Explore tweets tagged as #LIHTC

LIHTC subsidies inflate housing costs, pad the pockets of favored real estate investors, and disincentivize families from earning more income. Instead of expanding the LIHTC, Congress should eliminate it. @AmericanFreedom

1

5

13

John DeJovine, CPA, tells Michael @Novogradac about significant differences between the #LIHTC and #HTC for developers who are considering pairing the incentives in one transaction. #TaxCreditTuesday.

0

2

0

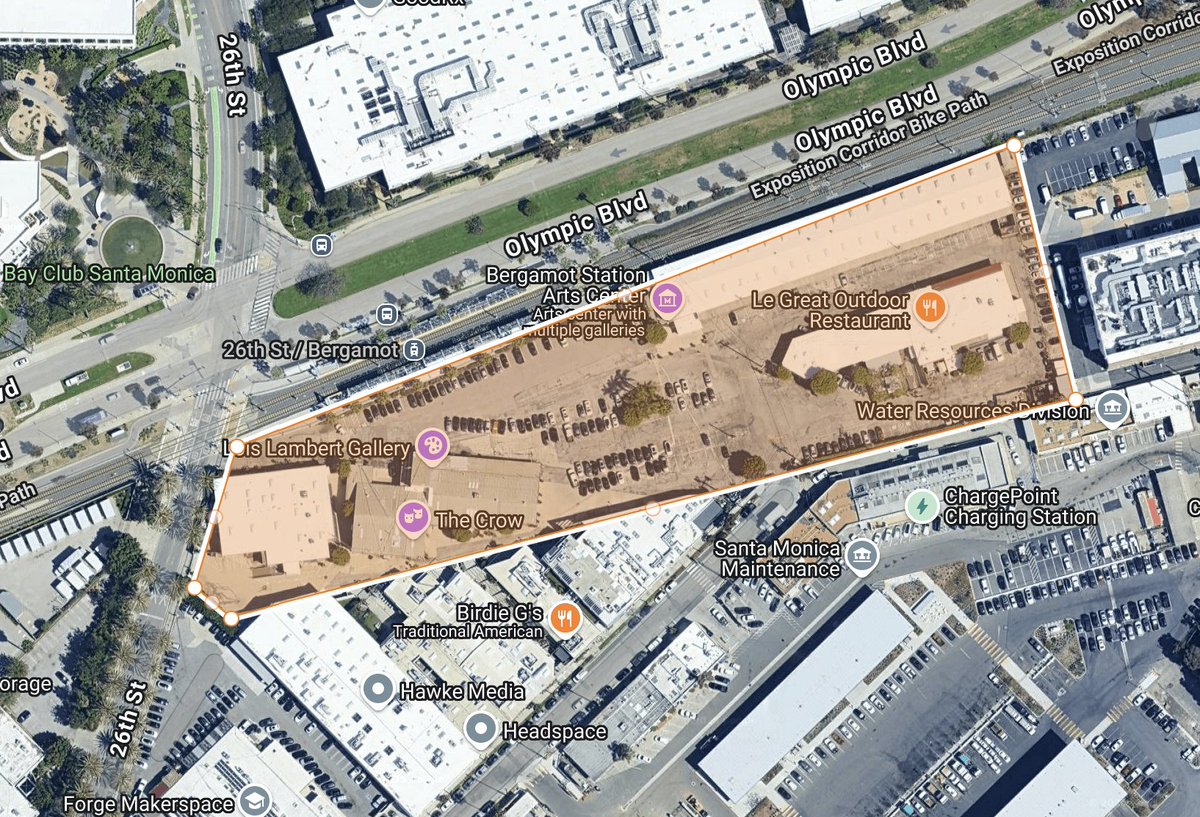

Debating if I write some kind of substack chronicling, from start to finish (hopefully), the effort to develop ~280 LIHTC units in Rochester, MN and then compare the process to a similar project in a less structured and restrictive state…. ????. #LIHTC #affordablehousing.

3

0

15

Here’s a fact I’m sure @NancyMace is proud of:. The U.S. spent about $13B on affordable housing (LIHTC) in 2023. The Big 💩 Bill, which @RepNancyMace proudly voted for, provides $45B to build immigrant detention centers. This is failed policy — and failed leadership.

ICE arrests in South Carolina are up 204%. Detention space is running out. Today, we called on ICE to coordinate with federal and state agencies to use every available resource including the Charleston Naval Brig, state prisons, and BOP facilities. South Carolina will not be a

3

9

33

"A @washingtonpost investigative piece confirms what we’ve been saying for years @CatoInstitute about federal housing subsidies. The $14 billion a year low-income housing tax credit (LIHTC) drives cost inflation in “affordable” housing projects." - @CatoEdwards.

1

7

19

Affordable housing advocates applauded the bill’s passage, saying that the LIHTC remains the nation’s most effective tool for building and preserving affordable rental housing. via @DianaOlick w/ @CNBC

0

0

0

Many Low-Income Housing Tax Credit (LIHTC) units will lose their affordability restrictions over the next decade. Learn more about what this means for the US #housingmarket in this article by @ChicagoFed’s Dustin Ingram and Maxwell Jaffe.

1

2

5