Curiosity

@Curiosity0x

Followers

249

Following

1K

Media

184

Statuses

549

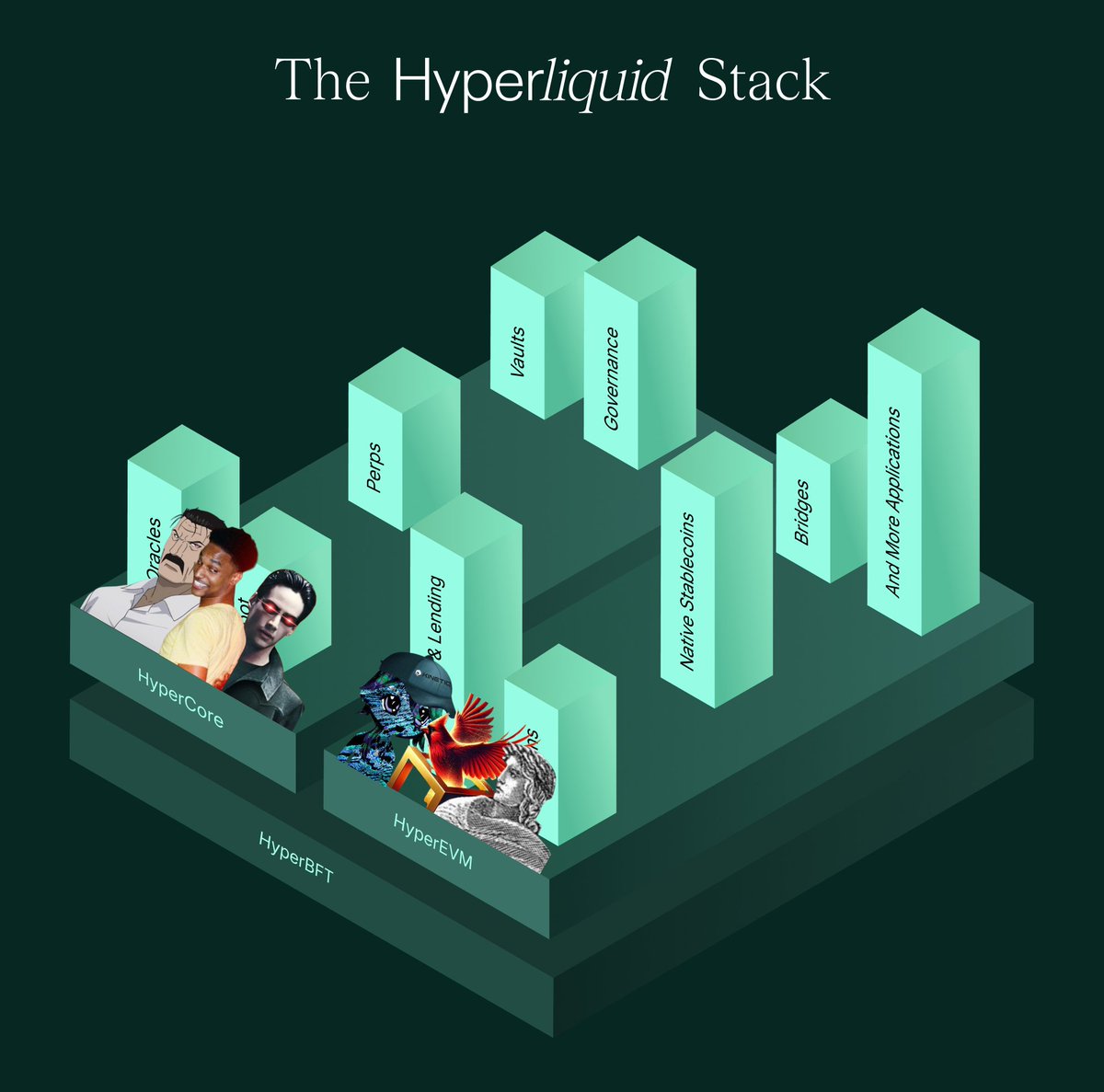

Read Precompiles. CoreWriter. HL bros, one of your biggest upgrades is coming and it’s not easy to wrap your head around. So I dug in. Read @emaverick90’s articles, tracked @0xOmnia’s tweets, and I think I get it. Now I’ll try to break it down for simple folks like me. First,

