zubin koticha

@snarkyzk

Followers

5,982

Following

1,339

Media

45

Statuses

1,390

Explore trending content on Musk Viewer

Kendrick

• 686182 Tweets

Rio Grande do Sul

• 271835 Tweets

Madonna

• 183773 Tweets

Nicki

• 107698 Tweets

Ole Miss

• 101365 Tweets

Sony

• 92446 Tweets

DAVI NO PODPAH

• 88694 Tweets

Porto Alegre

• 75203 Tweets

Star Wars

• 71973 Tweets

Hope Hicks

• 59399 Tweets

#David69

• 48549 Tweets

スパコミ

• 41460 Tweets

みどりの日

• 35302 Tweets

Mark Hamill

• 32025 Tweets

Keyshia

• 23454 Tweets

Luton

• 22274 Tweets

#TheAmazingDigitalCircus

• 20774 Tweets

Quintana

• 17567 Tweets

Verstappen

• 17408 Tweets

Getafe

• 12066 Tweets

Lando

• 11538 Tweets

Thiago Silva

• 11379 Tweets

Pomni

• 11175 Tweets

Benedetti

• 10820 Tweets

المعيوف

• 10135 Tweets

Last Seen Profiles

Hey Crypto Twitter,

It's been a while

This one's a tough one...

After the regulatory action against Opyn,

@alexisgauba

and I have made the decision that we are leaving crypto.

This is honestly really emotional for me and Alexis.

47

21

398

I'll skip the usual formalities.

All I have to say is, if you have the chance to work with

@danrobinson

& fam

@paradigm

, take it 😉

We've never been more ready to take on the $300 trillion options market for DeFi.

Watch out Wall Street.

18

21

234

I'm excited to announce that

@opyn_

has teamed up with

@dragonfly_cap

for our $2.16mm Seed fundraise to bring options and risk management to DeFi.

@rleshner

,

@balajis

& others joined Dragonfly's

@tomhschmidt

&

@hosseeb

in Opyn's seed round. 1/

9

21

166

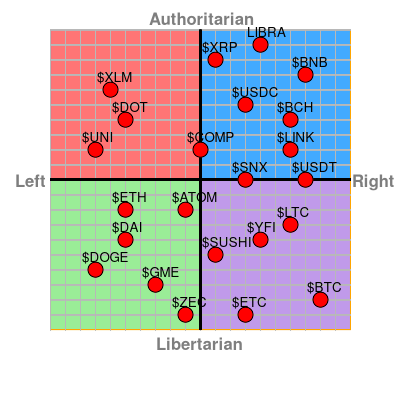

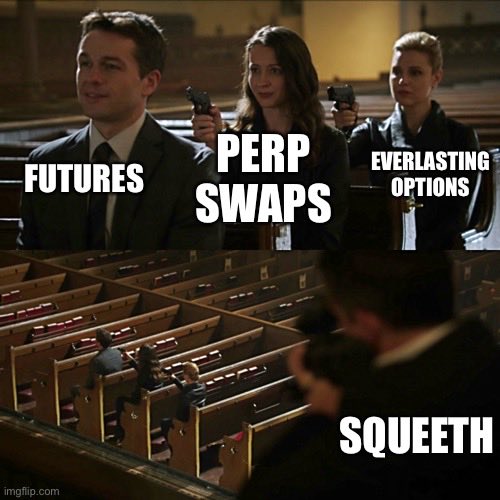

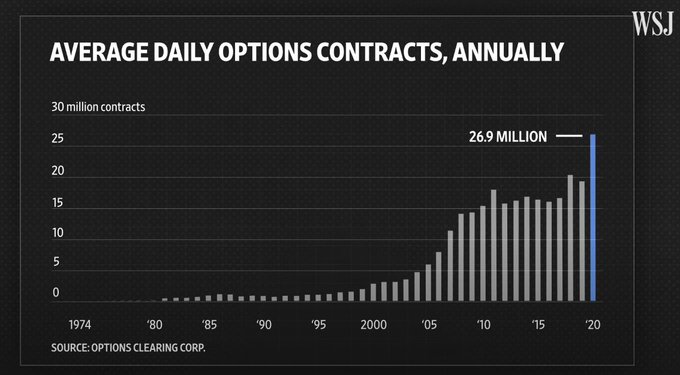

Why Haven't Crypto Options Markets Grown as much as Perps?

(or: why we're building squeeth

@opyn_

)

Thesis: Crypto options will compete only when they become perpetual

Perp swaps won over futures by killing expiries. No expiries is better UX, so ppl prefer perps to futures.

1/8

9

34

162

Structured Products: the future of DeFi Options?

