Not Jim Cramer

@Not_Jim_Cramer

Followers

31K

Following

2K

Media

5K

Statuses

9K

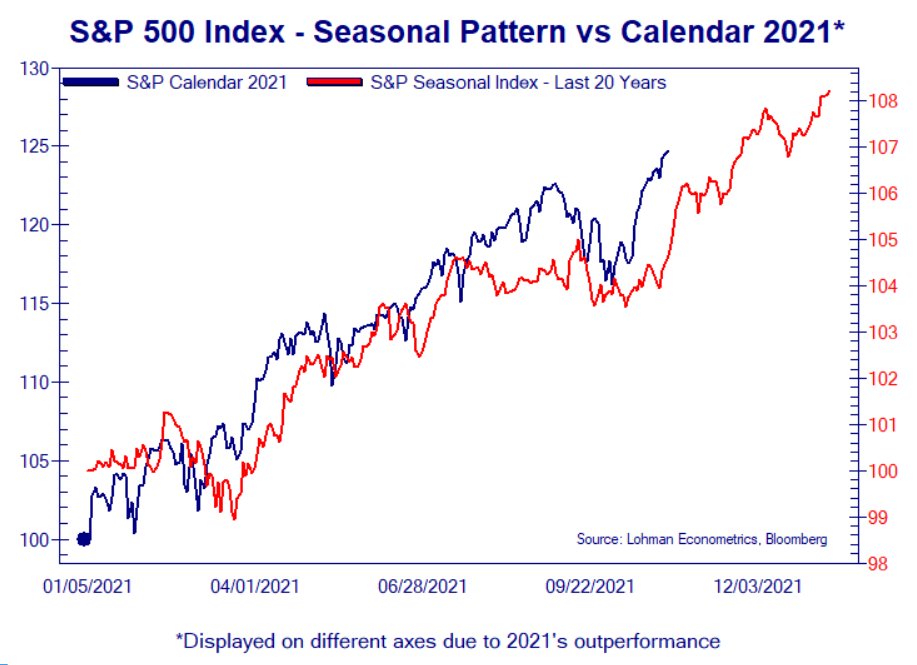

S&P 500 Seasonal Update - Continues to Track Historical Pattern (reminder: YTD correlation is 94% https://t.co/eyhBaghi3i).

0

17

64

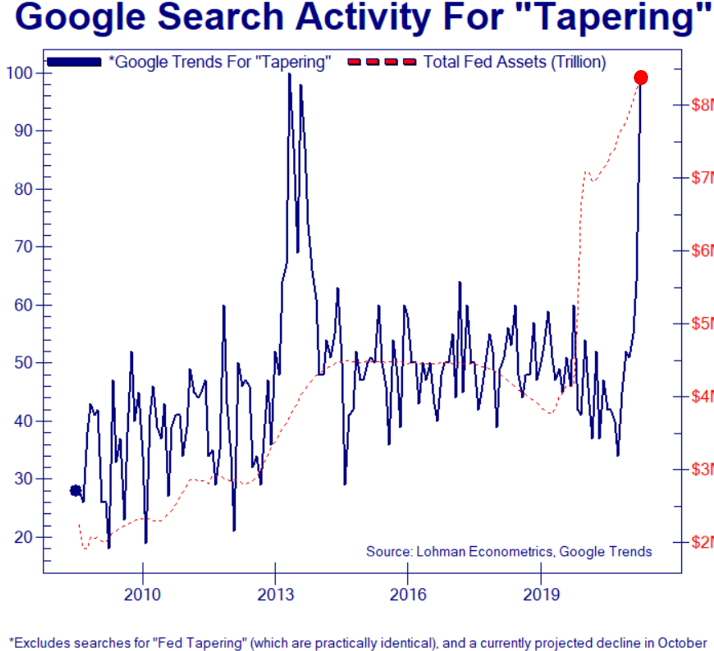

Google Trends for "Tapering" return to all-time highs.

