Joo 🦇🔊

@NotSoAnonJoo

Followers

2,238

Following

1,441

Media

107

Statuses

549

Stealth | Prev @Delphi_Digital

DegenFi

Joined April 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#NekkoxGFPressCon

• 222026 Tweets

#WEARE大阪生配信やで

• 199208 Tweets

taeyong

• 87138 Tweets

Biafra

• 75670 Tweets

海ちゃん

• 67122 Tweets

#CL_BEAUTRIUMxBEAUTILOX

• 64496 Tweets

見逃し配信

• 55903 Tweets

Azra Kohen

• 52361 Tweets

Charlotte Beauty Of Skin

• 49063 Tweets

Zuma

• 46442 Tweets

#魔改造の夜

• 41450 Tweets

Eastern Cape

• 31231 Tweets

ヤンマー

• 25943 Tweets

ライドカメンズ

• 24348 Tweets

元太くん

• 21358 Tweets

Limpopo

• 18900 Tweets

Zulu

• 18062 Tweets

スレイヤー

• 15177 Tweets

#ぐるナイ

• 13879 Tweets

MISTINE LIVE WITH POOHPAVEL

• 13565 Tweets

ライガーテイル

• 12775 Tweets

ヘルナンデス

• 11835 Tweets

ピッチャー

• 11252 Tweets

Canarias

• 10789 Tweets

Ley de Amnistía

• 10398 Tweets

大倉くん

• 10327 Tweets