Recently,

@opyn_

options &

@ribbonfinance

have seen our volumes & TVL numbers EXPLODE

DeFi options markets are growing fast, and they look different than many of us expected

What's going on here? 👇

4

21

140

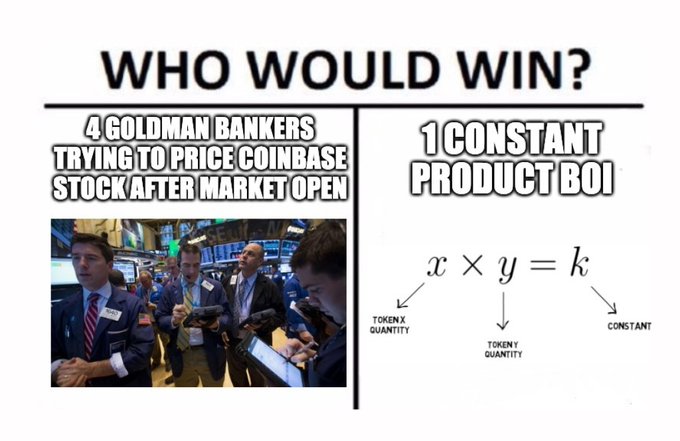

How to build any AMM curve with Uniswap v3:

In Uni v3, you can create any *static* curve by adding different amounts of liquidity at different price ticks.

But, you can’t create dynamic curves that change *over time*, like Yieldspace.

Or can you?

👇 (idea inspo

@danrobinson

)

2

26

136

So excited to announce that

@opyn_

v2 is almost here!

Featuring:

🍄 serious 💪 capital efficiency improvements

🍄 trade option spreads & combos

🍄 option auto-exercise at expiry

🍄 formal verification of contracts

🍄 upgradeability to decentralized governance 😉

Can't wait!

4

9

75

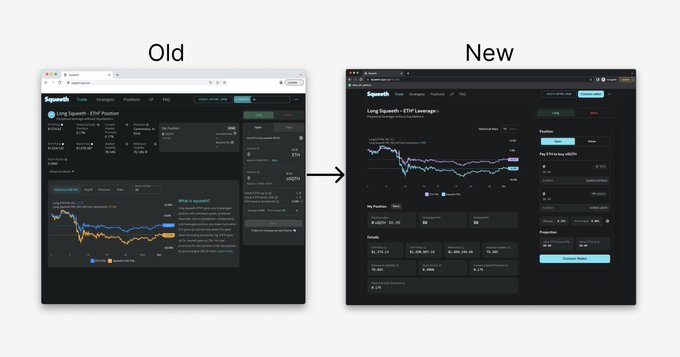

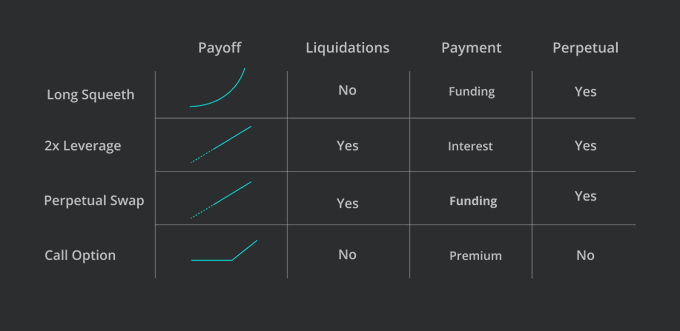

Introducing: Power Perps & SQUEETH

We

@opyn_

invented a new primitive with

@_Dave__White_

&

@danrobinson

SQUEETH (which is ETH^2) is a huge unlock:

-leverage w.o liquidations!

-no liq. fragmentation, cuz no strikes/expiries

-acts like always at-the-money option

-pure GAMMA

I've been working on a new financial product with

@danrobinson

and the team

@opyn_

: the power perpetual.

If the price of ETH doubles, the ETH^2 power perp 4Xs, the ETH^3 power perp 8Xs, and the ETH^5 power perp 32Xs.

50

145

853

2

12

76

With me and Alexis leaving, we considered all the possible paths for Opyn.

It became clear that the best would be to give Opyn strong leadership who has huge ambitions for the project.

So we're excited to say that

@andrewjleone

is going to be taking over as ceo of

@opyn_

.

3

3

66

Options spread trading, in simple terms:

Options beginners are often excited and confused by terms like "bull spread" and "butterfly spread."

These positions are very simple & powerful.

Since spreads are central to

@opyn_

's v2, here's a thread to explain them!

1/

👇

1

13

55

Great insight into the origin story of

@paradigm

.

The team

@matthuang

&

@FEhrsam

have built is itself proof that the many of the world's smartest are working on crypto, with a superstar cast of

@danrobinson

,

@samczsun

,

@gakonst

,

@arjunblj

,

@_charlienoyes

0

2

44

Making options perpetual is a difficult thing to do cuz options expire. That's a key part of their design!

The first way to make options perpetual was an ingenious way invented by

@ribbonfinance

, built on top of

@opyn_

The second way is squeeth, which we just sent to audit!

2/

2

5

36

Limit orders = new 0 gas trades!

This new feature

@opyn_

means that you can post orders for 0 gas, and if they get filled, your counterparty, not you, will pay the gas!

