Yin Wu

@yinyinwu

Followers

9,317

Following

551

Media

38

Statuses

823

Co-founder & Customer Success at @pulley . Startup helper. I heard people like profiles pics with dog 🐶.

San Francisco, CA

Joined August 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Galatasaray

• 110407 Tweets

Al Jazeera

• 102114 Tweets

Bernard Hill

• 86079 Tweets

Vlad

• 82440 Tweets

#GSvSVS

• 71298 Tweets

Spurs

• 66354 Tweets

Tottenham

• 62816 Tweets

West Ham

• 60174 Tweets

سعد اللذيذ

• 48917 Tweets

Theoden

• 44784 Tweets

Happy Cinco de Mayo

• 31198 Tweets

Ziyech

• 28038 Tweets

Mertens

• 26534 Tweets

Cavs

• 26258 Tweets

Anfield

• 19676 Tweets

Sivas

• 19069 Tweets

#محمد_عبده

• 18557 Tweets

Garland

• 18277 Tweets

Tim Scott

• 17319 Tweets

Paolo

• 17232 Tweets

LOSE MY BREATH MV TEASER 2

• 15482 Tweets

Emerson

• 14941 Tweets

Gakpo

• 13715 Tweets

Bülent Uygun

• 11254 Tweets

توتنهام

• 10122 Tweets

Last Seen Profiles

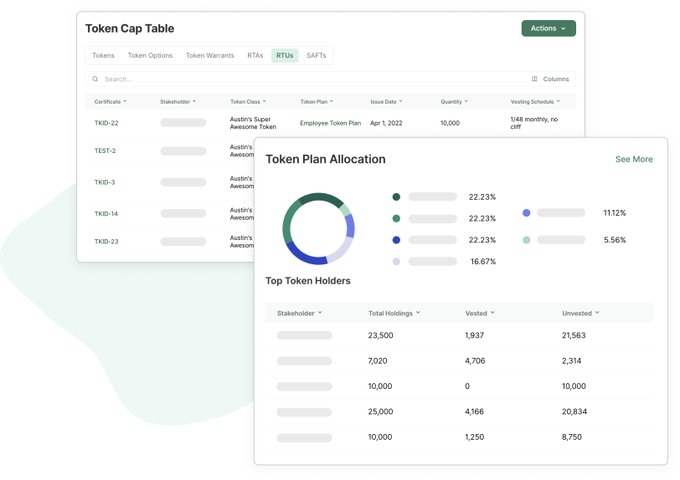

Congrats to all the founders in the midst of

@ycombinator

S23!

First time founders obsess over the product. Second time founders obsess over distribution & sales.

Here's what I learned about founder lead sales to close

@pulley

's first $1m 🧵

20

132

1K

0/

@pulley

raised $40M led by

@rabois

at

@foundersfund

!

We're excited to keep working with

@stripe

,

@eladgil

,

@avichal

,

@ycombinator

, and the many angels below.

We are launching a new *free* tier, Pulley Seed, to help more startups navigate equity👇

51

49

793

1/ Congrats to all the companies starting

@ycombinator

's winter 2023 batch!

I often talk at YC about how to launch and get traction before Demo Day. "If you build it - they will come" doesn't happen.

Here's my advice on how to scale in three months 👇

9

58

505

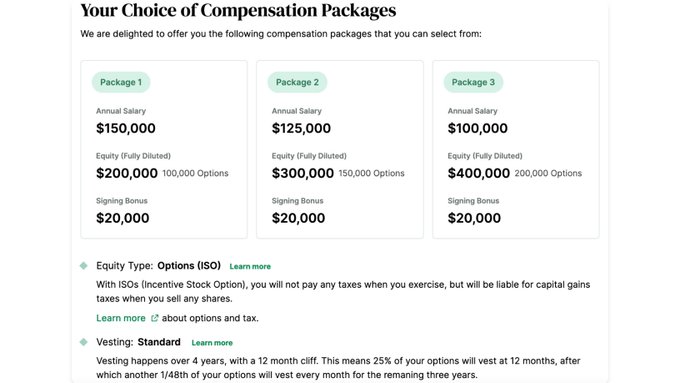

0/ Compensation is hard to get right.

I gave a talk to

@ycombinator

founders on hiring & comp for startups on the lessons we learned scaling

@pulley

from 15 to 50.