13

17

89

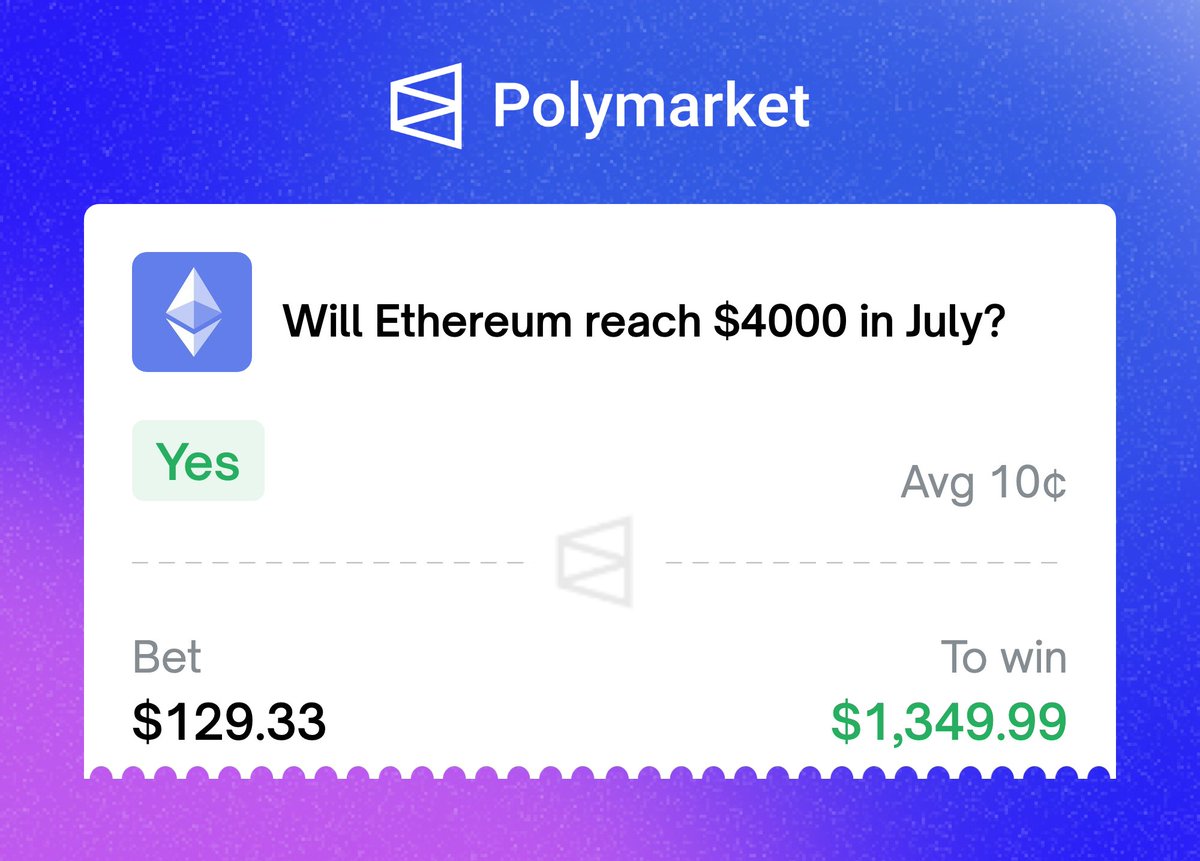

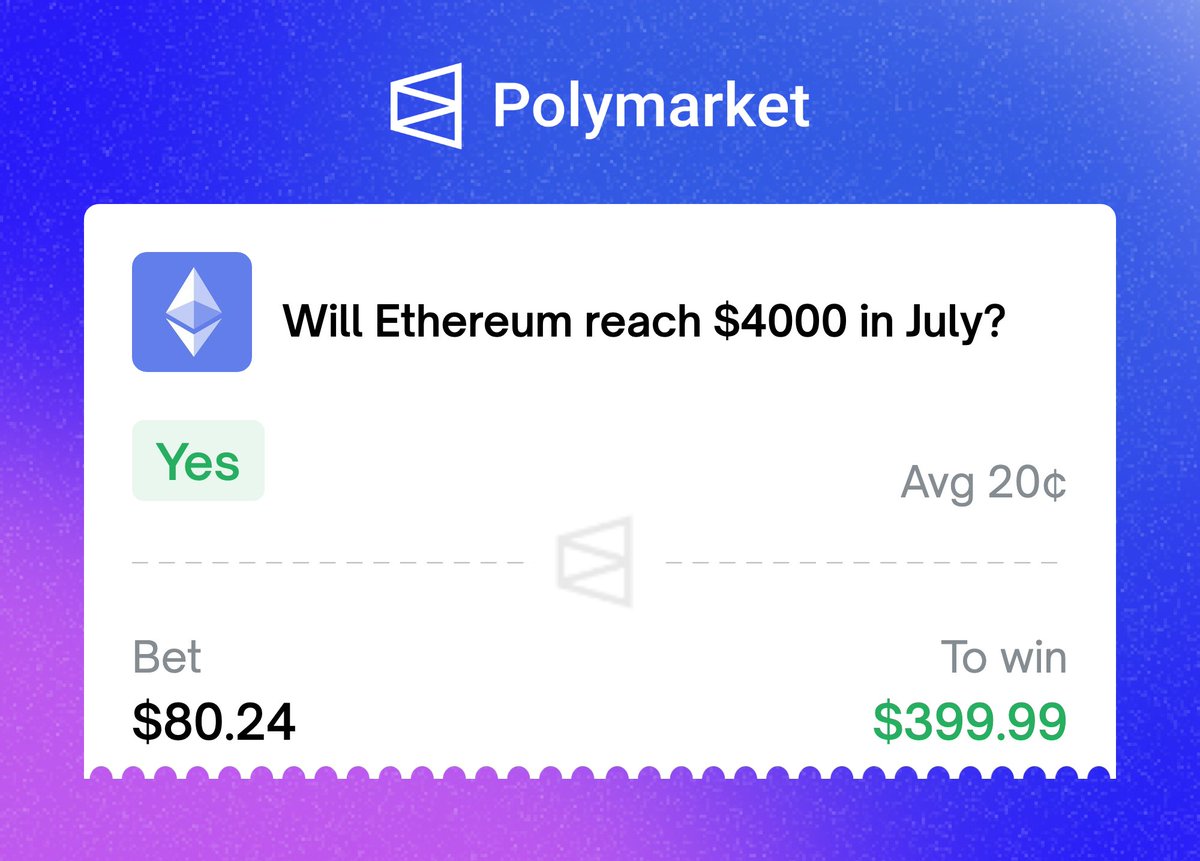

Day 96:. I'm currently about 90% exposed to the market. It's been a long time since I've had this much exposure. This time, no reckless bets. My recent buys have only been $ETH. Pretty simple actually: instead of chasing outperformance and getting burned again, I'm first trying.

Day 95:. Currently, three protocols stand out on HL. Each of them has the potential to make a real impact on the whole ecosystem and benefit from HL’s growth organically. And what’s more interesting, none of them seem to have revealed their full endgame yet. Brick by brick,

