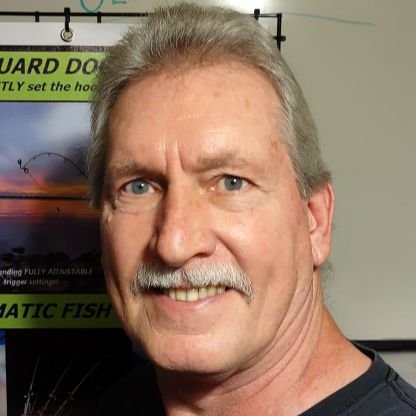

Dave W

@daveweisberger1

Followers

31K

Following

5K

Media

767

Statuses

15K

Former Chairman @ https://t.co/IefA0LZJgJ - ALL opinions are my own, & do not constitute investment advice. Bitcoin for saving & Crypto for markets.

Miami Beach

Joined November 2020

I would say I feel sorry for all those Bitcoin sellers that sold after the liquidation event, expecting a cascade of forced selling like 2022, but that would be lying…

17

2

182

New York needs a candidate like you @FrancisSuarez In 4 years, the city is going to need a savior...

Socialism is the easiest sell in politics…it’s just never worked in the history of humanity. The only equality it has delivered is equality of poverty, misery and repression.

2

1

37

Who else is bracing themselves for all the technicians to talk about the CME gap tomorrow? Of course, if this ISN'T another Sunday fakeout, it could be an interesting week...

28

5

223

We’re celebrating Alex Albon’s new Mexico GP helmet Get in the race to win $500 USDG (10 winners, $5K total) One lucky winner will also win Alex’s Race Worn Mexico GP helmet! Powered by @KrakenFX & @WilliamsRacing How to enter 👇

0

0

0

To think that betting on a spin of the Roulette wheel live has given this guy such a large following...

Imagine this. $XRP teleports over $500 per coin instantly. The administration then use the premine to pay off the $35T debt Whole new financial system. Ripple at the centre of everything. Early holders are now upper class elite humanoids - Wynn

10

0

44

This take, which is common among wannabe Bitcoiners MISSES THE POINT. IF Bitcoin gains adoption as THE most accepted and utilized store of value, it becomes THE measuring stick by which governments will be measured for fiscal sanity. THAT is the best hope for ending the FIAT

When I used to be into Bitcoin — my idealism was about its potential to compete as a currency — digital peer to peer cash / with privacy. #Bitcoin FAILED to become this. It failed to compete and be a tool to fight the system! Instead Wall Street and political pimps pumping now.

8

0

47

Thank you James:

@daveweisberger1 @JoeCarlasare @RenaudAdorno To be clear: I said the draining of the RRF means excess liquidity is now soaked up (read my article in full to understand how and why). So this is a 'stop sign' toward possible liquidity stress, not a symptom. The Bank Reserves falling below a certain level is also a stop sign,

2

0

17

What if love wasn't real... Or, is it? ❤️ He is lonely. She is perfect. Her name is "Betty". A story of loneliness, desire, obsession, and heartbreak! - Pop/Electro song. ORIGINAL NEW SONG! Definitely Different!

0

1

8

And now we know how the matrix will be built…. (If it hasn’t already, of course)

Wow. Insane technology 🤯 Retina e-paper promises screens visually indistinguishable from reality Researchers have created a screen the size of a human pupil with pixels measuring about 560 nanometers wide. The invention could radically change virtual reality and other

3

1

12

Well said @tyler Add to this the FACT that CZ SERVED his sentence already & the MAIN benefit of the pardon is to allow one of the great entrepreneurs in the space to be able to go back to work. And, before the "he is a bad guy" nonsense gets thrown around, remember that

IMO, @cz_binance deserved to get pardoned. His prosecution was politically motivated and his punishment was disproportionate. He was thrown in jail for failing to maintain an effective compliance program. Bankers have compliance failures all the time and they never get perp

8

5

72

One would think @steve_hanke would be tired of the SAME nonsensical refrain, but cognitive dissonance is powerful… Zero value, with the worlds largest computer network backing it, turning energy into value is pure ignorance

Eric Trump says America loves Bitcoin. REALLY? BITCOIN = A SPECULATIVE ASSET WITH ZERO FUNDAMENTAL VALUE. https://t.co/kYGlnagBZr

4

0

28

Mempool Accelerator™ fixes this Launch of open beta starts today! Click Accelerate from the transaction page and pay with lightning or fiat. No sign up necessary. Initial mining pool partners make up 40% of Bitcoin’s global hashrate: @FoundryServices, @MarathonDH, @SBICrypto,

21

65

313

Lugano = crypto city IRL. Our team is at @LuganoPlanB Forum this week. Why Lugano matters: It's not just Bitcoin-friendly. Bitcoin is legal tender - used for taxes, municipal services, daily commerce This is what real adoption infrastructure looks like, and exactly what

6

2

3

This is the sort of clickbait NONSENSE that will end in tears for those who believe it. Brad is not saying ANYTHING about XRP overtaking Bitcoin in VALUE, but rather that it (and other chains) are better rails for PAYMENTS. (very true) What he doesn't say is how COMPETITIVE

Ripple’s CEO has boldly claimed that #XRP is poised to overtake Bitcoin, coinciding with the ISDA’s move to open the doors to a staggering $1.5 quadrillion market a potential game-changer for global finance. 💥

7

2

25

Impressive. Congrats to @ianweisberger & the team.

Big milestone: @coinroutes is @dYdX Chain's first governance-approved revenue partner. We're bringing institutional execution infrastructure to decentralised derivatives. Protocol-aligned incentives + deep liquidity + smart routing = the kind of ecosystem growth crypto needs

1

2

18

Unsurprisingly, @cz_binance nails it. Tokenizing an asset, unless it exists DIGITALLY, does NOT verify its provenance. Gold, must be stored, guarded, & continually VERIFIED, whether or not it is represented by a token, ETF share, certificate of authenticity from a mint, or

Saying the obvious. Most people “in crypto” know this, most people “not in crypto” may not understand yet. Tokenizing gold is NOT “on chain” gold. It’s tokenizing that you trust some third party will give you gold at some later date, even after their management changes, maybe

21

14

187

While being long gold wont hurt Tucker in the long run, I look forward to seeing his pain when he realizes how much wealth he squandered by avoiding Bitcoin...

NEW: Tucker Carlson says he’s a hard "NO" on Bitcoin, claiming it was created by the CIA and calling himself “a gold person.” “I fear it’ll become a scam run by financial elites and politicians to tighten control over society… Nobody can tell me who Satoshi is. I grew up in a

42

7

196

WHY the F $ ! are we parsing CRAMER https://t.co/TQ87vDhiOk via @YouTube

1

1

11