Paul Johnson

@PJTheEconomist

Followers

68K

Following

464

Media

900

Statuses

5K

Director IFS. Author Follow the Money - "gripping and horrifying, witty and brilliant" (The Times). "Thinking person's (fiscal) crumpet" (The Times)

Joined March 2015

Worth repeating. Take all the tax changes coming in over next few years and:. If your income is < £155k, you lose. If your income is > £155k you win. If your income > £1m you gain more than £40,000.

Despite today's tax cuts middle earners are still set to lose as a result of tax changes over next years. The freezing of allowances and thresholds is still a big tax increase. Only those on over £155,000 will pay less tax overall. The very rich will pay tens of thousands less.

189

4K

7K

Staggering statistics. Real average weekly earnings are same today as in November 2005. A completely unprecedented period with no earnings growth. Hard to compare but likely this has not happened over any comparable period since Napoleonic wars.

Long view on today's labour market stats is price-adjusted average pay is down £35/wk since Feb 2008. A drop from £532 to £497 over 182 months' of data. Few would have guessed possible (without a revolution!) -- except those who knew the US horror story .

198

2K

4K

I don't think I have ever read anything so absurd in @FT Why publish it? The idea that VAT somehow creates a trade barrier, and is equivalent to a 25% tariff, is self evidently utter nonsense.

297

661

4K

Buckingham Palace, valued at around £1bn, sits in band H and is charged £1,828 by Westminster City Council, less than an average three-bedroom semi in Blackpool. 46% of households in England will receive a bigger council-tax bill than the Palace.

@Occasional70366 @PJTheEconomist Look at the council tax for Buckingham Palace and the council tax for a 3 bed semi in Blackpool.

131

1K

3K

Statement and chart are literally true. But do they reveal the truth? No. Economy grew strongly because it collapsed so much in 2020. Only interesting comparisons are with pre-covid levels. We've done less well than most of G7 since then.

New GDP figures released this morning show the UK economy has reported the strongest growth since the Second World War.

88

1K

2K

This is actually awful. Yet more years of real incomes barely growing. High inflation, rising taxes, poor growth keeping living standards virtually stagnant for another half a decade.

Over the next 5 years real household disposable income is expected to grow by 0.8% per year, well below the historical average. But growth had been weak in the decade before COVID, meaning average incomes are now expected to be 28% (£9,000 per capita) below the pre-2008 trend.

110

1K

2K

Every time I see this chart I am amazed. ONE in SIX 55-64 year olds owns a second property. It's the flipside of low ownership rates among the young - they are renting from their parents' generation. The allocation of housing, not just the quantity, matters.

Multiple property ownership is becoming more common among older people than in the past, and these properties tend to be held onto throughout retirement (5/6)

196

1K

2K

A pretty good reading of my feelings when I spoke to @Steven_Swinford about this.

.@PJTheEconomist does not often get angry. But you can feel the steam coming out of his ears in his quote to @Steven_Swinford about @RishiSunak’s plan to cut the basic rate of income tax

25

546

2K

Inflation overall is 9%. But our analysis suggests that the poorest are facing an inflation rate or around 11%. That’s because they spend a large fraction of their budget on energy and food. Their benefits of course rose by just 3.1%.

NEW: Average inflation reached 9% in the year to April, but the poorest households faced inflation rates of 10.9%. This is 3 percentage points higher than inflation rates for the richest decile. [THREAD: 1/4]