バンバンッ

• 10021 Tweets

Last Seen Profiles

Mapping the Moon:🌙

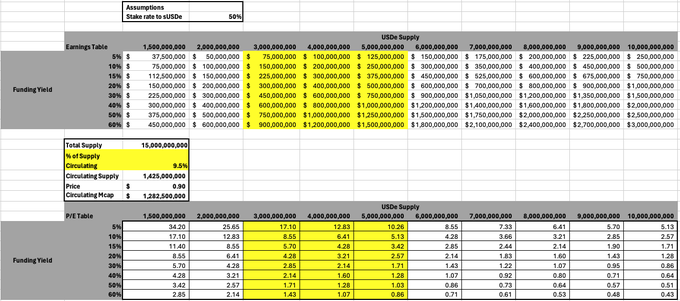

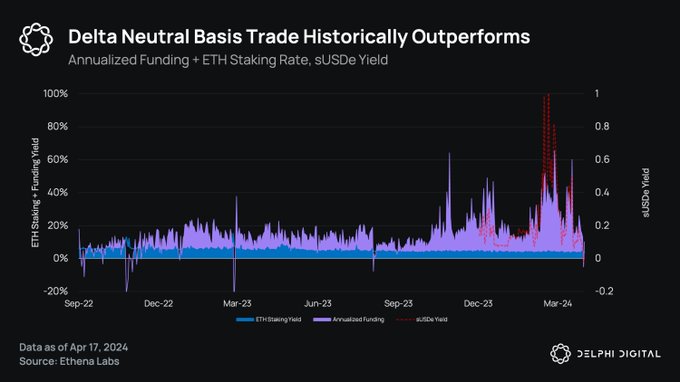

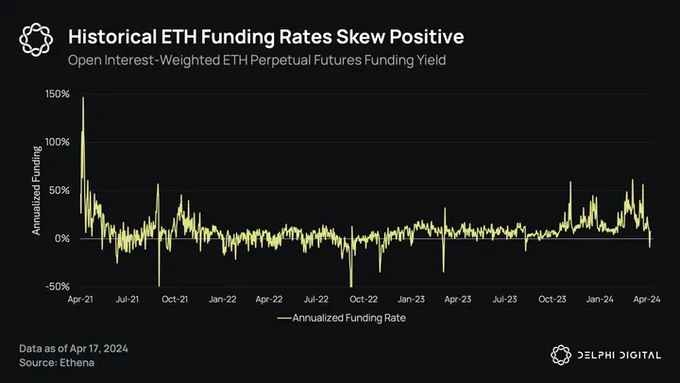

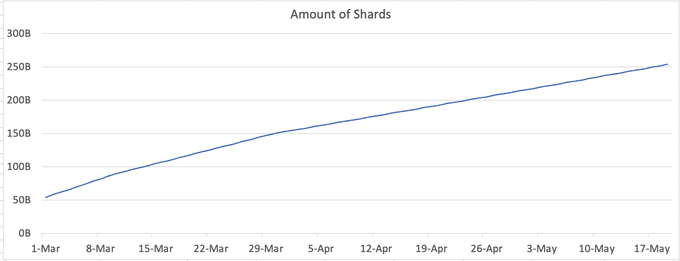

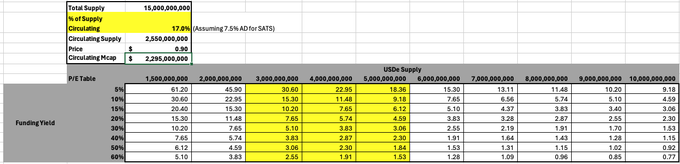

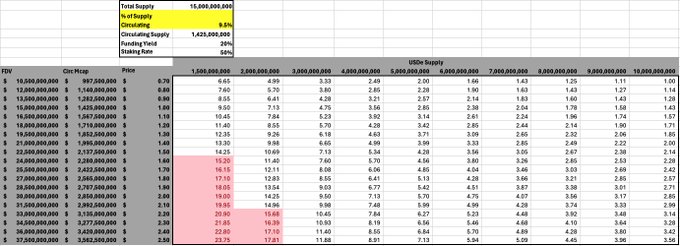

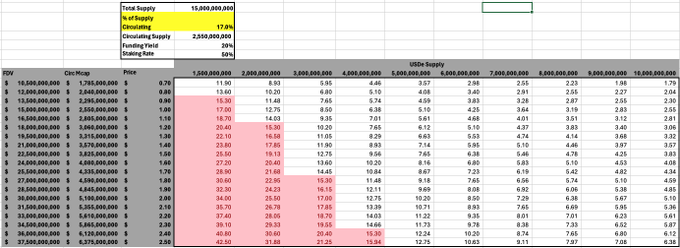

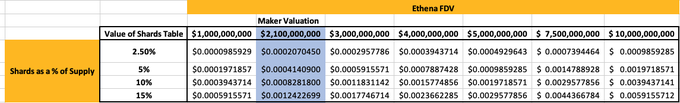

$ENA by

@ethena_labs

dropped yesterday. Here's my conservative take on their potential earnings and metrics

At 50% stake rate to sUSDe and 20% funding yield, $ENA is expected to generate $300M-$500M in EARNINGS

Implying P/E of 4.28x to 2.57x at circ. supply

30

83

395

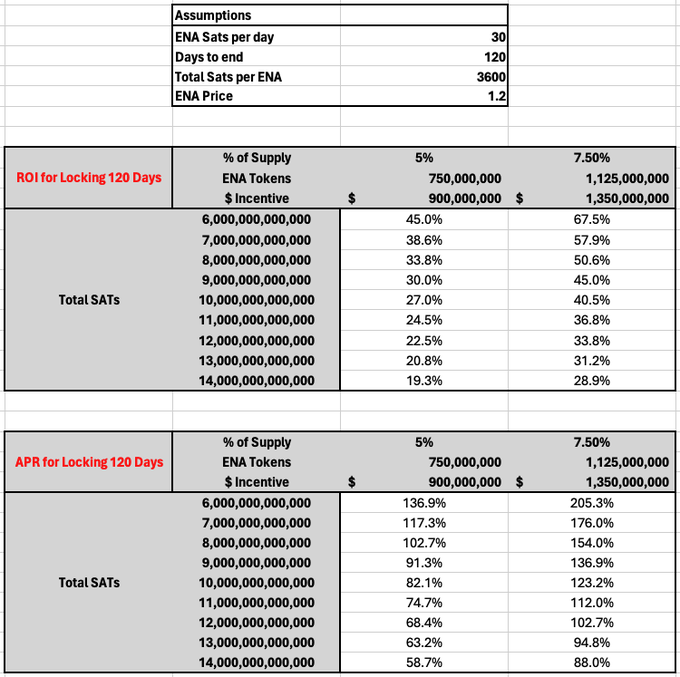

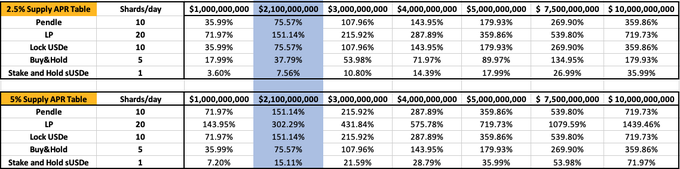

Mapping the Yields💵

So

@ethena_labs

introduced $ENA locking for 30x SATs

Should you lock $ENA if you don't have USDe positions?

