnight and is now above 6%.

I've never seen moves like this and I've been tracking the Shanghai Gold Exchange since it started...

75

339

1K

16

45

157

@michaelxpettis

Michael is right. For 50 years America has been oppressed by the BRICS and forced to pay its deficit in USD, while actually all the US wanted to do was to pay in Gold. This oppression must not stand, free the US Gold for payment of the trade imbalances. Michael =freedom fighter!

6

12

121

@Sorenthek

An asset that is not a liability so that it enables to avoid double counting reserves, and hence enables wealth transfer by transfering purchasing power instead of double counting it, enables PPP gap shrinkage via Gold arbitrage, & ends the vendor financing of the RoW to the US.

4

10

93

1/2 🧵

#Coreweave

has a history of dumping GPU at a loss to the investing public by contributing GPUs to TTM co, then reversed merged into Sysorex. Then dumping shares of Sysorex (crypto mining Etherum)

WATCH 📺 the Graph recording In Augmented Media

👉

3

19

72

@Kathleen_Tyson_

@YouTube

It's not only possible, reserve ccy foreign FX in a central abnk is actually the problem. "Reserve currency" was invented by the League of Nations in 1922 (resolution 9). It's inflationary, it's seigniorage. Local ccy swaps + balance in Gold gets rid of parasitic "reserve ccy"

2

23

72

1/25 🧵

How to Rug pull a system of “reserve ccy” in history? Not so complex;

it happened twice.

The 3rd is happening rn, (a smoother one)

How

In 1927 Rist from Bank of France is in NY with Strong and Montagu Norman and tells: "Enough FX as reserves, send me my

#Gold

". Game over

7

19

73

$NVDA The "bridge financing" might go sour if the CW IPO fails. GPUs don't qualify AT ALL as long term collateral imo.

The whole idea was fast IPO & change the capital structure.

When China pricked the miners bubble (04/2021), Coreweave moved from pump to dump on GPUs like 🫰

8

12

67

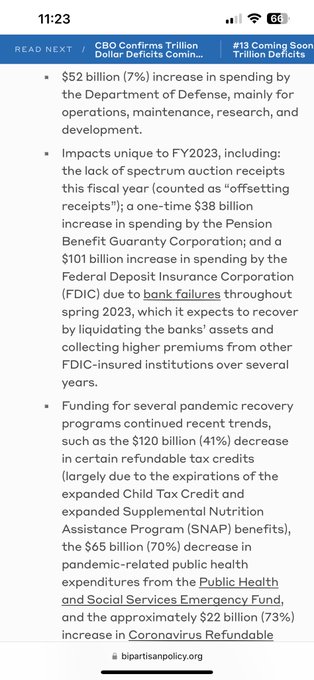

We are a 4.42%... on UST, we'll get to 6%.

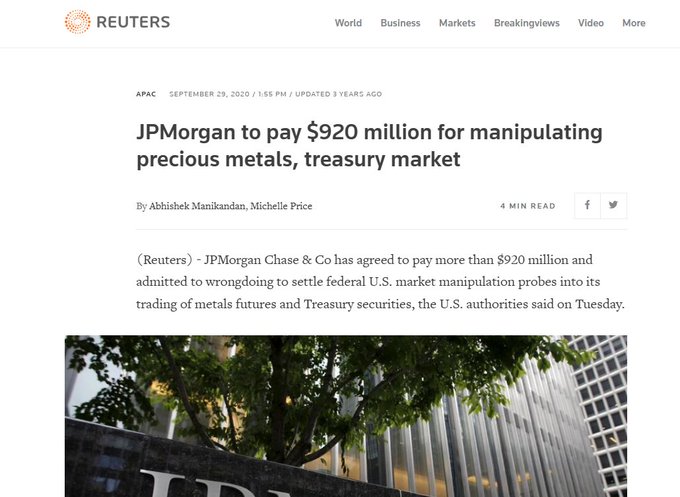

Countless attempts by Gov to manipulate prices in 300 yrs of archives. It always fails eventually.

Don't despair, it will implode nicely. 😊

Good day to you

@BogachanOz12426

6

10

66

@OptionsMir

@JerrBearr

To avoid an undisclosed related party transaction, IR should have made sure that the NVDA ownership in Coreweave was disclosed on the call. When it's omitted in the financial statements themselves it can lead to SEC charges

@Citrini7

@SamanthaLaDuc

6

11

65

The shortening of maturity is indeed another sign of fiscal dominance.

