omer

@omeragoldberg

Followers

4,060

Following

87

Media

269

Statuses

1,403

founder @chaos_labs | eng @instagram , @meta , | cs @TechnionLive

Williamsburg, Brooklyn

Joined August 2016

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Renzo

• 149514 Tweets

#WWERaw

• 82544 Tweets

#GodMorningTuesday

• 37096 Tweets

Scarlett Johansson

• 33379 Tweets

Oilers

• 32756 Tweets

Fani Willis

• 31365 Tweets

定額減税

• 30436 Tweets

Kingdom Hearts

• 28122 Tweets

राजीव गांधी

• 26553 Tweets

梅雨入り

• 25308 Tweets

Birds Nurturing

• 24042 Tweets

給与明細

• 24010 Tweets

Gunther

• 22163 Tweets

#Canucks

• 20882 Tweets

Vancouver

• 20788 Tweets

#ファンパレハーフアニバーサリー

• 18934 Tweets

Edmonton

• 17581 Tweets

ドジャース

• 17426 Tweets

金額明記

• 17231 Tweets

Amber Rose

• 15464 Tweets

ショートアニメ

• 14937 Tweets

キングダムハーツ

• 14089 Tweets

Lyra

• 12452 Tweets

国民実感

• 10659 Tweets

Last Seen Profiles

1/

@synthetix_io

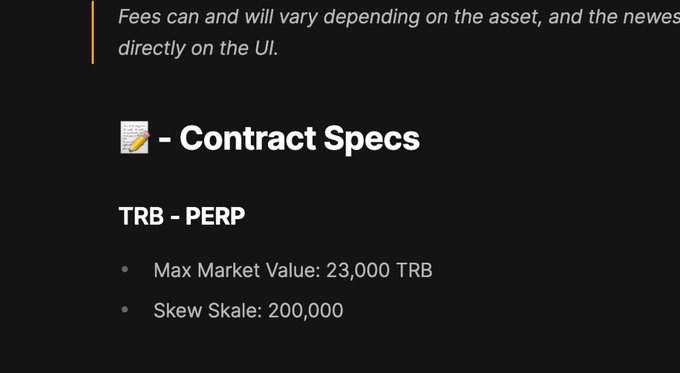

Market Manipulation

We've received outreach about today's market manipulation. This incident is isolated to the $TRB market, resulting in a ~2m loss to $SNX stakers. Let’s give some background before diving into the attack.

3

70

347

Thank you to everyone who reached out over the last three days. The

@chaos_labs

team landed in Israel last weekend, where our R&D headquarters are based, just before the nightmare of Hamas terrorist attacks began.

As of this morning, we are all accounted for - our American,

16

16

248

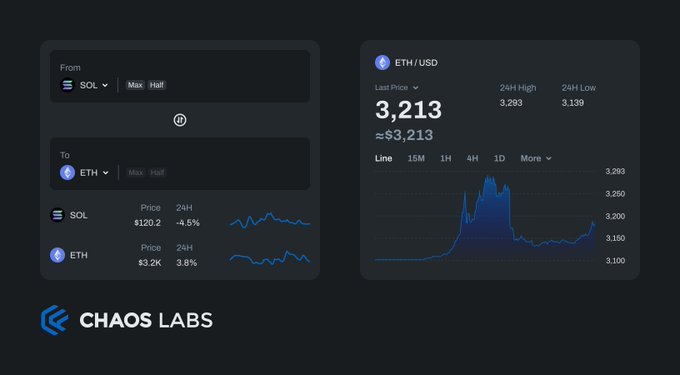

1/ Excited to share that

@chaos_labs

has partnered with

@GMX_IO

to launch the GMX GLP Risk Hub! 🥳💥

V0 is live for

@arbitrum

@avax

and focuses on margin at risk, real-time metrics, alerting, and VaR simulations.