You'll get 19%-68% ROI over 120 days aka 59%-205% APR

This is a juicy way to increase ENA exposure just by locking

100M ENA left till 200M limit

24

20

154

Personal Year-End Review at

@delphidigital

for the past 9 mths (2 intern, 7 full time)

Thread Below👇

4

7

100

Last month, I left

@Delphi_Digital

after 3 years.

Here’s how it started, with some appreciations

10

0

84

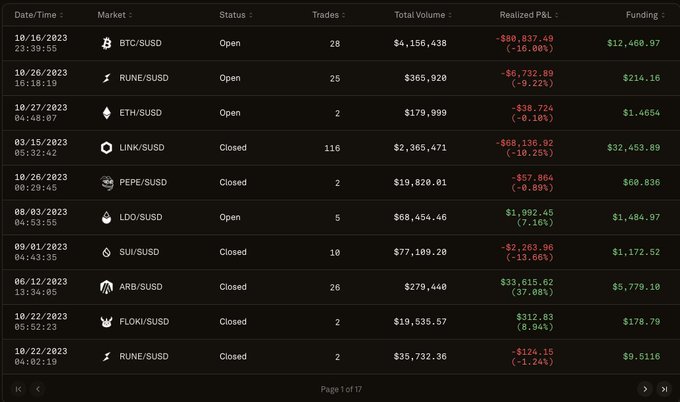

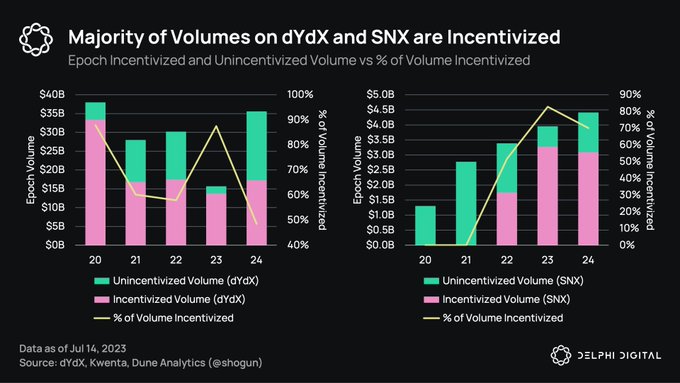

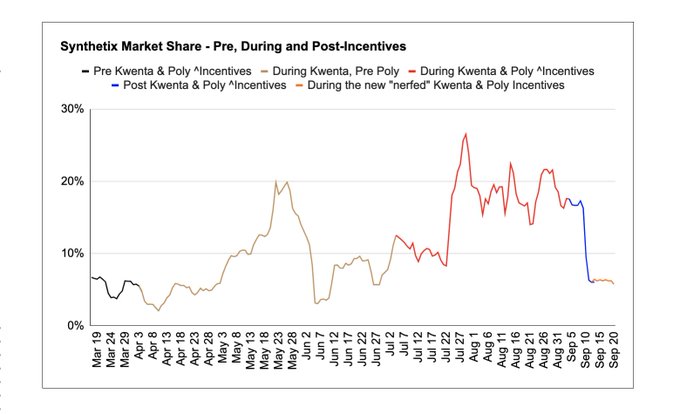

Another Simple & Creative Yield Strategy

(Synthetix Perps)

A few arbitrageurs have taken advantage of

@synthetix_io

perp's unique funding and price impact systems.

This trader has been printing funding rates while he sleeps.

Here's what you need to know and how to execute.