8

11

58

$AMZN Yep,

They almost managed to match the the operating income of 2 years ago same quarter.

Q2 2023 EBIT

7.68 Bi

Q2 2021 EBIT

7.702 Bi

6 Mo ended June 2023

EBIT 12.4 Bi

6 Mo ended June 2021

EBIT 16.5 Bi.

Nominal, don't even think about adjusting to inflation.

Growth 🙃

11

6

56

@NGLFundamentals

The social contract before 2008 was this:

You can get really rich in America, but if you fail you fail, your problem. And then the social contract was broken.

2

5

54

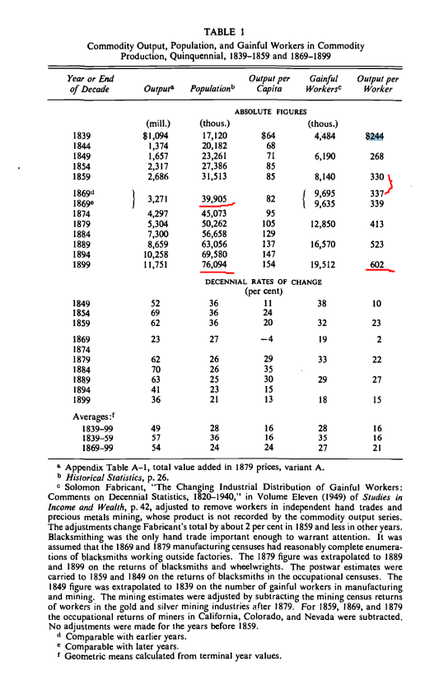

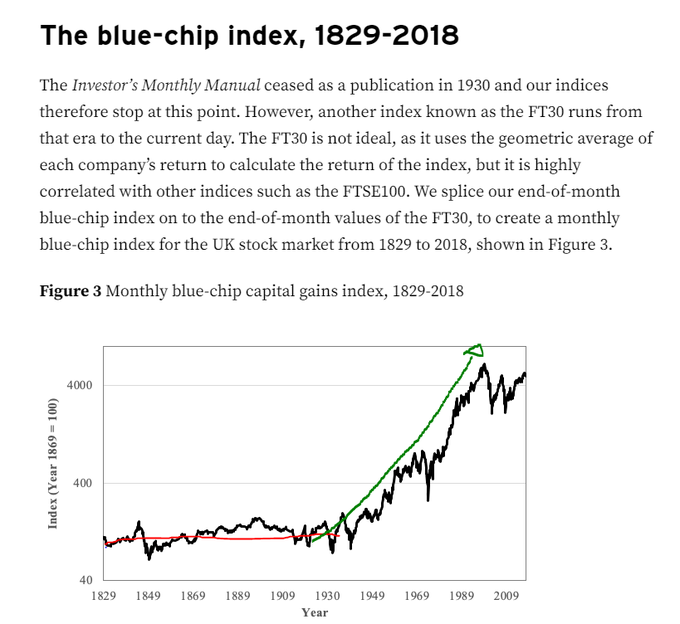

@LukeGromen

Exactly, and people would be surprised how much the US manuf would benefit. The biggest growth of the US was during 1866-1913, no central bank, no reserve currency, no large gov spending, prices falling ( & I am not even an "Austrian" )

The artifice dates back from 1922.

5

7

51

1/9

Let's look at that one.

Say Ganha has USD IMF debt, exports

#Gold

&

#Cocoa

to China. Today they need USD to repay the IMF so they sell those commos in China in USD. China needs USD to buys those commos, so they undevalue their labor to export to the US and get USD.

4

9

48

@LukeGromen

They don't really need to.

In fiscal dominance:

higher rates mean higher inflation & lower ccy.

To wit:

10/01/2022 (1st duration shock)

- Rates peaked 50 bps LOWER

- YET Gold today is 10% higher

- Yet DXY 5 pts WEAKER

Gibson paradox / Thomas Tooke always works

Ask Argentina.

6

3

46

$AMZN decided in 2022 that its computers were more durable, hence taking less depreciation charge.

