Julie Margetta Morgan

@jmargetta

Followers

3K

Following

6K

Media

15

Statuses

579

President @TCFdotorg. Former: @cfpb, @usedgov, VP of Research @rooseveltinst, policy for team @ewarren.

Joined June 2010

In just the week before Trump took power, CFPB: - ordered Equifax to pay $15M - ordered a major auto lender to return $10M to customers - ordered CashApp to refund $120M to customers - sued Capital One for cheating people out of interest payments This week it's closed.

NEW: CFPB employees were just abruptly informed that the watchdog agency's DC headquarters will be closed this week. The email, obtained by @CNN, did not explain a reason for the sudden closure. This comes days after Elon Musk tweeted out: “CFPB RIP” with a tombstone emoji.

831

9K

27K

I ran the DOL office that many of these ED programs are going to during the last administration. It's hard to describe how nonsensical what Trump is doing but I'll give it a stab

The Trump administration’s attempt to transfer core functions of the Dept. of Education to other agencies is an illegal bypass of Congress to achieve through fiat what they cannot win legislatively. Millions of families would be harmed in the process: https://t.co/MsjFDEGT3p

1

15

14

Private equity is charging upwards of $50 a month for parents to watch streams of their own kids’ playing sports.

Private equity firms are buying up youth sports and their first move has been to ban parents from recording their kid's games so they have to subscribe to the company's own online streaming service which costs more than ESPN...

28

522

2K

Past due balances to utility companies jumped 9.7% annually to $789, said The Century Foundation, a liberal think tank, and the advocacy group Protect Borrowers. The increase has overlapped with a 12% jump in monthly energy bills. https://t.co/7i27Uo5DFx

apnews.com

A new analysis of consumer data shows that more people in the United States are falling behind on their utility bills.

4

35

29

Nearly 6 million US households have utility debt “so severe” that it will soon be reported to collection agencies.

47

634

2K

@RepYassAnsari brought the receipts: “Since 2020, utility costs have skyrocketed 🚀 increasing by 35%. As a result, 14 MILLION Americans are drowning in severe utility debt.”

1

3

4

Today, @jmargetta @Edi_Nilaj and I put out a new analysis from @TCFdotorg @BorrowerJustice looking at the boom in past-due utility bills appearing on Americans' credit reports. The upshot: energy bills are going up and families are falling behind. This is Trump's economy.

🆕Rising utility costs are taking a toll on American families. New analysis and fact sheets from @TCFdotorg and @BorrowerJustice show an AVALANCHE of household utility debt has been building over the past three years. https://t.co/hG11bbxevJ

1

11

15

🏠📄NEW: Our latest paper — "Capital Crunch" — is OUT NOW! The paper details the policy choices that created today’s financialized homebuilding industry, which bends to the will of Wall Street, restricting single-family home supply and raising prices. As covered in @FT👇

2

34

103

Please keep telling us how the economy is booming when people can't pay their utilities https://t.co/R23rl38CVy

apnews.com

A new analysis of consumer data shows that more people in the United States are falling behind on their utility bills.

58

227

570

More people are falling behind on paying their bills to keep on the lights and heat their homes, according to a new analysis of consumer data — a warning sign for the U.S. economy and another political headache for President Trump.

abcnews.go.com

A new analysis of consumer data shows that more people in the United States are falling behind on their utility bills

188

549

1K

Climbing energy prices and overdue utility debt put families at risk. But they're also a sign of deeper problems - families are stretched so thin that they can't even keep up with bills for the essentials

apnews.com

A new analysis of consumer data shows that more people in the United States are falling behind on their utility bills.

0

0

1

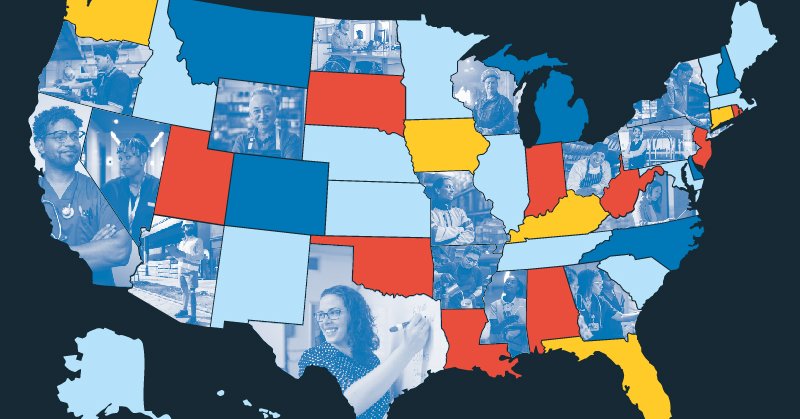

Utility bills rose 35% between 2022 and 2025 - and they climbed by 12% in just the last year. While some states are hit harder than others, our analysis shows that this is a nationwide problem.

1

0

1

NEW: Nearly 6 million U.S. households now have utility debt so severe, it’s heading to collections. Our analysis with @BorrowerJustice finds that average past-due utility balances jumped 9.7% while monthly energy bills rose 12% in just one year. https://t.co/IfaOof6vpX

apnews.com

A new analysis of consumer data shows that more people in the United States are falling behind on their utility bills.

1

8

13

How are American families coping with higher energy prices? Not well, it turns out. An @TCFdotorg and @BorrowerJustice study shows that 1 out of 20 households are facing severely delinquent utility bills.

tcf.org

As temperatures cool and Americans’ dissatisfaction with the economy grows, families across the country are staring down a winter season that will be more

2

23

22

We need to bring down prices in key area fast instead of asking families to wait years for markets to respond. @BharatRamamurti and Neale Mahoney show why price controls can be the right solution

nytimes.com

Voters are demanding short-term price relief, and temporary price controls may be the only viable way to provide it

0

1

3

Our country is in the middle of an affordability crisis. We need our leaders to bring down prices, but we need them to bring up wages too, and to make jobs safer and more secure. @JulieSuLabor and Rachel West have a plan for states to lead the way.

tcf.org

Foreword by Julie Su It is no secret that workers across the country are feeling stressed, strained, and under attack. Paychecks aren’t enough to pay the

0

4

6

This is so important from Rachel West @rwest817 and @JulieSuLabor: “How States Can Lead the Way for Workers: A State Playbook” The corporate right wing has perfected laying out playbooks and draft legislation for states, we need so much more like this.

1

17

23

This is exactly right. Democrats capitulating in a fight to lower costs will reverse all the brand gains they have made over the last few months. If they can’t do this, voters will be even more cynical. Two parties who talk about affordability but neither will fight to deliver it

If this is the so-called 'deal,' then I will be a no. That’s not a deal. It’s an unconditional surrender that abandons the 24 million Americans whose health care premiums are about to double.

6

91

429

every place your kid goes is out here asking for an irrevocable, perpetual, worldwide, royalty free, unrestricted right to use your kid's right of publicity for any purpose in the world & expecting you to waive all their rights to enable them to attend one (1) birthday party

4

6

84

This seems like an idea hatched in a meeting with a bunch of mortgage lenders. Long-term indebtedness is a gift to banks, not families.

0

1

10