8

18

78

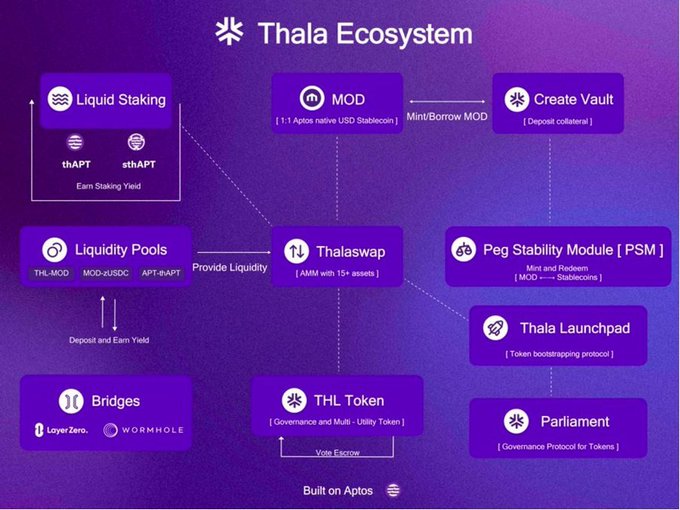

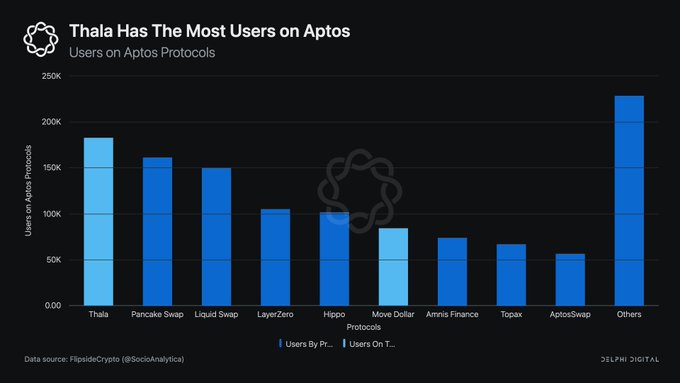

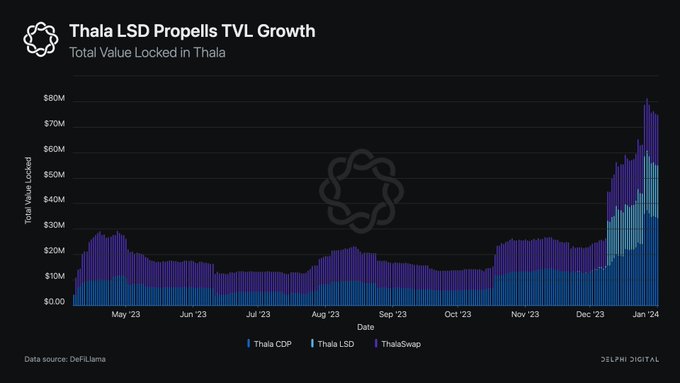

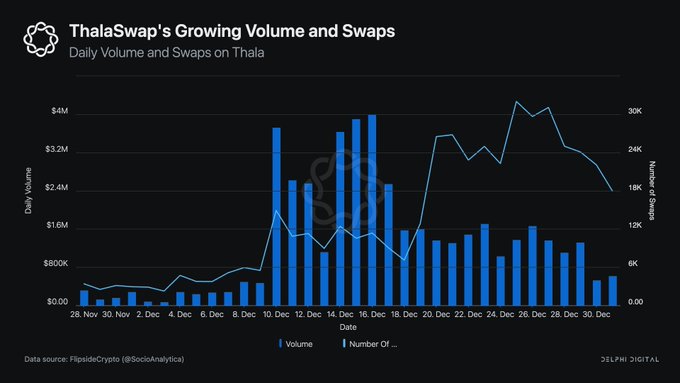

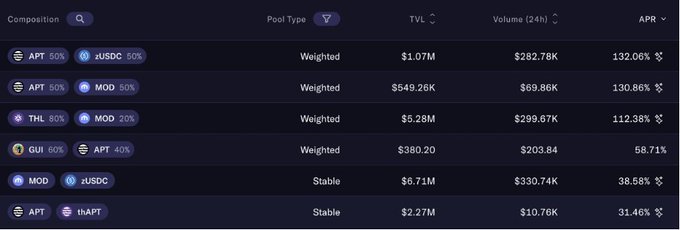

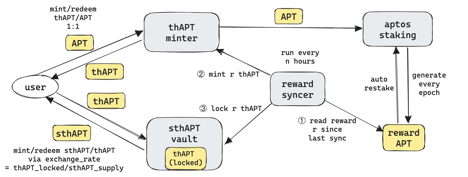

Thala, an Underlooked Gem Within the

@Aptos_Network

Ecosystem

🧵 Thread on

@ThalaLabs

and why it is well positioned in Aptos

4

21

74

Lads at

@Delphi_Digital

just dropped a report of

@ethena_labs

They did a great job covering the risk side of things

Some of my favorite charts

The chads:

