Mark Ritchie II

@MarkRitchie_II

Followers

35,041

Following

5

Media

366

Statuses

2,304

Trader/Investor/Portfolio Manager. Featured in 'Momentum Masters'. All thoughts, opinions, ideas and commentary are for education only.

Joined June 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Claudia Sheinbaum

• 567752 Tweets

Fauci

• 397924 Tweets

River

• 130693 Tweets

चुनाव आयोग

• 121802 Tweets

#FixTF2

• 120573 Tweets

Farage

• 117916 Tweets

Venom

• 101847 Tweets

Monica

• 67507 Tweets

Jadue

• 65851 Tweets

Enzo Maresca

• 61434 Tweets

#すとぷり8周年

• 57505 Tweets

First Take

• 53857 Tweets

Bolivar

• 36059 Tweets

Botafogo

• 33783 Tweets

Clacton

• 27629 Tweets

Barriga

• 26138 Tweets

Reform UK

• 25785 Tweets

Başın

• 25218 Tweets

The Strongest

• 23481 Tweets

Colo Colo

• 23118 Tweets

Justin Jefferson

• 22968 Tweets

Stephen A

• 21848 Tweets

ヴェノム

• 21226 Tweets

Talleres

• 18264 Tweets

SHORT N

• 17446 Tweets

Berkshire Hathaway

• 17083 Tweets

산소호흡기

• 16757 Tweets

Djokovic

• 16404 Tweets

Larry Allen

• 14072 Tweets

gracie

• 13240 Tweets

NYSE

• 12852 Tweets

ISABELLE MEDALHA RUY ARAUJO

• 11771 Tweets

RESPIRATOR OUT NOW

• 11198 Tweets

Real ID

• 11185 Tweets

Sri Lanka

• 10979 Tweets

Ducati

• 10654 Tweets

Last Seen Profiles

