3Jane

@3janexyz

Followers

18K

Following

46

Media

29

Statuses

102

The credit-based money market. Borrow against the future. U.S. only

Joined November 2021

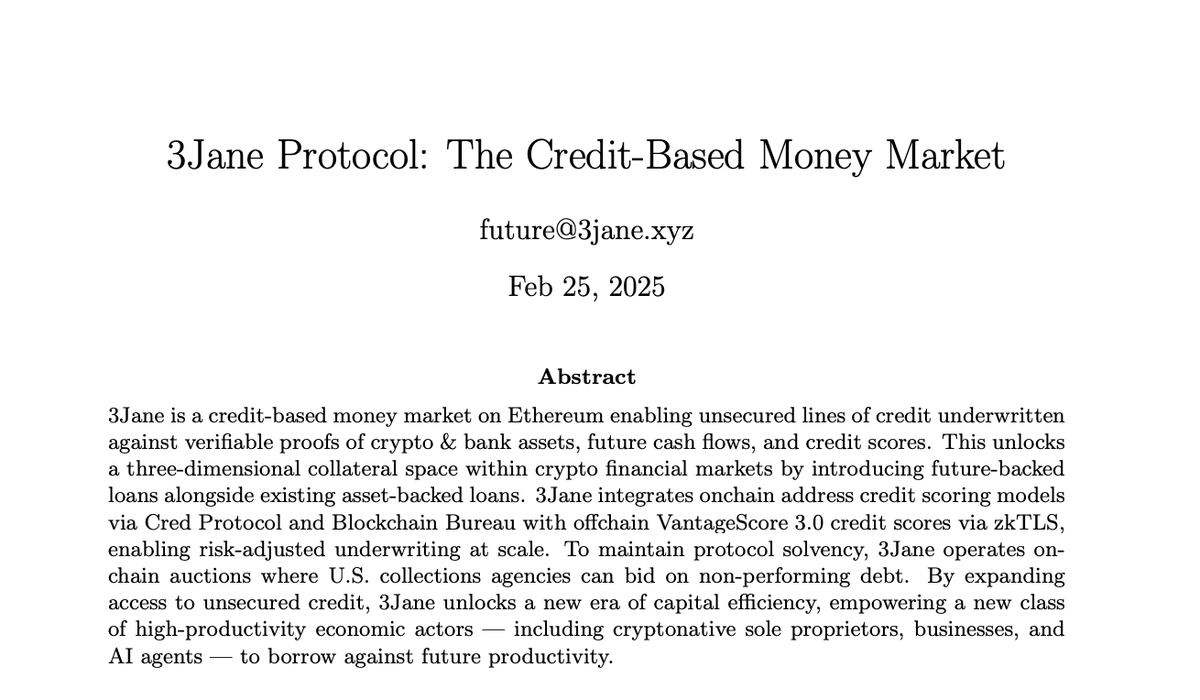

1/Introducing the 3Jane Whitepaper:. The foundation for the first capital-efficient and scalable money market on Ethereum enabling users to borrow at 0% collateral. Borrow against the future.

61

149

1K

Unsecured credit is on the farthest end of the crypto risk curve and helps facilitate the most novel and productive use-cases for capital. [3jane] "represents a huge opportunity for the crypto industry" - thank you for the mention @FT.

6

9

101

RT @Delphi_Digital: One of the largest untapped markets in crypto is undercollateralized lending. @3janexyz takes this further, unlocking….

