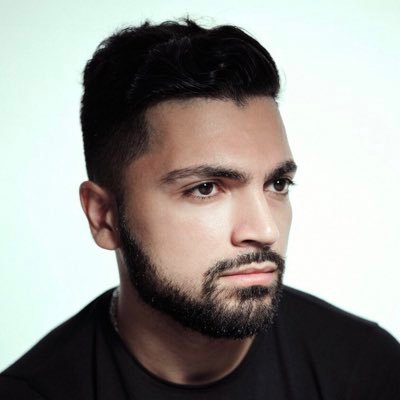

Ted Chen

@tedchenCPC

Followers

266

Following

93

Media

2

Statuses

77

Founder of @CarnegieParkCap, Sponsor of @TLGYAcq, and Co-Founder of @Stablecoin_X

Joined August 2025

Today, we are proud to announce Multicoin Capital liquid fund’s investment in ENA, the native token for Ethena Protocol, the issuer of USDe, the leading synthetic dollar. Synthetic Dollars aim to generate yield and create stability by executing fully-collateralized delta-neutral

100

61

342

The stablecoin wars are only just starting. Ethena has some of the biggest guns in this fight given the GENIUS Act doesn't impact their core USDe business. Everyone else will be subsidizing or cannibalizing their existing business to gain scale. Remember when people thought

0

0

2

5D: Whatever size Ethena whitelabel stablecoins collectively aggregate to will ultimately mean USDtb (as the backing asset) will also scale accordingly. USDtb at scale = significant TradFi partnership opportunities. Is there a difference between USDC and USDtb at that point?

1

0

3

4D: It also opens up the opportunity to capture significant share of USDC's 76 billion circulating supply. The USDH saga taught us that Circle is stuck between a rock and a hard place. As a public company, it can't share the majority of its yield or it's shareholders will puke.

1

0

3

3D: Ethena can aggressively scale into this market because the model is synergistic with, rather than cannibalistic to, Ethena's core USDe product. It creates a new value proposition by allowing whitelabel stablecoins to incorporate USDe into their backing, should their

1

0

2

2D: The model addresses the #1 pushback the market has with everyone wanting their own stablecoin - liquidity. Pending risk committee & governance approval, whitelisted participants can swap Ethena whitelabel stablecoins into USDT/USDC in USDe's backing. Instant liquidity!

1

1

3

1D: Ethena Whitelabel leans into the demand for yield from distribution channels (exchanges, apps, wallets, etc.), giving the market what it wants. This is par for the course, as Ethena has always been about democratizing access to yield, a mission first demonstrated by USDe.

1

0

3

Not sure people fully understand the 5D chess moves that @ethena_labs and @gdog97_ are playing.

This September, we introduced Ethena Whitelabel: our stablecoin-as-a service stack. Since its introduction, we secured major partners, including @megaeth_labs, @suinetwork, and @jupiterexchange. The world's largest chains and apps are choosing Ethena. Learn more below on why

5

8

88

Want to commend the speed with which Binance has addressed the losses on their platform. The size of user compensation is unprecedented. This is the first step to regain user trust which will be rebuilt through time. Now is not the right time to be blaming each other. Binance

263

81

861

In the storm of volatility, fundamentals speak loudest. USDe had and has always remained overcollateralized, @chaos_labs oracles held the line as intended, and positions on @aave stayed safe. Through it all, PTs and yield strategies on Pendle stayed resilient just as designed

This is why a price oracle ** is ** a risk oracle. Secondary market price of @ethena_labs's USDe temporarily hit 0.65 on secondary markets like @binance due to the market sell-off, following Trump's China tariff news. All of this is while USDE was overcollateralized, continuing

15

17

192

Ethena did NOT depeg, agreed with @hosseeb but there's a shorter, clearer description imo: The peg is not defined as the price on a single venue. If I create a centralized place where I buy/sell USDC for $.90 for a few hours does that mean “USDC is depegged?” Of course not. The

Did Ethena Really Depeg? I’ve seen a lot of chatter about the Ethena depeg during the market mayhem this weekend. The story is that USDe briefly depegged to ~68c before recovering. Here’s the Binance chart everyone is quoting: But digging into the data and talking to a bunch of

50

30

327

Friday could have one of DeFi's worst black swan events. On paper, over $19 billion in liquidations hit across CEXs and perp DEXs. The real figure was likely higher. Many were surprised that on-chain lending markets came out mostly untouched, but outcomes can be misleading.

42

63

342

💯correct. Exactly what people need to understand: $USDe DID NOT depeg. This was entirely a liquidity vacuum and exchange issue. Anyone saying $USDe depegged either doesn’t understand how market structure works or simply looking to spread FUD.

Did Ethena Really Depeg? I’ve seen a lot of chatter about the Ethena depeg during the market mayhem this weekend. The story is that USDe briefly depegged to ~68c before recovering. Here’s the Binance chart everyone is quoting: But digging into the data and talking to a bunch of

0

0

1

The Oct 11 Crypto Crash — What Really Happened TL;DR: Roughly $60–90M of $USDe was dumped on Binance, along with $wBETH and $BNSOL, exploiting a pricing flaw that valued collateral using Binance’s own order-book data instead of external oracles. That localized depeg triggered

681

2K

9K

While we share these suggestions privately with any partner we work with across both DeFi and CeFi, want to surface this publicly so there is zero doubt going forward on what we view as appropriate oracle design and risk management for USDe:

205

212

1K

The TLDR on $USDe is that: (i) mint/redeem was uninterrupted (ii) backing remained over-collateralized and even had some unrealized P&L (iii) underlying basis trade had any issues (e.g., no ADLs) Which basically means USDe worked as expected and never depegged on the primary

0

0

1

TLDR: mNAV compression is the result of bad execution or poorly structured vehicles. It’s not because DATs don’t work. $MSTR and $BMNR at positive mNAVs is real-time proof of that. The market is evolving, not dying. DATs are here to stay. Let’s just get smarter on them.

0

0

2

But it needs to be done in a thoughtful way and too many continue to be poorly structured. Not every altcoin ecosystem is going to resonate with public equity investors. But at a baseline, pitch the fundamental thesis. Fundamentals matter. And if the token is garbage, the DAT

1

0

1