exponential.fi

@ExponentialDeFi

Followers

11K

Following

3K

Media

1K

Statuses

3K

The all-in-one platform to earn yield with DeFi.

Joined February 2022

We’re excited to announce that Exponential has raised a $14M seed round, led by @Paradigm, and is now available to the public. Exponential is a new investment platform that makes it easy to discover, assess, and invest in DeFi yield opportunities

34

253

456

We have big news to share 📣. Join our digital collectible rewards campaign, Degens & Dragons, on @Galxe. Claim digital collectibles to earn rewards like discounted transactions on Invest, our new DeFi investment platform.* . Join the quest: .#ExpxQuest

19

815

212

🚨 Risk alert . @Balancer 's domain ( has been hijacked and its prompting users to approve a malicious contract that will drain your wallet. As far as we can tell, protocol funds are safu and the issue is limited to the hijacked front-end.

16

125

141

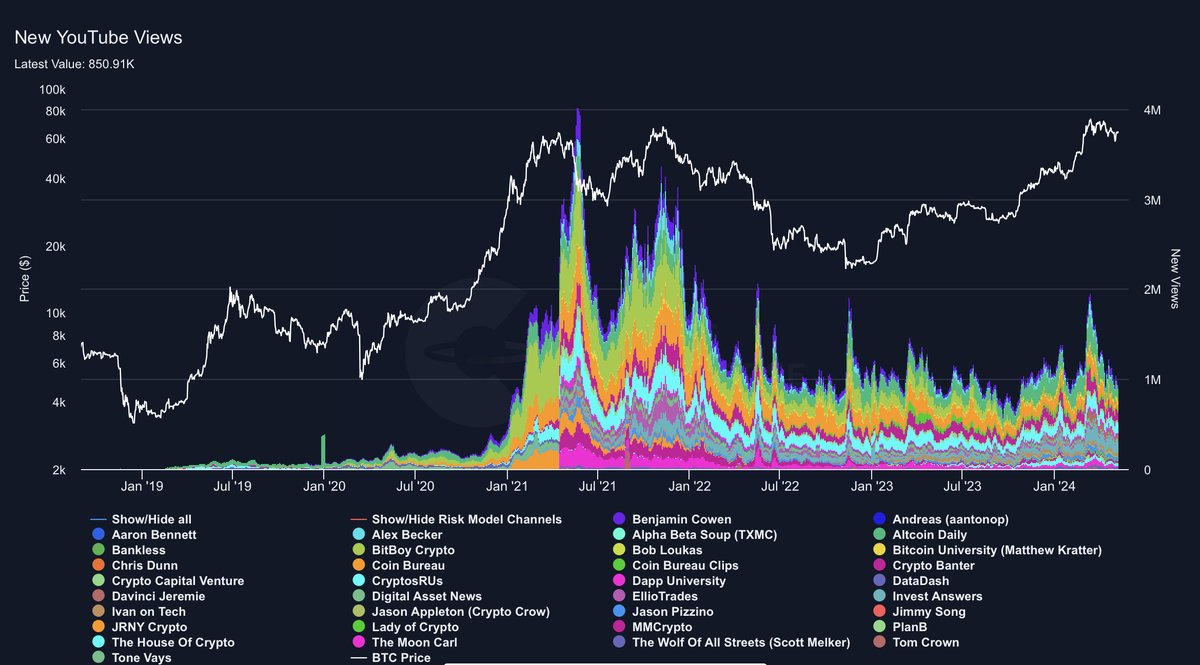

We’ve just released our latest DeFi Yield Renaissance report in partnership with @DefiLlama's @dl_research. DeFi is maturing beyond its incentive-driven origins — real yield, sustainable revenue, and capital efficiency are taking center stage. While some still question DeFi’s

5

21

122

Up and to the right 📈. Here's how we're becoming the all-in-one platform to invest in DeFi:.

.@ExponentialDeFi has turned its DeFi risk assessment platform into an all-in-one trading app. @skesslr reports.