40

1K

1K

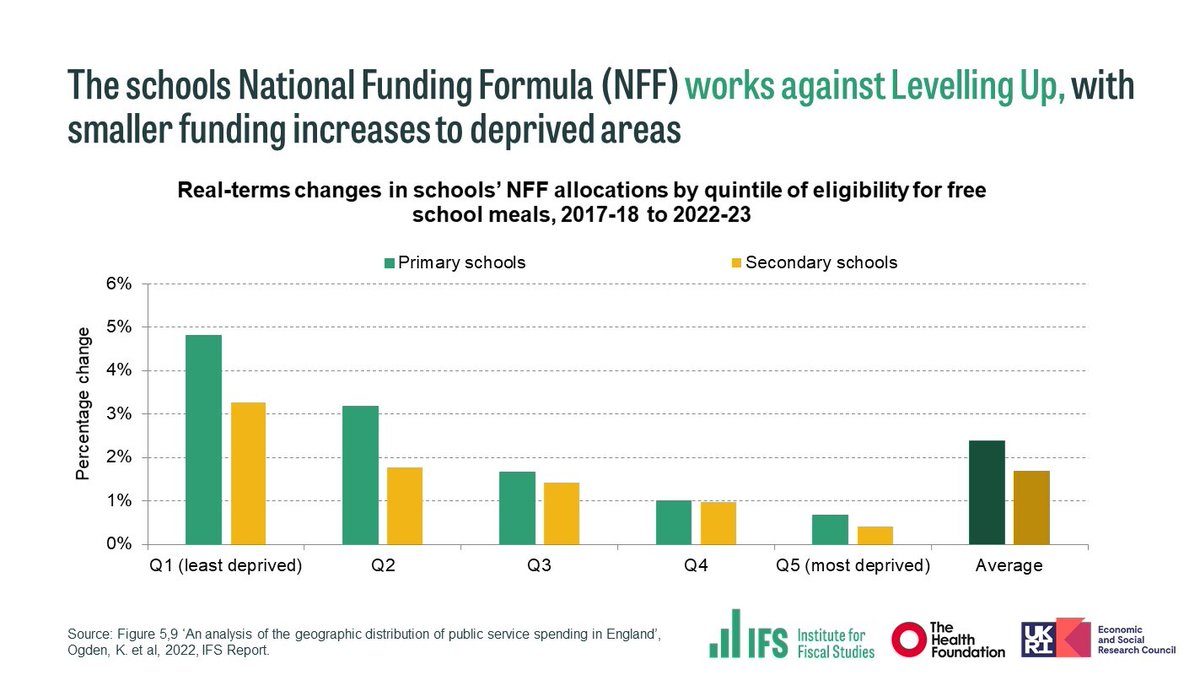

Still have to pinch myself when I see this. Biggest cuts in funding per pupil have been in deprived schools outside London, precisely those which are already struggling the most.

📊 #IFSSatStat: The new National Funding Formula has boosted funding for the most deprived fifth of schools the least (by less than 1%) since 2017. This follows bigger cuts for schools in deprived areas during the 2010s, esp. outside London, where educational outcomes are worst.

57

1K

1K

Genuinely I don’t get politicians. This was obviously a campaign with little merit. How can serious people hoping for high office support knowing they can’t deliver? Similar with all three main parties at different times on student finance, and on tax and spend in last election.

110

225

1K

Your regular reminder that, whatever its merits as a policy, abolishing tuition fees is of no help to the half of young people who don't attend university, is of no help to low earning graduates, and is a big giveaway to the highest earnings graduates.

The highest-earning graduates would benefit most from Labour’s policy of scrapping fees and bringing back maintenance grants. Loan repayments for the top third would fall by around £50k. Actual loan repayments for low-earning graduates would be almost completely unaffected.

