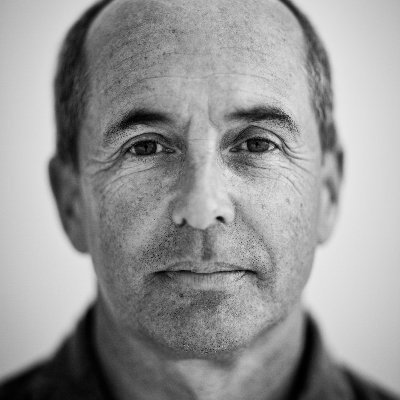

Daniel Koss

@daniel_koss

Followers

11K

Following

5K

Media

171

Statuses

2K

Investing in AI & Tech Infra | Sharing wins & fails openly $NBIS $ASTS $KRKNF $TE $EOSE

Switzerland

Joined March 2013

🔥NEW $NBIS 2026 price target: $403 (+211%) Disclaimer: This post is not financial advice. I currently hold a highly concentrated long position in Nebius. This is my base case, not my bull case. Personally, I’m leaning a lot more bullish 😉 Many questions will be answered if

63

82

613

I will live-tweet $NBIS earnings tomorrow! All the good, bad and interesting stuff. Decided not to stream, as I believe the tweets will be faster and easier to skim through for those who can't make the time :)

14

3

98

$NBIS earnings tomorrow pre-market. This is the part where we lean back, sip our favorite (non-alcoholic) drink and maybe grab some popcorn. Friends, just learn to trust the process. Let it go. Hand the talking and thinking over to Arkady, Roman, Marc and team. Just sit back

8

3

114

I’m obsessed with asymmetrical investments. That's how I 10x'd my portfolio since 2024. Here’s how I think about it: 1. Limited downside The stock already trades as if the worst case happened, or even below the value of its tangible assets. Risk is largely priced in. Even in a

35

28

433

How will $NBIS stock react to earnings? They see Nebius trading at 30 x guided ARR and call it overvalued. We see Nebius trading at 6 x forward ARR and believe it will be at 22x (+ subsidiaries worth billions). We call it cheap. Time will tell.

10

5

146

King George III (1738–1820) was a diligent man of wit and intelligence until he was finally stricken by illness. There is no doubt that he was intermittently mad or psychotic. But the nature of his illness remains an insoluble mystery, though a source of fascinating discourse.

1

0

7

Waaait we should livestream $NBIS earnings together and have some people who really understand Nebius discuss earnings live on stream afterwards. Who's interested or already planning this?

24

1

176

$NBIS earnings on Tuesday. I don't think I've ever been so hyped in my life for an earnings call 😂

23

9

342

Speculation: $MSFT might take a stake in $IREN 👀 "IREN’s expertise in building and operating a fully integrated AI cloud, from data centers to GPU stack, combined with their secured power capacity makes them a strategic partner." - Jonathan Tinter The interesting part is not

9

13

181

X still doesn't understand that $NBIS could 100% build their own data centers and would be world-class at it. They don't want to! It might make sense at some point, but not now. Advantages of working with partners: 1. Speed Working with (multiple partners) who already have

13

9

99

The future of channel ecosystems goes full circle, but what does that mean? At @Cisco’s Partner Summit, @danielnewmanUV hosts Cisco SVP, Tim Coogan, to unpack the Cisco 360 Partner Program, and discuss setting a new standard for predictable, profitable, and transparent partner

0

0

4

@jiahanjimliu's post on why IREN gets less /MW / the IREN bull view:

$IREN Topline Explained So why is $NBIS getting ~13.92m/MW-yr while $IREN is getting ~$9.7m/MW-yr (4)? Granted NBIS is paying Colocation to DataOne, but what's the steps for IREN to get 13.92m/MW-yr? This is important as the delta is net profit. To answer this, we must first

1

2

10

SemiAnalysis (one of the most respected independent research outlets in semiconductors and AI infrastructure) is incredibly bullish on $NBIS ❤️ - They still put $CRWV on top right now. - Nebius close 2 (Gold tier), "direct competitor" to CoreWeave - Nebius already better at

22

36

248

Elon was right! Now they are asking the government for money. AI doesn't need OpenAI. The playing field must stay fair!

2

2

20

🚨I don’t know who needs to hear this, but if you’re incredibly bullish on AI, you should be playing it with stock + LEAPs (long-dated options) right now. Don’t get wiped out because you were short-term greedy, overleveraged on margin, and forced to realize massive losses even

6

5

37

When his stocks go down -> market manipulation 😡 $IREN $CIFR (tweet already deleted, of course) When stocks he doesn't like $NBIS $CRWV (competitors to the stocks he owns) go down, due to a broader market pullback -> NOT macro or manipulation, market is "waking up" 😆 Quite

41

8

207