0

12

0

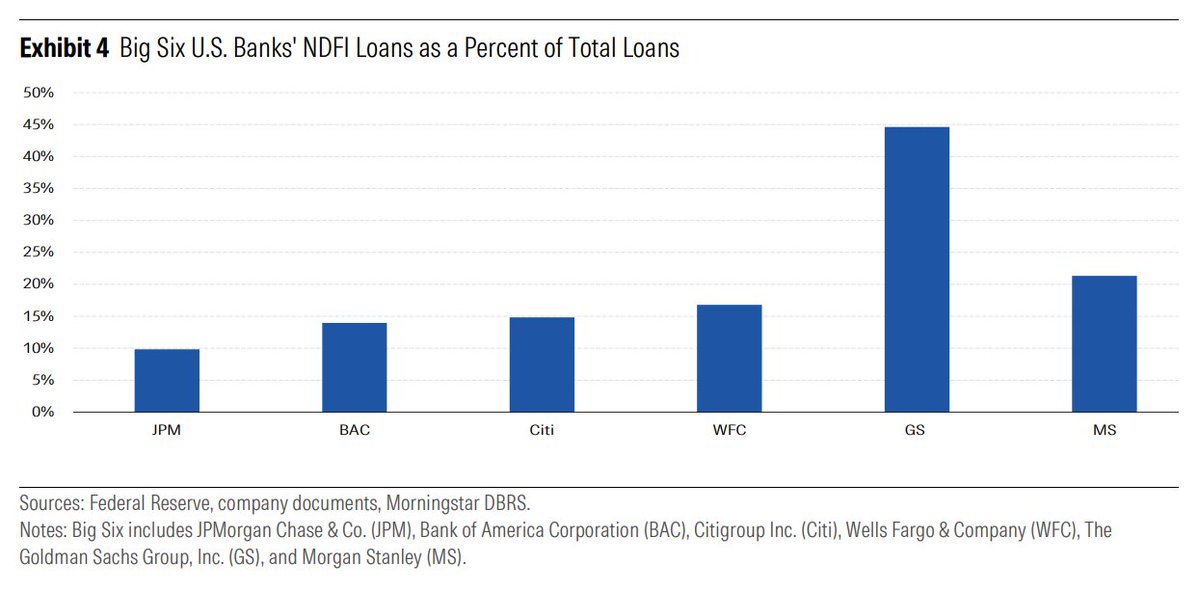

Bank loans to shadow banks have surged to $1.2T (~20x) in an effort to juice higher yields on deposits. 🎰. Capital will inevitably flow to speculation-backed credit products.

Bank loans to shadow banks: .2010: $56B (less than 1%).2024: $1.2T (9% of all loans). Banks: 'We're not doing risky lending anymore'.Also banks: lends $1.2T to the people doing risky lending

4

1

37

Messi is a DeFi legend, and if you don’t know him you’ve certainly been his counterparty once or twice. We’re extremely proud to have him in our corner to scale up unsecured credit on Ethereum.

Chud has signed on to his first *official* advisor role @3janexyz. After signing up to use their product, I was so impressed that I begged to get involved. 3Jane is bringing uncollateralized lending on chain. Made possible by zk tech. We're all getting fast usdc loans soon.

7

2

88

RT @Psaul26ix: Really glad to see this evolution from true fi. As I recall it's the most OG solution for uncollateralised loans and institu….

0

1

0

RT @WildcatFi: Wildcat doesn't just unlock institutional private credit, it's also part of the engine increasing the money multiplier for t….

0

4

0

RT @Curiosity0x: How can you borrow money in DeFi without locking up capital?. Right now, it's simply impossible. Most money markets rely….

0

3

0

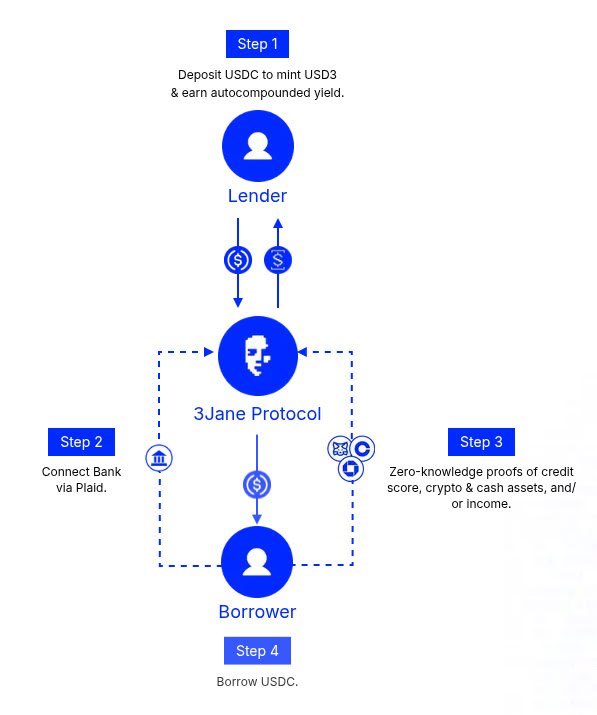

15/ Generate your credit line and join as an early user in Q3. U.S.-based users only.