351

763

1K

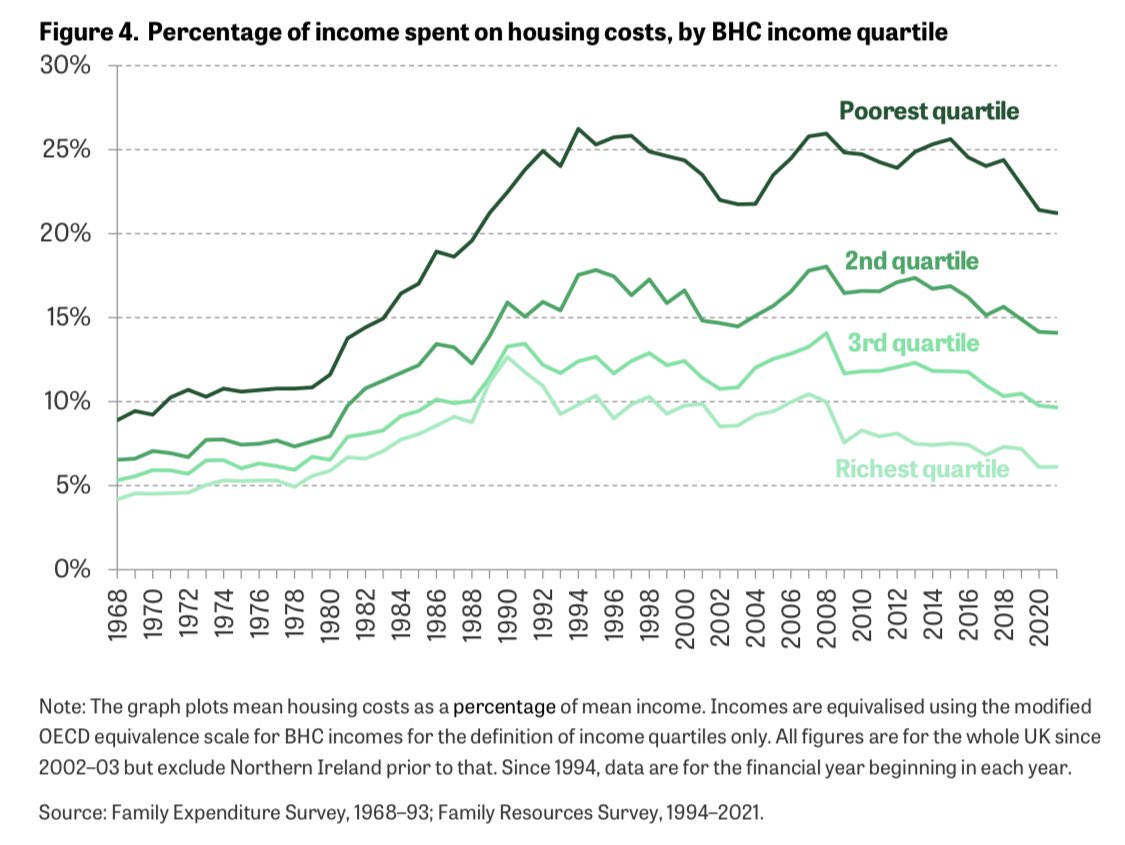

You cannot understand poverty or inequality in the UK without understanding housing costs and what has been happening to them. They are a much bigger fraction of the budgets of the poor than the better off and have been rising far faster for the poor.

In 1968 housing costs made up 9% of average incomes for the poorest households and 4% for the richest. By 2021 this has gone up to 21% and 6% respectively. That is, housing costs now make up 3.5x as much of the budgets of the poor as of the rich. 🧵on our new @TheIFS report👇