@robbiepetersen_

&

@yeak__

Read it here:

3

16

66

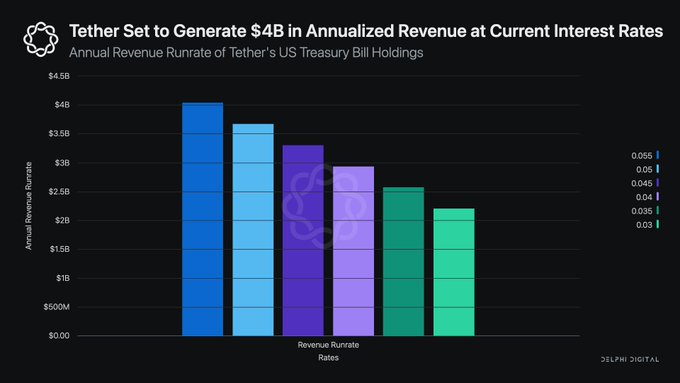

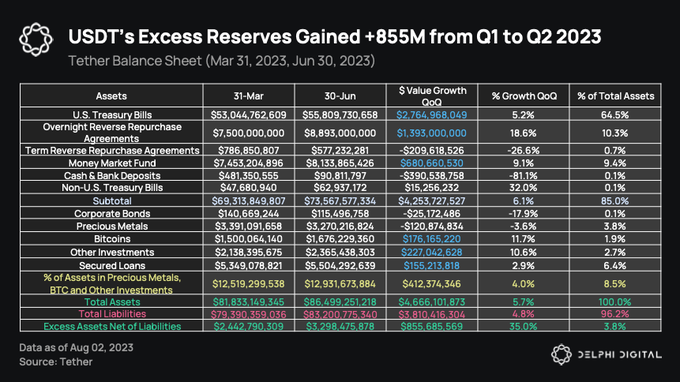

@Tether_to

recently released their Q2 report. They've generated over $1B in operation profits. Here's a thread to break down their business model, and potential risks.

2

80

63

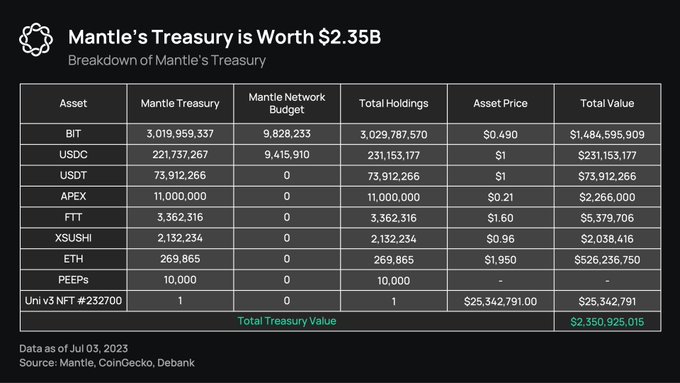

Let’s talk about

@0xMantle

, an L2 that’s been flying under the radar.

With a whopping >$2B in its treasury, they're not just well-capitalized but poised to bootstrap their way to prominence. 💰

A thread on why Mantle and its recent updates.

4

13

54

.

@aori_io

is a revolutionary orderbook DEX, powered by the Seaport Protocol.

The Seaport contract is the backbone of NFT trading giants like OpenSea & Blur, ranking 3rd in ETH gas consumption!