47

15

56

🚨 Exploit alert . @LodestarFinance was exploited after an attacker manipulated the price of plvGLP (@PlutusDAO_io auto-compounder of $GLP) to borrow assets . Key takeaways: Lodestar wasn't audited and allowed an asset without robust price feeds as collateral.

6

22

70

Just as we call out the risks, we want to recognize teams that take risk management seriously: . 🏅 @LiquityProtocol .🥈 @eulerfinance @MakerDAO .🥉 @AaveAave @compoundfinance @HubbleProtocol . Read more about our new framework for liquidity protocols 👇

In the world of DeFi, code is law. But that doesn’t make it foolproof. In Vol II of our lending market blog series, we demonstrate how investors can use Exponential’s Risk Ratings to assess risk in protocols like @eulerfinance @AaveAave @LiquityProtocol .

5

10

57

This week we added 20+ new pools featuring @HopProtocol @merofinance @defichain @0vixProtocol @OriginDollar. We've included the $DUSD pools on DeFiChain to our list of #RiskiestPools. Scroll down to learn more 👇

4

7

47

We took @0xSifu 's feedback seriously so we went back and restated all of $mSPELL yield data based on how many MIM fees have been effectively claimed by stakers on a rolling 28d basis. We estimated a much lower APR at 5-6% than the 29% advertised by @MIM_Spell

@ExponentialDeFi @thedefiedge Looks like you're showing advertised yield copied from their UI, not real yield? Some of those apps have averaged under half that APY over the 30 day period shown.

6

4

43

Attention onchain users!. We’re excited to bring to @Base for qualified users!. Discover how is supercharging your DeFi experience on Base, and how you can get your crypto to work for you👇

9

6

35

LSD-heads, listen up! 🎧. We've got new @pendle_fi pools for you to devour – $rETH, $sfrxETH, $ankrETH, and $StaFi-rETH. Or if you're feeling more adventurous, try a mixed flavor with @unsheth_xyz. 🍨

1

5

34

DeFi yield is getting a major upgrade. We're excited to introduce our first-ever USD lending pool on @MorphoLabs, a trustless and highly efficient lending platform, managed by @gauntlet_xyz. Let's dive into the details 👇

4

7

35

. @MakerDAO has proposed to increase its credit line to @ethena_labs USDe/sUSDe borrowers—from $100M up to $1B. If the latest proposal passes, we expect to downgrade the Maker sDAI pool to B (low risk) from A (lowest risk). Let's recap on what is happening and why 🧵.

2

8

33

🦄 alert! . We're thrilled to welcome @Uniswap to our investible opportunities at Exponential! . Starting today, you can provide liquidity to select Uniswap pools in a single click and track your yield and earnings seamlessly on our platform.

23

2

18

@LidoFinance V2 is live!. This is a huge milestone for Ethereum staking and Lido users. Here’s what you need to know about the upgrade and how you can invest in Lido $stETH and $stMATIC pools on Exponential. 👇

1

6

29

Hey anon . Have you been paying attention to @SturdyFinance ? . The lending pools are in our selection of "Best Risk-Reward", an exclusive club of the top yields in DeFi. Double digit yield at >$5m TVL is an exception

1

5

27

In the world of DeFi, code is law. But that doesn’t make it foolproof. In Vol II of our lending market blog series, we demonstrate how investors can use Exponential’s Risk Ratings to assess risk in protocols like @eulerfinance @AaveAave @LiquityProtocol .

0

2

25

MEV is an industry formed by extracting value from block production. Since 2020, over half a billion dollars of value was generated from MEV on just the Ethereum network. What if there was a way for you to capture a slice of this revenue?. A 🧵on MEV and @foldfinance

1

6

29

We're back with another #DegenResponsibly episode! 🙌. We invited @BotanixLabs to discuss how they're building the first EVM Layer 2 network on Bitcoin, the benefits of this approach, and the experience for users and developers. Listen now 👇.