1

19

82

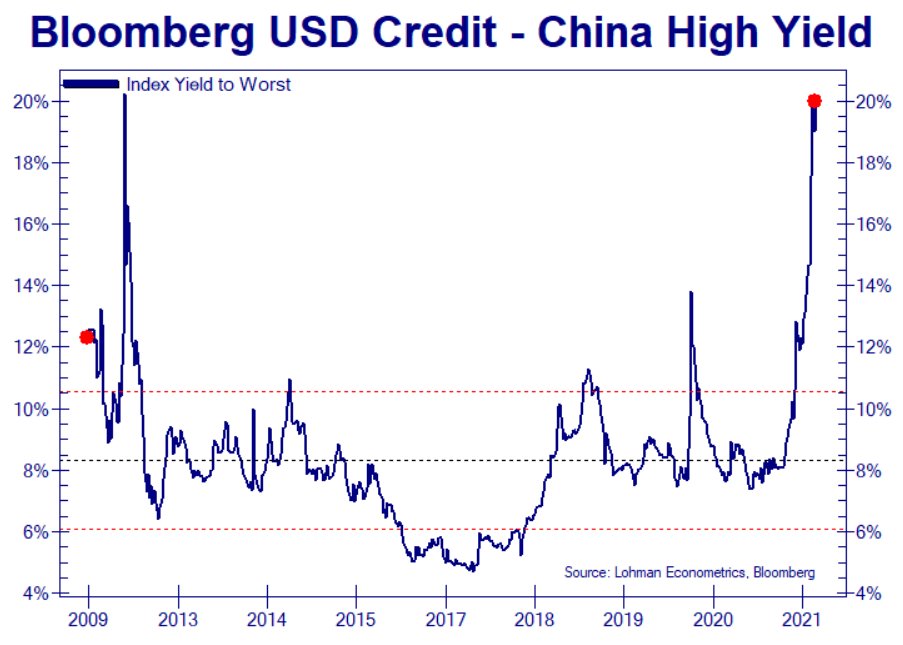

Speaking of Credit Market Dislocations, the China Junk Bond Market (which has been a leading tell) is Retesting Record Levels. More Contagion Coming?

