Andrew Batson

@andrewbatson

Followers

13K

Following

1K

Media

474

Statuses

4K

Partner and China research director at Gavekal Dragonomics. Aspiring blogger. Former Wall Street Journal. Variously from Louisiana, Beijing, Pacific Northwest.

Joined March 2009

Great report. Fragmentation isn't uniform. High-tech trade is increasingly geopolitical, low-tech isn't. China expands exports everywhere while slashing imports from the West. The "techno-security state" is real, asymmetric, and concentrated where it matters most.

Trade fragmentation is often framed as the world splitting into blocs—countries trade within blocs, but not across them, as presented in many IMF or ECB reports. This is wrong. In a new FEDS Note, we show this misses what’s actually happening in the data: fragmentation is uneven

1

20

70

Here is the link to Nick's piece, which I hope will move the debate in a more productive direction:

piie.com

Many experts see China’s economy as constrained because of a weak social safety net, especially the retirement system, resulting in anemic domestic consumption spending. This view is out of date....

3

5

27

The key to "boosting consumption" therefore is not the social-safety net but traditonal macro: China needs macroeconomic policies that tighten the job market and move it closer to full employment. That's what will reassure households. 9/

3

7

27

In my view the main drivers of the persistently high household savings rate are now cyclical rather than structural. Households are cautious because the job market has been weak and uncertain for at least four years (six if you count the pandemic). 8/

2

2

28

It just doesn't make sense to think that the social problems of the 2000s are still determining the household savings rate in the 2020s. We should look to more proximate causes, which I think are actually quite obvious. 7/

1

2

13

Public spending on benefits as a % of GDP has already doubled, but a lot of economists keep saying that the government needs to expand spending on social benefits in order to get the household savings rate down. That spending will expand anyway as society ages. 6/

1

2

19

The view that Chinese society is wracked by insecurity made sense in the 2000s, in the aftermath of the massive SOE layoffs of the 1990s and before the government had built a new benefits system. It doesn't make sense today, when social insurance at least touches most people. 5/

1

2

22

These days China's social-safety net is pretty decent by middle-income-country standards, and in some cases (like those pensions for former SOE/gov't employees) arguably overly generous. 4/

1

4

24

The single most important change was the creation of the "resident" pension program in 2012, which extended income support in old age to those outside the privileged minority of SOE/large urban employees. This has led to substantial gains in government transfers to households. 3/

2

2

26

In fact I've been making this argument for literally a decade (the receipts: my blog post titled "the death of the precautionary savings hypothesis" is dated April 2015). Those paying attention know China started boosting public spending on the social safety net around 2006. 2/

1

4

29

Nick Lardy has an excellent new paper out reviewing China's progress in building up a social safety net, particularly its pension system. He thinks the consensus view that a weak social safety net is pushing up savings and pushing down consumption is outdated. I agree! 1/

8

33

169

Interesting list, not just the usual

The 10 Best Books of 2025: Ten works of fiction and nonfiction that stood out among those our reviewers read this year. https://t.co/Ze5uKMET2G

0

0

0

Eighteen centuries before Adam Smith!!! 🤯 “There must be farmers to produce food, men to extract the wealth of mountains and marshes, artisans to process these things and merchants to circulate them. There is no need to wait for government orders; each man will play his part,

18

137

696

On this theme, the great novel of trying, but failing, to achieve The American Dream is Wallace Stegner's *The Big Rock Candy Mountain*, which I re-read recently. Hardworking, talented guy keeps trying to strike it rich, comes close a few times but it always goes wrong.

0

1

6

How do people in a rising power view their country's global standing? My new paper in @IntOrgJournal finds significant national overconfidence in China and shows that misperceptions can be corrected and triumphalism mitigated https://t.co/8w3eh66RBW 崛起大国的过度自信及其校正

cambridge.org

Reckoning with Reality: Correcting National Overconfidence in a Rising Power

13

44

138

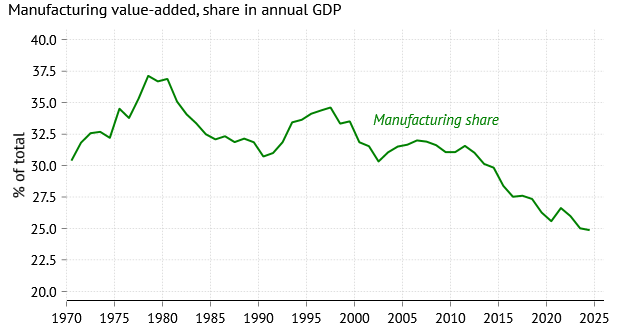

At least, it is good for China's planners to recognize reality and attempt less distortion of the economy in pursuit of unattainable goals. More at the blog:

andrewbatson.com

Reading China’s five-year plans, one of the most immediately striking things is just how many things they attempt to plan. These are not just documents about where to build airports or highwa…

1

0

4

Will these tweaks in wording make a real difference to the economy? Maybe not. But they could signal a change at the margin away from the recent pattern of all-out subsidies for manufacturing output and investment, which many would welcome.

1

1

3