TADA!

A gain on EBIT of 2.8 Bi.

Accounting can be quite creative.

@ecommerceshares

@concodanomics

That means that compared to 2021 Q2 EBIT is down 10% nominal this quarter.

5

6

44

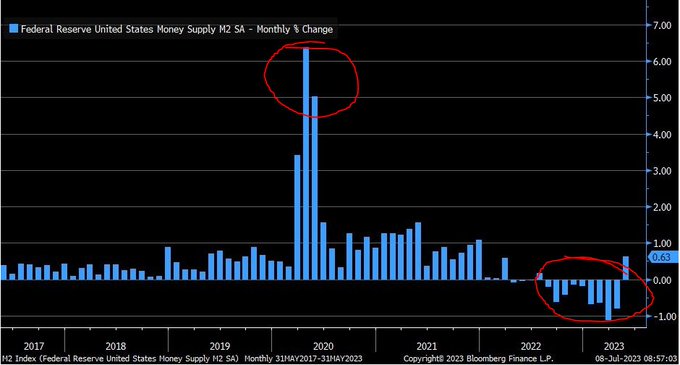

1/7 Few thoughts about the expansion of M0 that is not QE but seems like it could turn into it.

The

#Fed

has turned the spigots on BTFP. At first it looks like your traditional lender of last resort thing and backstop of credit.

1

13

42

PROBLEM OF DISCLOSE AT NVIDIA:

1/3 related party transaction

Since Coreweave is responsible for the beat 17% of sales so fast, & since NVDA is backing it, the NVDA IR should have put a lot of care in disclosure. Now it looks like an undisclosed related party transaction.

There's something very suspicious about Nvidia's earnings and their big client nobody's ever heard of: Coreweave.🧐 Thank you to

@SamanthaLaDuc

for taking the time to talk about it! $NVDA

#AI

#Coreweave

95

175

788

8

18

43

@KingKong9888

@ThomasFontaine1

Pricing

#Gold

in 2 ccy does a massive change

1 ccy

If the PBOC sell USD for

#Gold

it would only push Gold vs USD, no CNH/USD impact

2 ccy

W/ physical Gold in Yuan,

#Gold

becomes the Kingpin again to force trade to matter again in FX via Arb. Short USD,buy Gold, Sell Gold Buy Yuan

6

8

42

@Sorenthek

Gold is most important of all commos, it is the one you use for the Christening of your child if you are Catholic, for a wedding ring, for a precious gift in many cultures or for ceremonies. Those who do not understand are nihilist nerds out of touch w/ the world they live in.

4

0

41

1/20 🧵

#Bitcoin

is is more like fiat than

#Gold

. It is like

#Fiat

“nothingness” but without the State to enforce its use. And the scarcity argument is 100% misguided. Before you dismiss me as a Tech hater my little co has a US algo patent approved.

@nntaleb

@LynAldenContact

9

6

39

@farmersteveg

@Kathleen_Tyson_

@michaelxpettis

Me? No. I have the highest respect for the institutions (council of foreign relations) receiving money from defense contractors.

@marcuschown

@BBCNews

Here’s a handy list of which think tanks and lobbyists are on the defence industry payroll:

2

19

45

1

4

40

Wow, 5,000 followers. Thanks to each and every one of you, especially

@SamanthaLaDuc

,

@ces921

I have the opportunity to work with,

@LukeGromen

with whom we shared professors at Weatherhead in Ohio,

@KingKong9888

for the 1-2 punches deriding financial absurdum

4

1

38

@Kanthan2030

@Kathleen_Tyson_

In mid XIXth century you had 4 monetary standards and it was more stable than today..... The idea that you need absolutely only 1 standard is not verified by long history.

0

4

37

1/3 In the beginning, there was Satoshi Nakamoto,

he was sitting in the monetary desolation....

On the first day he wrote the white paper, and the white paper became electronic flesh

#Bitcoin

16

14

47

@AndreasSteno

It NEITHER of the two. If you know you classics about commodities, you would know that during embargo fear ppl create a bubble with backwardation, and then when the fear is released, speculative positions puke. This has been true since embargo on Sugar during Napoleonic wars.

