Ayesha Tariq, CFA

@AyeshaTariq

Followers

56K

Following

67K

Media

4K

Statuses

33K

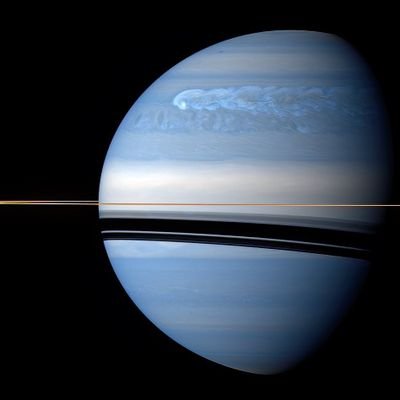

Mother | I analyze macro, markets & companies to find investments | There's always a story behind the numbers | https://t.co/ZIChZ8GjWD 🪐🧩

Dubai, United Arab Emirates

Joined June 2009

China property market worries are coming around again. Actually, they never really went away. Some of the stimulus measures worked for a bit - but seemingly, they were more of a stop-gap solution. Consumption levels are still a problem, and overcapacity is also a concern.

1

1

7

Earnings growth estimates are picking up in the US. Materials is one sector that surprised me! Source: WSJ

1

2

14

GS expects a pick up in US economic growth to help stabilize the job market in 2026.

2

2

11

Implied vols fell across asset classes last week as Fed easing expectations picked up. Even crypto stabilized after recent selling, though implied vols remain elevated. The chart shows how various asset class implied volatilities are trading relative to their own history, using

2

1

6

Have you mastered your trading mindset? If not, watch this video and start improving your consistency and approach.

If you're been interested in learning more about the psychology of trading then I've got a treat for you, friends! Here's a free 42 minute presentation on how I recommend traders conquer the biggest obstacle of all: their own minds. Check it out and let me know your questions!

4

6

19

Powell has his work cut out for him this week. The FOMC hasn't been this divided about what to do next in some time. What do you think the Fed should do? 🤔

9

14

44

$SPX flow is put-heavy to start the day here, targeting $SPX 6825 (or #ES_F 6832.75). The whole chain put-call ratio is also bearish at 1.30. It's likely that some of this is hedging ahead of the Fed on Wednesday.

2

2

14

The deal with Warner Bros will push Netflix’s revenues to dominate the streaming industry. $NFLX

3

3

18

A new CERN breakthrough may have finally revealed why anything exists. In a groundbreaking experiment at CERN’s Large Hadron Collider, physicists have observed a rare imbalance in the way matter and antimatter behave—offering a potential clue to one of the biggest mysteries in

184

497

2K

Markets are pricing in a rate cut with near-certainty next week. If Powell fails to deliver, we'll likely see a meaningful sell on Wednesday. Otherwise, new all-time highs seem all but certain now.

21

8

83

Deloitte was paid a million for a 526-page report that included AI hallucinated citations. Did anyone review it before sending? Probably not. It's legitimately remarkable how sloppy the big consultancies are becoming as they lean more on AI and less on junior staff. 🤦♂️

13

30

171

Even 10 years ago it was unthinkable that a DVD rental turned streaming company would buy out a massive legacy media operation. Deal economics aside, bravo $NFLX!

3

2

24

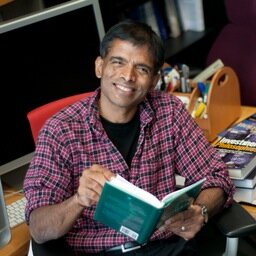

Professor Damodaran on Nvidia. You may or may not agree with his views but, I always learn something from him.

Nvidia breached the $5 trillion market cap a few weeks ago, and even after giving back a chunk, it is one of a dozen companies with market caps exceeding a trillion. Overpriced stocks or Business marvels? https://t.co/rWVLPWuXJR

9

6

39

Oil is holding on to minor gains, for now. For one, OPEC+ announced no production increases for Q1, 2026. Oil held in tankers is piling up. ANZ estimates 2m bbl/d of oil may be released if the peace deal goes through, keeping prices below $60/bbl for a while.

3

8

31

GS asks: Where would the market be if ChatGPT wasn’t invented?

1

2

12

Morgan Stanley is trying to offload some of its data center risk exposure. Part of this could be to make space for exposure to the bigger boys, such as Oracle. But it still means that the riskier credit gets pushed on to others. Banks repackage debt, transfer risk, sell

7

10

30

Quite the inspirational speech by Alex Karp. I first bought $PLTR in 2021. Glad I haven't let go!

7

3

25

I've always wondered why the Energy Sector isn't talking about AI the way the other sectors are. I think it could be particularly beneficial given the large amounts of data that these companies have to navigate. Barclays reports, that now they're seeing discussions pick up.

4

5

18