Jeanna Smialek

@jeannasmialek

Followers

65,802

Following

2,396

Media

1,605

Statuses

9,322

Federal Reserve and economy reporter @nytimes . Pittsburgh native, Tar Heel. Wrote a book on central banking's new era, link below.

Washington, DC

Joined February 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Arsenal

• 479509 Tweets

Flamengo

• 158384 Tweets

Tottenham

• 129609 Tweets

Spurs

• 128897 Tweets

Forest

• 107078 Tweets

Botafogo

• 87489 Tweets

Raya

• 67532 Tweets

DAVI NO DOMINGAO

• 57969 Tweets

melanie

• 50602 Tweets

Lite

• 48539 Tweets

Romero

• 35525 Tweets

Maracanã

• 25075 Tweets

Brunson

• 20954 Tweets

Gazzede SoykırımıDurdurun

• 20537 Tweets

Candace Parker

• 19659 Tweets

Türkiye Yüzyılı Maarif Modeli

• 19279 Tweets

Göztepe

• 18995 Tweets

Gabigol

• 18495 Tweets

Brest

• 14543 Tweets

Arrascaeta

• 14440 Tweets

Duhamel

• 14155 Tweets

Chris Wood

• 10060 Tweets

Last Seen Profiles

This is interesting: "Beijing has tested expiration dates to encourage users to spend it quickly, for times when the economy needs a jump start." via

@jamestareddy

188

447

1K

I'm excited to say that as of April 29, you'll be able to find me

@nytimes

writing about the Fed + the economy. I'm between work emails, but feel free to DM me between now and then.

86

16

709

Self reflection is important, and it's especially important if your job is to inform people.

I've read through

@Noahpinion

's takedown of my Sunday Business piece, and though he did not ask me for a comment, I have one.

31

63

675

I published two stories with my friend and frequent co-writer

@bencasselman

yesterday. I took the lead byline on one and he took the lead byline on the other.

Only I got this email yesterday evening.

37

90

523

The London interbank offered rate has died after a long battle with regulators. It was 52.

An obituary for finance's most important number, from

@LananhTNguyen

and me.

28

135

467

NEW: Fed officials and staffers spent last week quizzing market participants about the risk of a financial accident in the United States, post-U.K. So did the White House.

Prognosis: Not imminent, but not impossible.

w/

@jimtankersley

@JARennison

22

107

354

Let's talk about what is going down here.

My friend

@arappeport

and I wrote last week that Treasury might try to kill the novel Fed facilities. Now it is. (1/)

16

152

343

Getting off the ski slopes to discover that a few of you have thoughts about my article on

@StephanieKelton

32

38

323

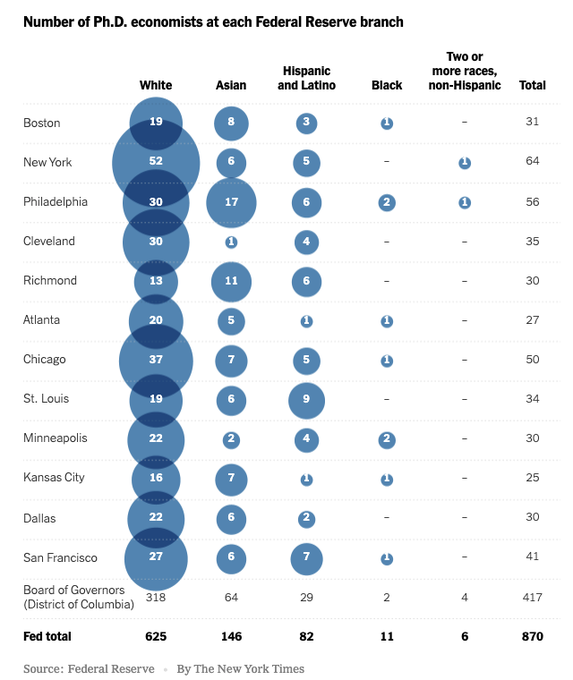

Monroe Gamble was the

@sffed

first-ever Black research assistant. In 2018.