8

46

190

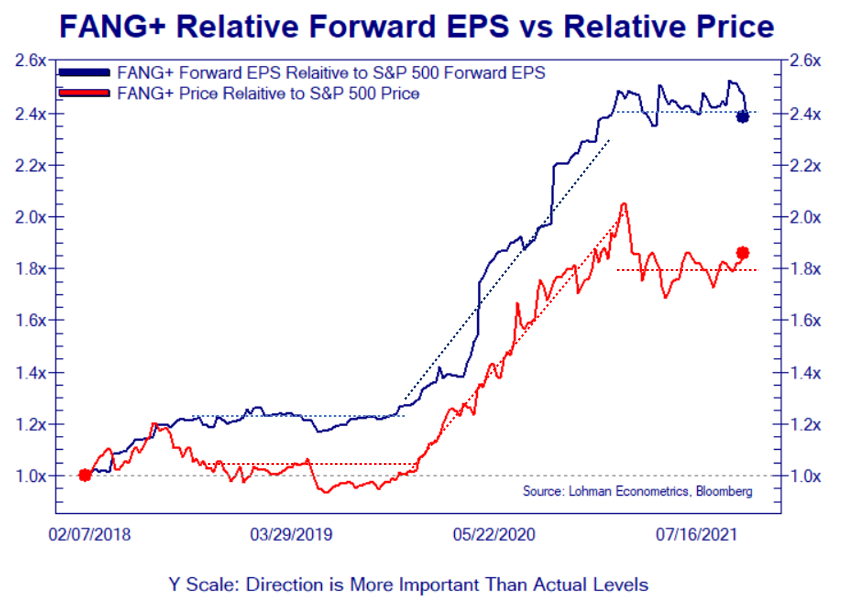

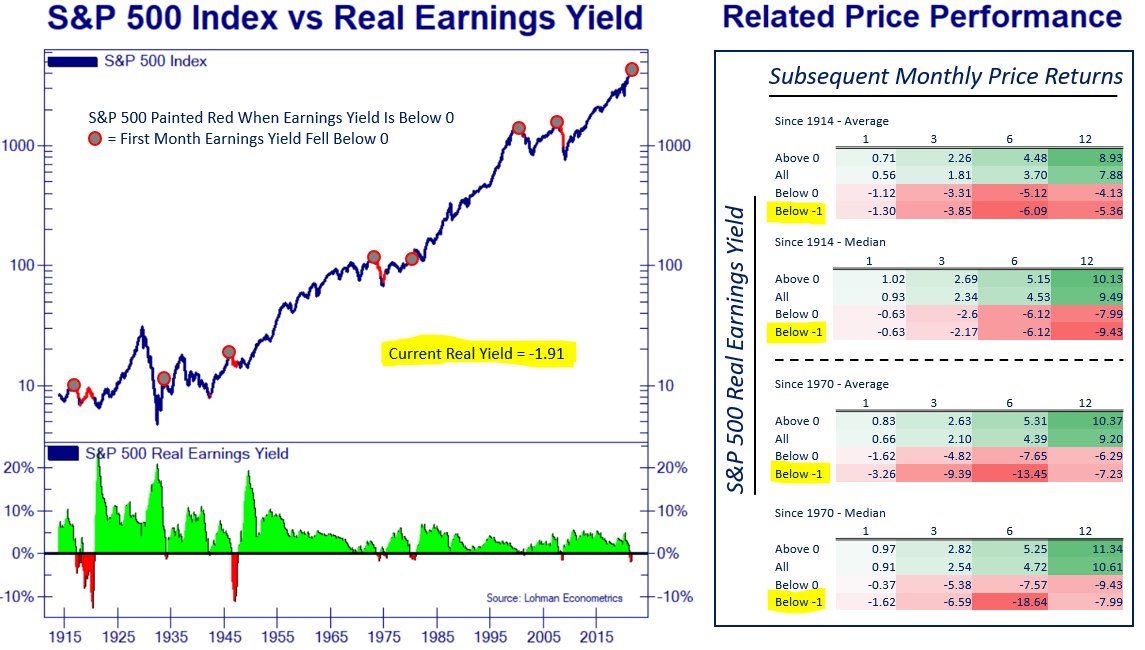

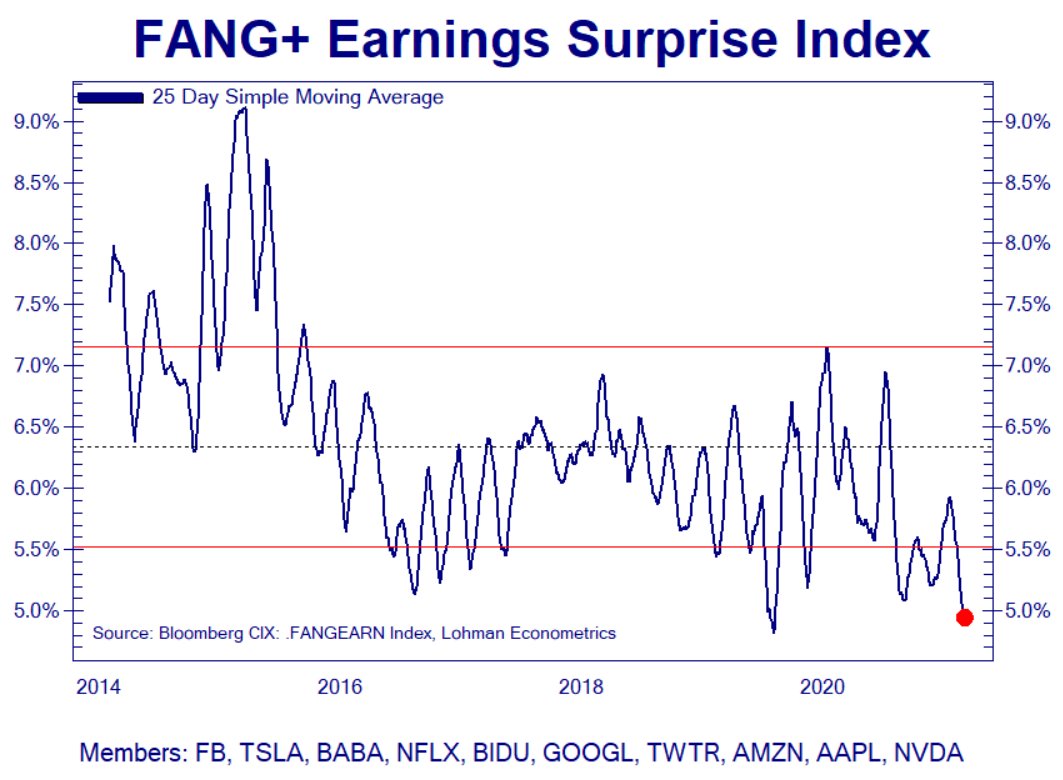

FANG+ Forward EPS Relative to the S&P 500 are stagnate/rolling over to the extent it's difficult to see them reasserting leadership, which is problematic for the market overall going into Q1 2022.