3jane.xyz

Borrow against the future

2

0

15

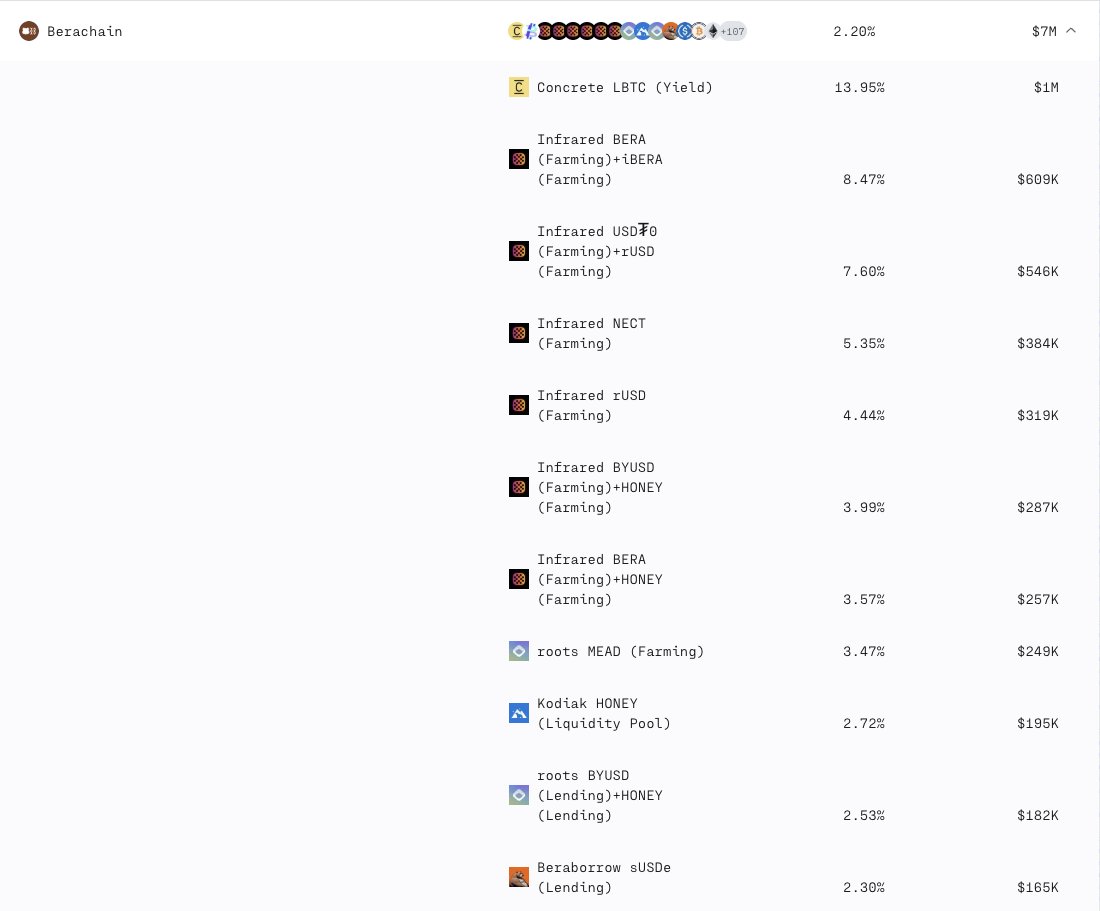

11/ Berachain backing is comprised of $7M across 129 assets. Top 5 farms:. @ConcreteXYZ LBTC @ $1M.@InfraredFinance BERA/tBERA, USDT0/rUSD, BYUSD/HONEY @ $2.4M.@rootsfi MEAD, BYUSD/HONEY @ $431K.@KodiakFi HONEY @ $195K.@beraborrow sUSDe @ $165K

