Danny Dayan

@DannyDayan5

Followers

21K

Following

56K

Media

1K

Statuses

22K

Ex Hedge Fund Manager; Global Macro Volatility Portfolio Manager. Chicago Booth MBA & CFA. My views do not consist of investment advice.

Joined October 2022

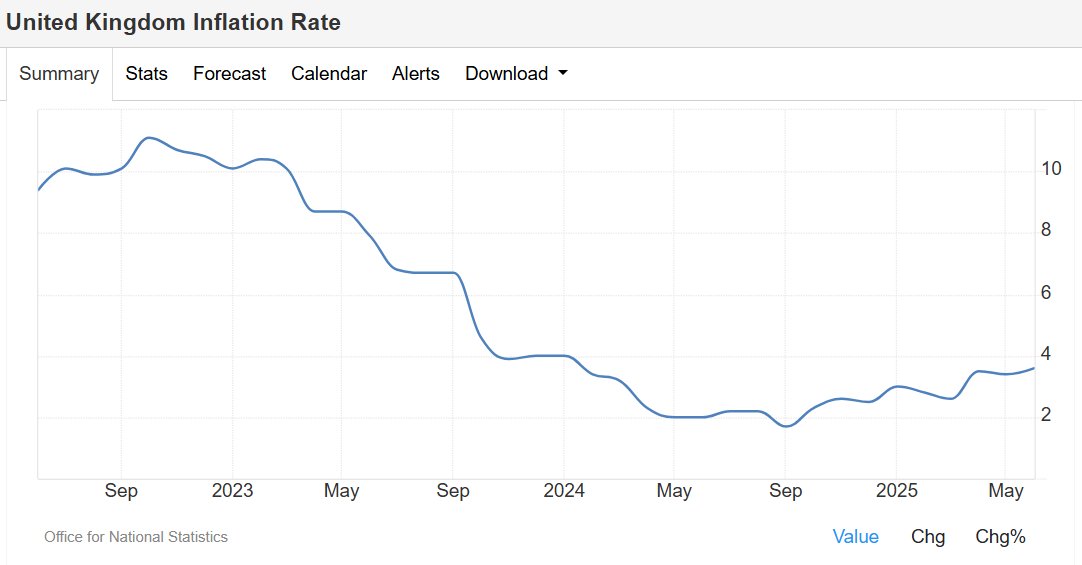

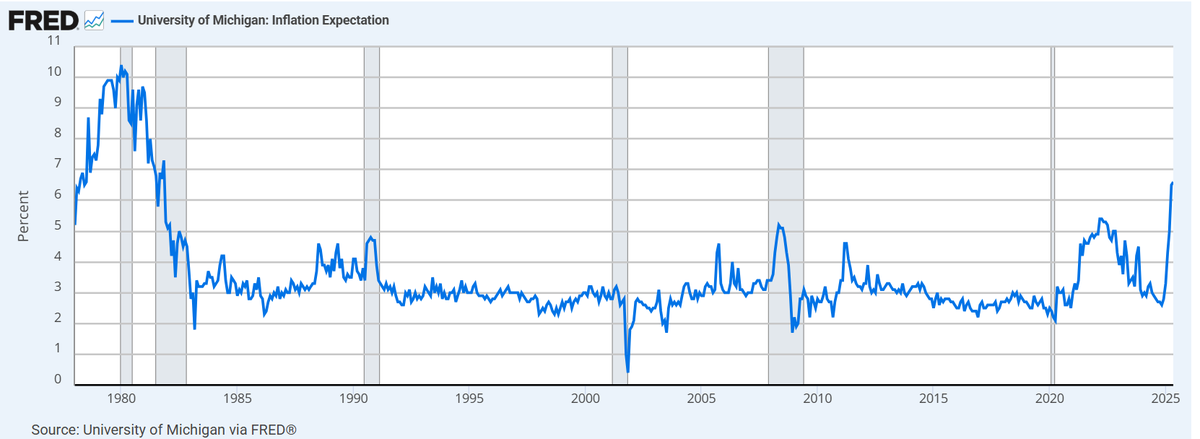

Had a great time joining the Forward Guidance crew for a wide ranging conversation. We covered the growth vs. inflation tradeoff, inflation expectations and the potential for a Dollar Doom Loop. We also discussed how I am trading this challenging market. Hope you enjoy!.

NEW WEEKLY ROUNDUP! 🔥. We discuss:.📌 Danny’s dollar “Doom Loop”.📌Why inflation expectations are unanchored.📌The importance of remaining nimble in fast-moving markets.📌How we’re seeing equities, rate cuts, and bonds through 2025.📌Whether the Fed can rescue growth.📌Why the

8

7

58

Bernanke and Yellen using the post WW2 argument for Fed independence. They are far smarter than me. Listen to them.

nytimes.com

Political pressure interferes with a mandate to work for stable prices and maximum employment.

3

0

13

RT @lord_fed: Most traders don’t lose on bad ideas. They lose on bad execution. Part 1 was the map, this is the manual. Zero to Stock Her….

lordfed.co.uk

Part II

0

150

0

November 1999. The labor market continues to tighten (UR 4.1%, today 4.1%), but the Fed is most concerned about the speculation in tech stocks. NDX has gone up by 25% in the last 6 months (today 40% in 3 months since the low). They hike 25 bps to 5.5%.

June 1999. The Fed is concerned about:. -Rampant equity speculation and its impact on wealth (SPX PE 24x, today 23x).-Too tight labor markets (UR 4.3%, today 4.1%).-Too high wage growth (ECI 3.5%, today 3.6%).-Inflation (Core CPI 2.3%, today 2.8%). They hiked from 4.75% to 5%.

23

5

49