2

3

35

@Kathleen_Tyson_

@SamanthaLaDuc

@LukeGromen

@SantiagoAuFund

@izakaminska

@wmiddelkoop

@marcmakingsense

On September 22nd, the sale of

#TSY

of 19.2 bi was not not coordinated with Yellen. Kodo news . At the same time that Japan was wacking the MOMO yield pigs, the

#TSY

yields gapped up massively. SAME EXACT time. Gilts were trading inside and blew up.

2

7

37

@realdeepakterra

@historyinmemes

It is absolutely not about the gov, since the gov was oppressive and collaborating while the villagers disobeyed !!! 😇

0

0

35

#Silver

, you think it's bonkers? You should get 800 years of data. The monetary dominance guys shorting the best electric conductor metal (the stuff you need in an AI data center for electronics) with moderate "spec premium" at 90X GSR ratio yet w/ gigantic fiscal dominance pb🤭

3

4

36

9/10 So why does Mr. Buffet hate

#Gold

?

He pays negative real yield on insurance policies, & buys inflation repricing assets.

It's a permanent wealth transfer of the XXth century to finance WWI/ WWII / colonial wars, Vietnam...

Welcome to the Matrix

@MikeCristo8

@RudyHavenstein

3

6

35

1/8

This thread is interesting but somewhat fails to grasp that EVEN IF the issuance of USTs is not a liquidity event, it can increase the probability of a recession ANYWAY, by other means. 🤯

2

4

35

@LukeGromen

If Russia sells below market, Shale does not cover costs. Rigs count goes down. It's very apparent per Dallas' Fed survey, rigs counts drop and you get a mini-squeeze (right not) or large squeeze at some point

@RealKeithWeiner

3

0

33

The end game of financialization followed by monetization of bad debta, sprinkled with denials about the long term inflationary effects of M0 finally moving from monied capital and getting into the circulation.

#slumpflation

3

7

29

2/2 Ppl forgot that before being used for AI (a better market) the GPUs were used for Crypto-mining. As it soured in 2021 Coreweave dumped GPUs in a 2 step.

Reverse Merger filing, 13-Ds

explained in the augmented media link ☝️ part I

@JG_Nuke

@SamanthaLaDuc

@Citrini7

3

3

31

@SamanthaLaDuc

Yes, I saw Paul Tudor Jones just explaining the same. He has done his sovereign debt/ solvency studies/ homework. It's the bonds market that is delivering the rate hikes, not the

#Fed

.

Same as

"Gov cost of funding transferred to the private sector."

1

9

32

1/4 🧵

Fiscal dominance in Full Display:

This has consequences. Because the the

#Fed

has a negative remittance to the US Gov.

In other words the US Gov is losing on the inflation tax when it sends back interest

to the Banks in RRP.

2

11

28

@ecommerceshares

As Thomas Tooke famously wrote in 1826, do not confuse return in money and return in kind. In other words, get the S&P dollar value in USD and go to the grocery store & see what you can buy with it (return in Kind). The decrease of return in kind of bonds is what makes them sink.

2

1

26

1/3 🧵

As Rueff explained the system invented by resolution 9 of 1922 Genoa convention FX as reserves, disconnected trade from Gold distribution. So the Gold price was benign, some sort of Bitcoin PLUS if you will.

2

12

28

@vtchakarova

Let's stop denying reality: Ukraine should be have split a long time ago. Most pragmatic thing to do. No chance Russian speaking ppl will ever reconcialiate with the Ukrainian speaking ppl and vice & versa. Would have saved lives and treasure. Let's get real.

33

1

23

@elbitcoinamb

@Sorenthek

No,

#BTC

is not an asset, it is a scriptural monetary abstraction like USD, CNH, collective imaginary yardstick, a "Name" to measure things of value (goods & services), not a thing of value itself . The purchasing power depends on monetization (use for goods & services)

10

1

27

@PeterSchiff

No Central Bank who could print ever turned its back on its Gov and have it default in 300 years of financial history. Central Banks always keep their master liquid. But maybe this time is different? So the second option is clearly the most likely.

