Eddie Fishman

@edwardfishman

Followers

16K

Following

13K

Media

89

Statuses

2K

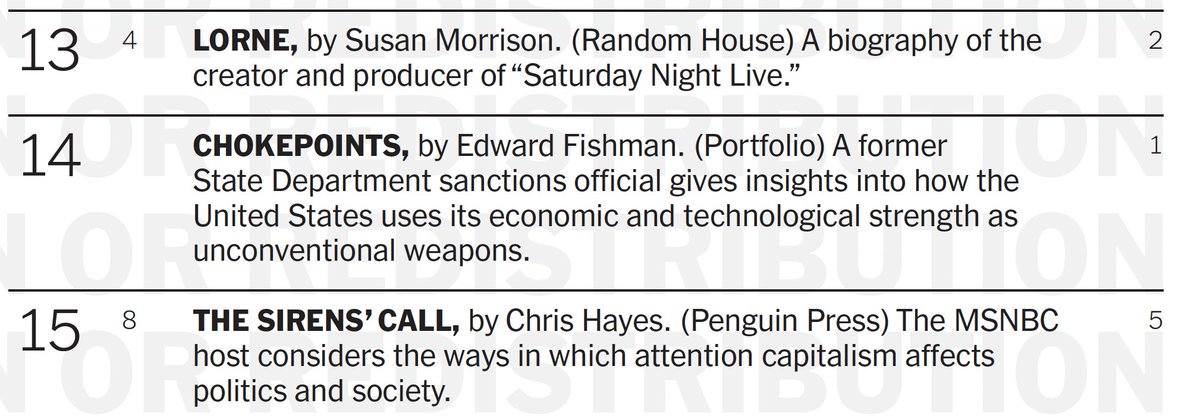

Author of Chokepoints: American Power in the Age of Economic Warfare | Senior Research Scholar @ColumbiaUEnergy, Fellow @CNASdc @AtlanticCouncil

Joined June 2009

"Chokepoints" made the New York Times bestseller list!. I’m deeply grateful to everyone who made this possible—your support means the world to me. I can’t wait to share the book with even more readers in the weeks and months ahead

10

20

124

RT @ColumbiaUEnergy: CGEP scholar @edwardfishman joined @CBSNews correspondent @TheKellyOGrady to unpack the White House's new 25% tariff o….

0

2

0

Trump has slapped secondary tariffs on India for buying Russian oil. I joined @CBSNews to break it down. Thanks to @TheKellyOGrady for the thoughtful conversation. Watch here:

cbsnews.com

The White House on Wednesday slapped an additional 25% tariff on India for buying oil from Russia. Kelly O'Grady reports on the details surrounding the tariff.

0

0

5

RT @ACGeoEcon: Join us, @ACEurope, & @atlantikbruecke at the Transatlantic Forum on Geoeconomics in Brussels 9/30!. Experts Beth Baltzan, @….

0

5

0

RT @yarbatman: Sanctions! Tariffs! . Tariffs for when countries violate sanctions! . I spoke with @edwardfishman about the old, the new, an….

0

2

0

Honored to be the first guest in the new season of The Sanctions Age, the fantastic podcast by @yarbatman . With Trump's deadline to Putin fast approaching, it's a timely moment to dig into his approach to economic statecraft

2

1

9

RT @BanklessHQ: LIVE NOW - How The U.S. Controls The Global Economy. Can a country wage war without ever firing a bullet? . In this episode….

0

6

0

RT @Przeswity: Już w listopadzie ukaże się polskie wydanie książki @edwardfishman . "Chokepoints: American Power in the Age of Economic War….

0

11

0

RT @ColumbiaUEnergy: Six months in, President Trump's trade war has entered a new phase. 🎧 On this week's episode of #ColumbiaEnergyExchan….

0

6

0

Remarkable that the EU is imposing secondary sanctions on Chinese banks—a bridge the U.S. still hasn't crossed—just as Washington pauses export controls on China. 🤷♂️

SCOOP Trump freezes export controls to secure trade deal with China & boost the odds of a summit with Xi Jinping. Security experts concerned at Trump allowing Nvidia to sell H20 to China.

2

6

24

RT @edwardfishman: The EU is moving to lower the price cap on Russian oil *unilaterally*. That breaks from the original concept, which call….

0

12

0

The EU is moving to lower the price cap on Russian oil *unilaterally*. That breaks from the original concept, which called for G7 consensus on any changes. It’s the first time I can recall the EU getting this far out ahead of the U.S. on sanctions policy 👏🇪🇺.

Europe gets tougher on Putin. It slashed the oil price cap to $47.60, kicked 22 Russian banks out of SWIFT, sanctioned Chinese and Indian entities for helping Putin, and permanently blocked Nord Stream revival. WSJ: Trump must follow with 500% oil tariffs, $300B in asset.1/

0

12

33

RT @jakluge: This is the end. The Nord Stream saga is finally over for good, 20 years after it was launched by Schröder and Putin. https://….

0

626

0

RT @euronews: As global trade dynamics continue to shift, US economist @edwardfishman breaks down how tariffs used as a so-called ‘bargaini….

0

2

0

RT @JasonBordoff: Packed house @AspenSecurity for brilliant book talk by @ColumbiaUEnergy’s @edwardfishman about his fantastic new book Cho….

0

4

0

It's a pity because Trump *could* wield secondary sanctions to reduce Russia's energy revenues.

foreignaffairs.com

Congress should wield oil sanctions to force Russia to negotiate.

1

2

6

If the goal here is to reduce Russia's energy exports, it won't work. 100%+ tariffs on China already proved politically impossible. Now Trump is threatening 100%+ tariffs on India, the EU, and Japan, too. Empty threats won't change behavior.

President Trump says the US would impose “secondary tariffs” of about 100% on Russian imports if deal is not reached in 50 days.

3

5

22

Excellent piece by @joshualipsky. "Dollar dominance" means many different things. The parts of it that are critical to national security could erode faster than others—especially if the U.S. fails to invest in upgrading payment systems that were built half a century ago.

The dollar is fine/the dollar is in trouble. Both are true - but you have to break down the difference between the national security and macroeconomic role of the dollar. That's what I try to do in a new op-ed in @nytopinion today.

0

1

5

RT @edwardfishman: This is exactly right. This may be the best chance Congress gets to ramp up pressure on Russia during Trump’s term. I ho….

0

3

0

As I wrote in @ForeignAffairs last month, there’s a tried-and-true model for Congressional oil sanctions—one that would likely work against Russia. @LindseyGrahamSC should replace the existing 500% secondary tariff with the Iran model:

foreignaffairs.com

Congress should wield oil sanctions to force Russia to negotiate.

3

14

39