David Mihalyi

@davidmihalyi

Followers

3K

Following

12K

Media

367

Statuses

3K

Senior Economist at @WorldBank & PhD candidate @kielinstitute. On bsky: davidmihalyi

Washington DC

Joined April 2009

#HiddenDebtRevelations! How reliable are public debt stats? Our working paper with S. Horn, @NickolPhilipp, @cesarspa1 is out today analyzing hidden sovereign debts across 146 countries and 53 years. Let’s dive in! ⬇️

2

41

101

For the Clauses & Controversies fans out there, see the inclusion of claw-back provision.

0

0

2

Next level transparency in debt restructurings. UK just published their agreement with Sri Lanka.

gov.uk

This treaty was presented to Parliament in October 2025.

1

0

1

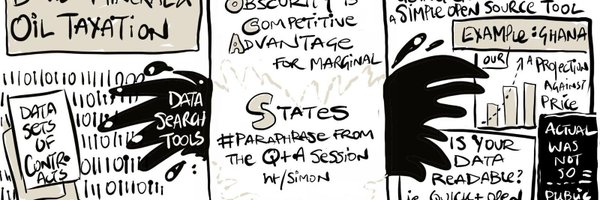

🔵 Following #FfD4, the #IMF and #WorldBank Annual Meetings, and #UNCTAD16, we held our workshop on public debt transparency, which explored ways to advance the ‘Seville Commitment’ in terms of shared responsibility for increasing transparency and accountability, from borrowers

0

8

9

New CEPR Discussion Paper - DP20747 Africa's Domestic Debt Boom: Evidence from the African Debt Database @MarkManger @davidmihalyi @upanizza, Niccolo Rescia @globalsov @amseaixmars @CNRS, @Ch_Trebesch, Ka Lok Wong @ECA_OFFICIAL

https://t.co/RR7zvQo0CO

#CEPR_DE #CEPR_IMF

2

8

11

Goodbye, #DebtCon8 … until we meet again, because that’s what #DebtCon is about @GeorgetownLaw @DebtCon8GU @LaynaMosley @upanizza @davidmihalyi @TheoMaret @ChayuDamsinghe @GtownLawIIEL

0

7

21

Kudos for wonderful program to @AGelpern & team, can't wait!

0

0

1

And an exciting revamp of our African Debt Database featured later on day 1 w. Niccolò Rescia, @BelaichThomas, @upanizza, @MarkManger, @Ch_Trebesch, @SteveKLWong.

1

2

3

I'll be presenting on how to Assess Creditor Contributions to Easing the EM Liquidity Crunch in the opening plenary (paper w @RivettiDiego , @anirudhsb).

1

1

3

DebtCon meets The Odd Lots. Awesome conference program feat. @tracyalloway, @HyunSongShin , Lee Buchheit, ...

1

3

6

Debt swaps have often been assessed using inconsistent metrics, leading to unclear evaluations of their financial benefits. To address this, we’ve developed a streamlined online tool that introduces clarity through standardized, transparent indicators:

worldbank.org

The Debt Swap Calculator helps you analyze potential savings from conducting debt swaps. It allows you to compare existing debt instruments with a new debt option to determine if refinancing would be...

2

16

51

Sovereign debt data is improving, but the devil is in the details. In a new @WorldBank report,@RivettiDiego, @davidmihalyi, @anirudhsb, Roberto Lobarinhas, and I look at how debt transparency has evolved since COVID. A few of my thoughts: https://t.co/tHlJgb2W01

worldbank.org

This report calls for a radical shift toward debt transparency as critical to debt sustainability, urging legislative reforms, stronger oversight of unconventional debt, broader loan-level reporting,...

1

4

7

I’m now in the other place where the sky is blu and there is so much less vile and dumb crap in my feed everyday.

0

1

7

1/5 Official announcement from WB regarding expansion of CRDCs to cover a much wider range of hazards beyond those for which reliable parametric triggers are available for @jsphctrl @emilycwilkinson @MichaiRobertson @davidmihalyi @nkearse2016

worldbank.org

The World Bank Group has expanded its lifeline to countries struggling to rebuild from disasters, allowing small, vulnerable states to postpone loan and interest repayments after a catastrophic event...

1

3

5

Great to listen to @Ch_Trebesch giving an historical overview @IMFNews of official lending over cycles of war and peace—very relevant given current geopolitical tensions. #debt

0

7

40

Our paper “Hidden Debt Revelations” (with @davidmihalyi @NickolPhilipp and Sebastian Hirn) is the ‘featured paper of the day’ in the NBER’s website. Thanks @nberpubs for promoting our work.

1

11

48

1

2

55

A first - measuring impact of debt transparency on borrowing costs using natural experiment of Cameroon's temporary contract disclosure regime. By @leecrawfurd and Theodore Mitchell of @CGDev

0

4

21

Family picture at the PDM conference. Great fun & great seeing so many friends

0

1

10

"Opaque borrowing also hinders debt restructuring." A tonne of public debt is never made public https://t.co/fEeEyWpN1a from @TheEconomist

economist.com

New research suggests governments routinely hide their borrowing

0

3

8

The Economist (@TheEconomist) just published an article discussing our new "Hidden Debt Revelations" paper (joint w/ Sebastian Horn, @davidmihalyi and @NickolPhilipp). Check it out! https://t.co/o8k4p44jLT

economist.com

New research suggests governments routinely hide their borrowing

3

13

69