Abra

@AbraGlobal

Followers

45K

Following

9K

Media

895

Statuses

6K

Where high-net-worth investors and institutions access elite crypto solutions - https://t.co/Cl7RJzQgIy

Abra Global

Joined February 2015

https://t.co/hMReJmWyvF DeFi makes borrowing against Bitcoin cheaper and more reliable. With #Abra, it's never been easier to access

23

4

19

In a few short weeks Solana Breakpoint (@SolanaConf) arrives in Abu Dhabi with Formula 1 and Abu Dhabi Finance Week! 🇦🇪 Crypto, capital, and speed — in one place. I’ll be speaking on Abra's plans for crypto banking and real world asset tokenization - possibly with a MAJOR

16

12

87

ACM has had no downtime and no clients were liquidated yesterday.

My thoughts on the past 24 hours… If you had no leverage or a 35% LTV loan on bitcoin you’re totally fine after yesterday. Or you will be. If you were operating with leverage on altcoins you probably got wiped out and I’m sorry. Some of you are looking for a scapegoat for

3

1

5

Thanks for joining the mission @billbarX! 🫡 I look forward to working with you and the @AbraGlobal team on the @FreedomFundPAC to help realize President Trump’s vision of making America the crypto capital of the world! 🇺🇸🚀

I’m thrilled to announce that @AbraGlobal is now a proud supporter of the Digital Freedom Fund (@FreedomFundPAC), a pivotal step to position America as the global leader in Bitcoin and crypto innovation. The Digital Freedom Fund shares our vision that the future of finance is

27

18

96

Even Morgan Stanley is recommending clients allocate 4% to crypto. Abra Private is the safest, easiest and most robust way to access custody, lending, yield and DeFi for treasuries, family offices and high net worth investors. It’s time to get off zero!

ICYMI: Morgan Stanley’s Global Investment Committee now recommends allocating up to 4% of portfolios to crypto for growth-oriented investors — a clear signal that digital assets are entering the mainstream of portfolio construction.

3

1

3

I’m thrilled to announce that @AbraGlobal is now a proud supporter of the Digital Freedom Fund (@FreedomFundPAC), a pivotal step to position America as the global leader in Bitcoin and crypto innovation. The Digital Freedom Fund shares our vision that the future of finance is

10

18

50

Great overview of the crypto lending market @yash_belavadi - but @AbraGlobal is actually a hybrid of CeFi and DeFi - lending is sourced from DeFi markets, title remains with the client and the keys are multi-sig :-)

I mapped the Bitcoin lending landscape 🟠 15+ active players → grouped by CeFi, P2P, decentralized, and wrapped BTC in DeFi

1

1

6

Model portfolios. Stablecoins. Collateralized borrowing. Practical crypto strategies you can use now. Join @ricedelman and @abraglobal's @billbarX on Oct 9 for a free 1 CE webinar. 🔗 https://t.co/meIhOjrDIc

2

5

4

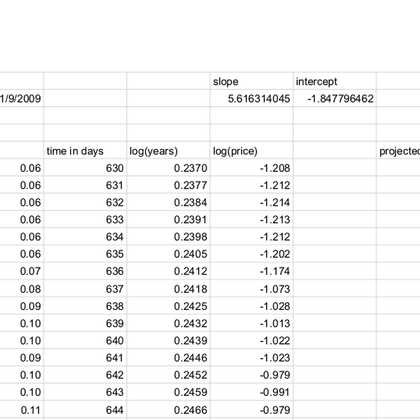

I tested the power law using daily, monthly, and yearly data. Turns out, monthly data is good enough, and even yearly data is not bad. Daily data: Power = 5.62, Trendline = 102,425. Monthly data: Power = 5.63, Trendline = 101,067 Yearly data: Power = 5.9, Trendline =

docs.google.com

22

18

254

@APompliano and I talking about why everyone is so interested in @AbraGlobal . Borrow, Invest and Trade at great rates... all from your secure vault. (Rates and yields not guaranteed. Risk of loss.)

2

3

9

Crytpo mkt cap ex btc+eth. Unchanged from '21 peak, not that much above '18 peak. 7 yrs ago there were no stables, no defi, no yield, no sol, no nft, no dexs, no rwa, no ai, no prediction mkt etc etc DAE (digital asset ecosystem) growth not priced in. Alt season ahead. 🚀

60

162

1K

10/10 🪙 Bitcoin Reserve: US to create Strategic Bitcoin Reserve & Digital Asset Stockpile from seized assets. Treasury leads, no selling BTC—use for national goals. Budget-neutral ways to add more. Cement US leadership in a new golden age of crypto! 🇺🇸 #BitcoinReserve

0

0

2

9/10 💰 Taxation: IRS guidance on staking/mining income, wrapping transactions, de minimis rules. Apply wash sales to crypto, amend broker reporting. Make tax policy recognize crypto's uniqueness for investors & entrepreneurs! 📊 #CryptoTax

2

0

4

8/10 🛡️ Illicit Finance: Update AML/CFT frameworks, clarify BSA for foreign actors. Equip firms to mitigate risks, boost info sharing via FinCEN. Tailor laws for digital assets, add sanctions tools. Target bad actors, protect law-abiders—no misuse! 🚔 #CryptoSecurity

1

0

1

7/10 💸 Stablecoins & Payments: Innovate with USD-backed coins for faster, global payments. Execute GENIUS Act fully. Promote private sector leadership in cross-border tech. Ban CBDCs domestically & urge allies to do the same—keep private innovation thriving! 🌐

1

0

1

6/10 🏦 Banking Recs: Ditch Biden's "Choke Point 2.0"—no discriminating against crypto firms or denying bank access. Tech-neutral risk guidance, relaunch innovation hubs. Clarify charters, master accounts, & capital rules to reflect real risks. Banks + crypto =

1

0

1

5/10 🏛️ Market Structure: Establish taxonomy for digital assets (securities vs commodities). Enable federal trading now via SEC/CFTC. Congress: Give CFTC spot market oversight for non-securities. Embrace DeFi by assessing control, modifiability, & compliance. Liquid

1

0

1

4/10 🔍 Crypto 101: From Bitcoin's blockchain solving double-spend to smart contracts on Ethereum/Solana. Explains keys, wallets (hot/cold), stablecoins, DeFi, oracles, & bridges. Permissionless tech born from grassroots forums, not Wall Street. Essential basics! 🛠️

1

0

1

3/10 🌟 Intro highlights: Crypto is America's next innovation wave, like railroads or internet. Trump's approval among crypto holders? 72%! Over 68M Americans own crypto, with 83% of institutions planning bigger investments. Trump clearly wants to make the US the crypto

1

0

1