Let's dive into the platform below! 👇

27

74

216

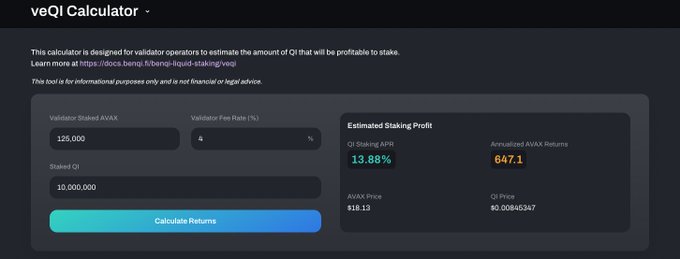

We’re excited to announce the launch of the

@BenqiFinance

$veQI calculator! This tool completes our analysis of Benqi’s new $veQi model and how

@avalancheavax

validators can benefit from it.

Link:

1/3

7

43

173

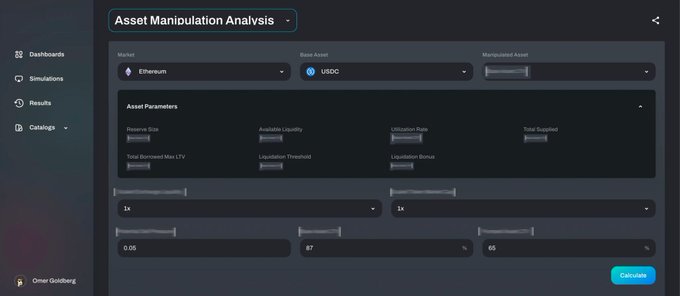

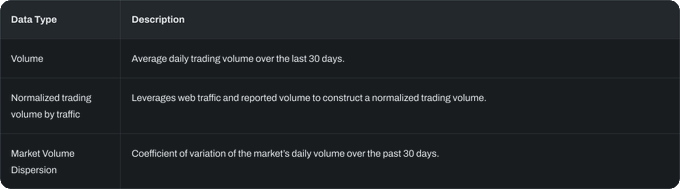

1/

@chaos_labs

is proud to launch the

@Uniswap

V3 TWAP Oracle Risk Portal, in collaboration with

@UniswapFND

.

The Portal highlights real-time cost of of TWAP manipulation across V3 pools.

14

40

192

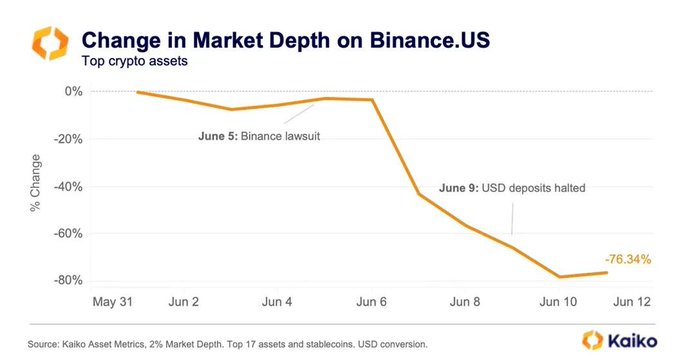

1/ Compound V2 Oracle Failure Causing Bad Debt

@compoundfinance

V2 accrued over ~500k in Bad debt from the UNI +40% candle, driven by the

@UniswapFND

proposal to activate the fee switch. The issue? The Oracle didn’t update fast enough.

