Teddy

@mkesome

Followers

560

Following

572

Media

97

Statuses

3K

Thoughts and Investments

New York, NY

Joined March 2015

$PATH - The $PLTR of Rote Tasks? I’m opening a position in UiPath. Here’s why: They are the world leader in Robotic Process Automation (RPA) - essentially means robotic automation in the digital realm. It's software that mimics human action for repetitive tasks. Examples:

0

0

3

The right time to buy $PLTR was after they released AIP with Foundry. They didn’t have the same potential before this product’s release.

1

0

3

When sentiment erodes price but fundamentals remain strong it’s a great time to buy. New positions in $PATH $SEZL and $FOUR Added more $HIMS

0

0

5

Bought more $HIMS Once again one of my largest positions. Fantastic opportunity at these levels.

1

0

8

$PATH has wonderful potential and downside is protected. Love these type of bets.

0

0

5

$GRAL A potential 10 bagger (or more) Grail is the leader in multi-cancer early detection (MCED). Their lead product, Galleri, requires only a simple blood draw and can detect up to 50 different cancers types - including deadly ones like pancreatic, ovarian, and liver that

1

2

13

$FOUR is a phenomenal value at this price. Mature net margins are likely to be above 15% Therefore, it’s currently selling at 10x look-through-earnings and growing super fast!

0

0

2

$ROOT is essentially selling under 8x look-through-earnings Considering: 1. Long-term loss ratio target of 60-65% (currently 59% - already exceeding goal) 2. Scaled expense ratio meeting industry average of 28% 3. Add 3% to operating margins for investment income on float

0

0

16

This is the kinda post that causes loss of reputation.

@mikepat711 @GavinSBaker Super Cruise (GM) and Blue Cruise (Ford) are both ADAS Level 2, same as $TSLA. Mercedes’ Drive Pilot is a limited Level 3 system. I continue to believe that Level 4 autonomy will be standard equipment on all vehicles by 2030-32.

0

0

2

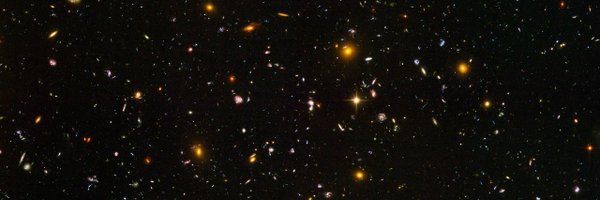

A solar panel in space produces 5x the annual power compared to a solar panel on Earth. There’s no atmospheric filtering and essentially continuous 24/7 sunlight.

Did Elon really just say he wants to put 100GW of solar power AI satellite in SPACE?! This is mind boggling, someone please explain this to me like I'm 5 years old on how this would work lol

0

0

1

Those worried about PIF are not seeing the methodical approach mgmt has towards growth. Too often the market extrapolates short-term stagnation out indefinitely (think AAPL 2015-2016) Investors with a keen eye on long term prospects take advantage of these times and win!

0

0

2

Therefore: $1.3B mcap / ($1.45B TTM rev × 12%) = $174M earnings 7.5x look-through-earnings! For a founder-led, scaling business with niche moat, and over 60% 3-year revenue CAGR.

2

0

1

Considering: 1. Loss ratio already 59.5% (long term target 60-65%) 2. Scaled expense ratio meeting industry average (28%) 3. Add 3% to operating margins for investment income on float Therefore: ~15% operating margin at scale ~12% net margin at at scale

1

0

0

New Position: $SEZL Fast growing (67% yoy) founder-led player in the burgeoning Buy Now Pay Later (BNPL) space. Industry tailwinds with massive runway as consumers are increasingly presented with and selecting BNPL options at checkout. $SEZL specializes in underwriting for

0

1

11

Was thinking how headquarter shaming is kinda lame since I respect businesses that can keep headquarters modest - why waste the capital? (Kiewit Plaza rings a bell). But on second thought if a tech company needs to attract talent then place of work should be super nice since

Reminder: These are the 'headquarters' of the 4 quantum computing companies driving this insane speculative bubble. They have now all dropped 50+% over the last month but still: $IONQ has a MC of $16 Billion $RGTI: MC: $8.3 Billion $QBTS: MC: $8.2 Billion $QUBT: MC: $2.25

2

0

4