Here's what I shared on startup comp👇

12

58

433

OpenMarketCap is a new crypto tracker that calculates price and volume using data from the 10 trusted exchanges on the

@BitwiseInvest

report.

A 95% drop in trading volume means the market for most alts is extremely illiquid / non-existent:

20

141

393

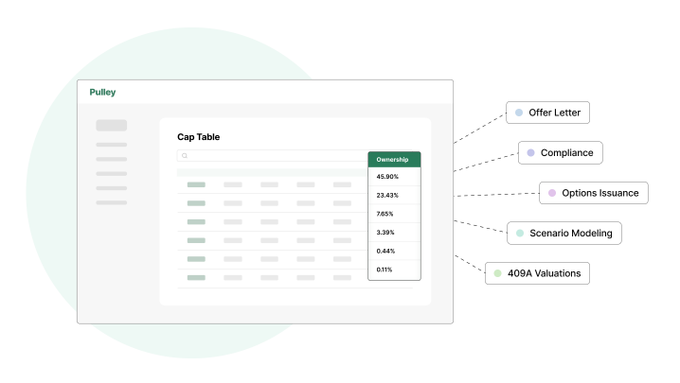

For the 8th straight batch,

@pulley

is, by far, the most popular cap table solution for YC companies.

170 out of 247 Demo Day companies use pulley.

Thank you to all of the

@ycombinator

founders for trusting us. Good luck raising and congrats on getting through Demo Day.

17

8

383

We ran our own process to announce the funding for

@pulley

and received coverage from

@TechCrunch

,

@axios

,

@VentureBeat

.

Here's how to pitch your story to get coverage without a PR agency 🧵

10

40

378

Had a great conversation this morning with

@jaredfriedman

at

@ycombinator

for

@startupschool

Excited to come back to share share a few lessons from being a 3x YC alum who's spend a decade of working on many startups that have failed.

Thread below👇

21

33

258

My mom used GPT-3 to help her write holiday notes to co-workers.

This usually takes her 2+ hours because English isn't her first language.

She's not a first adopter by far. She's usually the last to try a new tool and loved

@OpenAI

.

Really excited by what's to come.

9

14

188

Applications for

@ycombinator

are due TODAY!

I've been through YC 3 times because the community is so valuable.

@pulley

would not exist if it were not for the support of the YC community.

DM me if you want a review of your application.

8

11

169

@karrisaarinen

@joeblau

Common misconception is that it's difficult. It's not.

Here's what it involves: export a cap table from Carta, import cap table to new system.

You do need to contact your stakeholders on the switch, but given the recent news, many folks will welcome the switch.

Many Pulley…

4

8

140

Pivots are far more common than most founders think.

Today

@davj

@tangjeff0

and I are chatting with

@ycombinator

startups on pivoting.

Join us:

How to pivot successfully 👇

1/ when & how to pivot at the early stage

2/ how to come up with new ideas

4

20

82

Ownership matters for economics and control.

I'm excited to collab with

@femstreet

to write a series on how equity works. We want more women (and men and all) to own more of the companies they start.

3

10

61

@ycombinator

@pulley

10/ We made it easy for you to explain comp in your offer letters on

@pulley

.

Founders can plug and play different comp packages, making it much easier for candidates to understand their options.

Walk through a sample here:

2

1

57

I'm giving a talk on how to navigate comp and hiring in a downturn. Looking forward to meeting with 300+ founders at

@ycombinator

’s women founders summit!

If you’re a YC alum, would love to see you there

If you can't make it, LMK if you want

@pulley

to host an event on this

3

7

45

7/ Thank you to our amazing investors in this and prior rounds for supporting us:

@jaltma

,

@lachygroom

,

@sama

,

@ljxie

,

@emilykramer

,

@kloughlin

,

@stanine

,

@lafamigliavc

,

@tonsing

,

@sniyogi

,

@jeff_weinstein

,

@karimatiyeh

,

@adrianaoun

,

@haridigresses

,

@sherwingandhi

,

@HHorsley

2

1

39

@ycombinator

@pulley

4/ Tip 1: Create a growth plan

Set your goal and work backward to hit the numbers.

Avoid the situation where you are 2 weeks from Demo Day and realize that you need to close 100 customers to raise.

Here is a growth template for SAAS:

1

1

39

1500 people signed up for this

@stripe

fireside chat on raising your seed round.