2

1

15

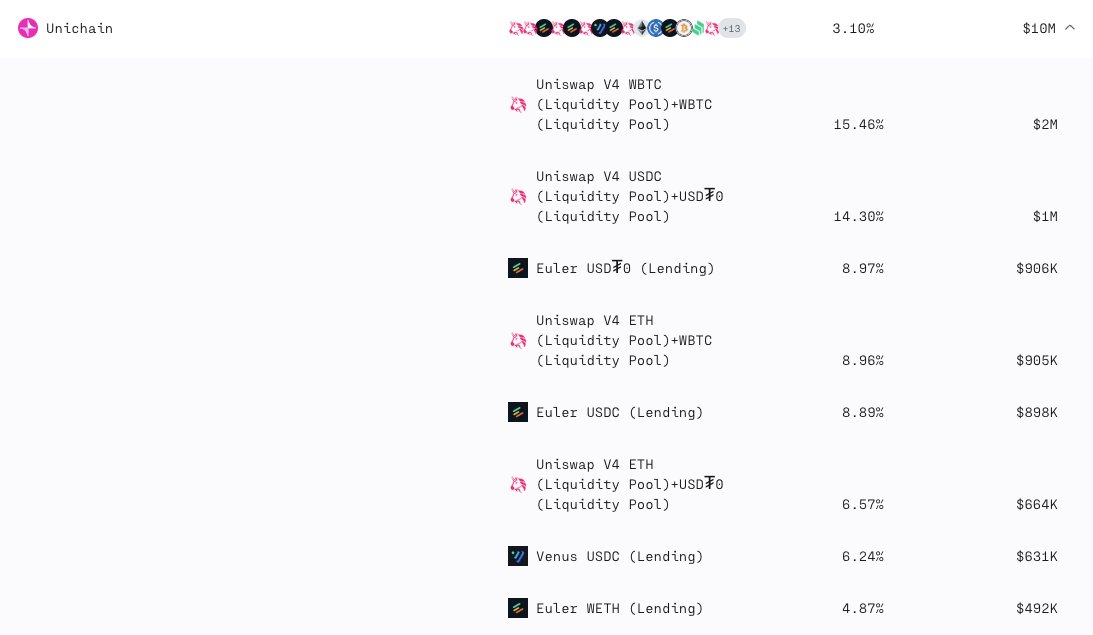

10/ Unichain backing is comprised of $10M across 28 assets. Top 3 farms:. @Uniswap WBTC/ETH, USDC/USDT0, ETH/USDT0 pools @ $4.5M.@eulerfinance USDT0, USDC @ $1.8M.@VenusProtocol USDC @ $631K

1

0

7

9/ Sonic backing is comprised of $14.4M across 117 assets. Top 5 farms:. @Rings_Protocol USDC @ $1M.@ShadowOnSonic USDC/xUSD @ $1M.@stabilitydao USDC @ $1M.@StreamDefi xUSD @ $978K.@SiloFinance USDC @ $363K