65

580

1K

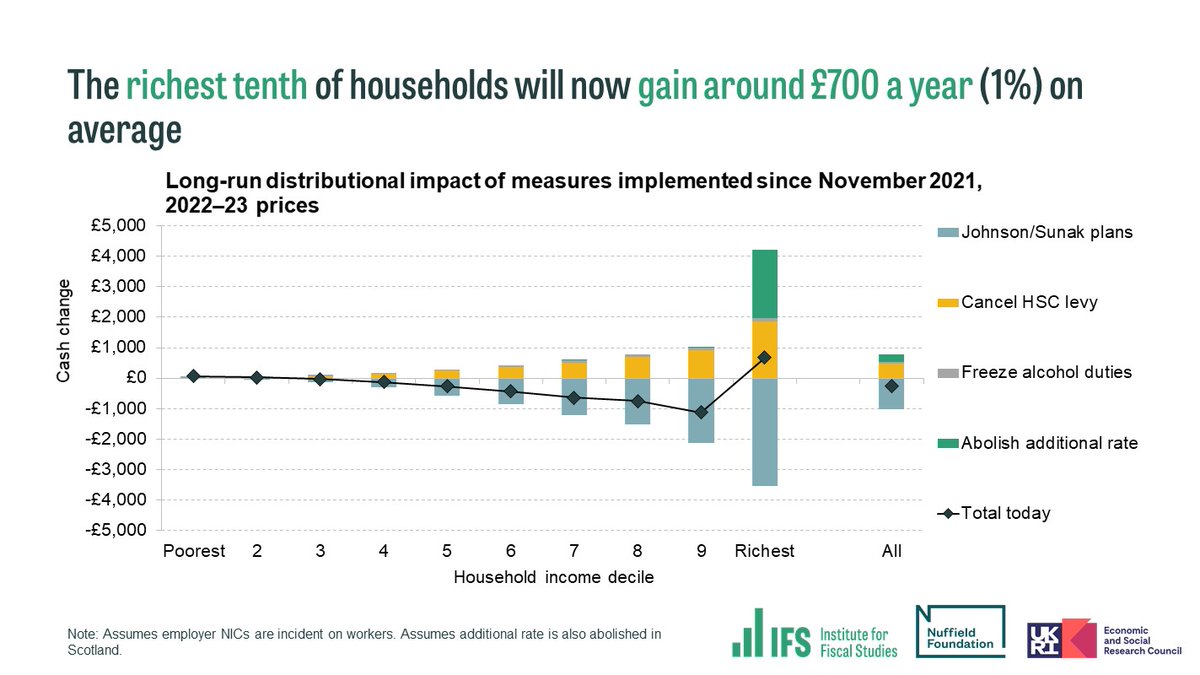

Despite today's tax cuts middle earners are still set to lose as a result of tax changes over next years. The freezing of allowances and thresholds is still a big tax increase. Only those on over £155,000 will pay less tax overall. The very rich will pay tens of thousands less.

Today’s measures mean that the richest tenth of households, who were set to lose around £3,500 a year (3%) on average by 2025-26 under Johnson and Sunak’s plans, will now gain around £700 a year (1%) on average. #minibudget

37

758

1K

Tax and spending promises by leadership candidates: . - Raab: £30bn+ tax cut;. - Hunt: £20bn+ more spending on defence;. - Johnson: £10bn tax cut;. - Gove: abolish VAT;.Me in @thetimes on lack of seriousness. What are their actual fiscal strategies?.

155

635

1K

Remarkable fact:. Average teacher pay is about the same today in real terms as it was in 2001. Average pay across the economy is about 18% higher than in 2001.

Average teacher pay is 6% lower in real terms than in 2010, and about the same level in real terms as in 2001. Meanwhile, earnings across the economy are 6% higher than in 2010. This may help explain some of the teacher recruitment and retention problems. [6/8]

46

665

1K

Economy - and hence our living standards - is 2.5-3% (£55-£66bn) smaller than it would have been without Brexit vote. We have lost out on 3 years of global economic growth. Citi analysis in @TheIFS Green Budget published today

49

979

1K

Important context from @DanNeidle So much special pleading and motivated reasoning when favourable tax treatment is reduced. Makes rational reform so hard. And why govts should think very hard before introducing any tax breaks. Once there they are very hard to get rid of.

Lots of over-the-top coverage right now about the £1m cap on inheritance tax agricultural property relief (APR). Quick thread:.

64

268

1K

“UK is only G7 economy not to have re-attained its pre-pandemic level by Q2 2022”.

.@Citibank's Chief UK Economist Benjamin Nabarro presents on the economic outlook for the UK in our #IFSGreenBudget launch. Watch live here>

41

591

891

Obviously not true in any seriouse sense. £1,000 gross not net. Anyone on UC will lose much more than half of that. Lots of people on UC are not on NLW. Etc etc.

Treasury confirms that national living wage will rise to £9.50/hr and says this will be £1,000 annual boost for a full-time worker - almost exactly replacing the impact of the universal credit uplift ending. .

