Signature Block

@signatureblock_

Followers

742

Following

55

Media

82

Statuses

200

A newsletter on how to build a successful venture fund, created by @weekendfund ✍️

Joined October 2022

AngelList is considering aggregating multiple fund-of-funds that want to invest $Xm+ into emerging managers that fit their thesis. There’s interest. Would this be useful?

42

9

205

Our latest post on Signature Block is all about that value-add (and how to actually be helpful): https://t.co/ofA6ZTXziJ (thanks, DALL-E)

2

3

27

Another shoutout to @dsog for contributing to the post. Our bad for not tagging Khaled earlier!

0

0

1

Subscribe at https://t.co/FmFusWL50G for more content on how to build a venture fund.

1

0

1

Shoutout to @adrianlocher, @heatherhartnett, @joemarchese, @jspujji, @JonnyDreams, @juliesandler, @NotMattWang, @miluntesovic, @crrob, @noahbreslow, @shawnvc, @omribloch, @peterpham, @safwaankay and @FurqanR for contributing to this post.

1

0

7

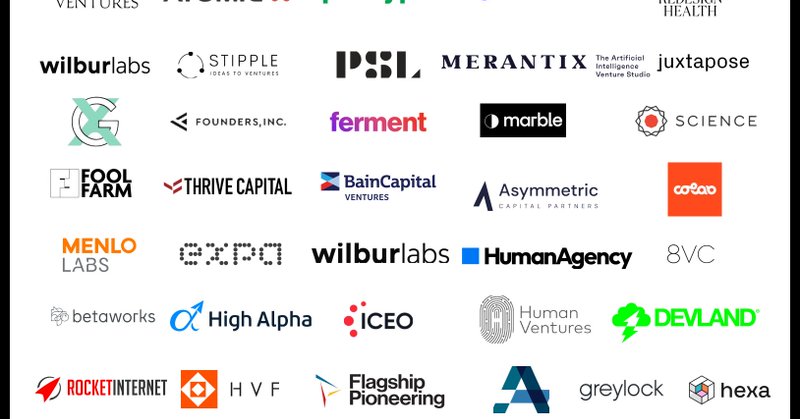

There have been few breakdowns into the rise of venture studios. In our latest Signature Block post, we dive into the incubations model: https://t.co/I4fGrArfC8.

signatureblock.co

$100B+ of enterprise value created, 800+ venture studios worldwide. Hear from the operators of the top venture studios.

1

0

4

Venture studios and incubations have exploded in popularity. 800+ venture studios around the world. $100B+ in enterprise market value created. Several IPOs: Snowflake, Hims & Hers, Pure Storage. The model is extremely hands-on, bespoke, and potentially very lucrative.

6

10

46

Shoutout to Andy Chung, Ariana Thacker, @bentossell, @BRosenblatt4 @ericsles @jmj, Dakota Torres, Lauren Hill @TheFundCFO @djdan85 @lpolovets @markscianna, @MattHartman, @Nick_Davidov, Marina Davidova, @itsvijen & @yoheinakajima for contributing, And @TheManMikeTan for leading.

0

0

1

Subscribe at https://t.co/y5lYFqygFp for more content on how to build a venture fund.

1

0

1

Teams at venture firms often have structured, recurring communication routines that allow them to collaborate, plan, and execute. Here's how Chapter One manages team communication.

1

0

1

Most funds have a diligence process that involves surfacing all of the things they need to know before committing to invest (or pass) on a deal. Here's how DVC manages diligence.

1

0

1

An outbound sourcing strategy can help funds reach outside their immediate networks, expand their coverage, and increase deal flow. Here's how Untapped Capital manages their outbound sourcing.

1

0

1

Managing deal flow, and moving opportunities a pipeline, is critical to any investment firm. Here's how Tiny VC and Ben Bite's Fund manage their deal flow.

1

0

1

The key 🔑 to running an efficient fund: workflows. In our latest edition, we cover 30+ workflows used by @craft_ventures, @SusaVentures, @chapterone and other venture funds to save time and get more done. https://t.co/NJYdbcWKP5

1

2

6

And if you don't know what some of these acronyms mean, we gotchu: https://t.co/JFrWjJxP06

signatureblock.co

You don’t need this. You totally know all these terms. ;)

0

0

1

We like learning with others. Shoutout to Akash Sharma, @arian_ghashghai, @_clairepan, @ColinRogister, @EnoReyes, @heikirk, @seidtweets, Marcus Naughton, Rahul Sheth, @RazRazcle, Roanak Baviskar, @saayanath, and @tammiesiew for their input.

0

0

6

We dive into themes we're excited about alongside other investors and founders in the space: - Enterprise data integration platforms - Privacy, safety and compliance platforms - Model chaining platforms and more!

1

0

1