JH

@CRUDEOIL231

Followers

12K

Following

3K

Media

738

Statuses

4K

Hedge Fund Commodity Strategist / Deputy Head of Derivatives Desk - Macro, Commodities, FICC / Middle and Far East representation

Joined August 2021

RT @DannyDayan5: Powell’s error is immense and broad. First, he said all inflation is tariffs and thus he expects it to be transitory.….

0

43

0

Although President Lula is a big risk, Brazil is doing well. Since I bought $BRZU at the end of last year, it ranks third in my stock portfolio. Not only is its YTD performance satisfactory, but what's even better is that it pays an annual dividend of over 5%. If you are.

3

2

17

RT @BenniKim: Easy. Debase the USD and go golfing on weekends. Insanely bullish USD assets like stocks, gold, real estate, commodities, bu….

0

3

0

RT @CRUDEOIL231: UBS on Copper. Copper awakening. Some on Wall Street are waking up to the truth! . #oott #copper $hbm https://t.co/….

0

38

0

RT @AleRodjfnfo: 숏츠와 릴스에 중독된 세대들이여. 무엇이든 전문을 보라. 표현은 맥락에서 생겨나고, 그 맥락은 몇 마디 단어의 미묘한 조합만으로는 결코 총체적으로 이해될 수 없다.

0

2

0

Although the fact that the implied balance is very weak and prices are likely to remain bearish in the future remains unchanged, there is not much room for shorting from a positioning perspective. Be wary of unexpected short-term spikes. It seems better to wait for some of the

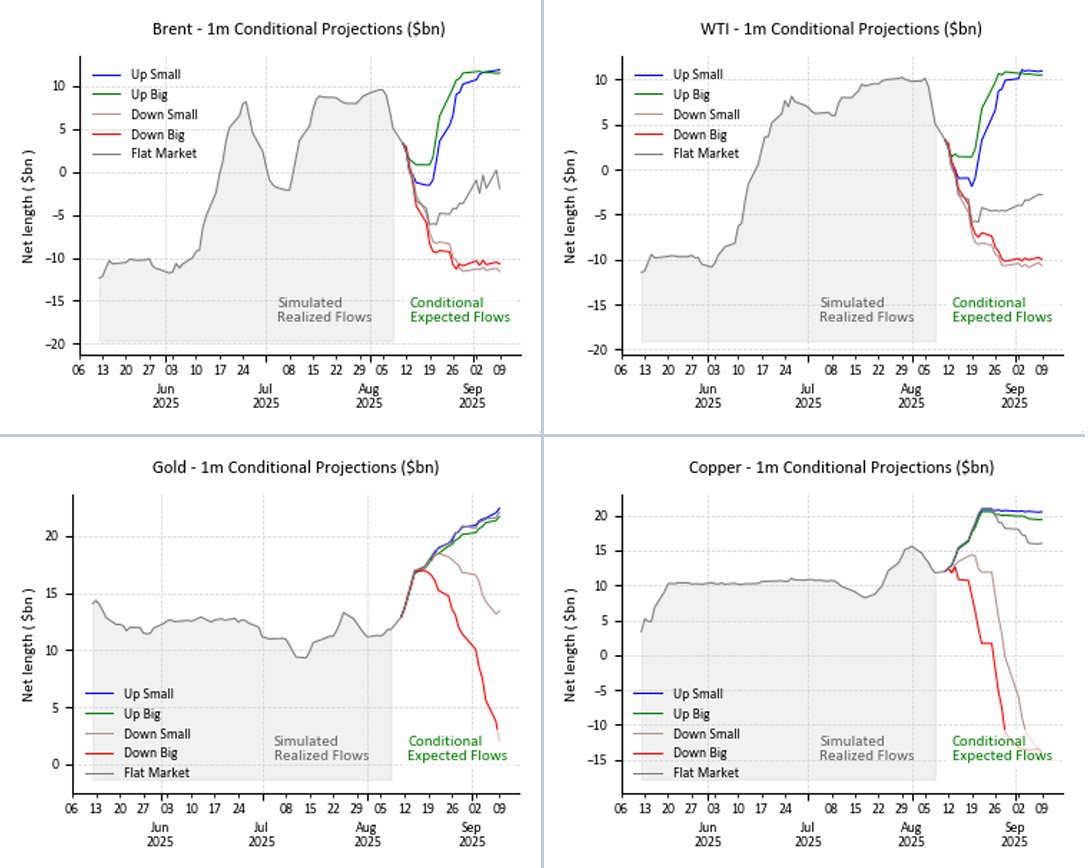

Charts on crude net-positioning of non-commercial accounts (=managed money and other reportables) in Brent and WTI futures and options combined (ICE, CFTC) #OOTT latest value is August 12

5

5

75

The ECMWF ensemble currently forecasts that Tropical Storm Erin will not make direct landfall in the eastern US. GFS also has only one ensemble scenario landing in the eastern US. #natgas #oott #HurricaneErin

0

0

19

RT @PauloMacro: @CRUDEOIL231 @hkuppy I am very far from top man. The battle is internal. Top suggests I am competing against others. So man….

0

1

0

I recorded my biggest loss of the year on #Natgas. Quite a few colleagues and Fintwits had a short-term bullish outlook on Natgas, but the majesty of nature made that disappear. I have been trading Natgas for many years, but this summer has been the most dynamic yet. I would.

39

6

300

September Saudi (and OPEC+) crude exports will be very interesting. Obviously high OSP. There seems to be a clear desire by the Saudis to return paper barrels to the market, but not to flood the market. #oott #com.

Saudi Aramco raises the official selling price (OSP) for Arab light for Asia by USD 1.00/bbl to USD 3.20/bbl above the benchmark (Oman/Dubai average) for the month of September #oott.

3

9

67

This also holds true for H1 2026. Despite the low likelihood of a move into contango before inventories begin to accumulate, the strength of the current backwardation remains notable, especially given the widespread expectations of a significantly bearish balance. #oott #com

4

4

38