2

7

22

New ETH yield pool to celebrate the launch of ETH deposits 🎉. Introducing ETH Lending by @0xfluid. 13% APY with a B risk rating. Here’s what makes this pool unique:. 🧵

3

7

26

We are now tracking the following assets on Exponential!. @stader_polygon MATICX.@defichain DFI, DUSD, dBTC, dETH, dUSDC, dUSDT.@AlchemixFi alUSD.@mstable_ mUSD.@gnosischain xDAI. Check them out at

1

5

21

Join us and @AngleProtocol next Monday 11am ET to talk about all-things $agEUR, why euro stablecoins are needed and how Angle is leading the charge. Set your reminder: . Claim your attendance NFT at:

0

9

22

Have you heard of the new features that @Uniswap recently launched? They are called Permit2 and Universal Router, and they are game-changers for the DeFi space. Here's why you should care: 🧵.

4

6

27

The best risk-reward USD yield pool:. USD Fee Sharing by @AngleProtocol. 20% APY with an A risk rating. Here’s what makes this pool so unique:. 🧵

9

3

22

Join us and @TrueFiDAO to discuss uncollateralized lending and what makes TruFi unique on 10/25 . Click below to get a reminder 👇.

1

5

23

Degen Responsibly is back next week! . Join us and @Rocket_Pool on March 15 at 5pm ET to talk about LSDs, rETH and how they lead the charge in decentralizing staking power. Set your reminder: Claim your NFT:

0

125

19

Llamas 🤝 DeFi. Today we are announcing two big collaborations with @DefiLlama. 1) Our full risk ratings are now live on DeFiLlama’s yield dashboard. 2) Together with @DL_Research, we are releasing the 3Q24 State of DeFi report. (1/4)

4

10

26

Happy #FarmingFriday! 🚜🌽. This week we published 34 new pools (including 4 new Best Risk Rewards): . @lyrafinance sUSD option vaults.@BendDAO lending and #realyield pools .@rage_trade liquidity vault .@SynapseProtocol stablecoin and ETH pools in 5 chains .@dopex_io straddles

1

3

24

Check out new 20+ pools that just launched on Exponential featuring @NotionalFinance @idlefinance @GainsNetwork_io. You can find all of our #RecentlyAdded pools at

1

4

25

Pool of the day. @TokemakXYZ @Balancer ETH Market Making. Provide liquidity for ETH staking and restaking tokens and earn yield from swap fees and protocol incentives. Tokemak’s Autopools automatically manage your position across top DEXs. A set-and-forget strategy for ETH bulls

2

2

25

Friendly reminder to avoid signing unlimited allowances when interacting with a new contract 😎. Roughly 60% of all approval transactions allow unlimited usage of funds ☠️. Kudos to those in the other 40% who restrict the amount and seem to be living on @optimismFND or @0xPolygon

2

4

22

Pool of the Day 👇. @0xfluid USD Lending. • Yield: 10.8% APY.• Risk Rating: Low.• Yield Source: Primarily from the interest rates paid by borrowers who leverage the assets you've supplied for trading or farming. This opportunity acts as a savings account denominated in USD.

1

2

24

Tired of sky-high Ethereum gas fees? Join the savvy traders switching to Exponential for more wallet-friendly transactions. 😎⛽️. This week:.- We take a closer look at @mavprotocol.- New pool ratings from @yearnfi and @TraderJoe_xyz.

2

4

4

@criptopaul @UmamiFinance Thanks! We point out in our research into this vault that it compounds risks from Tracer/Mycelium, GMX and also a high sensitivity to leverage, given how they used Tracer tokens to hedge. BTW, we only want to bring transparency so users know the risks they take 🤓

4

1

23

👀 .Did someone notice @iearnfinance is on @optimismFND now? Because we did . You can also start following the five Yearn vaults on optimism (sUSD, DAI, USDC, WBTC and ETH) . Tracking yields before anyone else does

4

7

24

@thedefiedge We are featuring 7 #realyield pools at the moment across 4 chains, including risk ratings for each. Happy to send you an invite to test our private beta!

