Simon Mongey

@Simon_Mongey

Followers

7K

Following

9K

Media

294

Statuses

3K

Senior Research Economist at Minneapolis Fed. Views here are my own, not those of the Fed.

Minneapolis, MN

Joined April 2019

For interested students, we spent quite a bit of time on the replication package. It isn't available on the AEA website yet but is available on mine and includes tex files for the paper and appendix, in addition to all code.

11

49

502

There was a great deal of writing about "hot labor market" post-pandemic, but all of that supposed heat was required to keep real wages growing at their pre-pandemic rates ...and they didn't quite get there. I wrote about this earlier this year

minneapolisfed.org

Job-market indicators turned red, but real wages were falling. Rising prices and work-from-home likely drove employees into the job hunt.

A reminder: inflation burns but it is the level of prices relative to income that most consumers are struggling with. Too many don’t have the income to make ends meet. That is the result of compounding price increases without broad enough gains in wages to allow prices to recede

2

4

19

Coordinating a range of data, our economist @Simon_Mongey finds immigration changes can only explain about half of the weak U.S. jobs market. Among the evidence: Slower wage growth for workers we might expect to benefit from falling immigrant labor.

minneapolisfed.org

Broadly slowing labor market is a major factor in falling jobs numbers

0

1

4

Key insight from work by @tradewartracker and @neilmehrotra. This paper appears in the recent issue of the @MinneapolisFed Quarterly Review

Researchers at the Minneapolis Fed conclude that tariffs have effects similar to a "negative productivity shock" even though they don't change productivity. The upshot is that they lower the neutral rate of interest sharply in the short-run (but not in the long run): "To the

0

0

7

By far the bigger issue is that measures of job *ads* have no notion of the number of positions that need to be staffed. JOLTS doesn't ask for how many job ads an establishment has but how many positions it is seeking to fill.

Pedantic but overlooked labor market data quirk: Job *postings* (as measured by the fine people at Indeed) and job *openings* (JOLTS) don’t measure exactly the same thing. You can have an online job posting without a job opening (if you don’t plan to hire)…

0

1

14

5/5 While none of this is a smoking gun, its a set of observations that lead me to the conclusion that the decline in employment growth is *not entirely* driven by a decline in net migration. Although slowing net migation is certainly a large part of it!

0

0

5

4/5 Finally, if slowdown was net migration, we might expect stability in the shares of Unemp, Emp, Out-of-labor-force (N). This isn't the case. N/(U+E+N) has risen. Consistent with workers being discouraged by a labor market with low hiring, low real wage growth, less openings.

1

0

3

3/5 Third, we look at wage growth. Real wage growth has fallen, as nominal wage growth moderates and prices have increased. But wages have slowed more at the bottom than the top. Doesn't look like a net drop in supply of lower wage workers.

1

0

3

2/5 Second, we split US employment in half, first by sectors then by states. One half contains the most unauthorized worker heavy states / sectors. The other half, the least. In each case employment growth slowdown is largest in the half with the least unauthorized workers.

1

0

4

1/5 First, some simple back of the envelope calculations where we make assumptions to get an upper bound. We try CBO, BEA, SF Fed estimates for net migration change, push through age distribution / emp rates and get between 29% and 66% of the slowdown from lower net migration.

1

0

5

0/5 Was a bit preoccupied with the birth of our second son last Thursday to follow up on this ♥. Below is a short piece covering 4 observations that suggest that the recent slowdown in job growth is more than just reduced net migration.

How much of the weak-looking U.S. labor market is explained by falling immigration? Only about half, finds our Principal Research Economist @Simon_Mongey. Many signs point to a labor market struggling broadly, well beyond the effects of migration changes.

7

6

65

How much of the weak-looking U.S. labor market is explained by falling immigration? Only about half, finds our Principal Research Economist @Simon_Mongey. Many signs point to a labor market struggling broadly, well beyond the effects of migration changes.

minneapolisfed.org

Broadly slowing labor market is a major factor in falling jobs numbers

0

8

16

Is U.S. inflation continuing its progress down to the Fed's 2% target? In the latest "Basket," Senior Econ Writer @JeffHorwich calls out the three big inflation trends you need to know.

0

1

4

#QJE Nov 2025, #3, “Bottom-Up Markup Fluctuations,” by Burstein, Carvalho (@camecon), and Grassi (@Basile_G):

academic.oup.com

Abstract. We study markup cyclicality in a granular macroeconomic model with oligopolistic competition. We first characterize how firm, sectoral, and aggre

1

3

12

This is incredibly exciting! John somehow knows a lot about everything in macro. Congratulations John, @Austan_Goolsbee, and @ChicagoFed!

Thrilled to announce that John Leahy will become the @chicagofed’s next director of research John, the Allen Sinai Professor of Macroeconomics and Public Policy and chair of the Econ dept. at @umich, is a lovely guy and a fabulous economist. Welcome to Da Bank, John.

1

0

25

A useful exercise would be to take the top performing stocks in any time period and ask what share of stock returns, earnings growth etc they account for over that period, and then compare to these statistics for "AI-related stocks"

Via JPM's Michael Cembalest, AI-related stocks have driven: - 75% of S&P 500 returns since ChatGPT’s launch in November 2022 - 80% of earnings growth over the same period - 90% of capital spending growth - Data centers are now eclipsing office construction spending. - In the PJM

0

0

5

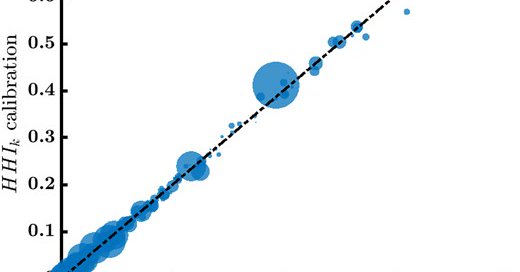

The sequel to our 2018 AER "Aggregate Recruiting Intensity". We combine JOLTS QCEW microdata to test our earlier work and construct a 'ground up' measure of ARI. Importantly, we solve a clear "missing intercept" problem linking aggregate tightness and firms' recruiting decisions

Forthcoming in AEJ: Macroeconomics: "Macro Recruiting Intensity from Micro Data" by Simon Mongey and Giovanni L. Violante.

1

10

50

Excited to be joining RED as an Editor! Please send us your best papers, and we'll handle them efficiently and fairly!

Join us in welcoming our three new editors Alessandra Fogli, @Simon_Mongey, and @InaSimonovska! We are so excited to have them join us!

7

5

192

Ownership of #Treasuries has shifted from price-insensitive investors to price-sensitive investors, putting upward pressure on yields. 🔗: https://t.co/PA6M6qL9SK

#EconTwitter #Finance

1

15

52