Lisbon Macro Workshop

@LisbonMacro

Followers

297

Following

7

Media

64

Statuses

79

Joined August 2023

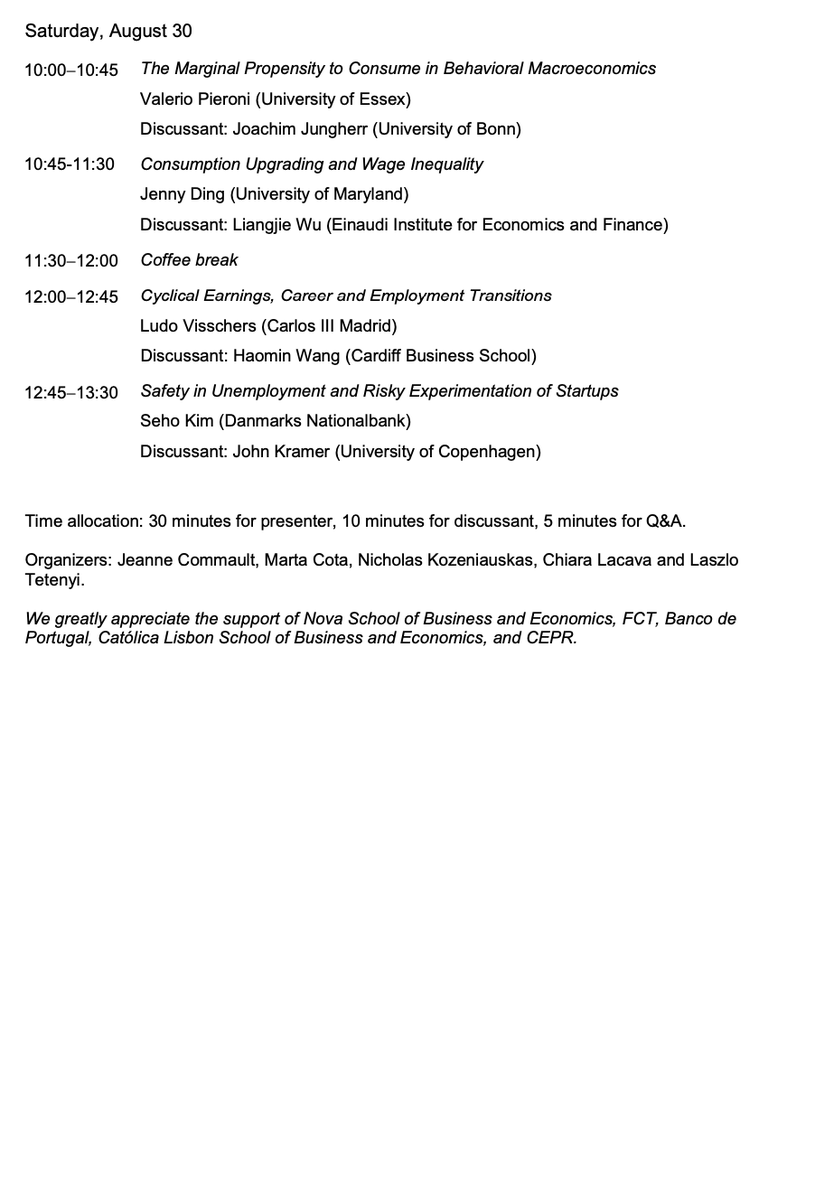

📢 Excited to announce the program for the Lisbon Macro Workshop 2025, taking place August 29–30 at Nova School of Business and Economics.📍 Lisbon.📅 Aug 29–30.🔗 Nic Kozeniauskas, Laszlo Tetenyi, @joj_como @MartaCota @chiaralac

