Mark Ungewitter

@mark_ungewitter

Followers

23K

Following

12K

Media

4K

Statuses

8K

“I don’t necessarily agree with everything I say.”. –Marshall McLuhan.

26

41

304

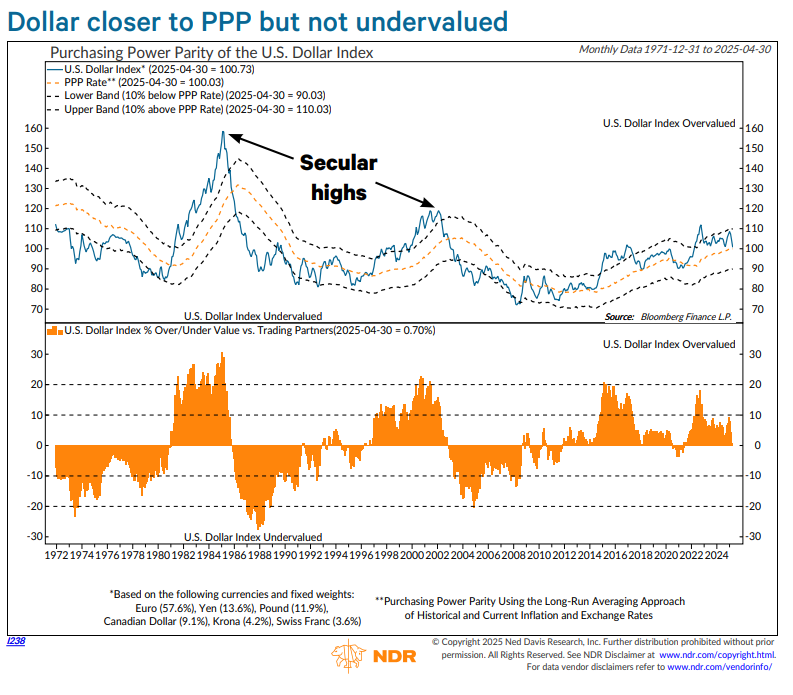

DXY has ranged from +20% to -20% of purchasing power parity somewhat regularly since 1970. Great long-term perspective from @_rob_anderson.

The U.S. Dollar Index has stabilized in recent weeks after plummeting during the first half of the year. From a PPP perspective, the dollar is no longer overvalued. However, prior secular tops saw the dollar overshoot, dropping to more than 20% undervalued in both 1987 and 2004.

27

6

32

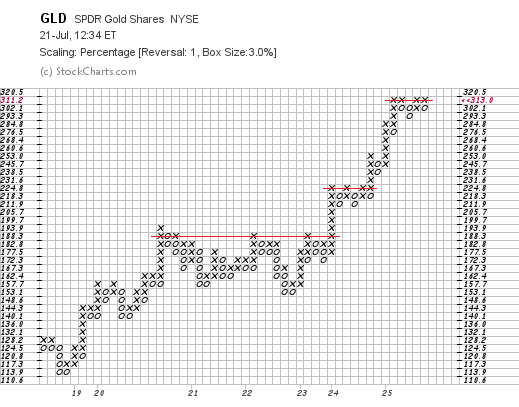

The de-dollarization trade is well baked, but probably not fully baked, according to this interesting study from @TimmerFidelity.

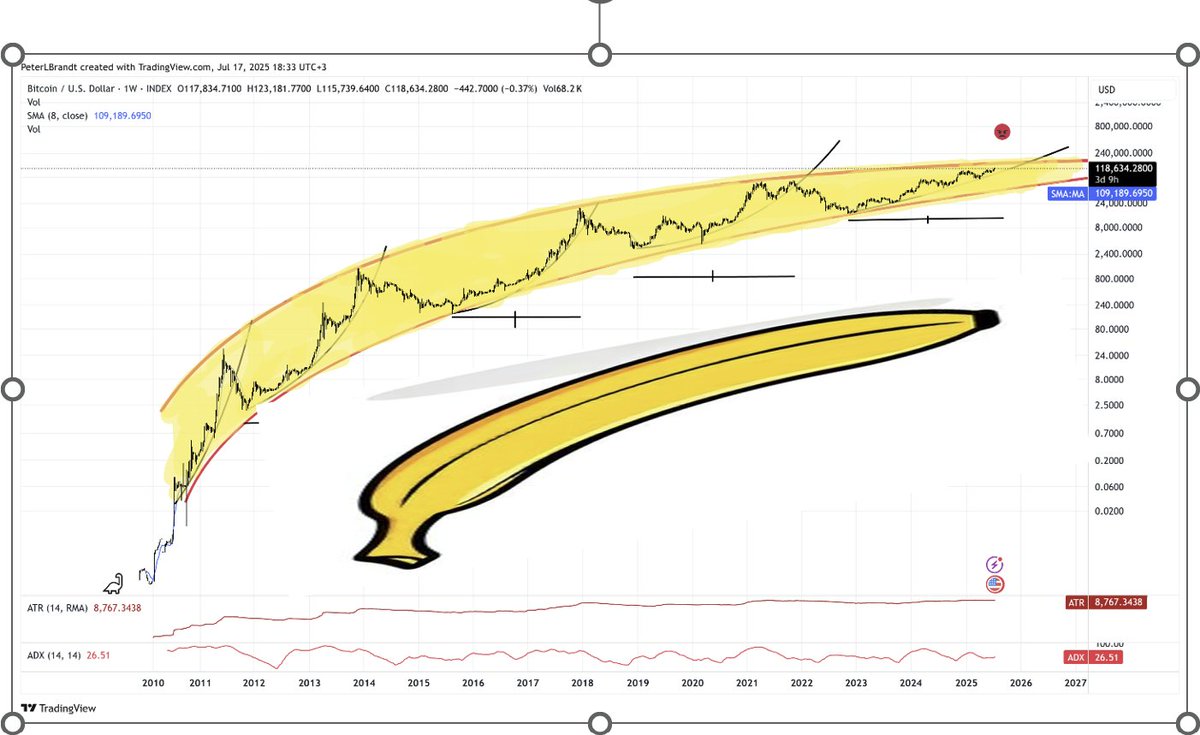

The one “devil’s advocate” challenge to the otherwise unmistakably bullish narrative driving gold and Bitcoin is the question of how much of this fiscal dominance and de-dollarization playbook is already priced in. The combined value of above-ground gold and Bitcoin is now around

6

0

10

More price momentum.

The S&P 500 has now closed above its 20-day moving average for 55 consecutive trading sessions, an impressive streak that reflects the kind of persistent buying pressure typically associated with strong bull market trends. 🔗Read @DeanChristians's Jul 15 "A bullish win streak

3

4

32

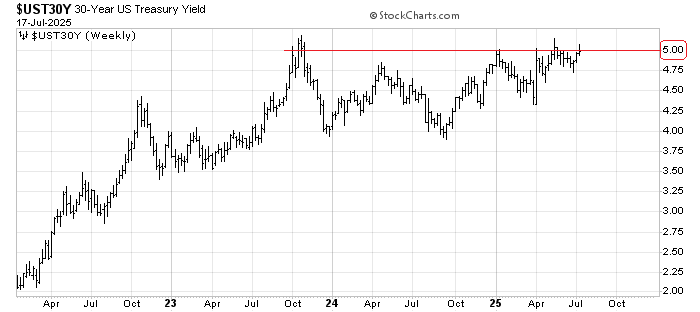

RT @Fullcarry: Not hard to imagine front-end becoming absurdly rich as real-money reduces duration.

0

8

0