Quantifiable Edges

@QuantifiablEdgs

Followers

21K

Following

1K

Media

486

Statuses

5K

Assessing Market Action with Indicators and History

U.S.

Joined July 2008

Interesting article on the @NAAIM_Official exposure index and the current divergence Tom has noticed. .

2

4

18

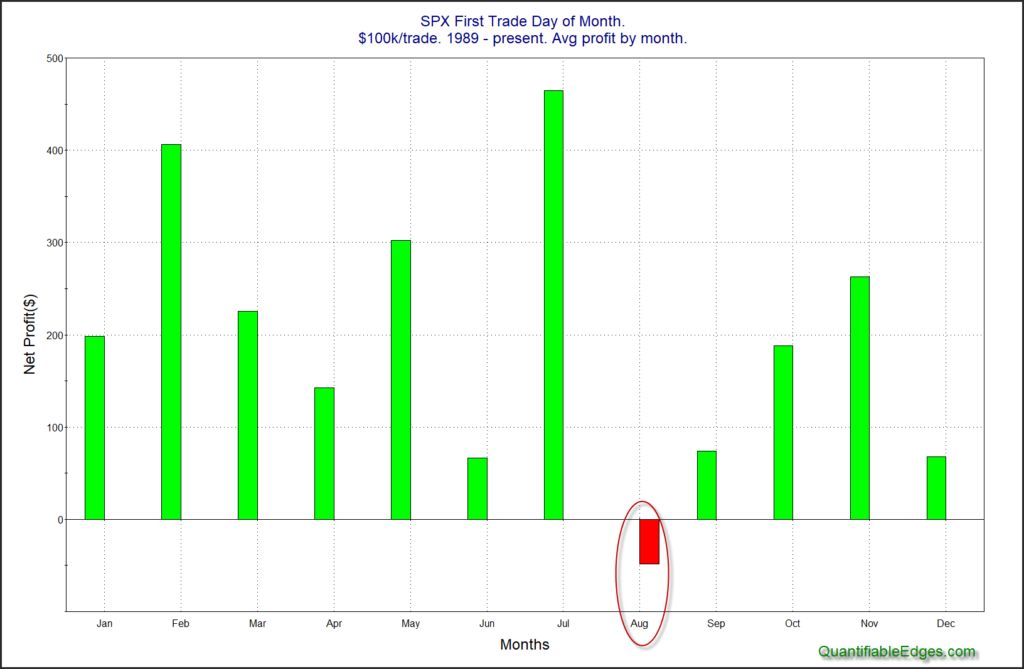

First trading day of the month has generally been strong. except August: $SPX $SPY #seasonality $QUANT $STUDY

1

0

21

RT @RyanRedfernCMT: I'm at @NAAIM_Official Uncommon Knowledge conference reading my daily @QuantifiablEdgs newsletter. And who is sitting….

0

1

0

RT @Callum_Thomas: ICYMI: Weekly S&P500 ChartStorm blog post Thanks + follow reco to chart sources.@topdowncharts….

chartstorm.info

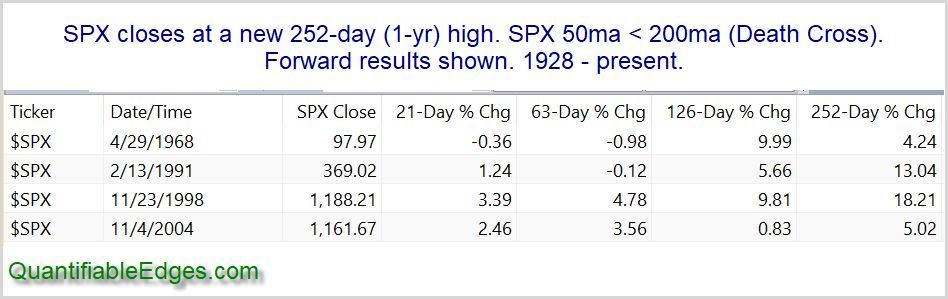

This week: technical check, death cross fact and fiction, market indicator notes, gold vs stocks, retail buy the dip, bear market regimes, and rethinking the bull case...

0

7

0

21-day realized vol for $SPX is now 46. Hasn't been this high since 2020, when it peaked at 95. The 46 should continue to rise over the next several days, since low-volatility days from mid-March will be falling off the back of the calculation. $VIX is typically above realized,.

7

3

20