0

6

25

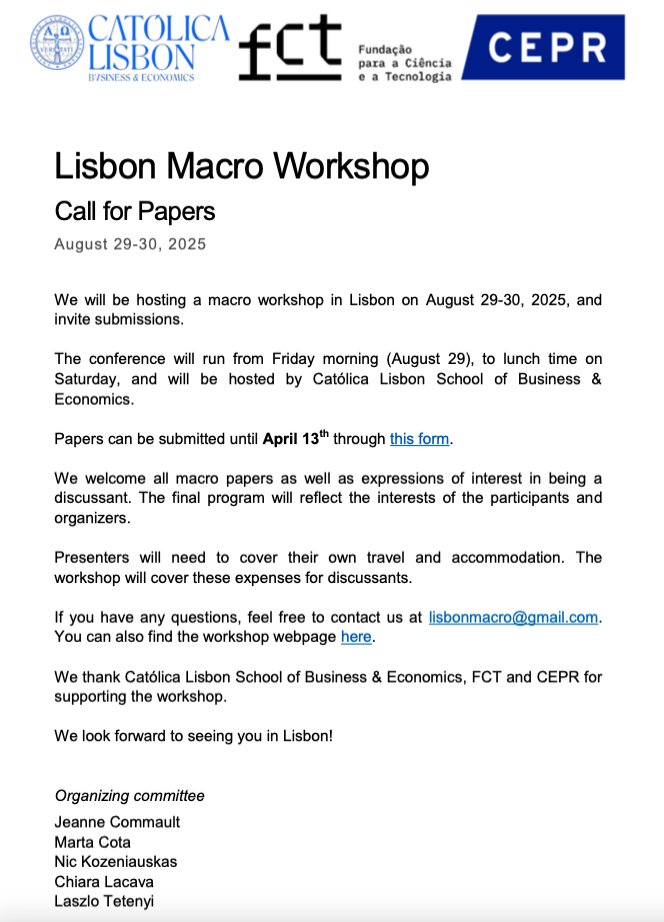

📢 Calling all macroeconomists! 📢. The 4th Lisbon Macro Workshop is happening on August 29-30! 🏛️.✨ Submit your paper by April 13 & join us in Lisbon 🇵🇹.🔗 Submit here: Spread the word!. Co-org.: @joj_como @MartaCota14 Nic Kozeniauskas, Laszlo Tetenyi

0

14

27

RT @JorgeMirandaPi5: Had a great time presenting at the Lisbon Macro last week and at Bocconi today. Very good feedback on two papers we ar….

0

2

0

🎉Thanks to all participants for the great presentations, comments, and lively discussion! It was a really fun and productive workshop! 💫.#macroeconomics #econtwitter .@joj_como @chiaralac

0

10

90

@TryphonidesA closes the workshop discussing Michael’s paper with insightful considerations on the model’s aggregate implications and calibration strategy

0

0

2

What are the implications of coholding for fiscal and monetary policy? Using a quantitative model with fully rational coholding, @mboutros_econ shows that the joint distribution of assets and debt is key for the aggregate marginal propensities to consume, save, and repay debt.

1

2

12

What drives the concentration of #aggregaterisk on the balance sheets of leveraged agents? @prtjns shows that the countercyclicality in idiosyncratic labor risk can lead to considerable amplification of aggregate volatility

1

0

10

@MartaCota14 discusses the implications of Denis' paper for the household finance literature suggesting new tests to explore the link between reference-dependence preferences and the price-volume relationship

0

0

2

#Houseprices in the U.S. react quickly to #monetaryshocks. Denis Gorea shows that this is mostly due by changes in expected future interest rates, rather than the #FEDrate, suggesting a crucial role of #expectations about the future path of #monetarypolicy

1

1

8

@LudovicPanon closes the day by discussing further margins that could be considered in the model

0

1

3

@NicoloRusso_ discusses the paper pointing out that the dynamics in the market of men teachers could have played a role in the decline in women teachers' quality

0

0

1

Next, @KPLarkin investigates how falling market barriers faced by women lead to the reallocation of highly productive women from teaching into the market sector. This had important aggregate implications, raising aggregate welfare but lowering human capital

1

1

9

@SenaCoskun11 highlights how the model can also be used to study alternative policies aimed at boosting fertility, like policies that lower the time cost of parenthood for women

0

0

3

Do cash transfers at birth boost fertility? @Lidia_Cruces_ uses a dynamic model of employment and fertility and finds that while cash transfers boost short-term births in Spain, their long-term effects are more modest, influenced by age and job stability

1

5

32

@AttilaGyetvai replicates the paper using Hungarian data finding slightly different results for occupational non-switchers, could it be due to the different wage setting framework (CBA vs minimum wages?)

0

0

2

Next, @ana_gfigueiredo shows that occupational sorting dynamics over the business cycle create an illusion of cyclicality in entry wages. @AttilaGyetvai discusses.

1

3

19