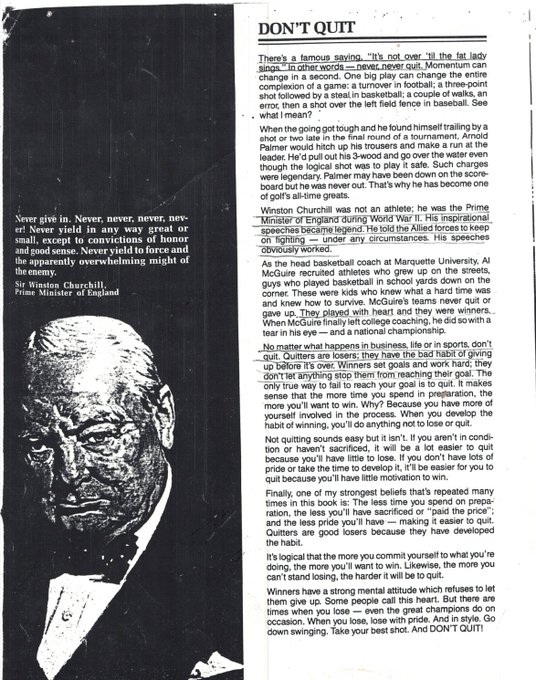

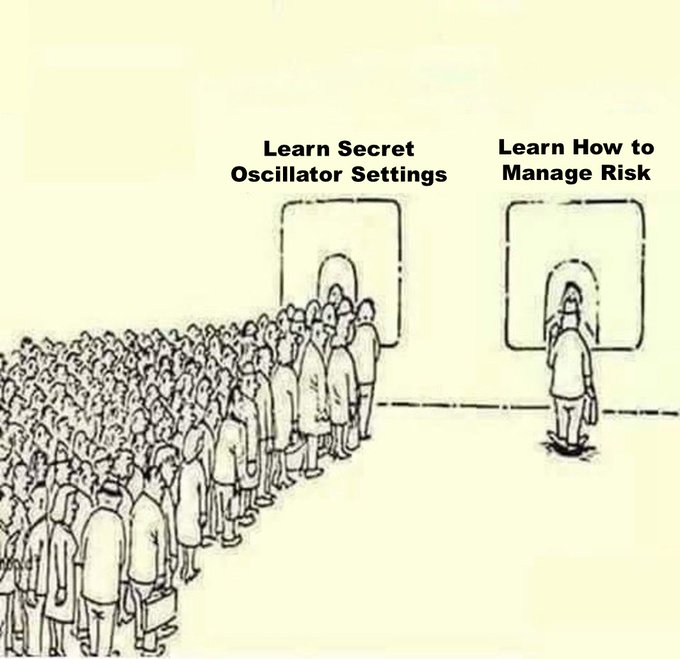

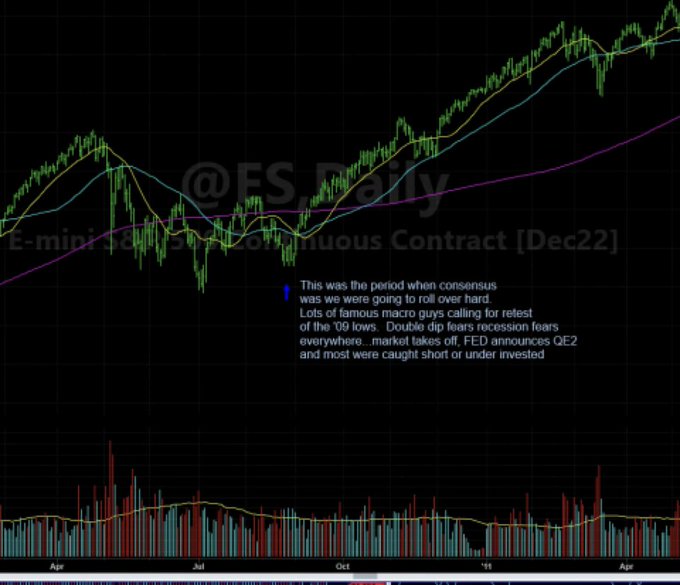

If you haven't felt stupid then you aren't managing risk. I've stopped out of lots of trades right on or near the lows and taken profits only to watch prices go WAY higher without me. Consistent application of discipline doesn't take 'feelings' into account.

21

73

415

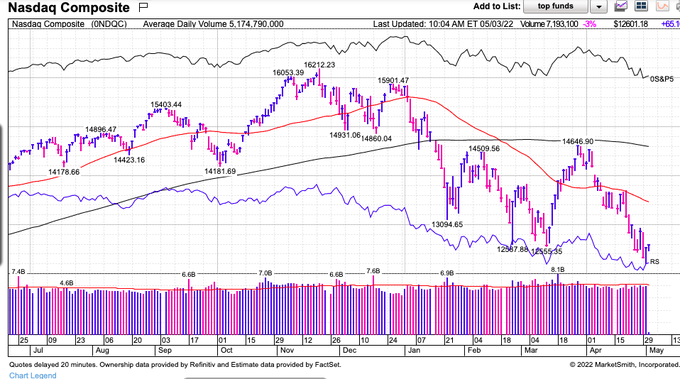

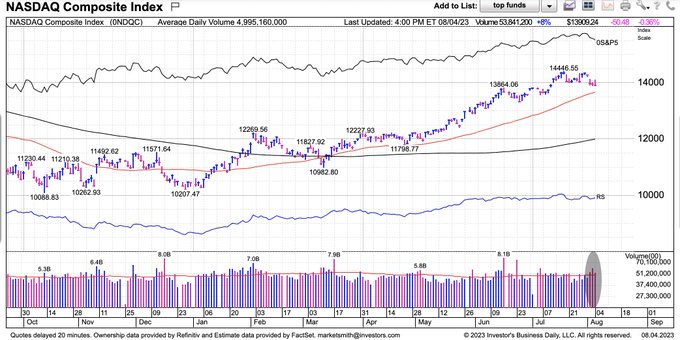

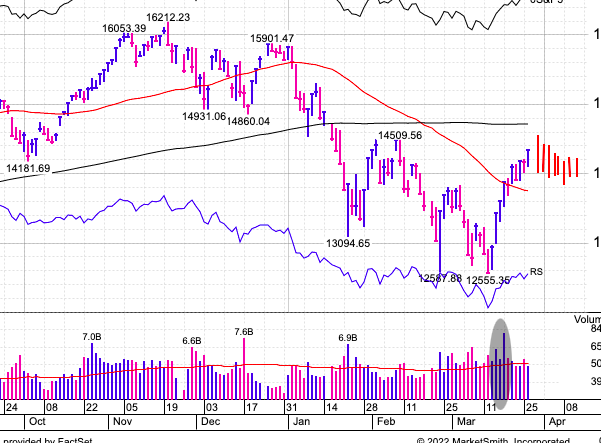

When David Ryan talks, I shut up and listen...not saying he's right but watching closely to see how the market responds to today's reversal and if we get distribution in the subsequent days etc.

12

22

352

In today's Q&A session

@markminervini

stated that 'when opportunity intersects with your preparation' is when the really spectacular results occur. The more I've thought about this the truer it has been in my own story. Many have the opportunity but are unprepared...

9

38

307

Hey twitter friends:

Just wanted to say many thanks for the overwhelming kinds words/comments from this mornings thread. Quite humbling to be honest but tells me there is a real hunger out there for more truth & transparency. If true, much more is on the way.