What questions do you have for

@FiroziParinaz

and me?

2

13

35

@ycombinator

@pulley

11/ Most common question I'm asked: How do I compete against FAANG?

TL&DR: Don’t compete. You can’t win on cash comp.

Win candidates based on:

Culture

Equity growth

Team

Growth opportunities

Your goal is not to close every candidate. You only need to close just the right one.

4

1

36

I'll be speaking about crypto and

@DirtProtocol

at this year's Forbes

#Under30Summit

. Thanks to

@DelRayMan

, I have free tickets to give away. Msg me if you're interested!

3

6

34

Launch early to drum up inbound leads.

Be your biggest advocate.

Multiple launches doesn't matter because no one is paying attention.

@ycombinator

@pulley

11/ Tip 5: Launch early

The closer to demo day, the harder it is to stand out.

More companies launch, and reporters are busy. Going early reduces your competition for attention.

A general rule is to launch before you think you’re ready.

1

0

12

1

1

34

If your buyer persona is unclear, return to square one.

Clarify who you are trying to serve and rebuild with a clear user in mind.

Here's more on identifying your customer:

@ycombinator

@pulley

6/ Tip 2: Identify your customers

Your ICP needs to be clear enough that an upworker contractor can build a customer list.

Unclear:

- People looking for a better Zoom: there isn't a repeatable way to find them

Better:

- Finance leads at series A startups

1

2

26

1

0

34

We have two guidelines around meetings

@pulley

:

- No agenda, no attenda

- Reset every month: prevents the recurring meeting that last in perpetuity

One value I've found of meetings is teaching. You can teach async, but miss out the most valuable part of the Q&A.

4

2

33

Excited to partner with

@TechCrunch

to share the 3 questions on seed funding we hear founders ask the most👇

1. How much should I raise?

2. How do I determine my valuation?

3. What are gotcha terms?

I didn't know anything when raising for the first time.

1

6

33

2/ We work with

@altas

and

@clerkyinc

to make it easy to onboard to Pulley immediately after incorporation.

Our team reviews every startup's cap table. For the rest of the year, we'll waive our standard onboarding fee.

Get started here: !

2

1

33

This is how you build for founders. Everyone should use Atlas to incorporate.

@pulley

loves partnering with

@jeff_weinstein

and

@stripe

to make it easier for anyone to start and scale their companies.

0

3

32

@VitalikButerin

1/ The data type matters. TCRs are useful for objective, publicly verifiable data (ex: erc20 token and their smart contract address for decentralized exchanges). Trusting a central source for this info is a single source of failure.

1

3

31

@ycombinator

@pulley

7/ Most candidates don't understand the value of equity.

Walk through:

- growth potential by comparing to similar startups

- relative discount of common vs preferred shares

Do NOT oversell your equity. Good candidates are smart. Acknowledge there is a chance it goes to $0.

2

0

27

@ycombinator

@pulley

6/ Tip 2: Identify your customers

Your ICP needs to be clear enough that an upworker contractor can build a customer list.

Unclear:

- People looking for a better Zoom: there isn't a repeatable way to find them

Better:

- Finance leads at series A startups

1

2

26

@ycombinator

@pulley

19/ I'll be tweeting a series on how to make the most out of YC.

We'll cover:

- Founder led sales

- Pivoting

- Fundraising

Comment below if you have other topics you want to learn more about.

Follow

@yinyinwu

and

@pulley

for tactical advice on scaling startups.

6

1

26

Do what you love.

Bad advice for founders because you're starting a company and not a hobby. Working on a problem you love isn't enough because you need traction to hire good people and fundraise.

Zoom out from the business and consider the market and business model.

Female founders: What is common startup advice that has been dangerous for you to follow?

@cadran_c

@esthercrawford

@rachellipstick

@APatelThompson

@alyssaatkins

@chewishgirl

@ooshma

@marronelisa

@yinyinwu

@Tracy_Young

@triketora

@CatchKristen

@LisaGelobter

@phaedrael

11

7

31

1

2

26

8/ Thank you, continued

@JLehot

,

@kevinhartz

,

@ramnikarora

,

@jubos

,

@dksf

,

@generalcatalyst

,

@HustleFundVC

,

@vincenzo

,

@combinevc

and many others without twitter accounts

3

2

26