1

0

8

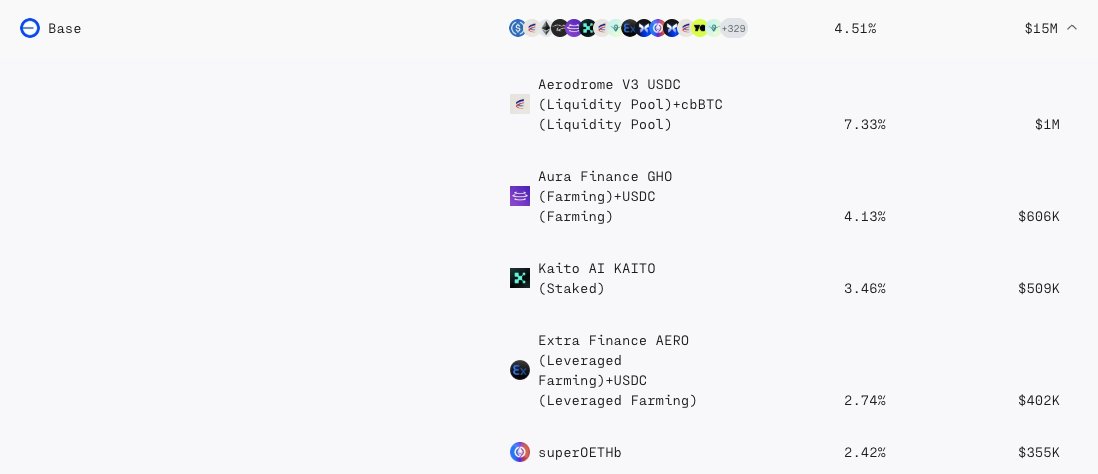

8/ Base backing is comprised of $15M across 338 assets. Top 5 farms:. @AerodromeFi USDC/cbBTC pool @ $1M.@AuraFinance GHO+USDC @ $606K.@KaitoAI KAITO stake @ $509K.@ExtraFi_io AERO+USDC @ $402K.@OriginProtocol OETHb @ $355K

1

0

8

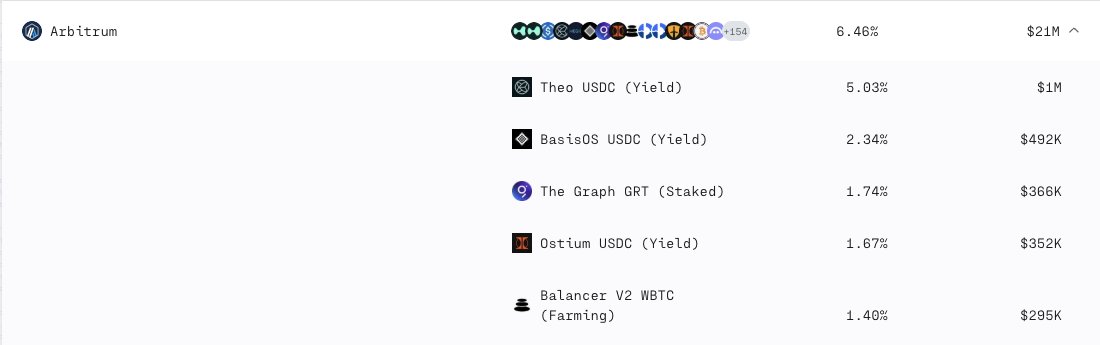

7/ Arbitrum backing is comprised of $21M across 169 assets. Top 5 farms:. @Theo_Network USDC @ $1M.@BasisOS USDC @ $492K.@graphprotocol GRT stake @ $366K.@OstiumLabs USDC @ $352K.@Balancer WBTC @ $295K

