Andrew Stein

@_Andrew_Stein

Followers

867

Following

3K

Media

79

Statuses

231

Head of Research @Lekker_Cap

Miami, FL

Joined February 2024

Student loan wage garnishment in conjunction with the FHA COVID-era mortgage assistance program ending is forming a stormy consumer health outlook for 2H25. My guess is the AI underwriters and BNPL face their first true credit test. Place your bets!. $AFRM $XYZ $KLAR $SZL $UPST

~2,500,000 (~1/3 of) FHA loans face avg ~$625/mo payment shock when STILL in forbearance (0 pymt in 5 yrs) SAVE student loans -> Repayment Assistance Plans 3-9 months after "big beautiful bill" passes. Student loan impact on mtg has yet to hit. Full analysis in first reply.

0

4

33

Clearly a sell the news event on $TSLA. $UBER and $LYFT live to fight another day. Does Lyft finally break out of this 3Y range after robotaxi launch?. May 2023 average STM EV/FCF: 8.5x.March 2024: 19.6x.80% of return was driven by multiple inflation. Closed yesterday at 7.3x

0

0

2

RT @blknoiz06: . @_Fullport — Bulls, Bears, and Ballistic Missiles feat. @WClementeIII, @qthomp, & @_Andrew_Stein

0

28

0

RT @_Andrew_Stein: The amount of $MSTR crypto treasury copycats hitting the market is reminding me of peak szn http….

0

2

0

Why isn't $LYFT (or $UBER for that matter) in the Autonomous & Electric Vehicles $DRIV ETF @GlobalXETFs?. Makes no sense.

Hey @CityofAtlanta friends, get ready – @lyft autonomous rides are coming your way soon!. Our first self-driving Toyota Sienna just hit the streets to start testing operations ahead of our summer launch. It's the first step with our AV partner @May_Mobility to bring thousands

0

0

2

Very egalitarian of you @coinbase . "Cardholders can earn up to 4% bitcoin back on their purchases. The more assets you hold on Coinbase the higher your rewards rate. You can hold any asset including USDC or USD to qualify. We’ll share more when the card goes live.". $COIN.

Introducing the Coinbase One Card. Earn up to 4% bitcoin back on every purchase. Powered by @AmericanExpress network. Coming fall 2025.

0

0

7

Consumer financial health is in big trouble and it's just getting started.

Student loan wage garnishment in conjunction with the FHA COVID-era mortgage assistance program ending is forming a stormy consumer health outlook for 2H25. My guess is the AI underwriters and BNPL face their first true credit test. Place your bets!. $AFRM $XYZ $KLAR $SZL $UPST

2

0

9

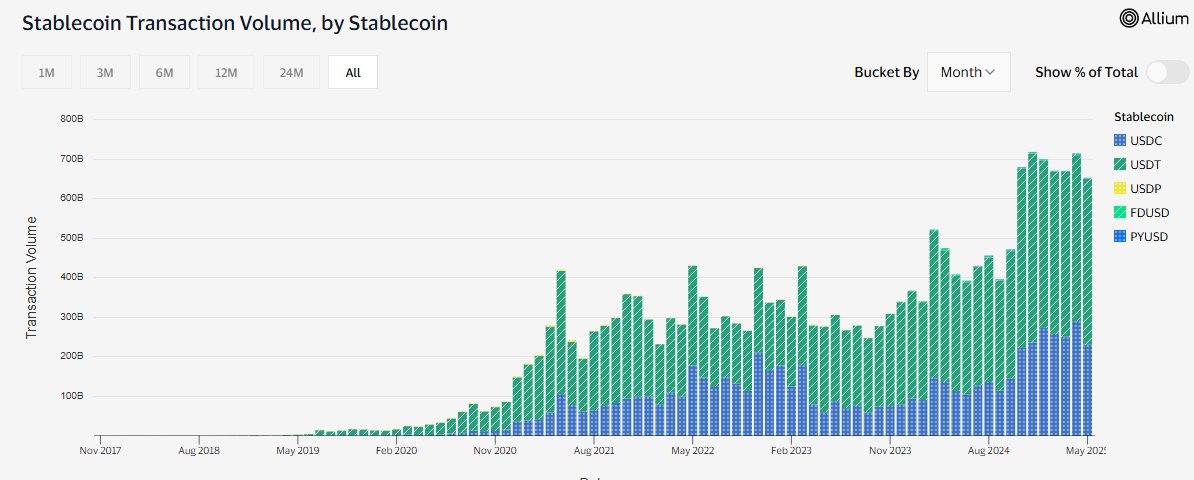

Consider me a skeptic of charging a 2%+ take rate on remittances in a couple years with the way stablecoins are trending $RELY

Remittances are the economic constant in uncertain times. While GDP slows globally, cross-border payments to India, Mexico and Philippines surge. Matt Oppenheimer, @remitly CEO, explains why digital adoption varies by country, and why that matters. Dive into the full

10

1

22