8

37

191

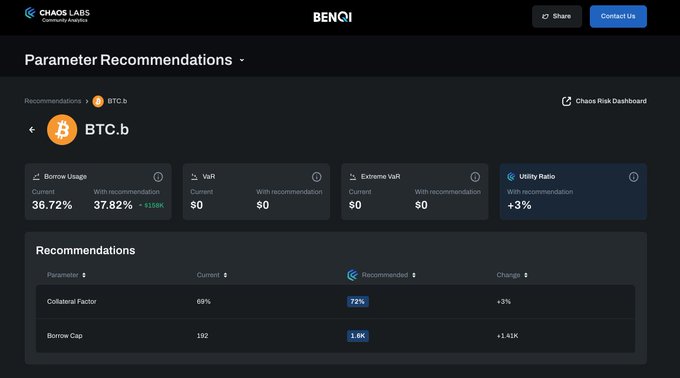

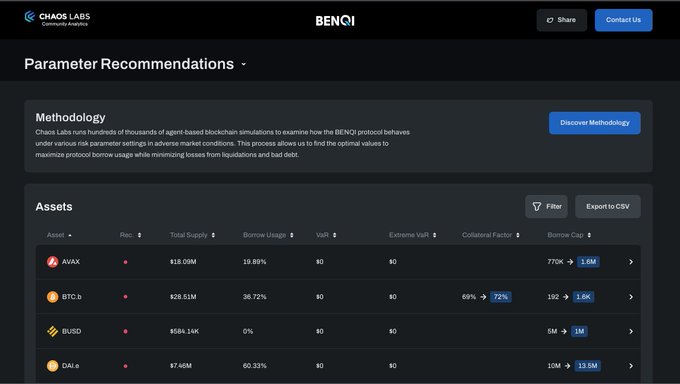

1/ Today,

@chaos_labs

unveils the Benqi Parameter Recommendations Platform, a cutting-edge risk management tool we created as part of our ongoing partnership with

@BenqiFinance

, an

@avalancheavax

native borrow and lend protocol.

15

59

168

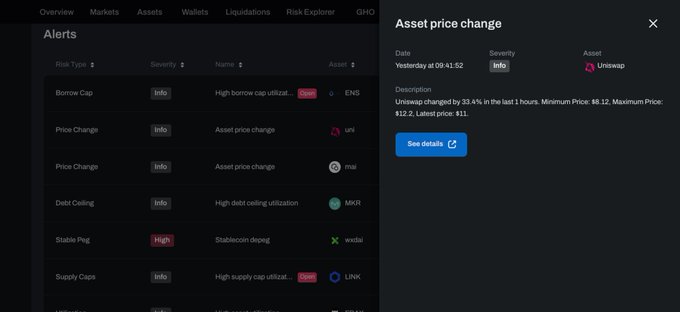

1/ Real-time DeFi risk management relies on observability and alerting mechanisms. To this end, we have integrated live alerts, offering users real-time data and enabling informed decision-making. This new feature is available on the

@AaveAave

and

@BenqiFinance

Risk hubs 💥✨

6

48

152

1/ Low Liquidity Weekend + Low mktcap asset = highly profitable trading strat?

@DriftProtocol

's $RLB LP DLP pool is down -162.00% over the past several hours.

Let's dive in 👇

11

40

137

1/ After months of rigorous research, and simulations, we're excited to share the

@GMX_IO

V2 Risk Framework and Methodologies.

@chaos_labs

is pioneering research in the DeFi derivative space, and bridging the gap between theory and practicality.

Stay tuned more soon 🙏

6

57

145

Working closely with the

@BenqiFinance

team, we've conducted an in-depth economic analysis of their new $veQi model and how $AVAX validators can benefit from it

2

32

125

1/ Ethena's Protocol Launch

First of all - hats off to

@leptokurtic_

and the team.

@ethena_labs

launch has been spectacular and well-deserved after months of hard work.

8

40

131

the next chapter of the

@chaos_labs

<>

@chainlink

partnership 🥁

oracle tooling for

@terra_money

! this is critical for allowing devs to build high-quality chainlinked smart contracts 💥

it is also a core piece of infra for simulations on terra 😎

8

32

125

1/

@chaos_labs

has been awarded a

@compoundfinance

grant to build a Cross-Chain Risk and Analytics platform for the community!

6

21

111

@chaos_labs

is excited to announce the v0 launch of the

@AaveAave

v3 Risk Application!

We support v3 deployments on:

@arbitrum

@avalancheavax

@0xPolygon

@optimismFND

@harmonyprotocol

@FantomFDN

So what does it do?

1/7

19

41

102

The heart of

@chaos_labs

will always be a best-in-class, product-driven Risk Platform for DeFi.

Our product teams hail from

@Meta

,

@instagram

,

@Google

, and more. We apply the same user-centric ethos to building the Chaos platform.

Check out the newest release! 🚀

1/ 🚀Chaos Labs is thrilled to unveil the latest version of our Risk Hub. Prepare for an upgraded experience redefining risk management, monitoring, and alerting.

