Market Sentiment

@mkt_sentiment

Followers

30K

Following

5K

Media

2K

Statuses

5K

Read our newsletter for actionable, data-backed insights for long-term investors, financial advisors, and analysts 👇

Join 50,000+ investors

Joined July 2019

After 3 months of development, I have built a personal intelligence assistant that delivers a daily briefing on all my positions. It scrapes hundreds of news sources 24/7, summarizes the findings, and delivers them as a newsletter. Repost/Comment "930" for early access

32

6

24

Just as $GOOG repriced in 2025, $AMZN will be next in 2026. Amazon's largest AI data center is already operational in Indiana, with half a million AWS Trainium2 chips entirely devoted to Anthropic. By 2027, it's expected to ramp up to 2.2 gigawatts, exclusively for AI

0

1

8

Top is in

2

0

10

We do know what followed just after right?

0

0

2

The best way to think about this is that you don't have to worry about either scenario. Either we are all guided to the promised land of abundance, or the last thing you see is a blinding flash of light.

0

0

0

The only good AI ad I have seen yet is by @Kalshi

https://t.co/uc1fYogcbA

Coca-Cola’s annual Christmas advert is AI-generated again this year. The company says they used even fewer people to make it — “We need to keep moving forward and pushing the envelope… The genie is out of the bottle, and you’re not going to put it back in”

0

0

4

One of the best portfolios ever created was achieved by using just 3 index funds. This simple portfolio was able to outperform 83% of active fund managers and 90% of endowment funds over the last two decades while having an expense ratio of < 0.1%. https://t.co/XIJmS8m9Hk

marketsentiment.co

Complexity sells, but simplicity wins.

0

0

5

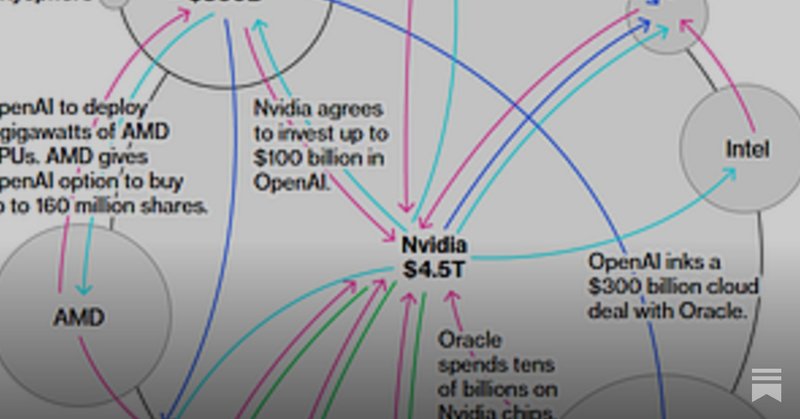

The problem with becoming the most valuable company in the world is that you will have a big target painted on your back. Competitors will consider you their biggest headache, customers will think you are price gouging, and Congress will accuse you of being a monopoly.

market intuition question: imagine the "S&P 1" instead of the 500 highest market cap stocks it purely holds the highest market cap stock (rotating whenever that stock is dethroned) how would this ETF have performed over the last 50 years?

0

0

8

Bad take. @boomaero designed, built, and flew a supersonic jet from scratch with fewer than 200 employees.

I live in Eindhoven, the ASML town. I was chatting with an employee at a gym last night. He works on the mechanical engineering side of the wafer table for EUV machines. The job is to align wafers to the source and ready it for exposure. The alignment needs to be accurate at a

0

0

0

Big Tech’s huge AI gambit has put investors in an all-or-nothing position. After the release of ChatGPT in 2022, AI stocks have accounted for — 75% of S&P 500 returns — 80% of earnings growth — 90% of capital spending growth Here’s how you can hedge: https://t.co/Assi10668K

marketsentiment.co

6 strategies to hedge against the AI bubble

0

1

5

Here are 3 mind blowing stats about gold: 1. Gold is now up 51% YTD against the dollar. 2. If you benchmark its performance against Gold, S&P 500 has been falling ever since the start of the millennium. 3. Gold has now outperformed Berkshire Hathaway over both 10-year and

marketsentiment.co

Were Gold bugs right all along?

0

0

3

Cool -- they can hire one Meta engineer!

The EU just launched a €1.1B “Apply AI” plan to boost artificial intelligence in key industries like health, manufacturing, pharma, and energy. The goal is simple but ambitious: build European AI independence and reduce reliance on U.S. and Chinese tech. Europe finally wants

0

0

5

Something about a broken clock.

REMINDER: I predicted the biggest crash in world history was coming in my book Rich Dad’s Prophecy. That crash will happen this year. Baby Boom Retirements are going to be wiped out. Many boomers will be homeless or living in their kids basement. Sad. REMiNDER: I have

0

1

13

Just as a PSA, if your portfolio blows up when the SPY is down *checks notes* 2.7%, you were gambling, not investing.

2

1

5

Gold has now outperformed Berkshire Hathaway over both 10-year and 20-year horizons.

0

5

28

With all the YTD posts I am seeing, just remember that if it’s good enough to screenshot, it’s good enough to sell.

1

1

2