14

9

308

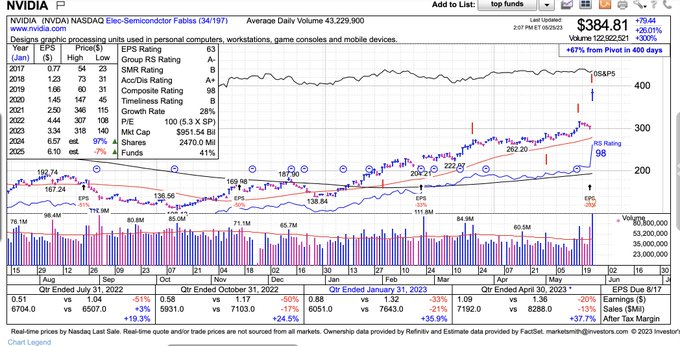

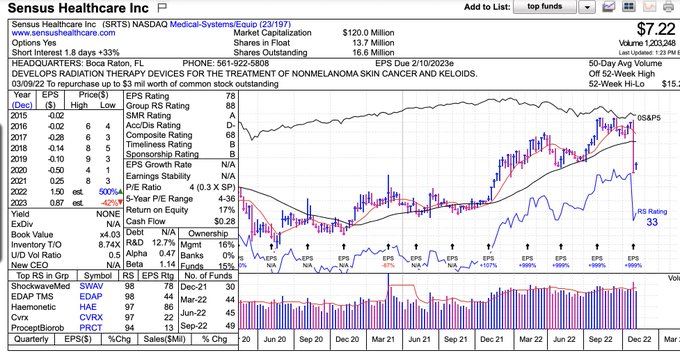

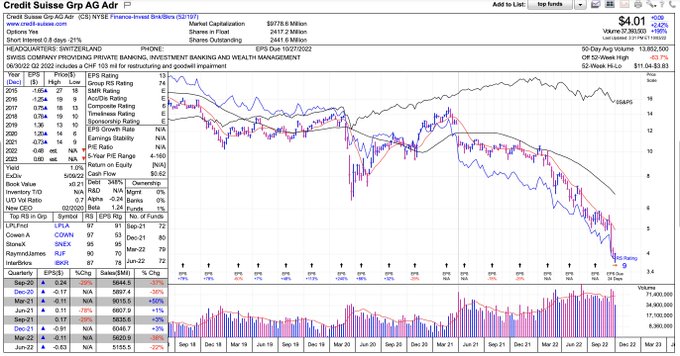

A great time to explain how I managed this & why as I was planning more comments on this stock from a few perspectives...first of all here are my entries for this name as I've been trading around a position for a few months and talking about how this was the clear liquid leader..

@MarkRitchie_II

I know you were holding part of a position. Did you sell any into this? I took some off on the 19th and 23rd. I also sold some yesterday and into today's rally. I will follow the 8-week rule with the rest. How did you manage it?

1

0

4

26

60

282

I'm wrong on MORE than 1/2 my trades/ideas. This is SO classic and everyone should read 'Marty Schwartz' book and interview in original MW. Who cares if you are wrong or have to take a loss? Get rid of the ego and focus on compounding good risk v reward decisions.

8

39

276

Ok another great question that is both important and personal, however I'm happy to share as I'm a big believer in 'counting the cost' of things and I'm not just talking money in this case prior to undertaking a significant life change...

Hello,

@MarkRitchie_II

went through both threads.

would really appreciate it if you can reply to the below question.

How did you financially get through a period of having no income and two kids and a wife?

Adding... Did anyone support you with money?