@AaveAave

@BenqiFinance

@GMX_IO

@VenusProtocol

@tapioca_dao

@compoundfin

@RDNTCapital

🧵🔍 New Developments 🔽

3

17

75

8

30

112

1/ Oracle Risk and Security Standards: An Introduction

Today,

@chaos_labs

announces the open sourcing of our Oracle Risk and Security Standards Framework after extensive research and audits for leading DeFi teams.

7

24

110

1/ Today, we're proud to share the

@chaos_labs

Risk Oracles launch 🚀

Complementing the existing work completed by

@bgdlabs

, Risk Oracles will streamline

@aave

's risk management, unlocking near-real-time risk adjustment capabilities.

9

23

104

1/ Another week, another launch! We're thrilled to announce the latest addition to our roster of offerings at

@chaos_labs

: the

@AaveAave

Asset Listing Portal. This platform is specifically engineered to facilitate and optimize the integration of new assets into the Aave protocol

5

36

98

1/ Today

@chaos_labs

launched the

@osmosiszone

Liquidity Incentive Optimization Hub in collaboration w/

@HathorNodes

✨

This will allow the Osmosis community to make data-driven decisions on incentive allocation. Here is a quick thread on how it works 👇

3

24

96

1/

@chaos_labs

is excited to announce the release of our Parameter Recommendation Platform for the

@AaveAave

community!

The platform is live here:

2

24

83

@chaos_labs

is really excited to partner with

@AaveAave

to build a Collateral At Risk and User Metric dashboard!

this is a small taste of the impact we hope to drive for the community moving forward 🥳 👻

thanks

@AaveGrants

for being a great partner!

9

22

76

@osmosiszone

Liquidity Incentives Portal Update ✨

@chaos_labs

has been selected for a grant from

@OsmosisGrants

to partner with

@HathorNodes

to optimize the Osmosis Incentives Distribution program.

1/6

7

13

71

1/ 🎉

@chaos_labs

is thrilled to announce a new strategic partnership with

@tapioca_dao

, centered around risk management and parameter optimization for the upcoming launch of the

@LayerZero_Labs

powered, omni-chain money market protocol and USDO.

5

28

69

1/

@chaos_labs

has been selected by

@UniswapFND

for a grant to create an innovative simulation experience for users to test sophisticated liquidity pool strategies on Uniswap V3

3

13

76

1/ During

@AaveAave

v3 Risk app dev, the

@chaos_labs

data pipelines detected that v3 subgraphs were returning incorrect data. This details the research, bug, mitigation, and collaboration with the AAVE team to deploy a fix. For more check out our blog:

6

14

70

1/

@chaos_labs

, in collaboration with

@compoundfinance

and

@compoundgrants

, has launched the Cross-Chain Analytics and Observability platform that offers risk analytics and monitoring across all EVM-compatible Compound deployments. Let's dive into the features below 👇

3

24

74

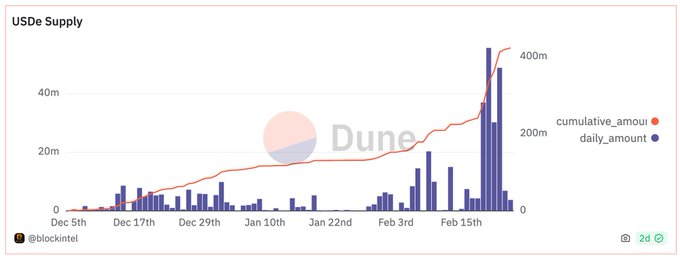

@chaos_labs

is partnering with

@leptokurtic_

and

@ethena_labs

to develop the USDe stablecoin. Ethena's vision is ambitious and innovative, building on the massive adoption of LST's like

@LidoFinance

's $stETH post merge.

Our mission? Securing Ethena from day one.

Stay tuned 🤝

1/ Chaos Labs is proud to announce that we're partnering with

@ethena_labs

to fortify the economic robustness of the innovative USDe stablecoin

2

34

83

0

24

72

crvUSD is novel and efficient in design. As the protocol scales, monitoring and observability is critical in enabling data-driven decisions in real-time.