4

4

21

Degen Responsibly is on a 3-week streak ⚡️. Join us and @tokenbrice from @liquityprotocol to talk about the hottest stablecoin at the moment: $LUSD any why decentralization matters . Set your reminders ⏰

1

6

16

2/ @GearboxProtocol lending pools are now live and offer passive yields that are further incentivized with $GEAR tokens. Degen traders & farmers utilize your funds to leverage up to 10x on DeFi positions like Curve, Uniswap, etc.

1

7

23

1/ @AngleProtocol USD Fee Sharing. This one's a no-brainer. • 10% APY.• Lowest risk score (A).• Yield from fees paid when users utilize the protocol's services. This acts as a savings account denominated in USD. Ideal for risk-averse investors seeking passive income.

5

1

20

🤝 Angle. We’re excited to announce our collaboration with @AngleProtocol! 🎉. Here's how you can earn yield with low risk on stablecoins 👇

6

3

16

1/ What is Chainlink staking?. Chainlink (@chainlink) is a decentralized oracle network that connects smart contracts on blockchains with real-world data and services. This is crucial because blockchains are inherently isolated and cannot directly access external data. 🧵👇

5

5

13

Join us next week on Thursday 16:30 UTC to discuss the state of risk management in DeFi and how as an industry can improve with two special guests: . @PaulFrambot from @MorphoLabs & @MonetSupply from @BlockAnalitica . Set your reminder ⏰.

2

140

17

It's a new year and a new opportunity to make big moves! 🚀. Let's start 2023 off with a bang by checking out the latest pools from @pendle_fi, @staderlabs, and @AngleProtocol. Here's what you need to know 👇

1

3

19

Join us in one hour together with .- @MonetSupply from @BlockAnalitica .- @inkymaze from @gauntlet_xyz .- @PaulFrambot from @MorphoLabs . To discuss risk management in DeFi and lending markets. If you can't follow live, stay tuned for the recording at

Join us next week on Thursday 16:30 UTC to discuss the state of risk management in DeFi and how as an industry can improve with two special guests: . @PaulFrambot from @MorphoLabs & @MonetSupply from @BlockAnalitica . Set your reminder ⏰.

1

15

19

Attention Arbinauts!. We’re excited to bring Exponential to @Arbitrum! 👩🚀👨🚀 💙. Discover how Exponential is supercharging your DeFi experience on Arbitrum, and how you can get your crypto to work for you👇

3

6

19

🚨 exploit alert . Dictum Exchange, a solidly fork that launched on Arbitrum with an airdrop on 12//5, has rugged all liquidity providers.

Not sure if this is worth a concern. @DictumExchange a solidly fork that launched on Arbitrum has few red flags.

0

0

10

Pool of the Day:. @AcrossProtocol ETH Bridging. • Yield: 5.5% APY.• Risk Rating: Low.• Yield Source: Bridge fees for ETH transfers, boosted by provider incentives. Perfect for Ethereum holders looking to earn passive yield on their holdings.

1

1

19

Now tracking @SiloFinance. Silo is a decentralized lending protocol that offers permissionless and risk-isolated lending markets for all crypto assets.

2

4

18

Join us tomorrow to chat about stLINK and how we are working with @stakedotlink to make DeFi easier for all . Set your reminders 👇.

.@stakedotlink and @linkpoolio will be hosting a Spaces with DeFi Platform @ExponentialDeFi tomorrow, Thursday 24 October at 11am EST / 5pm CET. Come learn about what @ExponentialDeFi is doing to make DeFi more accessible and enable end-users to be more informed about

2

6

17

Check out the latest episode of #DegenResponsibly! 🎧. We hosted @Curvance to talk about their innovative work during the bear market, their vision for an omnichain future, and how they handle risk in crosschain lending and borrowing. Listen now 👇.

4

4

14