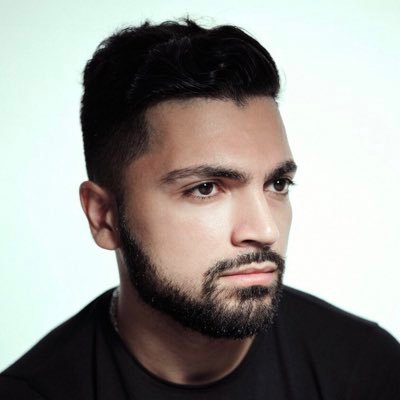

leo

@leo_escobar_

Followers

1K

Following

899

Media

150

Statuses

1K

DeFi will win | DeFi Architect | Current ███ @ ████

🌘 observatory

Joined December 2021

What I think:. Available liquidity in market should be the key parameter of Max OI, position size, etc. It all depends on market condition. Never can be ‘fixed’.

The crazy squeeze caused Hyperliquidity Provider (HLP) to lose ~$12M in the past 24 hours!. 0xde95 shorted $JELLY on @HyperliquidX and removed the margin, causing HLP to passively liquidate $4.5M short positions. A newly created wallet "0x20e8" opened a long position on

0

0

2

Another eye-catching DeFi protocol by @newmichwill is emerging - @yieldbasis. I have so many questions that I'm writing them all down here:. How does the 2x leveraged LP work?. Suppose I have 1 BTC and I deposit it into YB, then an equivalent value of crvusd is issued. This BTC.

2

1

9

@ethena_labs @fraxfinance @levelusd @SkyEcosystem @OndoFinance @Rings_Protocol Tagging people who are likely to support "DeFi will win.". @poopmandefi .@0xCheeezzyyyy .@Rightsideonly .@AndreCronjeTech .@crypto_linn .@belizardd .@thedefiedge .@Defi_Maestro .@PendleIntern .@SiloIntern .@danielesesta .@StaniKulechov .@davidjhlee.

1

0

7

Stablecoin Market Cap is at ATH - $230B. Compared to DeFi Summer 2020-2021:.- We have more yield-generating stablecoins.e.g : @ethena_labs @fraxfinance @levelusd @SkyEcosystem @OndoFinance @Rings_Protocol etc. - We have more protocols to utilize theses stablecoins.e.g :

13

8

64

Fun Fact of @flyingtulip_ by @AndreCronjeTech . You can.- trade spot (with leverage).- trade perps.- borrow/lend.- trade options.via one protocol/pool. capital efficiency szn. tulips gonna replace 'em all. tulips gonna fly. DeFi will win.

1

0

4

After market drops, all the other chains see steep TVL declines, but @SonicLabs TVL has surged over 100% in the past month. at Sonic, we have.- @AndreCronjeTech's new protocol, @flyingtulip_ , is waiting for its launch.- FeeM, which returns over 90% of gas fees to dApps.- Tons

0

22

114

derps are all chaotic. derps do derps thing. i'm closest to good, @SiloIntern closest to evil (which proves this is accurate). tagging other (chaotic) derps here.@0xfuneral @AndreCronjeTech @PendleIntern @Intern4Sonic @cryptohamm @SonicAssistant . @derpedewdz . derp

11

4

44

Pendle have reached 6th place among DeFi protocols by TVL. Now they're eyeing the 5th spot. @pendle_fi has a perfect PMF, and its growing TVL proves it. They just expanded to @SonicLabs ecoa and about to launch their new product, Boros, and they have a very cool team

8

10

69

I don't agree that poor performance of ETH would necessarily stifle a DeFi resurgence. DeFi is inherently more efficient than TradFi and allows for a broader range of products to be traded with ease—continuing the historical evolution of finance. As the world increasingly.

During defi summer I generally posited a thesis of BTC + defi apps under the general idea that you can abstract out ETH from defi apps (aave, just use wbtc) and that BTC would crowd out ETH on its own chain. Later changed my mind when I saw the demand for protocol-native SoV. The.

0

0

2

Bidding more. DeFi will win.

Backed from the HK/Denver Event. While I was away:. - Tariff news sent the market into a flush. - $ETH dipped below $2K before bouncing back. - Many alts—even those with solid fundamentals—are trading as if $BTC were stuck at $30K. But here's the kicker:. - @SonicLabs is setting

3

0

2

Why would someone choose the Pyth price oracle over other options?. i know it's cheap but, but in this case, that's not important.

Another DeFi user (Morpho) lost $30,000 by putting their money in the hands of Pyth. He borrowed ETH against cbETH (Coinbase wrapped ETH) and Pyth made sure his money ended up in the shadow realm. I've been calling Pyth the literal **least** reliable

0

0

3