1

0

4

24

46

273

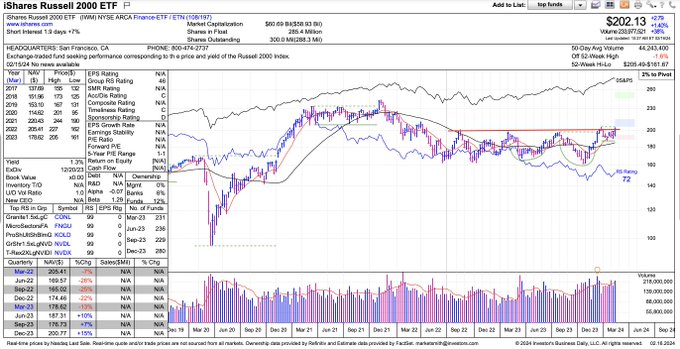

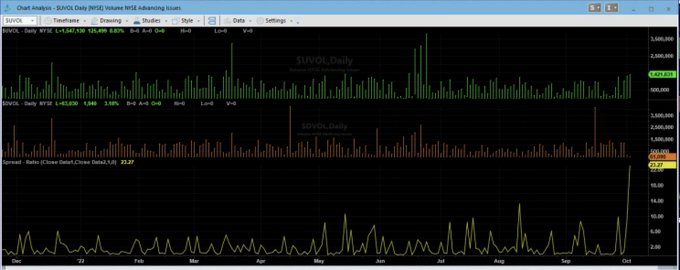

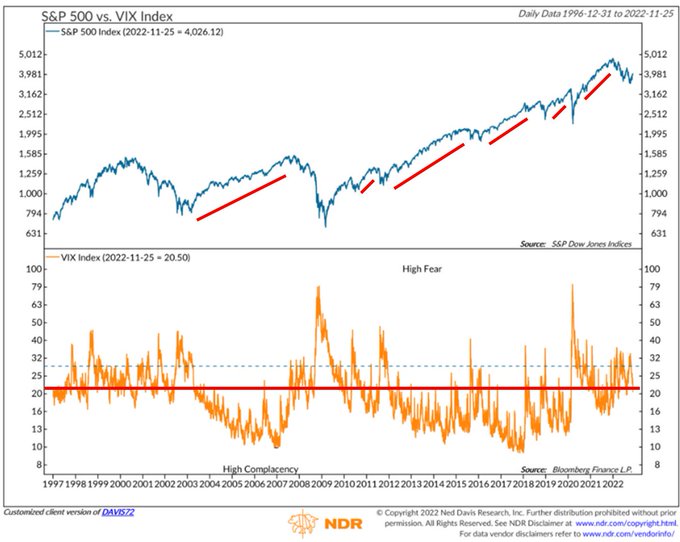

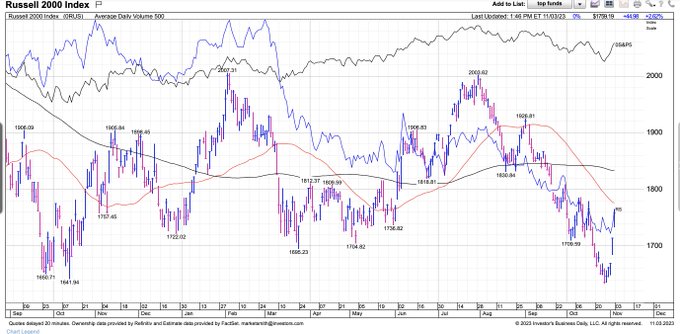

Ok a couple of scenarios to watch for here in terms of the general market as well as stocks under the hood.

#1

. Can we stay tight and continue to digest and round out a 'right hand side' in the general market? If so this should setup a lot of handles & pivots single names...

5

30

274

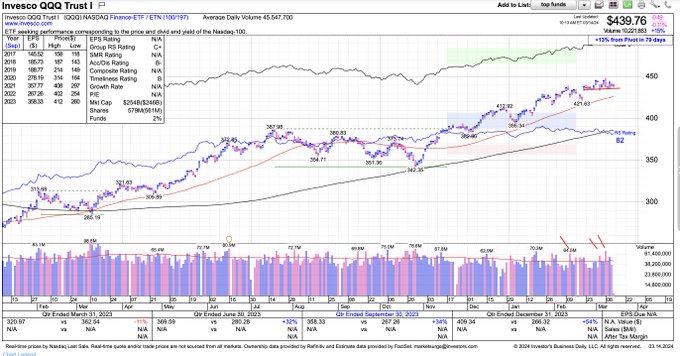

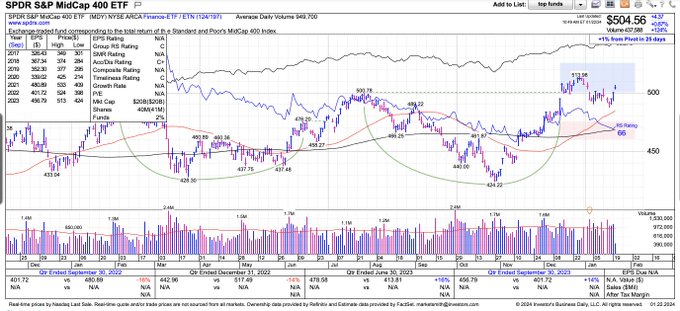

Hand raised...

Overbought...sure but that's a sign of health in a new bull advance.

Overvalued...valuation metrics are the worst timing tools in the history of the stock market imho.