2

5

30

Proud to support

@sunnya97

,

@valardragon

, 2 of the best builders in the space.

Excited for

@osmosiszone

’s cross chain vision! This is a massively ambitious project.

The Osmosis Foundation just conducted its first ever sale, raising $21M in a strategic round led by

@paradigm

! (number not an accident 😉)

Funds will support the many dev teams and DAOs building Osmosis into the leading DEX in the Interchain!

33

162

785

1

3

32

Day 3 and we already have people copying squeeth

(1/n) 01’s officially going to mainnet on January 27th 🎉

And we’re excited to offer both Perpetual Futures and the first ever orderbook based Power Perps

#SQUOL

built on

@ProjectSerum

, only on

@solana

77

363

566

3

0

32

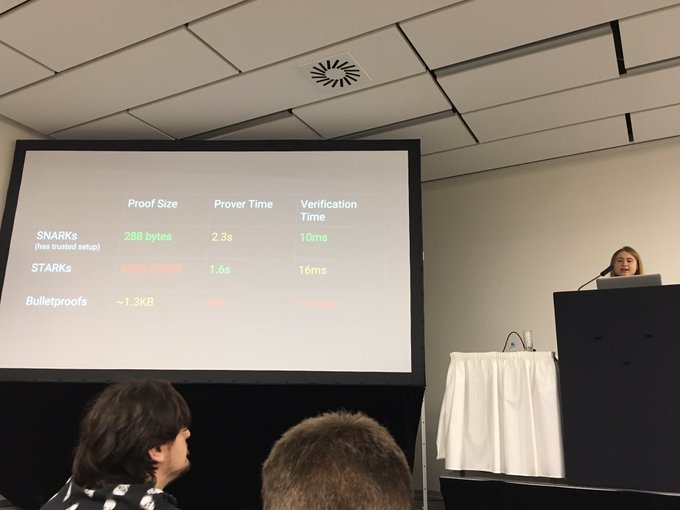

Amazing talk by

@leanthebean

about Zero Knowledge Proofs

@EFDevcon

! Be sure to check out her slides:

0

8

32

Paradigm has built THE research team of crypto, and chose THE best person to lead it.

Congrats

@danrobinson

- mentor, thinker, werewolf, and the most knowledgeable person in the world on AMM design.

0

2

32

Can't believe I'm saying this so soon, but Congrats to everyone who bought WBTC call options on

@opyn_

at a $25,000 strike.

They are now REALLY in the money.

0

2

27

Can't believe that

@opyn_

v2 is now live! 🍄

Excited to launch the most powerful, capital-efficient DeFi options protocol 🚀🚀🚀

So proud of the team's hard work and can't wait for the community to try it out at

Options marketplace

@opyn_

is rolling out an upgrade that targets capital efficiency and liquidity in the

#DeFi

options market.

@kalrajs23

reports

0

6

29

0

3

26

why have perps not caught on in a big way in DeFi yet?

compared with traditional margin lending, like

@compoundfinance

,

@MakerDAO

,

@AaveAave

, perps are still small market in DeFi.

what holds them back?

13

2

24

Just in from sources: When $DOGE hits $1 it becomes the official currency of the City of Miami.

P.S.

@FrancisSuarez

if you RT this, I’ll actually pack my bags and move to Miami tonight.

Had a wonderful dinner w the Founders of

@coinbase

@brian_armstrong

&

@FEhrsam

talking about how Miami can be the most crypto forward city in the country and how many people hold crypto in the US....staggering stuff

75

154

2K

1

1

25

One of the most exciting things about squeeth is the stuff that can be built on top of it

The community has lots of ideas for yield strats, Uniswap LP hedgers, etc

I'm excited to empower teams like

@ribbonfinance

&

@StakeDAOHQ

, and new devs build novel vaults using squeeth!

7/

1

1

24

.

@sunnya97

and other Cosmos folks must feel really good right now about building a system that can’t be re-org’d

After 4 years of trying, I finally redpilled

@snarkyzk

into Cosmos thanks to

@OsmosisZone

First thing he says after trying IBC: "Holy shit. You NEED safety over liveness."

6

10

152

1

2

24

Since people asked...

PREREQS for financial derivatives & options math:

- Interest rates & forwards

- Implied volatility

- Risk-neutrality

- Delta hedged portfolio

- Cont. probability

- Gaussians, lognormality

- ABM/GBM & relation to normal/lognormal

- MGFs

- PDEs

1

8

24

Vega: explains how an option's price changes as (implied) volatility of the underlying asset changes.

All options go up in value when the market predicts increased future vol. In this thread, I explain this relationship:

4/

2

1

23

DeFi is a massive group effort, and this paper is no exception: we especially appreciate the help we got from

@rleshner

& the

@compoundfinance

team, as well as the help from

@danrobinson

. The paper was heavily inspired by

@compoundfinance

,

@MakerDAO

, & the Yield Protocol.

1

1

22