Excited to begin contributing to the

@CurveFinance

community! 🙏

1/ Proud to announce the launch of the

@CurveFinance

crvUSD Risk Monitoring and Alerting Platform, supporting the new stablecoin on

@ethereum

.

Check out the portal here:

Let's dive into the features below👇

4

29

100

8

14

69

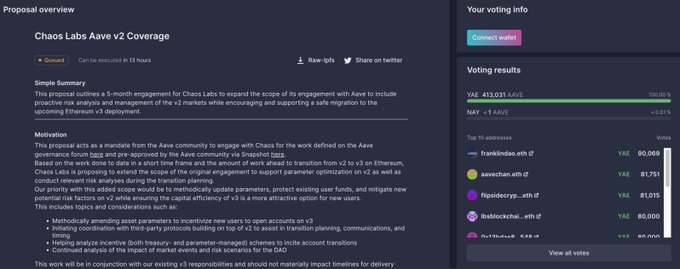

Very excited to share that the

@chaos_labs

proposal to expand

@AaveAave

risk coverage to V2 received unanimous community support 👻

7

2

68

1/ The early growth of the

@dYdX

Chain, driven by the community and the Launch Incentive Program, has been phenomenal. As Season 1 nears its conclusion in the next 10 days, let's dive into some exciting initial numbers.

10

20

68

1/

@chaos_labs

and

@ConsideredFin

have launched the

@dYdX

Risk Parameter Recommendation Portal, a tool providing real-time parameter suggestions based on market liquidity and order book data, for the larger

@dydxfoundation

@dYdX

community.

1

16

53

Proud to share that

@chaos_labs

is joining the

@AaaveAave

community as a full-time contributor focusing on risk for v3 markets following the successful on-chain vote!

We are building a state-of-the-art risk platform to empower the community to make data-driven decisions.

1/5

1

8

54

Advanced tooling for

@Uniswap

V3 LPs is critical in driving broader institutional adoption.

Extremely proud to partner with

@UniswapFND

, focusing on tooling for LPs.

@DefiLab_xyz

,

@RaffiSapire

,

@jason_of_cs

- thank you for the guidance and feedback 🙏

More soon 👀

1/ We're proud to share the

@Uniswap

V3 LP Simulator that helps identify profitable LPing strategies.

This

@UniswapFND

collaboration enables potential market makers to find the most lucrative pools to provide liquidity to based on the LP's preferences.

6

9

53

1

14

48

10/ Oracles are not a one-size-fits-all solution. An Oracle risk methodology that made sense once may not make sense in the future due to shifts in market dynamics, as we see above.

@chainlink

proposed disabling this feed months ago.

Proactive risk management is critical.