That wasn't a one-off. Black economists and RA's are a rarity across the Fed system, I learned from data the Fed provided for this story. (1/)

13

128

285

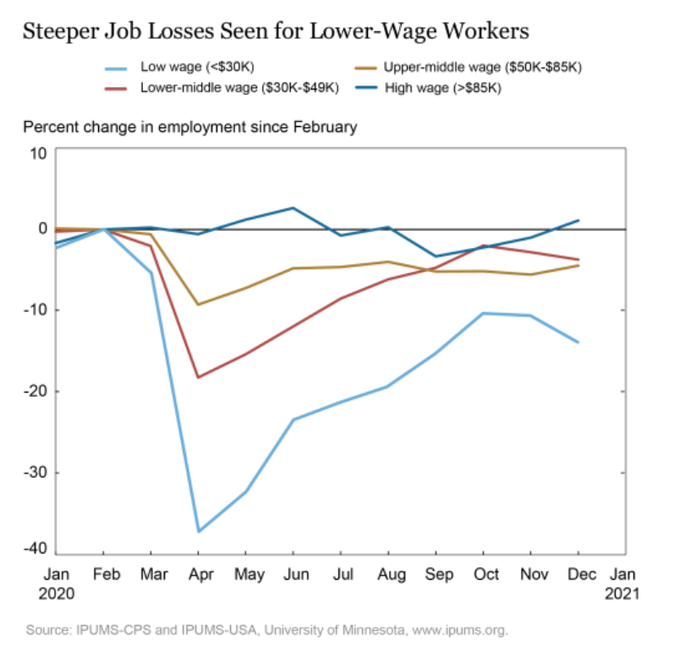

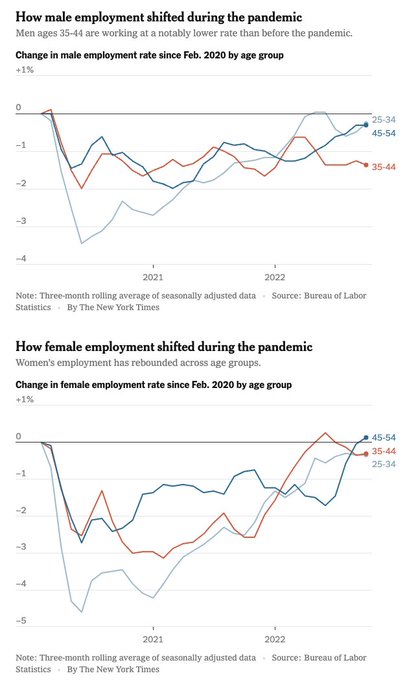

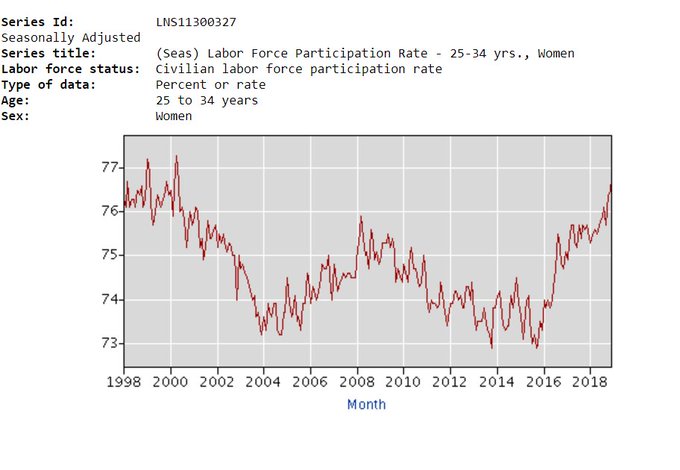

Men between 35-44 (elder millennials, younger gen x) just aren't staging the employment rebound we're seeing in other demographics.

Why?

@lydiadepillis

@bencasselman

and I dug into it.