Bubble...S&P 500 just made a new all time high after a 2 yr bear market, no bubble just a bull

13

19

263

Ok this is a great question and worthy of some comments. For starters let me be very clear on one point. The measure of a good trade is NOT the result. Just because you made or lost $ doesn't mean it was a good/bad play etc.

@MarkRitchie_II

can you please comment if you see anything wrong with this guy ? I thought this was a perfect buy then hit the stop today.

9

1

6

17

38

251

I think it was O'Neil that said 'sometimes the best stock to buy is the one you already own.' I heard it from

@markminervini

but this is exactly what I'm looking to do right now if indexes can mark time while a few names I own can hold and set subsequent pivots...

6

21

253

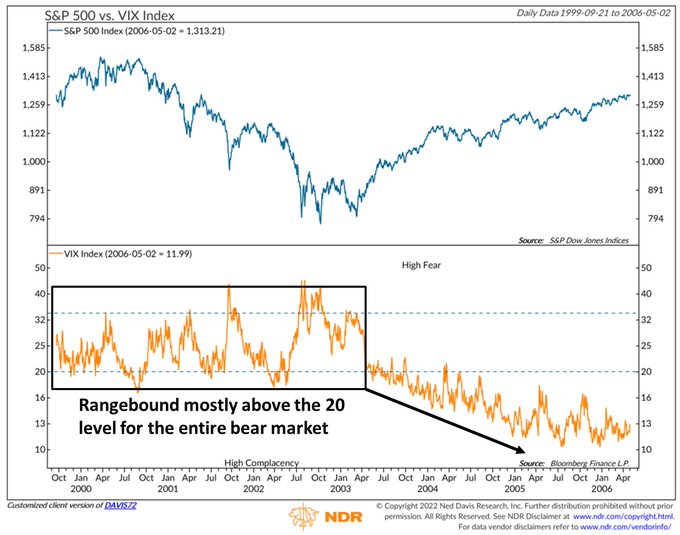

We've been talking about this for years at MPA. Many naively think that volatility is good for directional trading and that is because they don't understand the difference between volatility & alpha. Volatility is two directional movement, where alpha is excess return...

2

45

240

If this is indeed the end of the FAANG dominance this is GOOD NEWS!! If you are interested in outperformance and alpha this means there are new leaders on the way and great opportunity when this $ rotates out over time.

4

24

246

'Diversification is a concept that brokers came up with to cover themselves...if you want to get wealthy you need to have all your eggs in one basket, pick the right basket and watch it closely'

-Jim Rodgers (this morning on

@RealVision

)

still brilliant

13

40

241

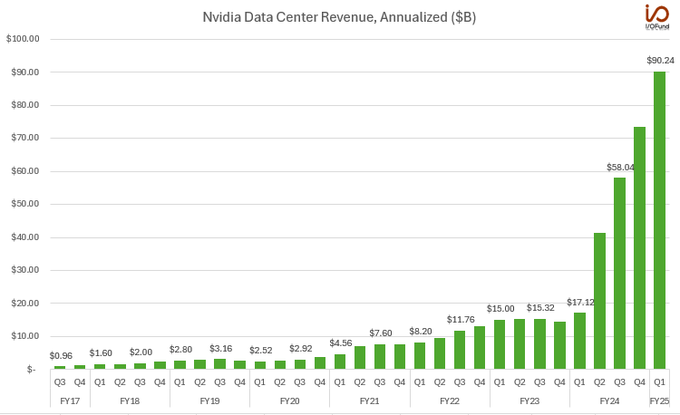

Kudos to

@Beth_Kindig

as she's NAILED this $NVDA move. It was her call on

@RealVision

back in Jan 2023 that got the stock on my radar when she said 'NVDA will own the AI space.' Stock has gone up more than 5x since despite every value bear you can find cursing & shorting...

11

16

240

The key is to protect capital and only get incrementally more aggressive on the heels of success. I've had periods where my account has gone no where for 12+ months and done a lot of trading/jockeying for very little net progress but the goal is to not dig a big hole.

@MarkRitchie_II

Hi Mark, thanks for sharing. Can u also pls share ur thoughts/wisdom for us newbies who are going through a bear market for the first time and feel like there isn’t as many buying opportunities & strong follow throughs ? It does “get” to our mindset. Tq 🙏

0

0

3

7

23

227

Important teaching note. Make a habit of knowing what you'd like to see ahead of time. Most of the time it won't happen but when it does it should be a flashing light on your dashboard telling you to get MORE aggressive!

5

33

229

There is NO WAY this poll squares with reality. Most quit after a few months of tough sledding let alone years. I would argue 80-90% quit in years 1-2, then more by years 3-5. Those remaining will do well or really well...that would be my breakdown fwiw

29

16

214