4

17

94

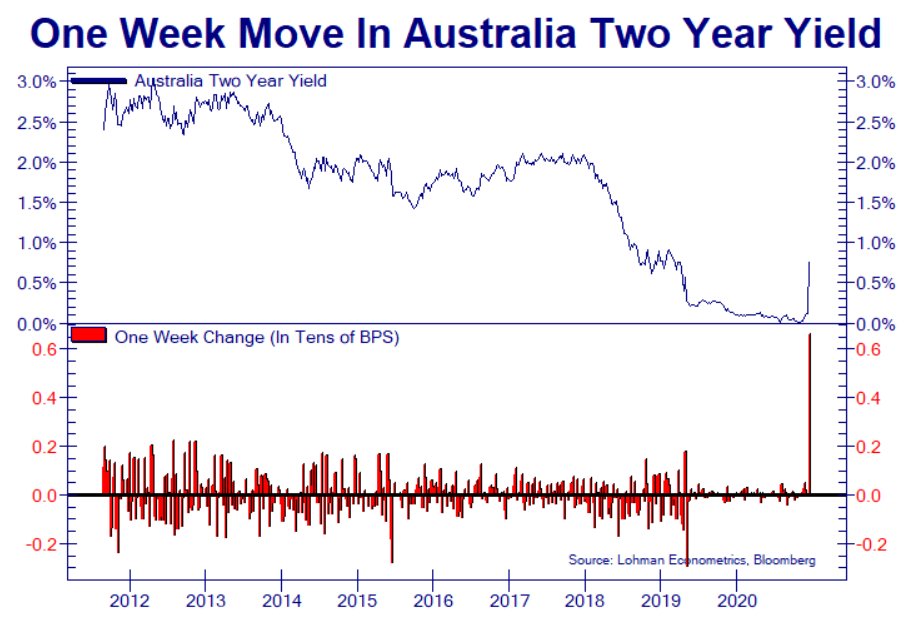

In the sh!tshow that was the action in global interest rates last week, Australia Two Year takes the cake with the highest upward move in at least 20 years

7

44

183

And FANG+ Earnings Surprise is hammered to a new low.