16

407

913

The 6 year freeze to income tax and NI thresholds really is a staggeringly big tax increase. It’s a key part of why taxes are rising to highest level ever. That such tax rises are needed reflects v high interest payments, poor growth and increasing spending pressures.

The six year freeze to income tax and national insurance thresholds is now set to raise a colossal £52 billion in 2027/28. To give a sense of scale, that's equivalent to 6p on the basic and higher rate of income tax, or increasing the main rate of VAT from 20% to 26%.

68

486

904

Bluntly, if we want to reduce immigration we need to pay more for social care. If we don't want to pay more for social care we will continue to rely on immigrants.

Both the Conservative and Labour parties have indicated a desire to bring down net migration. But substantially cutting migration could reduce the size of the workforce in key sectors. Workers from non-EU countries were 16% of the adult social care workforce in 2022–23. [12/14]

224

298

811

That, in a sentence, is what happened yesterday.

@PJTheEconomist “How did Mr Hunt afford tax cuts when real economic forecasts got no better? He banked additional revenue from higher inflation, and pencilled in harsher cuts to public spending.”

16

404

770

This is just astonishing. A doubling and more of the numbers in every age group moving on to Personal Indepence Payment (PIP - our main disability benefit) over just one year. This is NOT a catch up from people not claiming during Covid, it is a huge increase in claims.

Here we zoom in on the increase in that yellow line. This is the number of new claims by single year of age in July 21 & 22. Huge increase at every age, and in mental and physical health. Mental/physical split little changed - and this is true more generally across conditions.

43

366

804

Not that much to be Tiggerish about here. Growth forecasts dreadful compared with what we thought in March 2016, dreadful by historical standards and dreadful compared with most of the rest of the world.

72

957

756

On a per person basis it’s considerably worse than the headline figures. This was a period of rapid population growth. On a per person basis GDP has been falling consistently for two years. Not sure calling this a “mild” or “technical” recession quite gets at the scale.

Economy in Q4 2023 confirmed at £566.6 billion… (ABMI official measure). smaller than it was in Q1 2021 (£567bn. no net growth over two years, down 0.1%), and . Smaller than in Q4 2022, when the PM and Chancellor arrived in Downing Street (£568bn … down 0.3%).

19

360

738

Not surprising, but so depressing. Govt know perfectly well that council tax is out of date, regressive, inequitable, inefficient, gums up the housing market, and is anti "levelling up". Total lack of courage to do anything about it. Also, note Opposition silence on this.

🏠New: Government will not reform council tax. Response to Levelling Up Committee is pretty clear on changing unfair bands:. ⛔️ Too expensive to do.⛔️ Likely to hit pensioners

59

250

718

Govt playing silly games with numbers. Extra £13.4bn for defence must be against counterfactual of no cash increase, not of constant % of GDP. While £5.3bn cut in aid compares 0.5% GDP to 0.3% GDP. Thats how a £5.3bn cut “pays for”£13.4bn increase. Totally inconsistent figures.

Keir Starmer's Defence Spending announcement. Will raise from 2.3 to 2.5% by 2027. He says this means £13.4bn a year more. Funded in part by reducing aid budget from 0.5% from to 0.3 % in 2027. In 25/26, the aid budget was to be £13.7 billion. The reduction means £8bn.

49

332

820

There isn’t £40bn a year to be had from reducing interest paid on reserves at Bank of England. Not even half that. Can’t “fund” tens of billions of tax cuts like this. We don’t want a rerun of September 2022.

Reform UK propose large permanent personal tax cuts could be paid for by reducing the interest paid on Bank reserves. It is a complex area but is unlikely to raise even half the £40bn annually that has been suggested, and only in the short term. @PJTheEconomist's response ⬇️

24

319

686

Try as hard as we can, given plausible forecasts, we can’t see how to get public finances on a sustainable path without big, painful spending cuts or a reversal of £43bn tax cuts just announced. Chancellor has a big job to reassure markets his mini budget spooked so badly.