0

0

5

Day 95:. Currently, three protocols stand out on HL. Each of them has the potential to make a real impact on the whole ecosystem and benefit from HL’s growth organically. And what’s more interesting, none of them seem to have revealed their full endgame yet. Brick by brick,

0

0

9

Day 94: . Nothing today.

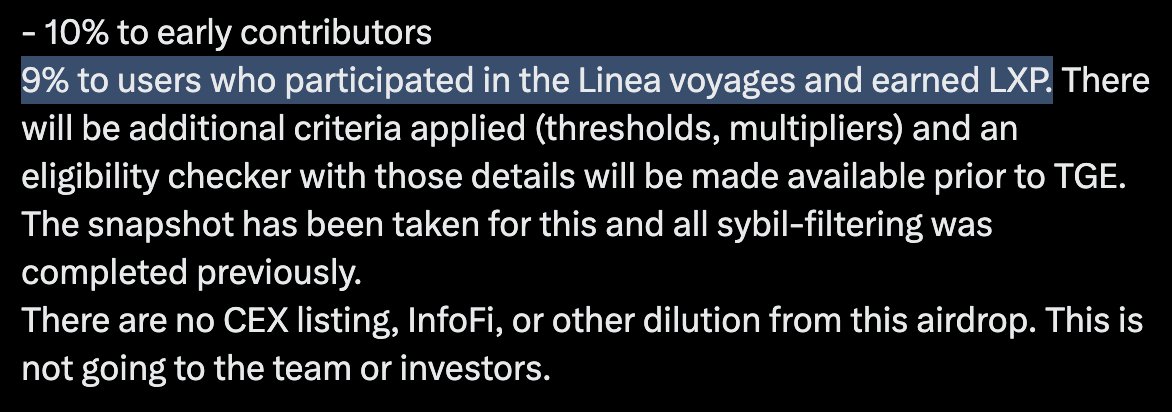

Day 93:. > Got filled on more YT $kHYPE (~11.5%). It’s a risky bet. A lot of things are still unknown:. - FDV.- Team behavior. > Potential dilution (product multipliers, time, multiple seasons). > % of supply for the airdrop. > Weird surprises (like more points per week). >.