A thread into Aori

2

12

48

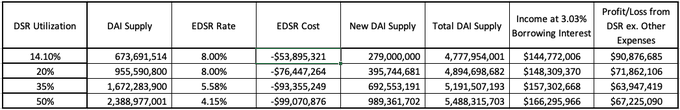

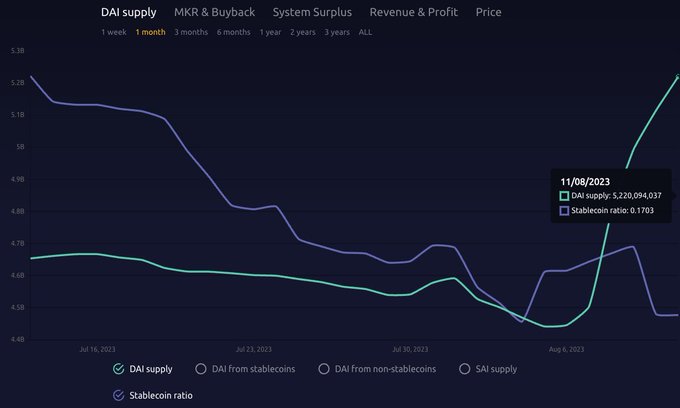

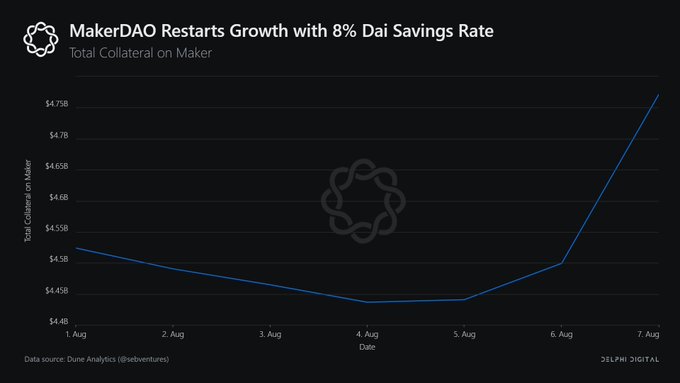

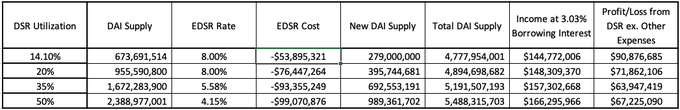

📢 The DAI Savings Rate (DSR) has just been raised from 3.19% to 8%.

How will this impact DAI and

@MakerDAO

?

Here's a thread to break down its potential growth

🧵0/9

3

13

44

Napkin Math of

@ethena_labs

Update:

200M $ENA * 30 = 6B Sats/Day

200M $ENA = ~$240M USDe Boosted, 20x sats = 4.8B Sats/Day

Current SATs Emissions is ~27B/Day

Assuming ENA Locks are filled, Sats Emission inflates to:

27 + 6 + 4.8 = 37.8B SATS/day (+40% emission rate)

3

6

42

With ~8% $ENA circulating float,

200M locked further reduces circulating float to 6.67%

@ethena_labs

bringing low float to another level

4

3

42

With $ENA

@ethena_labs

trading at $10.5B on

@aevoxyz

5% airdrop to shards = $525M

At 340B shards its $0.00154/shard

@WhalesMarket

how do i cash >2x on points? Its -EV for seller to adhere to agreement if tokens can be sold for >2x right?

6

3

35

3/3/0 lucked out WAGMI

@ParallelNFT

Prime: 1

Legendary [SE]: 1

Legendary: 8

Rare [SE]: 1

Rare: 2

Uncommon [SE]: 4

Common [SE]: 4

4

3

25

5/ $ENA looks incredibly cheap in my conservative scenarios.

In the bull market,

@ethena_labs

can capture even higher funding yields from levered bull traders

3

0

25

4/ Axie Infinity

@AxieInfinity

This was one of my favorite posts to write and chart. There were amazing data sets from

@axieworld

,

@DappRadar

,

@cryptoslamio

, and

@maxbrand99

. It was super fun to write with tons of data to analyze and model.

1

0

23

After Bald's fall,

@BuildOnBase

has shown exceptional resilience.

Base is now leveraging momentum from

@friendtech

.

A Thread on Base

0/8

4

20

21

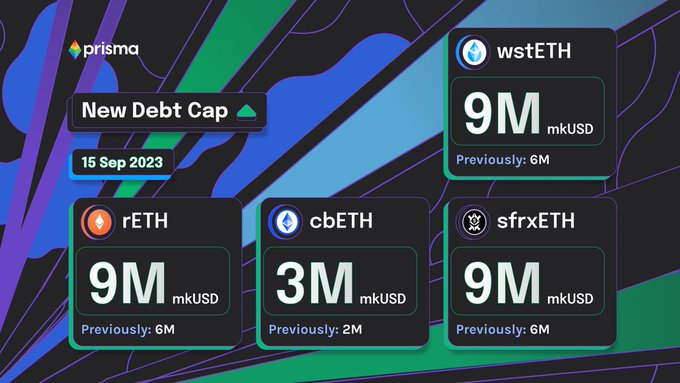

.

