Lawrence Jin

@lawrence_j_jin

Followers

523

Following

252

Media

0

Statuses

52

Associate Professor of Finance @Cornell; Faculty Research Fellow @nberpubs. Previously taught @Caltech. Finance PhD @Yale. Asset Pricing | Behavioral Finance

Ithaca, NY

Joined June 2021

An experimental test of efficient coding shows that experience tends to crowd out the effect of descriptive information on optimal allocation of coding resources, from @caryfrydman and @lawrence_j_jin

https://t.co/hmF1IW9427

1

4

14

A model of the law of small numbers reconciles the disposition effect with return extrapolation and makes new predictions about investor behavior, confirmed empirically, from @lawrence_j_jin and @peng_cameron

https://t.co/lsG4GbOMEp

0

24

86

Michael Jensen’s top paper has 130,000 citations. A towering figure in corporate finance; he deserved a Nobel. It is very sad to hear of his passing🙏

It is super sad to see visionary figures pass. But I am happy the community is celebrating all of the contributions Mike Jensen made to academic finance. He founded the JFE and made it WORK. Gene Fama has written a great piece here: https://t.co/xsY7SscrK0

0

0

13

Although I have only seen Kahneman present once when I was a graduate student at Yale, his research has had a profound impact on my academic career---the majority of my work relates to biased beliefs and non-traditional preferences, discovered by Kahneman and Tversky. R.I.P.

I was so lucky to be able to have Danny Kahneman as a best friend and collaborator for decades. He usually ended our conversations with "to be continued..." but I now have to simulate his part which is impossible. My favorite image of us "working".

1

2

24

This is very exciting. Great move for Berkeley!

Incredibly grateful for the generous endowment, and excited to help support the next generation of behavioral economics research: making economics truly about humans and integrating insights from medicine, neuropsychiatry, cognitive science, biology and more. 1/2

0

0

2

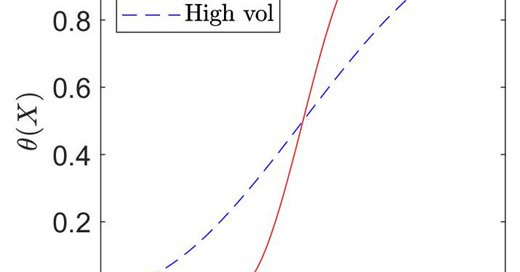

The probability weighting function from prospect theory is malleable in the manner predicted by efficient coding, from @caryfrydman and @lawrence_j_jin

https://t.co/uOZmPKLbBY

0

6

26

Thank you, @CFCamerer, for constantly promoting our work and providing us with great comments/insights.

Exeter Prize had a knockout showing by @caltech SS faculty and ex-faculty (Kirby Neilsen*, Lawrence Jin) and 3 @caltech SS PhD alums (Matthew Kovach, Cary Frydman, Gerelt Tserenjigmid) almost half of the 13 winners* & runners-up. (and KIM @Caltech is tiny-- about 5 SS PhDs/yr)

0

0

8

Prospect Theory's famous “S-shaped” value function is a cornerstone of behavioural economics. Surprisingly, more than 40 years after its inception, there seem to be a lot of remaining puzzles about it. Or... perhaps not anymore. A 🧵that may change your view on Prospect Theory.

26

314

1K

A lot to be done in cognitive economics; I view this as part of the third generation of behavioral models (cognitive noise, memory, attention, and learning algorithms).

A popular framework in cognitive science that combines model-based learning with model-free reinforcement learning can help explain actual investor behavior, from Nicholas C. Barberis and @lawrence_j_jin

https://t.co/bicsE3qnJc

0

2

17

Finally set up a new website: https://t.co/u3y8NjBn2F My paper on reinforcement learning (with N. Barberis) is finally ready to be posted online: https://t.co/uEZI46bVZ0 Comments are very welcome!

0

3

19

Hope it goes very well!🙏

Today begins our week-long Yale Summer School in Behavioral Finance program held at @YaleSOM! In its 7th iteration, it is an intensive PhD course in #behavioralfinance taught by Prof. Nicholas Barberis & other leading researchers in the field. #ICFSummerSchool #SOMfinfac

0

0

2

I am sharing a "gofundme" link for people interested in helping the families who lost their loved ones in the recent Texas school shooting. Texas Elementary School Shooting Victims Fund

gofundme.com

UPDATE: 3/27/2023: We wanted everyone to know that we've JUST launched ano… Victims First needs your support for Texas Elementary School Shooting Victims Fund

0

0

4

In July 2022, I will be joining Cornell’s Johnson College of Business as an Associate Professor of Finance. I look forward to working with a superb set of new colleagues; I am also grateful to all the support I have received from Caltech.❤️🙏

9

0

146

#QJE Feb 2022 #4, “Efficient Coding and Risky Choice” by Frydman (@caryfrydman) and Jin (@lawrence_j_jin),

academic.oup.com

Abstract. We experimentally test a theory of risky choice in which the perception of a lottery payoff is noisy due to information processing constraints in

1

4

16

An ambitious move by Harvard. My work with Barberis on reinforcement learning is also in this direction. I’m very excited about developing this line of research!

news.harvard.edu

University-wide initiative made possible by gift from Priscilla Chan and Mark Zuckerberg.

0

1

4

Glad that this is out! Return extrapolation not only explains facts about asset prices and return expectations, but also facts about cash-flow expectations. Question remains: what are the deeper mechanisms for forming expectations about different economic variables?

https://t.co/HPI5cBN0Fh

@lawrence_j_jin and Pengfei Sui show in a new model that return extrapolation is important for the quantitative explanation of facts about asset prices, return expectations, and cash-flow expectations.

0

1

5

Katrin is a good scholar. Please take a look at her application if you are hiring:-)

Thank you @jenniferdoleac🙂 Hi #EconTwitter, I am on the job market this year! I am a financial economist. My job market paper studies investor memory 🧠 Let me tell you a bit more👇🧵(1/5): #econjobmarket #financejobmarket #academicjobs

1

0

6

An open question is: with an alternative theory that implements loss aversion, can it lead to different conclusions? For instance, can a different model, calibrated to experimental findings of a high degree of loss aversion, work "better" with finance applications...? 5/5

1

0

0

All this has led me to think that the degree of loss aversion in financial markets is lower than previously thought. However, observations from @sdpbht point to another possibility: the TK (1992) implementation of loss aversion itself might have some issues. 4/5

1

0

1

The disposition effect is too strong in realization utility models if lambda = 2.25; CPT has a worse performance when explaining anomalies in the cross-section if lambda = 2.25 (compared to 1.5); recent experimental studies also suggest a lower estimate of lambda. 3/5

1

0

0