Heon Lee

@heonlee_

Followers

357

Following

3K

Media

47

Statuses

2K

Ph.D. @MizzouEcon. Monetary Theory. Views are my own.

Charlotte, NC

Joined October 2019

See this piece for how to incorporate inflation https://t.co/oDobul8Cb6

2

1

21

You CAN add search frictions to other markets. The housing market is a good example. Hicks made a distinction between fix-price markets and flex-price markets. That was a useful idea; but I would reframe the distinction as between auction markets and search markets. If you

@farmerrf "The answer I give is that the labor market is not an auction market. It is a search market." Doesn't this run into the Soviet LTV problem? In what sense it labor market special compared to other markets? Why can't I add search frictions between capital users and capital owners?

1

2

21

Few people in the profession are more impressive than Darrell Duffie. If you work in finance or in macro with asset prices, chances are you’ve spent time with his textbook “Dynamic Asset Pricing Theory.” I learned much of what I know about the subject by working through the

7

43

296

1/Hedge funds increasingly absorb growing issuance in US Treasury and other debt markets. 2/Hedge funds increasingly borrow heavily to do so in repo markets. 3./Fed thinks it needs to pump more reserves into the system because repo rates occasionally jump (and Fed will start

15

89

412

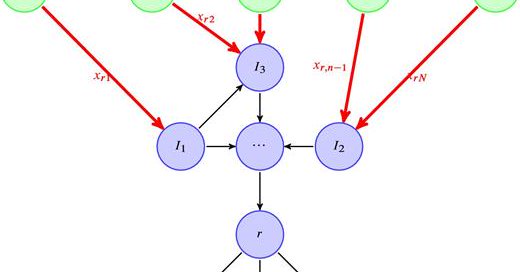

Labor Market Power (2022) (by David Berger, @KyleHerkenhoff and @Simon_Mongey) is a key contribution to the growing literature on monopsony power. Replication of the base model leads to highly intuitive results! I do the exercise here (Julia code): https://t.co/GtcfZWhU79

1

17

91

Hopenhayn (1992) is the workhorse model of firm dynamics. However, quantitative implementation of the original model remains scarce. I attempt to do the exercise here (Julia code + slides): https://t.co/jXsDcYlj3Q The resulting FSD is a remarkable baseline to match the data!

4

21

149

Super interesting! "Unpacking repo haircuts and their implications for leverage" by Felix Hermes, Maik Schmeling, and Andreas Schrimpf. "A central lesson from the findings of this Bulletin is that repo haircuts must be understood in the context of the underlying trading motive.

0

5

37

I just read a paper on this topic and it confirmed what we see here. In fact, it has huge implications for understanding U.S. manufacturing. In computers and electronics, productivity improvements have been greatly underestimated. Measure properly, adjust accordingly, get this:

Every time I happen to look at electronics prices, I'm shocked by how low they are. 50" 4k TV? $139.99. Great VR headset? $249. Starlink Mini? $229.99. M4 Macbook Air? $750. Consumer electronics have gotten incredibly inexpensive and the quality has gotten really high.

3

21

264

Jesús's answer to the Cambridge Capital Controversy seems to be (paraphrasing): "If we're concerned about capital heterogeneity, then we should work with models with heterogeneous capital types." While I broadly support that conclusion, there are still two problems: 1) We

academic.oup.com

Abstract. Aggregate production functions are reduced-form relationships that emerge endogenously from input–output interactions between heterogeneous produ

In 2013, Markus K. Brunnermeier (@MarkusEconomist) invited me to give a guest lecture in his Princeton graduate course on two venerable topics: the Cambridge capital controversy and Austrian business cycle theory. I put together a set of slides for what I recall was a 75-minute

11

20

134

🚨New Paper🚨 I study how US monetary policy shocks affect non-US firms depending on their carbon emissions: brown firms experience higher bond spreads, lower equity prices and investment. ➡️🟩/🟫 economies more/less resilient https://t.co/fWb4VLpha1 🧵[1/18] #EconTwitter

1

4

15

🥁🥁NEW WORKING PAPER ALERT 🥁🥁 Consumption Inequality, Household Risks, and the Business Cycle with @DBergholt and Lorenzo Mori https://t.co/SCZZMha5mR New and surprising results on consumption! #EconTwitter 1/N

2

16

73

Overall, my estimate of the distribution of Roman city-sizes in 100 CE results in a distribution of city sizes that is highly consistent with the distribution of European cities circa 1650 CE (from https://t.co/By3TiBM9I0):

0

1

6

I am a fan of the literature on endogenous cycles, particularly Richard Goodwin’s work. But Goodwin’s model was mechanistic and did not account for people adapting their behavior in response to anticipated price signals. To improve on that idea, I wrote a paper on nonlinear

5

14

72

@FanTastischenDa @JesusFerna7026 The funny thing about the opening statement is that Keynes (1936) does *not* rely on the assumption of sticky wages/prices. @farmerrf

2

2

15

I didn’t know that there is an alternative perturbation method which still can capture the limit cycles!

0

1

8

マクロIの授業資料公開しました. RBC, NK, DMPを扱い, できるだけ標準的な内容になることを心がけました. Dynareの代わりに MacroModelling.jl を使ったので, Juliaだけで完結しており, お手軽です. https://t.co/V9wdkWTyRS

kazuyanagimoto.com

0

35

164

A lot of Asians—especially those that are Christian, grew up in the US, or have names that are particularly difficult to pronounce—have an Anglicized name as well. Unfortunately, it’s always advisable to apply to things using that name.

2

2

37

Super happy to see Dynamic Programming by Sargent & Stachurski out in the world — rigorous, elegant, and full of applications. A beautiful piece of work❣️❣️❣️

Dynamic Programming by Thomas J Sargent and John Stachurski Provides a rigorous and unified presentation of recent advances in dynamic programming, along with code, algorithms, and many applications. 📚 https://t.co/5k26qTjsj5

2

72

395