@PrismaFi

will be increasing its debt cap for all four liquid staking collateral TODAY at 12pm UTC

A thread about Prisma

2

3

18

1/ How it all started:

Randomly saw

@anildelphi

post that he was looking for interns. DM-ed and got an internship. I was so excited to join as I've wanted to work in crypto for a while but was rejected from multiple places. (Bullish rejection)

The DM that started it all👇

1

0

19

9/ Personal goals for 2022:

1) Improve my writing. I have improved since joining, but still far from the standard I envision to be at. ty

@ashwathbk

for always giving tips on how to write better, ty

@mediodelphi

@YanLiberman

@jeremyongws

@Paul_Burlage

@genye0h

for the edits💙

3

0

18

1/ It all started when

@anildelphi

posted that he was looking for interns.

A single DM kickstarted my career in crypto

I worked really hard, and was extremely happy when I got converted to a full-time analyst. It was like a dream come true, to work in crypto.

Thanks Anil

1

0

18

Tagging some $ENA Chads

@ethena_labs

@leptokurtic_

@ZeMariaMacedo

@YanLiberman

@0xdef1

@Defi_Maestro

@0xYaro

@0xthlither

@VinegarWrites

@yh_0x

1

0

18

3/

The best part about this is the friends made long the way that made it enjoyable

@jeremyongws

@genye0h

@FloodCapital

@yh_0x

@fyhfyhio

James T.

@HelpedHope

@Shaughnessy119

@yeak__

@0xZoey

Carter Xixi and more

<3

6

0

18

2/

To those that paved my learning path:

My research senseis, MJ (wtf whr is his twitter) and

@ashwathbk

paved the way to how I fundamentally do research

Also shoutout to

@YanLiberman

and

@Kevin_Kelly_II

working together with gigabrains was always extremely insightful

1

0

17

Guesstimates for

@ethena_labs

1/ Printing ~4B/day in Shards, I assumed a reduction in shard inflation over the next 2 and 4 epochs by 25% and 50% from current rates. (Not official numbers)

Take this with a pinch of salt, it can vary from USDe supply increase & shard reductions

2

3

16

11/ Special shoutout to the OG intern chads😘

@Crypt0___F1sh

@thejewforu

@Jeremystormsky

@WynnLemmons

@notatugboat

and Aaron

2

0

15

6/ Special Inclusion:

Most torturous post goes to... World of Lunacia!

Shoutout to

@Jeremystormsky

and Aaron for the shared max pain in extracting more than 10,000 manual data points. The mind-blowing land visualization by

@mediodelphi

made it worth it.

1

0

13

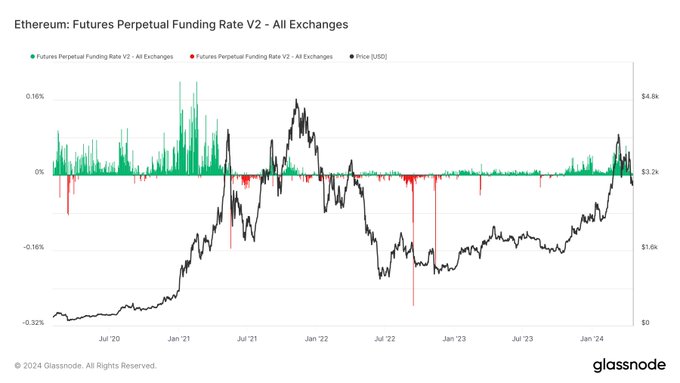

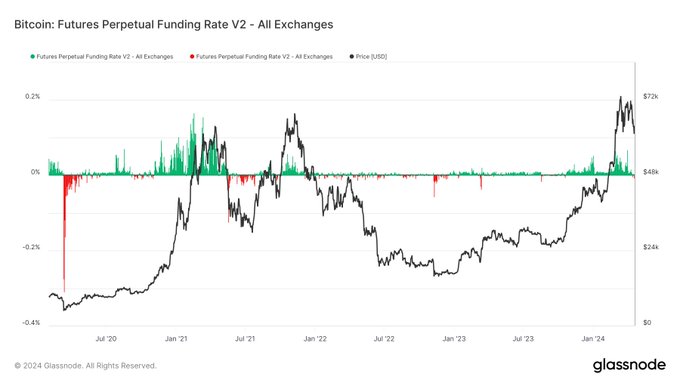

fud surrounding -ive funding rates affecting

@ethena_labs

long-term are short-sighted

1. Base funding rate is 0.03%/day for most cexs

2. The longest period of -ive funding was in the depths of the bear

3. Redemption of USDe adjusts funding back to +ive on lesser shorts

0

3

13

.

