This is really starting to feel steamy to me. What do some of you veterans of previous blow off tops thinks? What will send you to the exit door? $GC_F

110

36

420

Replies

@PeterLBrandt when the Granny next door comes to ask if i could accompany her to buy physical gold. That's the top

1

0

3

@luckyali127 Germany. The country that dumped the most economical and environmentally friendly energy source at the bottom of the market. Germany is an auto-fade. Think about it Zero and two in World Wars

0

0

0

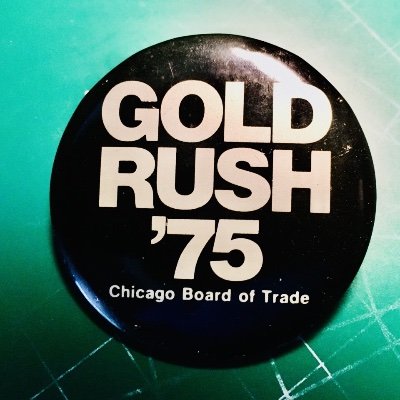

@PeterLBrandt Correction could come at anytime On the other hand, history says it’s still early

1

3

36

@PeterLBrandt After fifty years at this all I can say is don't "predict" BUT be sure to have active tight trailing stops on long positions. [taking windfall profits is a "good thing"].

0

0

6

@PeterLBrandt when US official gold at market price hits 40-60% of US foreign held debt. Today that is at 11-12%.

1

0

4

@PeterLBrandt Have to sell at least partial position now, possibly hold the rest until it breaks below 20-week sma

0

0

2

@PeterLBrandt No one is in this trade on the retail side. They are all DCA into bitcoin or buying Oklo. No one is buying gold. And certainly no bubble.

3

0

2

@PeterLBrandt Unaffordium and unobtainium phases have hardly begun. Silver $500 and gold $25,000 are levels I'm watching in the upcoming months/few years.

0

0

2

@PeterLBrandt Totally agree, Peter. The parabolic move’s looking unsustainable. Getting 2011 flashbacks without social media lol Riding it for now, but once $DXY stabilizes + volume/RSI crack Tier 4, I’m out. Stops tight, champagne corks tighter. 🥂

0

0

0

@PeterLBrandt When my wife tells me we have to go buy physical gold, the top will be in. She's perfectly marked the last 3 tops within a week or two.

3

0

51

@PeterLBrandt the chart is a ratio of $GOLD vs. Federal Debt held by Foreign and International Investors - If we are in a 'repricing event, 4th turning, revaluation, great re-set' what ever you want to call it and we have seen GOLD now surpass UST's as a net neutral reserve asset ..

2

4

14

@PeterLBrandt When I'm convinced it's JUST a trade. Right now I'm not sure our currency isn't getting severely devalued. THE TRUE PURPOSE OF GOLD ISN'T TO MAKE ONE WEALTHY, IT'S TO *KEEP* ONE WEALTHY

2

0

16

@PeterLBrandt Been trading gold since 2001. Correction soon, consolidate for several months. It’s early in this bull market, got to hold and be patient with positions. Prior precious metal bulls went for 8-10 years.

2

0

13

@PeterLBrandt I will watch GLD for the weekly ADX negative line (red) hitting a level of 5 (currently 7.7) PLUS a large weekly volume spike which could indicate retail piling in. Hasn't happened yet.

2

0

13

@PeterLBrandt Break of what I perceive as the new channel it has been respecting. Until I see a close below, I am riding it. This is starting to look parabolic and wanting a blow off at some point.

0

0

7

@PeterLBrandt Apologies for reframing your question, but: - Biden kicks Russia out of Swift + - US debt interest swallowing the budget in a few years + - Everyone down to Joe sixpack knowing something is deeply wrong = A constant bid Not sure we've seen the parabolic part yet

2

0

7

@PeterLBrandt Deviations from the mean now should not be compared to the ones in the bull market of the 2,000s because this is a currency crisis and that one wasn't. They should be compared to the deviations in the 1970's bull market which was also a currency crisis.

1

0

6

@PeterLBrandt Long lines to buy gold everywhere on TV. Isn't that more consistent with a short term top? These are historic times.

0

0

5

@PeterLBrandt When it comes to precious metals bull runs, better to just add a trailing stop and let the market take you out. Don't call tops. Feast or famine industries. When we feast, we feast. Expect heavy volatility at precious metals tops.

2

0

5

@PeterLBrandt Everyone on X and wall at is talking about gold , when my mailman asks me about it I’ll let you know.

1

0

5

@PeterLBrandt People have been calling a “top” for gold at $2,000, $2,500, $3,000, $3,500, $4,000 — and now again at $4,350. The truth is, trends can run far longer and higher than most expect. Trying to call exact tops or bottoms is a fool’s game.

0

0

4

@PeterLBrandt had i been trading gold, i wouldn't even still be in it. my profits would have been off the table well before now.

1

0

3

@PeterLBrandt @PeterLBrandt , for me, nothing. Im holding Au and Ag, as the US$ will ultimately fail . My reasons haven't changed much in 40 years. Not trading.

0

0

3

@PeterLBrandt Take half off and set the rest with stop at 3950 and don't worry about it. Spend the brain capacity saved to think about where best to deploy the othe half.

2

0

3

@PeterLBrandt I subscribe to an excellent research product, 40 yrs in the industry, and the target is 4700-4800 before pause

2

0

3

@PeterLBrandt riding this wave since 2003 but did some unload around 3500-3600 and now too. Precious metal is a group (platinum silver and miners too) with nice switch opportunities Some OTM CALL selling on Miners and...1 year PUT on gold around 3200

2

0

3

@PeterLBrandt It’s an insane run, and normally I’d be running for the exits, but the thing holding me back is wondering if this a systemic issue in currencies, and more specifically USD

1

0

2

@PeterLBrandt 3.5 ATR trailing stop. 120 Min chart I am a little late to the party- 4040 entry..

1

0

2

@PeterLBrandt It’s macro driven by central banks and huge buyers, not retail fomo. Gold accumulation for something big like BRICS backing. Goes higher.

1

0

2