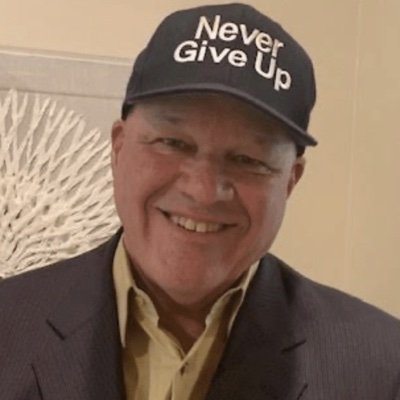

Steve McIntosh

@edgeofsteve

Followers

937

Following

10K

Media

307

Statuses

3K

Equities trader. Always bet on the fastest horse. Losers add to losers. Winners add to winners. The tape tells all. Ranked 5th USIC 2025 money manger division.

Florida, USA

Joined January 2011

I’m up 107% now in the USIC money manager stock division. It’s been quite a year and if the market gods are willing, the year can finish out strong. #USIC

5

2

53

You can focus on Greenland and Metals Futures this weekend as much as you want. This message is far more important than the news of the day or weekend.

8

49

396

I would say don’t be a perfectionist, and just because you miss day one of an entry the move and 5-7% it doesn’t mean it’s over , who cares about 5-7% if the stock doubles or triples etc. Too much out there on “the perfect entry” will keep you out of great stocks.

6

2

31

Charts are important, but understanding the fundamental story, narrative, or theme really provides an edge that technical only traders don’t have. When you know the fundamental story or narrative, it adds another layer of to the trade that helps you to sit without getting

16

32

284

$BTC $ETH and $IWM are green. this is a RISK ON environment. Everyone is busy looking at the $QQQ and its causing them paralysis on what is ACTUALLY moving. Software and the biggest companies in the world are not in favor at the moment. Meanwhile $IREN $MP $MSTR $COIN $RKLB $RIOT

20

15

200

The difference between the pros and the amateurs is that the pros cut their losses without hesitation.

2

3

18

NASDAQ tightening up and threatening breakout over $23,705!! 📈 If it holds with follow-through buying, I'm flipping to aggressively long and unhedged. This is the setup we've been waiting for - only thing better would be a recovery from deep bear territory 🚀

10

20

253

$QQQ - The NASDAQ looks ready to break out and confirm the strength in the other three major indexes. I'm watching the November 4 gap down as potential key resistance.

11

12

191

Stocks who have advanced 30% or more in 2026... priced above $15.00 with some volume... no ETF...

8

13

146

I've got some fantastic interviews scheduled with @Clement_Ang17 @ForteCharts @martinlukkt and @edgeofsteve over the next few weeks. What topics/questions would you like me to ask them?

73

9

295

I am participating again the USIC money manager division for 2026. #USIC Will make for two years of full transparency. Lots of lessons learned in 2025 and I'm ready to take on whatever 2026 brings. No predications as to what will happen. Nobody knows. But, cutting losers and

1

1

6

Great day for spotting relative strength and rotation. Staying flexible is a super power 👊 Money moved to: Optical $CIEN $LITE $APH Memory: $SNDK $MU $WDC Space/Defense: $ATI $RKLB $ASTS $GSAT $CRS Energy: $GEV $CEG $LEU $EOSE Semi's: $TSM $ASML $LRCX Data center: $HUT $IREN

0

3

5

Qullamaggie on Breakout Trading Works When Markets Are Strong “Yeah, I mean look, the breakout trading like breakout trading works when the market is strong. You know, in a period like this, breakouts don’t work. And you won’t get any setups. That’s a good thing you can just

6

45

309

Fantastic instructional video on support and resistance gaps

If you want to start incorporating support and resistance gaps into your system watch this video. https://t.co/13Ti2K36lb

0

0

3

The most successful traders I've met: - Learn with an intensity and urgency - Weren’t naturals - Avoid limiting beliefs - Are highly detailed - Iterate solutions quickly - Push through the hard work - Collaborate and trade with others - Still struggle and have drawdowns

28

86

1K

I do not think people fully realize how bullish small caps via $IWM look. 5y+ breakout.

59

86

1K

Leading stocks lead 🚀

Most wait for the indexes to confirm before leaning in. I do the opposite. If a leader breaks out with real power and early volume dwarfs recent sessions, I’m on top of it. That’s where real alpha shows up. The market catches up later. The best trades don’t wait for permission.

0

0

1

Knowledge more valuable than a 4 year college degree (in any subject not just liberal arts)

“Cut your losses quickly.” The single most important rule. Never let a small loss become a big one. Jesse Livermore famous line: “I have been in the wrong more times than I have been right, but I made money because I cut my losses short and let my profits run.”

0

0

3

Absolutely agree. It’s all about being wrong sooner. Why wait? The best trades work right away. I use lower time frames such as 15 and 30 min charts to place my stop near logical points at which a best trade would not violate.

Why I am all about TIGHT STOPS! 👇👇👇 Following up my post last week with some more detail: While wide stops might seem appealing to avoid whipsaws from market noise, tight stops provide superior risk management and higher potential reward multiples. Here’s why. Tight stops

1

0

5