0

0

7

Day 93:. > Got filled on more YT $kHYPE (~11.5%). It’s a risky bet. A lot of things are still unknown:. - FDV.- Team behavior. > Potential dilution (product multipliers, time, multiple seasons). > % of supply for the airdrop. > Weird surprises (like more points per week). >.

Day 92:. > Didn’t expect such a big drop on alts today, so I didn’t really have a proper plan to enter anything. So… I just did nothing. Yeah, writing it down makes it sound kind of insane. Also, this dip is a good reminder: the market doesn’t care about my targets. Optimism

2

0

8

Day 92:. > Didn’t expect such a big drop on alts today, so I didn’t really have a proper plan to enter anything. So… I just did nothing. Yeah, writing it down makes it sound kind of insane. Also, this dip is a good reminder: the market doesn’t care about my targets. Optimism

Day 91:. > Bought some spot $ETH during the dip. > Also started buying some YT-kHYPE. @kinetiq_xyz is positioned to become one of the biggest HL projects, but I don’t hold $HYPE and don’t want to lock stables into a DL strategy. Didn’t run any numbers just hoping they don’t.

0

0

6

Day 91:. > Bought some spot $ETH during the dip. > Also started buying some YT-kHYPE. @kinetiq_xyz is positioned to become one of the biggest HL projects, but I don’t hold $HYPE and don’t want to lock stables into a DL strategy. Didn’t run any numbers just hoping they don’t.

Day 90:. > Living a toxic relationship with this token. Got the info early thanks to a solid Twitter feed. Just took a bit too long to enter the position. Hope we get some communication before the whole move gets retraced. Think Alon has one or two days, max. > Withdrew my

1

0

5

Day 90:. > Living a toxic relationship with this token. Got the info early thanks to a solid Twitter feed. Just took a bit too long to enter the position. Hope we get some communication before the whole move gets retraced. Think Alon has one or two days, max. > Withdrew my

Day 89:. > @HyperSwapX points campaign ended today. Surprisingly, I finished with 7,800 points. Most of my farming came from mETH-ETH and XAUT-USDT0. I could’ve earned way more, but didn’t monitor my point accrual closely enough turns out those pools with super tight ranges

1

0

7

Day 89:. > @HyperSwapX points campaign ended today. Surprisingly, I finished with 7,800 points. Most of my farming came from mETH-ETH and XAUT-USDT0. I could’ve earned way more, but didn’t monitor my point accrual closely enough turns out those pools with super tight ranges

0

0

6

Day 87:. > Bought back some of the $PUMP I sold two days ago. Looks like the team might finally do something other than shitposting this week and that’s exactly what the market wants to see. The bottom probably was the day when I, and many others, capitulated.

Day 86:. Some tokens that interest me:. - $ENA is so strong and seems to be leading the way for DeFi/stablecoin tokens. TVL ATH, buyback, TradFi narrative, Converge. Looks like the token to bid if we get a good dip even if it’s not the kind of thing I’ll hold for too long. -.

1

0

4

"Liminal is working on a new system that will let users define dynamic allocation rules.". Obviously, @liminalmoney will need to offer more and more expressiveness to stand out from the competition. However, at some point, it will become too complex for a regular user to manage.

0

0

6

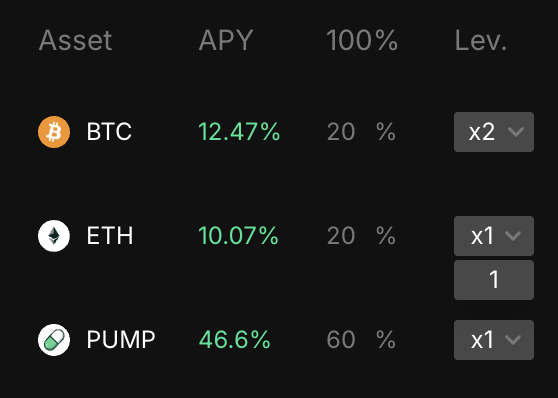

Hey @liminalmoney, I need some leverage with ETH to optimize my farming. Can the devs do something, plz?

2

0

20

Day 86:. Some tokens that interest me:. - $ENA is so strong and seems to be leading the way for DeFi/stablecoin tokens. TVL ATH, buyback, TradFi narrative, Converge. Looks like the token to bid if we get a good dip even if it’s not the kind of thing I’ll hold for too long. -.

Day 85:. I made a weird play. Yesterday, after Alon’s live, I sold half of my pump. Why? Because the team showed zero intent to do anything valuable for holders. That was my invalidation. Then I got that classic feeling: “did I just sell the bottom?”.Everyone was saying the.

1

0

6