NEW: Getting government debt falling in the medium term with a weaker economy and without cancelling tax cuts could force @KwasiKwarteng into big and painful spending cuts. Read our #IFSGreenBudget findings, with @Citibank and funded by @NuffieldFound>

81

339

670

Fundamentally important bit of economics. Whatever the benefits of any regulation the cost of employing people to enforce and comply is just that, a cost, to be set against any benefits. Too often see people arguing such job creation is a benefit when it is the exact reverse.

An underrated cost of regulation is the sheer number of smart people who work on zero-sum activities like impact assessments and other compliance documents. Freeing these people up to do other things is a benefit, not a cost, of deregulation.

61

167

807

I still struggle to get my head round these statistics. One in seven of those around the age of 70 don’t just own their own home, but own a second home as well.

85% of the #PlatinumJubilee generation are homeowners, meaning that most have benefitted from the house price boom that occurred during their working lives. 1 in 7 of them own a second home. [5/8]

53

195

686

This is not a complaint about policy. It is sensible to reallocate money especially at present time. It is a complaint about lack of clarity and transparency. It should not take us @theifs a week to work out what is going on. In part mea culpa, but really more transparency please.

27

181

656

Sad thing is to a large extent this is the path we chose, not an inevitability. Brexit, yes. Also cutting capital spending in 2010s, cutting education, failing to reform planning or tax, failure of housing policy, topped off by years of damaging political dysfunction.

Just to put things into perspective. If the UK economy had grown at the same rate after 2007 as it had in previous decades,. every person in Britain would be £10,600 a year better off on average. Economic growth matters. ENDS.

32

220

656

Following Sam is very bad for my blood pressure, but important. Day after day he reports on the way in which schemes for housing, infrastructure and business are blocked. If we want to get better off as a country, and give younger generations a chance, we need to change this.

Almost every problem in Britain today, from sky-high energy bills and rents to sluggish growth and not enough money for public services, can be linked to a single cause: Britain has stopped building. Britain Remade has a plan to change that. 🧵

25

124

698

I don’t want to be too grumpy. But there really are trade offs here. There is a limit to how far you can increase wages by government fiat. There was a reason for a lower minimum wage wage for the young. Making it more expensive to employ young and low paid is not win win.

54

125

763

Private school fees have risen 20% in real terms since 2010 and 55% since 2003. Numbers privately educated have been pretty constant that whole time. Removing tax exemptions likely to have only small effects on numbers. Net benefit to public finances likely to be £1.3-1.5bn p.a.

NEW: How much revenue would be raised from removing tax exemptions from UK private schools?. Our new report by @lukesibieta, funded by @NuffieldFound, calculates the net gain to the public finances from @UKLabour’s proposed policy:. [THREAD: 1/11]

63

200

649

Bit of a rant today I'm afraid. Rage at cutting winter fuel allowance, yet binning social care reform was infinitely bigger choice. Tory candidates say they want to reduce state, no ideas how. Govt goes on about £22bn "black hole" as if a surprise. Time to get serious. Please.

📰 It’s time to be honest about the funding of social care. The fury about ending the winter fuel allowance is a diversion from a much more important issue, @PJTheEconomist in @thetimes today.

54

174

675

Public spending per head in Scotland is c.30% higher than in England. Almost entirely paid for by transfers of revenue from England. SNP, and other Scottish parties, promised further big increases in spending, but said nothing about where the money would come from.

📰 “Where were all the parties intending to get the money from to pay for all these goodies?”. @PJTheEconomist in @thetimes this morning on the absence of costed promises in the Scottish elections. Read here (£) >

124

333

680

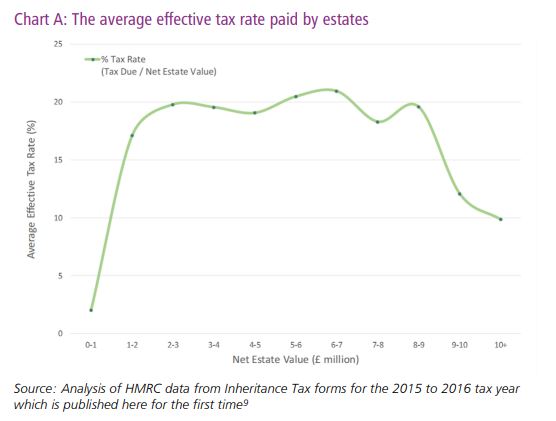

Rather than scrapping IHT we urgently need to reform it. It is genuinely unfair. The very wealthy pay an average rate half, or less, that paid by the moderately wealthy. If all you leave is the family house it's hard to avoid. If you have millions it is absurdly easy to avoid.

