Global Bagholding Opportunities IV L.P.

@justbrosef

Followers

5,434

Following

5,100

Media

418

Statuses

5,113

world’s first analyst-slash-therapist

Earth

Joined November 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

어린이날

• 536406 Tweets

こどもの日

• 501971 Tweets

#EğitimHaykırıyorTekinistifa

• 158199 Tweets

子供の日

• 136599 Tweets

#光る君へ

• 106150 Tweets

Mülakatsız68binAtamaistiyoruz

• 85104 Tweets

#ขวัญฤทัยEP12

• 79520 Tweets

GW最終日

• 72762 Tweets

予選突破

• 47466 Tweets

Al Jazeera

• 35248 Tweets

#CHEWHU

• 31796 Tweets

Happy Easter

• 29874 Tweets

Cole Palmer

• 28978 Tweets

Noni

• 28043 Tweets

Gallagher

• 20816 Tweets

柱稽古編

• 19825 Tweets

BINGLING THROUGH IT

• 19188 Tweets

سعد اللذيذ

• 16561 Tweets

Santner

• 15731 Tweets

四塩化一黄酸

• 15681 Tweets

GW終わり

• 15044 Tweets

Kerem Shalom

• 12131 Tweets

#فيصل_ابورميه_المطيري_58

• 11760 Tweets

Madueke

• 11515 Tweets

Happy Cinco de Mayo

• 10711 Tweets

蜜璃ちゃん

• 10065 Tweets

Last Seen Profiles

lmao Nelson Peltz is on a free Zoom tier and had his 40min free allotment expire live on

@CNBC

21

4

258

Wonderful insight.

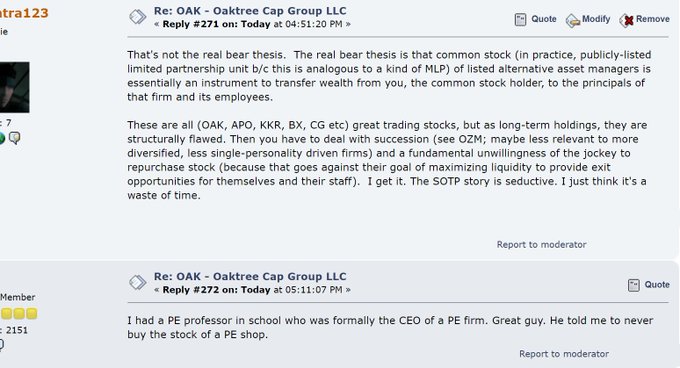

“The reason we had a massively diversified short book throughout the bull market and not lost money is because we were aligned with management [of the companies we were short]. Management was there to sell stock, and so were we”. -

@John_Hempton

1

15

82

Investors: “Look for reinvestment runway”.

Same investors: “Damn, $TXN capex next few yrs higher than we feared,

#sell

”.

5

2

81

What’s the point of doing a “here’s the story” / “here’s what I learned” twitter thread on Greensill when just a link to pretty much any of the 10 articles in the

@FT

will do a much better job?

6

1

47

Growth investors and VCs suddenly talking about “valuation” discipline and importance of “cash flow” after 10 years of YOLOing. 🤝

1

1

44

@marketeuphoria

@akramsrazor

if you paid a $54b market cap for $CRM in Jan 2010 the IRR on the stock til today would be more like 8.4% and not 14%. This is because of the 80% increase in the share count in the intervening years.

4

0

43

The fact that so many people seem to have interpreted this as a serious, genuine YTD performance is a valuable sentiment signal, possibly.

2

0

37