Mike Pierce

@millennial_debt

Followers

4K

Following

19K

Media

1K

Statuses

12K

I tweet about debt. Now: ED @borrowerjustice & @borrowersaction, co-founder @UC_SLLI | Then: @CFPB @RepSarbanes @theSBPC (He/Him)

ATL & DC (& Baltimore@❤️)

Joined September 2009

This is going to be an absolute catastrophe when the music stops. Our economy's transition from debt-financed homeownership to debt-financed groceries and healthcare is *the* story of the post-COVID era.

21% of Americans surveyed this month took out a buy now, pay later loan, and at least 41% considered applying for one — the highest level since LendingTree began tracking buy now, pay later behavior in 2021.

8

515

3K

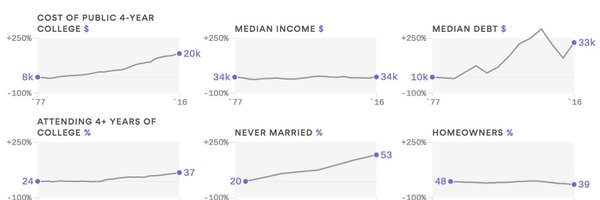

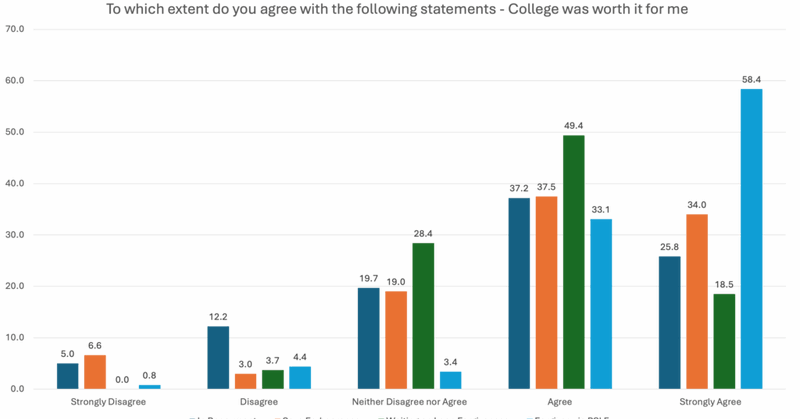

NEW RESEARCH🗣️📄 Borrowers who become debt-free are 30 percent more likely to say college is "worth it" & "important." Restoring public trust in higher ed means dealing w/ the short & long-term consequences of student debt. via @Dcollier74 & @markhuelsman

protectborrowers.org

For the first time, a novel set of research investigates the perspectives of student loan borrowers in various repayment plans on key issues, including (1) the value of their higher education...

0

4

3

Larry once sat at a bar in the Caribbean and said millions of Americans would need to lose their jobs to bring down inflation. I wonder if he thought they too should get 24 hours of lead time to announce they were stepping back before they got fired?

BREAKING: Larry Summers said he would be stepping back from public life & expressed deep regret for past messages with the late convicted sex offender Jeffrey Epstein in the wake of new revelations about the extent of their relationship by @samjsutton & me https://t.co/kAgBCA1hg6

4

93

576

When elites screw up, they “step back.” When the working class screw up, they get fired. Let’s be clear, this is not accountability. It’s still class protection.

Former Harvard President Larry Summers says he plans to step back from his public commitments after his correspondence with the late disgraced sex offender Jeffrey Epstein was made public by US lawmakers

13

903

4K

We had a years-long fight on whether it matters if you don't deliver on your campaign promises & now OH MY GOD HE ADMIT IT

8

43

353

@RepYassAnsari @millennial_debt @jmargetta @TCFdotorg Families should never have to worry about keeping the lights on or staying warm over winter. Rising energy costs are driven by back-room deals between corrupt energy executives & the tech giants fueling the A.I. data center boom. Cancel utility debt now. https://t.co/CMf5uTt33q

protectborrowers.org

Analysis finds monthly energy bills have climbed 35% since 2022; under Trump 2.0, number of households with severely overdue utility debt jumped by 117,000.

