David @ NextView

@davidbeisel

Followers

23K

Following

4K

Media

260

Statuses

2K

Co-Founder & Partner @NextViewVC, seed investing in Founders redesigning the Everyday Economy including: @attentivemobile @TripleLiftHQ @thredUP @ParsecTeam

New York / Boston

Joined June 2009

1/ Thrilled to unveil NextView Ventures' fresh new look! It’s more than a facelift—it represents how far we’ve come while staying true to our mission of backing seed stage founders as high conviction, hands-on investors:

nextview.vc

NextView helps entrepreneurs build companies of consequence to shape a future of collective prosperity. https://nextview.vc/

9

2

13

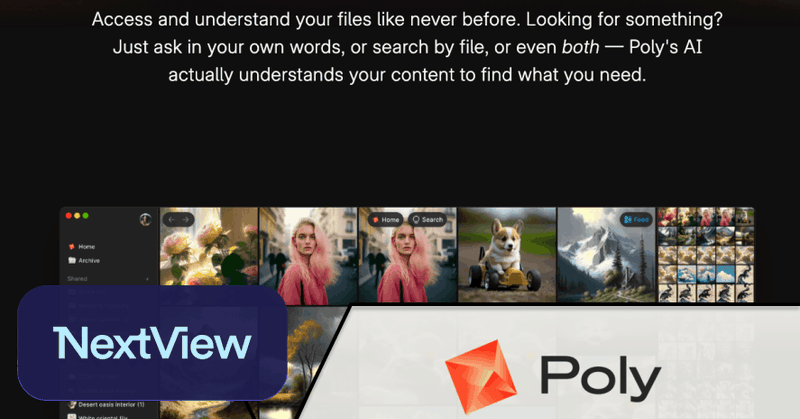

For 40 years the file browser hasn’t changed. Today, we’re launching with $8 million in seed funding to rebuild the file browser into something more intelligent, searchable, and delightful. The world is in the middle of a data explosion. We’re generating and using more files

584

375

4K

For Gen AI–native creators and knowledge workers, Poly feels like the future of interacting with your own content... faster, more intuitive, and actually delightful.

1

0

0

America needs you! Join U.S. Immigration and Customs Enforcement today.

2K

7K

32K

By layering AI directly into the file browsing experience, Poly lets users: 🔎 Search across all formats 📝 Summarize content instantly 🏷️ Auto-tag & organize ⚡ Act on files to create new outputs All from one intelligent interface.

1

0

0

At @NextViewVC , we invest in truly product-centric companies transforming the Everyday Economy, like @browsercompany and @withbeside. Poly fits squarely in that lineage.

1

0

0

We all use a file browser every day… and yet almost no one likes it. Poly is changing that by rebuilding the experience from the ground up.

1

0

0

After two years in stealth, Poly, founded by @Denizen_Kane, is emerging publicly with a beautifully reimagined take on one of computing’s most overlooked but pervasive tools: the file browser.

1

1

1

Excited to finally share more about one of our portfolio companies: @polydotapp ( https://t.co/vEmFKklF6u) — an intelligent cloud file browser redefining how we navigate computing in the generative age.

1

2

3

Every great story has an Arc. Thrilled to see @NextViewVC's portfolio company @browsercompany's next chapter is with @Atlassian. https://t.co/V3RHD11Ddp

theverge.com

$610 million is a pretty big number for a web browser

3

1

7

Thrilled to see my partner @melodykoh expand her role as Partner & CPO at @NextViewVC to lead our AI + data efforts—supercharging how we support founders. 🚀

After 6 years as a Partner at @NextViewVC, I'm expanding my role to lead our AI and data initiatives as Partner & Chief Product Officer. The window to build competitive advantages in VC is now—what we build in the next few years will reshape how we invest for the decade ahead.

1

0

2

Last week, my partner @robgo at @nextviewvc explained why seed VC is in crisis. This week, he explores what comes next. No silver bullets—but a clear framework for firm adaptation and optimism in the AI Supercycle.

Here's the follow-up to my post about the existential crisis facing seed VCs. Spoiler alert: I'm not going to give "the answer". I'm keeping that locked in the mystery box. But I'll share a few thoughts on the potential path forward. Full read: https://t.co/K1smrFcURi TLDR:

0

0

5

I see four forces that are creating a serious threat to the seed VC model: 1. Industry maturation eroding profits for sub-scale players 2. The nearly unstoppable forces of YC and the megafunds 3. Power-law thinking becoming consensus 4. The AI platform shift

1

3

9

Seed venture capital is at an inflection point—one that demands clear-eyed reflection and an honest assessment of the forces reshaping our industry. My partner @robgo has articulated this moment of existential questioning with unusual clarity.

Seed VC is facing an existential crisis. This isn't hyperbole. And it's not just a regular business cycle. It's a real crucible moment. My full thoughts here: https://t.co/H7aIX9Zzok But if you want the TLDR, here you go:

1

0

4

My full thoughts on the topic are in a post here:

nextview.vc

A milestone-driven, needs-based approach to determining the right amount to raise in a seed round requires building a financial model, adjusting for real-world scenarios and considerations, adding a...

0

0

2

The point is not to ask, “What’s the most seed capital I can raise?” but rather, “What’s the most amount of seed capital I can raise without increasing difficulty?”

1

0

2

That point of diminishing returns is NOT actually the magic number you want to raise. Instead, your magic fundraising number is the one which corresponds to approximately 80% of effort devoted to reach that highest point.

1

0

1

At some point, an entrepreneur begins to exhaust her network and the incremental hours devoted to fundraising will begin to yield less capital raised than the previous. There begins to be diminishing returns to devoting more time to fundraising:

1

0

1

Spreading your network broader to pitch more potential investors will inevitably result in more capital being available:

1

0

1

But soon, for any successful fundraising effort, the more effort you put into fundraising, the more results it will yield, in meetings and eventually in capital:

1

0

2

At first, fundraising goes slowly (…until it goes fast), as it takes a while to set the direction for prospects and to work through the kinks in the story and pitch. Those first few days and maybe weeks won’t yield much capital if any at all:

1

0

1