45

94

279

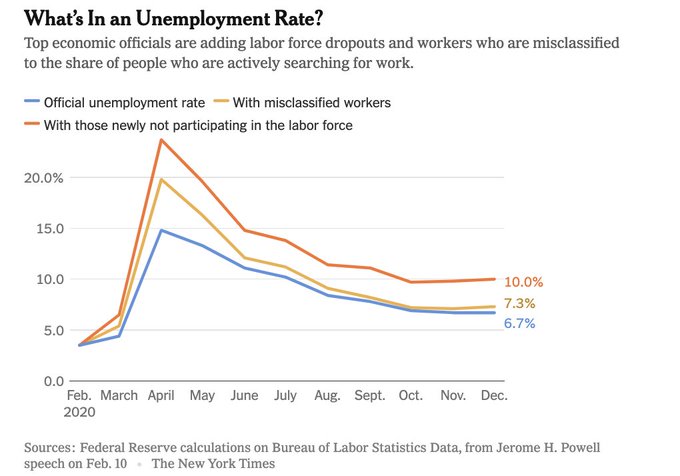

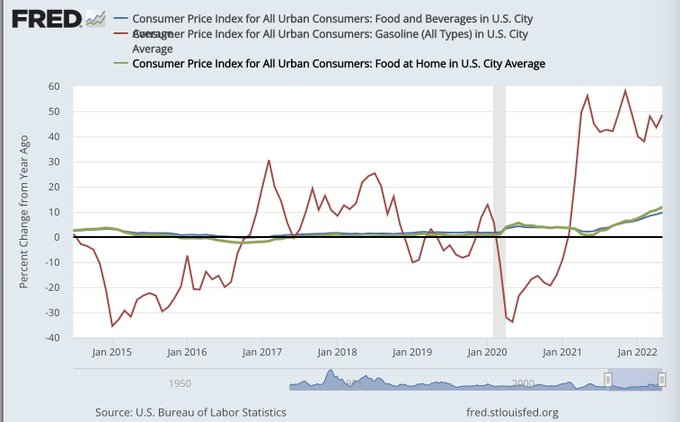

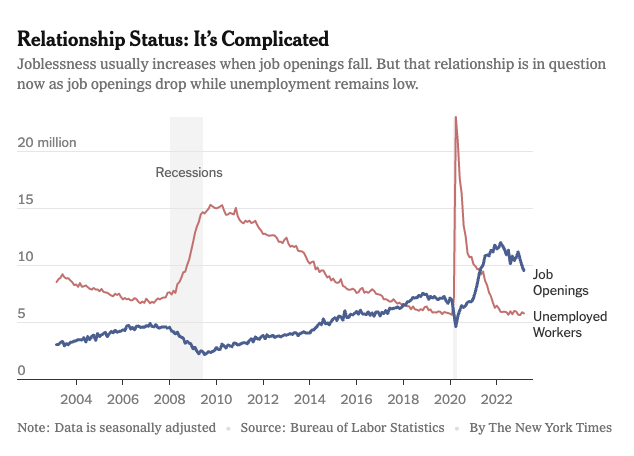

Remember the “she-cession”? What about the early-retirement wave, or America’s army of quiet quitters?

We underestimated the healing power of America's labor market — again. What lessons can we learn from it? w/

@bencasselman

13

85

268

@Noahpinion

This was not a literature review on what macro thinks of MMT. It was a feature story about how MMT is grappling (or not grappling) with the fact that inflation has proven incredibly hard to predict, when so much of its argument relies on predicting inflation.

10

11

256

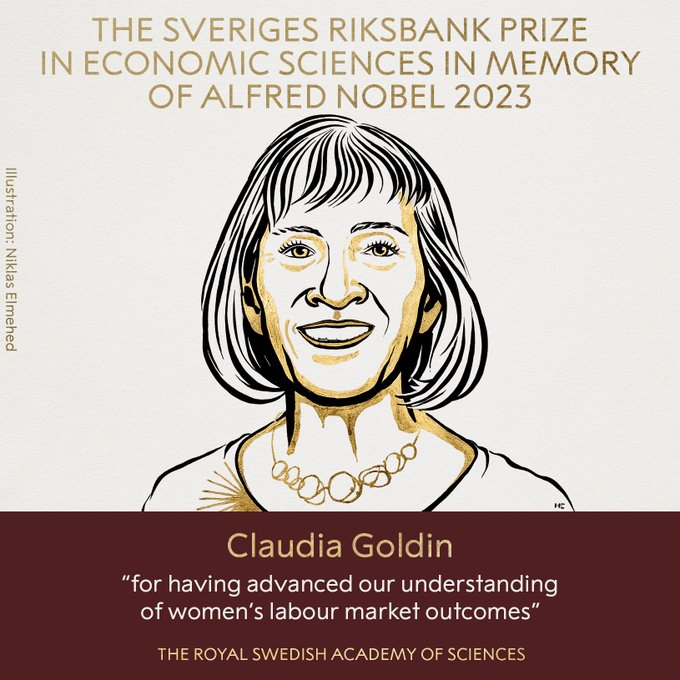

Claudia Goldin is the third woman to win the economics Nobel.

(She was also, fun fact, the first woman to be offered tenure in the Harvard econ department.)

BREAKING NEWS

The Royal Swedish Academy of Sciences has decided to award the 2023 Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel to Claudia Goldin “for having advanced our understanding of women’s labour market outcomes.”

#NobelPrize

420

10K

27K

10

55

228