3

2

47

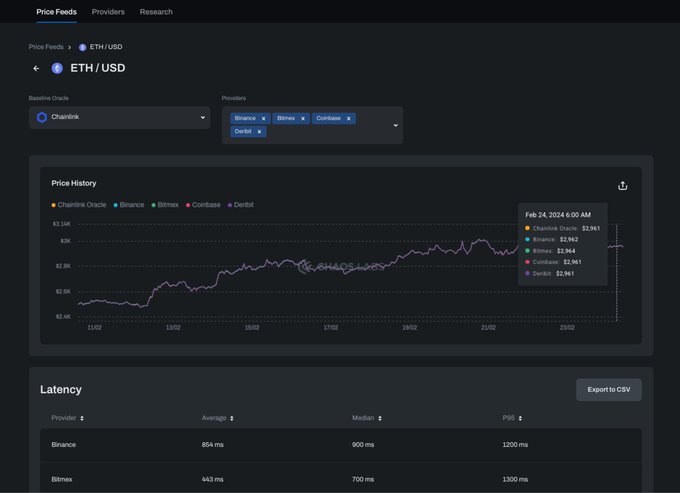

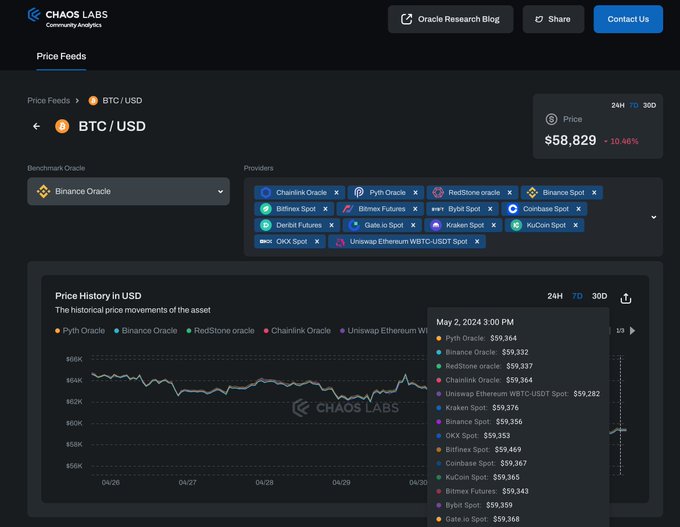

1/ Are You Confident in Your Oracle’s Data Security and Quality?

Blockchain adoption requires security to be as robust as Web2, ideally better. Yet, tooling to assess Oracle security, performance, and quality has not been available.

The

@chaos_labs

Risk Portal solves this.

2

14

44

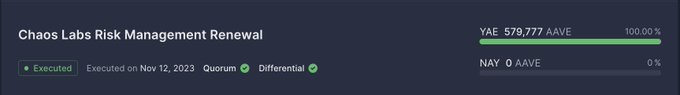

1/

@chaos_labs

extending the

@aave

Risk partnership is an incredible milestone.

In a short year, we've built a state-of-the-art platform providing 24/7 coverage across

@Polygon

@avax

@ethereum

@arbitrum

@optimismFND

@gnosischain

@MetisDAO

@BuildOnBase

.

1/ Thank you,

@aave

community, for your vote of confidence in Chaos Labs and the unanimous support for our renewal! We look forward to continuing our hard work in securing Aave and maintaining the protocol’s position as market leader 🚀👻

1

4

36

3

2

43

Decentralized insurance is one of the most promising frontiers of DeFi.

@chaos_labs

is excited to partner and collaborate with the

@NexusMutual

@NexusMutualDAO

community to ensure the economic robustness of the planned Ratcheting AMM.

1/ Chaos Labs is proud to partner with

@NexusMutual

@NexusMutualDAO

to ensure the economic robustness of the Ratcheting AMM (RAMM) design.

Chaos will collaborate with the Foundation Engineering and DAO R&D teams as the new tokenomics development progresses.

3

3

21

2

13

43

@chaos_labs

is super excited to release the

@Uniswap

v3

@HardhatHQ

plugin. We've been collaborating closely with

@uniswapgrants

and have built this on top of our previous grant work.

So what does our plugin enable?

1/3

3

11

39

Proud of the

@chaos_labs

team for supporting

@GHOAave

w lightning ⚡️ speed pace of shipping.

A huge leap forward for the

@AaveAave

community 👻!

This is just the start for our stablecoin support. More soon 👀

1

8

41

4/ This isn’t a

@chainlink

issue; instead, it’s a risk issue. Risk monitoring is critical, and liquidity is a core risk indicator on the

@chaos_labs

platform, as seen on the

@aave

Risk portal. Let’s dive in👇

1

0

35

Airdrops reward community engagement and drive growth, yet remain an evolving art in a nascent design space.

@chaos_labs

and

@nansen_ai

are committed to recognizing those who've established

@LayerZero_Labs

as an interop leader.

Transparency is key; stay tuned for updates 🫡

Sybil Report

LayerZero has been working with industry-leading partners

@chaos_labs

and

@nansen_ai

to conduct our sybil detection report. This analysis will consider every user’s total transactions weighted across all LayerZero applications with the goal of aligning TGE with

883

1K

4K

3

9

36

1/

@AaveAave

continues to expand, and

@chaos_labs

keeps on shipping 🚢

Excited to share the

@GHOAave

Risk Hub!

The dashboard is live here 👇

2

11

30

The strongest indicator of the future of DeFi is the quality of builders drawn to crypto.