Yes the big problem this country has is that the wealthiest 4% of families don't have enough money. Slow handclap.

37

190

603

Inheritance tax should be the most progressive of taxes. But the wealthy have become so adept at avoiding it that it now imposes a higher burden on middle class estates than on the very wealthy. It's time to act. Me in @thetimes (chart from OTS)

68

287

632

Given pressures on public spending and borrowing those £20bn in NI cuts never looked like good economics.

NEW: £20bn budget “black hole” is the same size as Rishi Sunak's pre-election tax cuts, leading economist says. @PJTheEconomist: “If those cuts were implemented in the knowledge that there was this kind of hole, that is not good policy to put it mildly”.

41

196

583

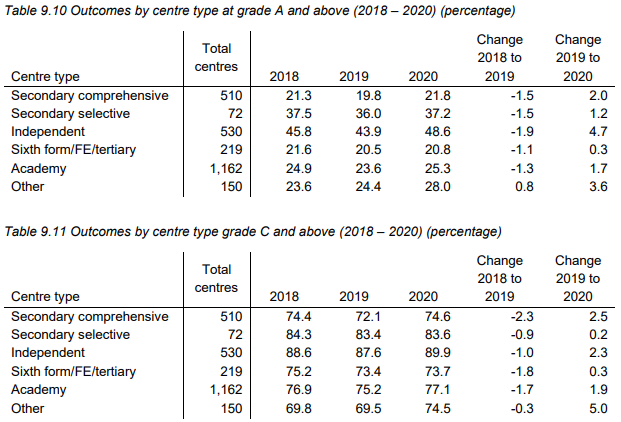

This from OFQUAL report is pretty striking. Big boost for private schools in A level grades awarded. FE and 6th form colleges seem to have lost out. Presumably because more weight given to teacher predictions in small 6th forms. Not obviously fair.

Looks like sixth form and FE colleges have particularly lost out in the standardization process for this year's A Level results. Private schools reaping the benefits with a huge increase in grade A and above.

53

510

597

Quite a chart. Scottish govt has implemented over £500m of income tax increases (equivalent to >£5bn in UK terms) .These have netted *nothing* in additional revenues relative to no devolution. Scottish incomes have risen more slowly, and income tax base has shrunk, relative to UK.

🚨 Three important (but so far little commented upon) nuggets from today's updated @scotfisccomm forecasts published alongside #scottishbudget. 1⃣ The continuing poor underlying performance of Scottish Income Tax revenues, driven by weaker employment and pay growth. [1/6]

39

335

647

The OBR was perfectly clear. They didn’t show impact of welfare reform because they didn’t get details of the reforms until far too late. They “will incorporate an estimate of these impacts in our next forecast”. This a failure of govt policy making not of OBR.

Breaking:. Keir Starmer criticises the Office for Budget Responsibility for failing to score the impact of the government's welfare reforms in getting people back to work. This is the first time that Starmer has publicly criticised the OBR - points to to wider concern in.

30

186

646

An important point. Given that Scotland has more than its fair share of great universities, a financial centre, and lots of hospitality, I’ve always been puzzled at the very low levels of international immigration.

It's easy for the SNP to be incredibly pro-migration because migrants don't really want to go to Scotland.

131

37

598

It wasn't actually a tax cutting Spring Statement. Rishi Sunak banked more in rising tax receipts, as inflation creates a lot of fiscal drag, than he gave away in tax cuts. Me in @thetimes

11

260

547