1

0

10

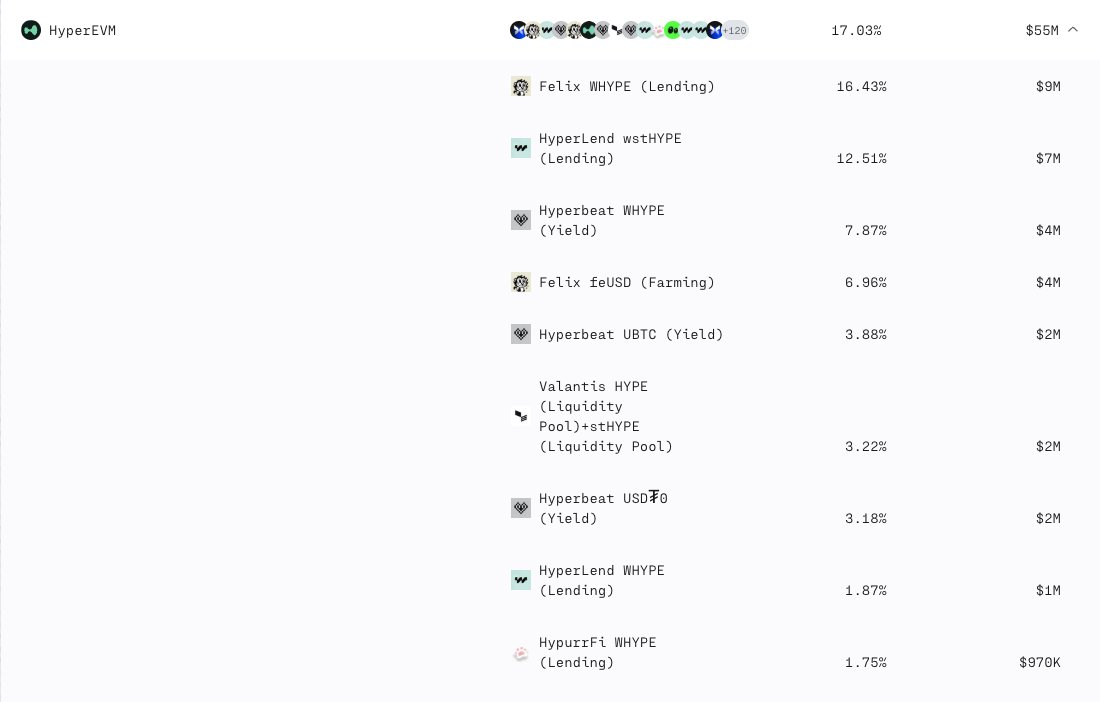

6/ HyperEVM backing is comprised of $55M across 138 assets. Top 5 farms:. @felixprotocol wHYPE, feUSD @ $13M.@hyperlendx wstHYPE, wHYPE @ $8M.@0xHyperBeat wHYPE, UBTC, USDT0 @ $8M.@ValantisLabs HYPE/stHYPE pool @ $2M.@HypurrFi wHYPE @ $970k

1

0

11

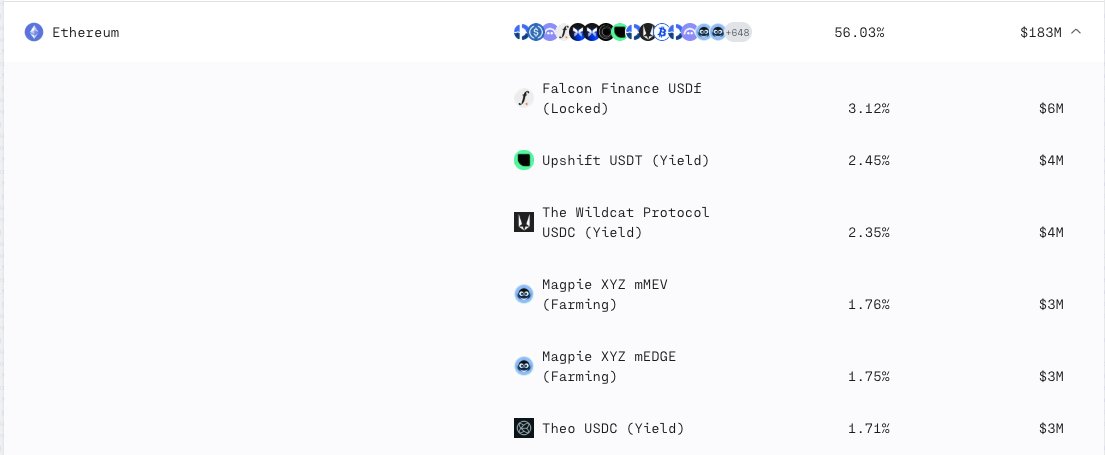

5/ Ethereum backing is comprised of $183M across 661 assets. Top 5 farms:. @FalconStable sUSDf @ $6M.@magpiexyz_io mMEV, mEDGE @ $6M.@upshift_fi upUSDT @ $4M.@WildcatFi wmtUSDC @ $4M.@Theo_Network USDC @ $3M

1

0

22