Working with the

@OstiumLabs

is a testament to that.

Excited to see

@kaledora

@contrarianmarco

lead the new wave of builders, and excited to build alongside them 🙏

1/ We’re thrilled to announce our partnership with

@OstiumLabs

!

We’re collaborating to enhance mechanism design and economic security through a risk modeling and monitoring platform.

2

5

36

3

10

35

Our collaboration with

@Uniswapfnd

continues 🥳

We are proud to have received a grant to continue our earlier research on TWAP vulnerabilities. We'll explore different attack vectors exposed by Ethereum's transition to PoS, including pricing & block manipulation.

1/6

3

10

34

1/ Excited to share the

@AaveAave

v3 Risk Bot!

A crucial requirement for risk monitoring is alerts and notifications for significant events. We’ve launched v0 of the AAVE v3 Risk Bot to increase visibility across risk events.

1

9

33

Great time speaking at

@DeFi_Conference

about Risk and Economic Security in Liquid Staking with

@benqinomics

and

@AradChen

🎊

Super excited for what the

@BenqiFinance

and

@Solidus_Labs

teams are building 👀

more news next week!

1

7

31

Really proud of the recent simulation work we’ve been doing with

@MakerDAO_SES

!

Join our

@MakerDAO

community call tomorrow to learn more.

In the meantime - here’s a written update :)

6

12

30

11/ For those focused on Oracle Security, we've built a platform to navigate these risk vectors and will share more soon 👀

Interested? Feel free to DM and connect on how

@chaos_labs

can secure your protocol🛡️

1

0

29

2/ A huge shoutout to

@GMX_IO

core contributors

@xdev_10

@coinflipcanada

@xhiroz

@TheHuangWay

, and the community, who were amazing to collaborate with 🙏

@chaos_labs

is super excited and humbled to contribute to the launch and ongoing economic security of GMX 🫐 🥳

0

5

26

collaborating with

@Uniswap

on tooling for v3 twap oracles was a great experience. ty

@uniswapgrants

🙏

twaps are powerful on-chain oracles. our goal here is to make them accessible and easier to work w in dev.

check out the deep dive here:

0

8

26

2/ The platform provides real-time simulation results to manage risk more effectively on

@avalancheavax

within the

@BenqiFinance

protocol. Our team has worked hard to design a critical component of the risk stack that streamlines the process and improves transparency

1

0

26

3/ By utilizing simulations and data models, our Param Recs Platform recommends risk parameters to

@BenqiFinance

and provides transparent recommendations for the parameters that best protect the protocol.

3

0

26

4/ We're confident that this cutting-edge tool will be an invaluable resource for managing risk. We're excited to partner with

@BenqiFinance

to deliver innovative solutions that grow the

@avalancheavax

DeFi ecosystem.

For more, check out our blog!

1

0

26

Proud to be featured as one of

@BusinessInsider

's most promising startups for 2022 🙏🥳

The year is still young and we're excited to keep on shipping and share more of what we've been working on 😎

Go

@chaos_labs

✨

0

6

24

6/ What should

@synthetix_io

do in response? Ultimately, limiting trading to top-tier assets isn't the solution. Instead, it's about finely tuning risk levers in relation to asset risk profile, market liquidity and volumes.

1

0

25

9/ At

@chaos_labs

, we derive OI cap values while considering manipulation costs, ensuring:

payoff fn << manipulation cost

We build models to estimate and monitor the manipulation cost, which is a crucial consideration for the parameter optimization engine.

Here’s an example:

1

0

24

looking for a tool to interact with the

@dYdX

api? check out the dydx-trading-cli 😎

we spent the last few weeks hacking on this and are excited to release it today for the ecosystem

Check out the blog post:

@dydx_grants

@dydxfoundation

🙏🥳

1

3

23

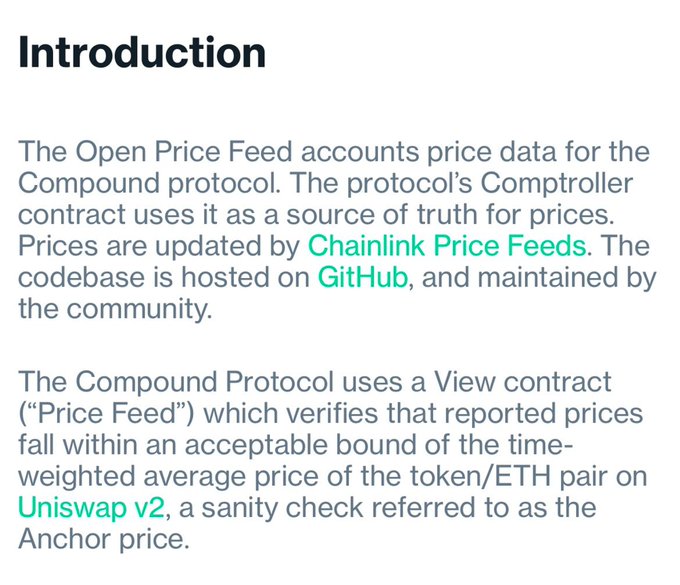

5/ So, how do

@compoundfinance

v2

@Uniswap

Oracles work? They integrate Chainlink feeds but add a twist by using TWAPs as a safety net. The idea?

@chainlink

's updates must fall within Uniswap's TWAP bounds or be rejected. This is aimed to serve as a risk mitigation guardrail.

1

0

23

@chaos_labs

is proud to contribute to advancing the

@dYdX

vision by introducing the Launch Incentives program. The program allocates up to $20 million in $DYDX to the platform's early participants, focusing on makers and takers, primarily emphasizing trading volume.

1/ Excited to launch the $20M dYdX Chain Incentives Program designed to boost early adoption and a seamless transition to the dYdX Chain.

@dydx

@dydx_grants

@dydxfoundation

@dydx_ops_subdao

13

17

88

4

4

24

@chaos_labs

has been growing at an incredibly rapid clip since pivoting 9 mo ago. As an engineer in a highly complex space - tech was my number one priority.

building a world-class eng team was going to be a challenge! How do I attract the best engineers from web2 giants?

1/n

1

6

22

RWA Tokenization is a driving catalyst for the next crypto bull market.

While RWA assets present massive potential, they have unique risk profiles. If you're building in RWA, reach out!

@chaos_labs

had a pleasure collaborating on research w/

@redstone_defi

🤝

Enjoy! 🧵👇

📕 "RWA Report: The Deep Dive into 2023 Market" 📕

We're thrilled to co-publish with

@chaos_labs

the most comprehensive RWA market overview featuring 31 projects, which is the fruit of over 1 month of research 🧐

Here's a glimpse of what's inside🧵👇

155

2K

3K

3

5

21

2/ This seems to be due to the

@PythNetwork

$RLB feed quoting inconsistent pricing. This analysis is based on empirical observations, which we will share below.

2

0

22

a quick update on our journey so far collaborating with

@makerdao

@MakerDAO_SES

we're onboarding core units to utilize chaos cloud for liquidation testing under adversarial market conditions and high volatility.

MIP coming soon 🥳

1

4

21

Excited to be speaking about the

@chaos_labs

journey at

@EVMNext

!

📣 Speaker Announcement!

We're excited to announce Omer Goldberg as a Speaker on our Panel titled:

"Beyond the Code: Building a Successful Ecosystem"

@omeragoldberg

is the Founder and CEO of

@chaos_labs

, a risk management platform for DeFi protocols.

0

7

26

0

2

21

@chaos_labs

has been collaborating closely with

@Uniswap

to improve v3 TWAP dev tooling

Part 2 of the TWAP Deep Dive reviewing architecture, storage layout, and our implementation for configuring oracle return values

Why does oracle config matter?

1/3

2

9

19

excited to partner with

@dYdX

on building analytics and open source tooling for the ecosystem 🥳💥

check out the blog ->

0

4

21

Today,

@osmosiszone

spends over 500k $OSMO on liquidity incentives per day. We are super excited to partner with

@Hathornodes

and

@OsmosisGrants

to optimize this spend for more efficient long-term growth utilizing the

@chaos_labs

simulation engine.

1/2

1

8

20