4

31

123

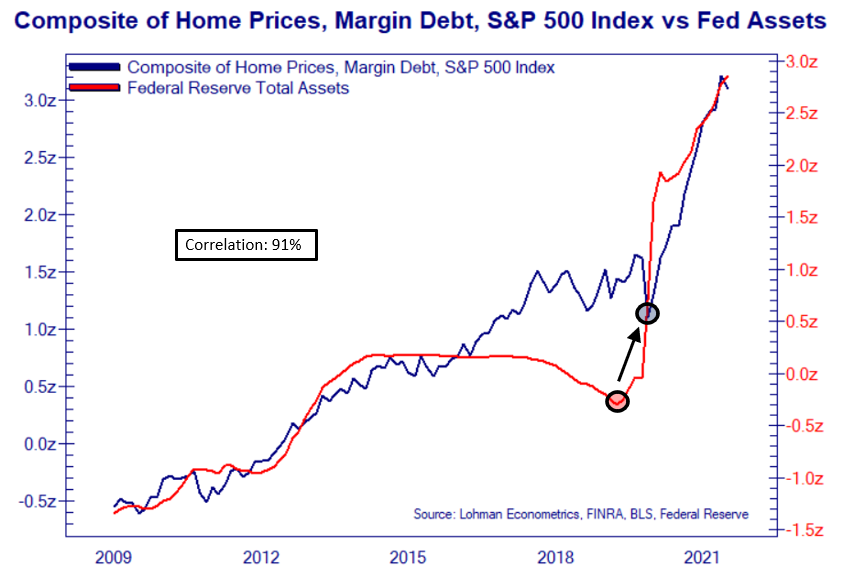

An almost surreal chart, but unfortunately that’s the reality we live in 👇 ht @Not_Jim_Cramer

5

50

205

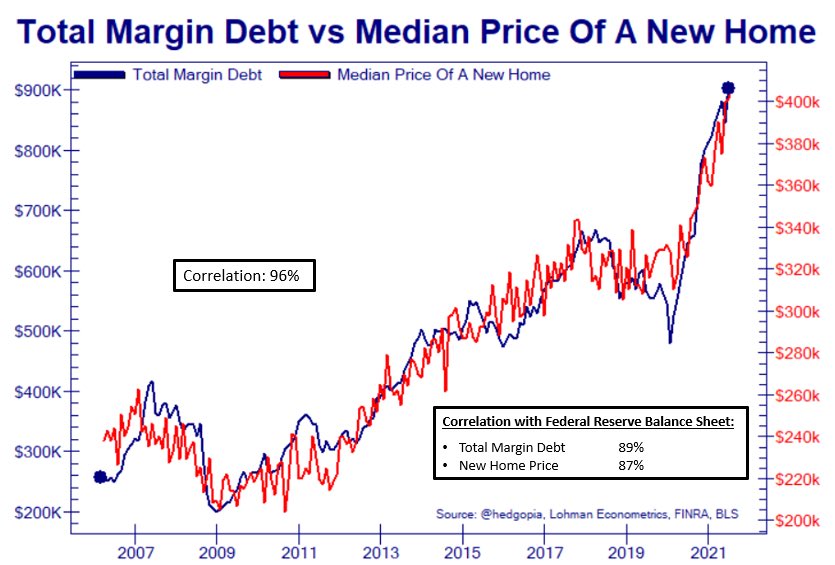

Why would margin debt and home prices have a 96% correlation? Because they're both risk-on responses to Fed Policy (courtesy @hedgopia).

10

89

351

FANG+ Multiple compression vs declining EPS Surprises.

1

7

25

An S&P 500 Real Earnings Yield of -1.91% remains a very significant problem.

8

86

320

Gold could get very interesting above $170 basis GLD.