2

1

25

@SamanthaLaDuc

As soon as the US Gov is fiscally responsible and the trade is balanced, the USD should probably stop falling aginst

#Gold

😊

9

4

26

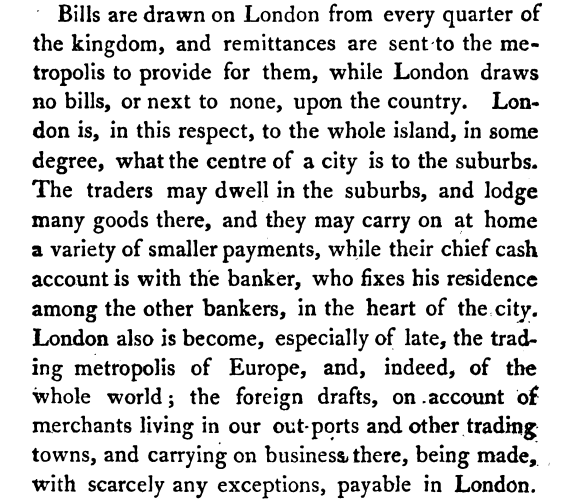

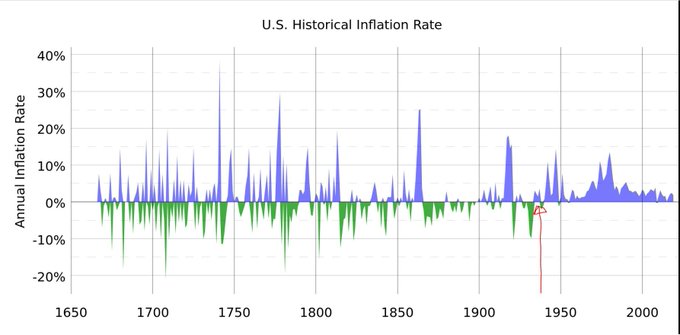

7/10 I can hear already some people scream bloody murder that deflation is a disaster

@hendry_hugh

The disaster:

Output up 4X between 1865 and 1889,

Population almost 2X

Prices? Down 50%

1

2

26

1/20 PM Miners ARE A SPREAD BETWEEN DEVALUATION AND INFLATION

The profitability of a PM miners is the difference between its sales & costs. Thank you Mr. Obvious.

J. Fullarton noted the issue of miners' margins during the UK's fiat episode of 1797-1821.

@KingKong9888

@GaryBohm5

2

6

26

@LukeGromen

It's desperate Luke, they don't connect the dots. I actually think that Putin's plan was to blow up duration as the main objective. With a Fed hell bent on using rates & paying M0 on M0-RRP as policy tools vs of reserve requirements, b/c Banks lobbied not to be starved like Japan

4

0

23

@financialjuice

Pff. Failed to pay interest in 1785...defaulted in 1787. Then went fiat temporarily but restored convertibility in 1870s post civil war. One century later default on Gold obligation (again). Currently in default by installments via the currency.

0

3

25

@jynpang

@Kathleen_Tyson_

Next Step: Washington will have only American Companies and American citizens left to sanction.

0

1

25

@FinanceLancelot

What a misinformed post. There are two sources of liquidity. Interbanking and reserves. Reverse Repo is just M0 sterilized. Have you check the deposit rates? I suggest you watch Richard Koo interview (Mr. Deflation Japan). Right now the biggest risk is sterilization failure.

3

1

22

The

#Silver

gap is so large you don't need the short leg to arbitrage. 🤣 Just bought.

@notanobject

You have 4 parameters on Silver.

- Silver to Gold ratio very high right now at 87

- Silver to Food commo ratio on the cheap again

- Silver miners margin low = USD too high

- Level of fiscal deficit in USD.

Not that hard to know which one is closer to the mid-range price.

1

0

5

3

4

24

@WallStreetSilv

Technically the US is largest debtor nation in world's history. Largest in external debt to GDP ratio... so who is semding money to whom right now...

1

0

21

2/12

f) We get a duration shock that cuffs the

#Fed

otherwise we have more banks' bond pukes into BTFP

We get credit downdgrade and the market asks for more yield

g) The gov officials are in denial making it worse

1

0

23

@AlessioUrban

You even have ppl who talk about deflation in the US...🤭

Inflation is just a "number" for markets to justify a low cost of Gov funding.

It is not meant to reflect prices in stores, it's just for show.

Deflation is a fantasy post 1933 (elastic money)

No green spike down after

3

1

20