0

2

3

@RepYassAnsari @millennial_debt “Rising costs for consumers—which should be treated as a public policy problem—are often shifted into private responsibility through debt. From our study: average monthly utility bills nationwide are $265! That's up 35% since 2022 & 12% since last year.” - @jmargetta, @TCFdotorg

1

4

3

@RepYassAnsari brought the receipts: “Since 2020, utility costs have skyrocketed 🚀 increasing by 35%. As a result, 14 MILLION Americans are drowning in severe utility debt.”

1

3

4

Today, @jmargetta @Edi_Nilaj and I put out a new analysis from @TCFdotorg @BorrowerJustice looking at the boom in past-due utility bills appearing on Americans' credit reports. The upshot: energy bills are going up and families are falling behind. This is Trump's economy.

🆕Rising utility costs are taking a toll on American families. New analysis and fact sheets from @TCFdotorg and @BorrowerJustice show an AVALANCHE of household utility debt has been building over the past three years. https://t.co/hG11bbxevJ

1

11

15

Past due balances to utility companies jumped 9.7% annually to $789, said The Century Foundation, a liberal think tank, and the advocacy group Protect Borrowers. The increase has overlapped with a 12% jump in monthly energy bills. https://t.co/7i27Uo5DFx

apnews.com

A new analysis of consumer data shows that more people in the United States are falling behind on their utility bills.

4

34

29

🏠📄NEW: Our latest paper — "Capital Crunch" — is OUT NOW! The paper details the policy choices that created today’s financialized homebuilding industry, which bends to the will of Wall Street, restricting single-family home supply and raising prices. As covered in @FT👇

2

34

102

Nearly 6 million US households have utility debt “so severe” that it will soon be reported to collection agencies.

47

634

2K

This Week In Debt! A meditation on opacity in lending, followed by news on a big 10th circuit ruling, credit cards, Erebor bank, private student loans, and more!!! My favorite bit: https://t.co/P6CPTGyiKu?

1

2

5

politics are so funny because guys will spend years arguing about how dems pick unpopular issues then die on the hill of “miller lite should cost $25 at a baseball game”

19

65

685

Price controls have well-documented costs. But they also may be the only way to provide the short-term price relief voters want and need. In today's NYT, @nealemahoney and I make the case for pairing targeted price controls with supply-side reforms. 1/

42

51

164

NEW: Before the recent Epstein disclosures, Larry Summers was poised to lead the economic policy plank for the Democrats' "Project 2029" effort at the Center for American Progress. He signed off on a housing policy paper CAP was prepping for next week. https://t.co/NpHQt64rK8

49

338

1K

🔥🔥🔥 👏👏👏 Get ‘em @jennzhang_

The Trump administration’s actions at the CFPB signal to banks and lenders that it’s open season for defrauding and taking advantage of working families. Via @jennzhang_ at @publicknowledge Full testimony: https://t.co/OJqK3RhVlF

0

2

5

The Trump administration’s actions at the CFPB signal to banks and lenders that it’s open season for defrauding and taking advantage of working families. Via @jennzhang_ at @publicknowledge Full testimony: https://t.co/OJqK3RhVlF

0

8

5

LFG 👊🟩🔥

THE VAULT: The nonprofit organization Protect Borrowers has hired a trio of Biden-era Consumer Financial Protection Bureau officials aimed at creating a new litigation unit. @BrendanPedersen has the details: https://t.co/rsqBjTDXf0

0

0

7

🆕 We're thrilled to host 3 former CFPB leaders & lawyers—Eric Halperin, Cara Petersen, & Tara Mikkilineni—as they launch an enforcement project focused on the weaponization of corporate power that is plunging working people into financial crisis.💫 https://t.co/7jsZ6lazeD

0

2

9