6

11

124

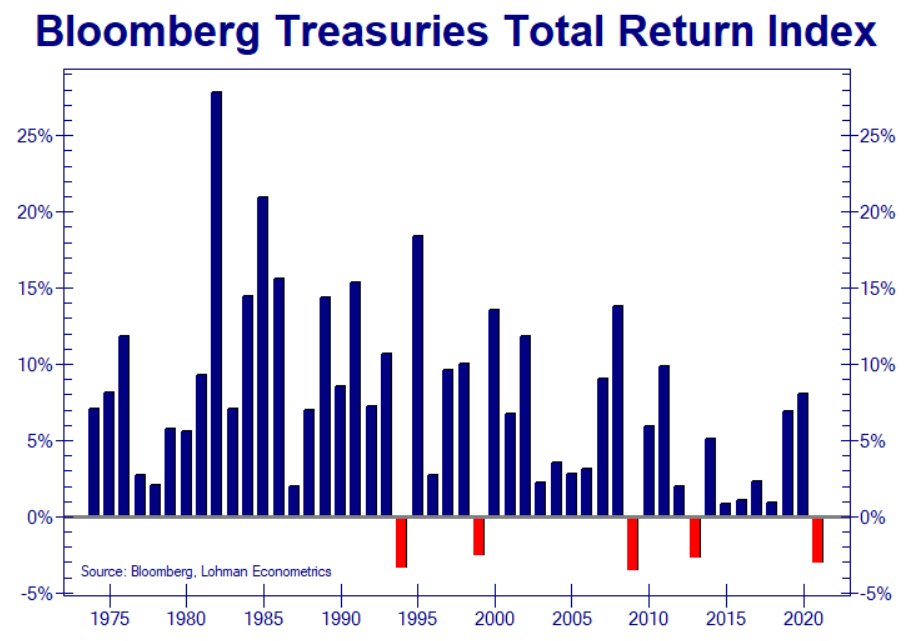

US Treasuries nearing worst annual return in at least 50 years.

6

34

165

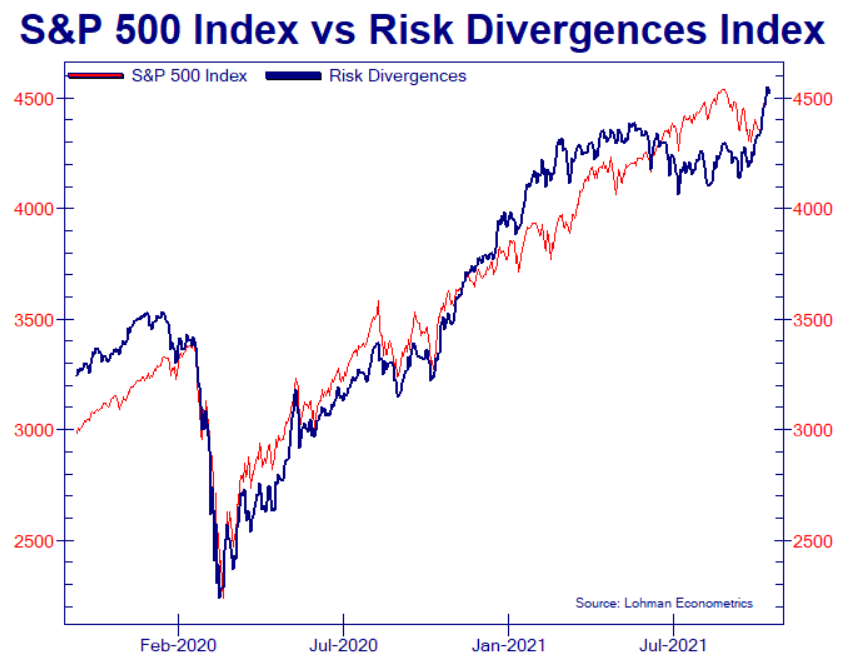

Most sensitive areas of Risk-On/Risk-Off (last updated: https://t.co/DzcMulYKLu) broke to new highs Oct 13th and haven't looked back (tho clearly overbought).

0

4

27

S&P 500 Index is close to its seasonal pattern. (FWIW, one of the most reliable seasonal setups over the 35 years I've been trading is a correction into October, followed by an October low, followed by a rally into the first week of January).

8

26

146

All the world is correlated in our Risk-On/Risk-Off environment.

0

9

41

In an environment where EPS misses are getting hammered, it's worth noting that Earnings Surprises for FANG+ are approaching all-time lows.

1

28

115