@fraxfinance

FRAX v3 unlocks RWA yields for FRAX alongside other unique implementations

A Thread on FRAX v3

1

2

11

Think LRT migration downwards from

@ether_fi

to

@puffer_finance

and

@RenzoProtocol

is very likely over the next month

Thread below

1

1

11

4/ my time

@Delphi_Digital

was truly enjoyable and I’ll definitely miss it.

I’m excited to see what

@ashwathbk

and

@ceterispar1bus

will cook soon

1

0

11

0/ Given how little information there is on creating scholarships for

@axieinfinity

as point out by

@ASvanevik

, here is a full hand-holding guide on how to do it.

Thread below👇👇

2

2

8

This was originally posted in

@Delphi_Digital

's Alpha Feed. Do check us out to stay ahead!

Also our 2024 Year Ahead Reports + 1 month of Delphi Pro is currently available for just $199!

@QwQiao

@Delphi_Digital

Soon 👀

In the meantime, people can get access to all our Year Ahead Reports and a month of Pro for $199

Also, highly recommend reading the other sector reports. Team worked really hard on all of these

0

1

28

0

0

7

Wow

@ThalaLabs

carrying the entire

@Aptos

ecosystem on its back

Dex

Cdp stable

Launchpad

Liquid staking

Restaking

MEV capturing validator client

Building the entire Aptos eco at 40m Mcap

Few…

0

0

8

@_deafbeef

For those asking how to check reveal,

1. Go to Read Contract

2. Under 5. getString, input token ID, and query

1

0

8

.

@rollbitcom

will be launching Duel Arena soon

Here's what u need to know and what it does for Rollbit🧵

2

0

7

.

@ethena_labs

held one of the shortest and yet most successful points campaign

$USDe grew to $1.35B and continues propelling upwards

Annualized revenue at $270m

$ENA will have mad circulating P/E and P/S metrics from low float

Will be looking out for their incentives program

0

1

6

The best 4.5 hours you’ll spend

0

0

7

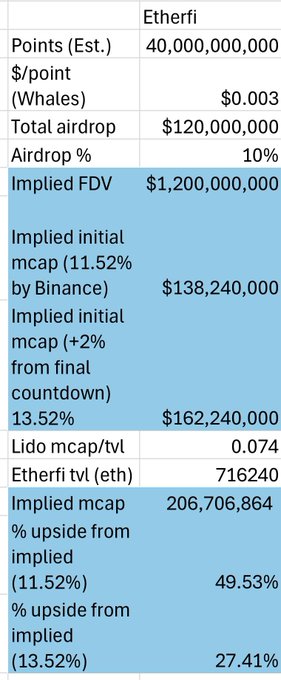

Doing

@ether_fi

numbers cause bored in reservist.

Whales pricing at ~1.2B FDV but there will be nuances in S1/S2 AD

Decent ROI for 4 days if you think Mcap/TVL will be similar to Lido

Personally thinks higher upside cause low float high fdv into

@eigenlayer

beta narrative

2

0

5

The EDSR by

@MakerDAO

grew DAI supply higher than what I initially forecasted. From 4.4B to 5.2B in supply, ~$800M in DAI minted!

Stability fee income soared to $162M annually, highest it has been over the past year.

With utilization >20%, we can expect EDSR rates to drop soon

1

1

4

I think few understand how big this shift is from a PvE to a PvP centric game. Yesterday, they were considered 'miners', today they transition to become 'skilled players'. Weak teams will be phased out, players will grow and have a higher skill level that is rewarded. Meritocracy

0

0

3

If you like this post, please help retweet it! :)

This post was originally posted in Delphi Research's Alpha Feed.

@Delphi_Digital

1

0

4