Laura Weiss

@LauraEWeiss16

Followers

3,928

Following

1,629

Media

81

Statuses

4,463

co-author of @PunchbowlNews 's The Vault covering tax, economic policy & financial services. prev: Roll Call, Hearst CT newspapers. laura @punchbowl .news. she/her

Washington, D.C.

Joined January 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mother's Day

• 1314944 Tweets

CDMX

• 157204 Tweets

Mauro

• 144917 Tweets

Clara

• 121887 Tweets

#DebateChilango

• 107104 Tweets

Emma

• 71880 Tweets

Nuggets

• 69921 Tweets

Taboada

• 54385 Tweets

Murray

• 48311 Tweets

Wolves

• 47669 Tweets

つばさの党

• 44186 Tweets

Iztapalapa

• 42721 Tweets

Denver

• 34863 Tweets

Jokic

• 34779 Tweets

Cruz Azul

• 28570 Tweets

Minnesota

• 26326 Tweets

Rayados

• 25991 Tweets

Pumas

• 25422 Tweets

家宅捜索

• 23352 Tweets

Monterrey

• 23149 Tweets

Tigres

• 22425 Tweets

Oilers

• 16880 Tweets

Gobert

• 16699 Tweets

LOSE MY BREATH REMIXES OUT NOW

• 15123 Tweets

Jordi

• 13602 Tweets

バンドリ

• 13595 Tweets

Gambino

• 13198 Tweets

#Canucks

• 13185 Tweets

#ほっともっと16周年

• 11814 Tweets

Ernestina Godoy

• 11759 Tweets

#ElectionDay

• 10506 Tweets

Last Seen Profiles

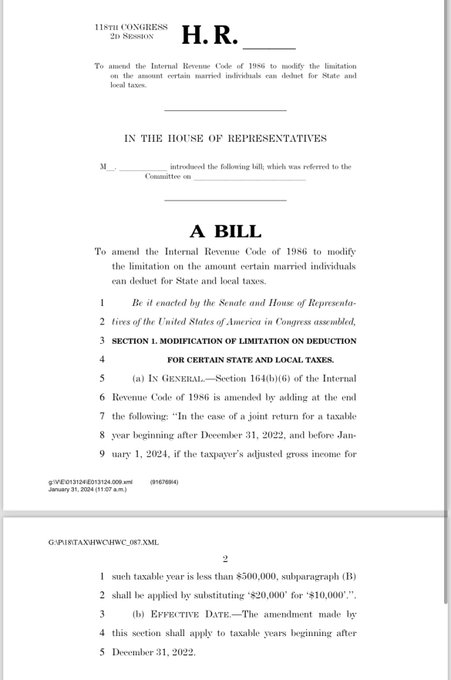

NEW: The House will no longer vote on a rule tomorrow for New York Republicans' SALT bill, per multiple Democratic sources

New Yorkers pushed for SALT in the bipartisan tax bill last week. Instead Rules teed up this bill, providing some SALT relief in 2023

w/

@heatherscope

15

64

206

Thrilled to announce it's my first week at Punchbowl News! I’ll be co-authoring The Vault with the great

@BrendanPedersen

and covering tax, financial services, banking and more on economic policy/politics in Congress.

Add me to your press lists & send along any tips/thoughts!

29

12

212

If you love tax news, we’ve got it for you in

@PunchbowlNews

PM!

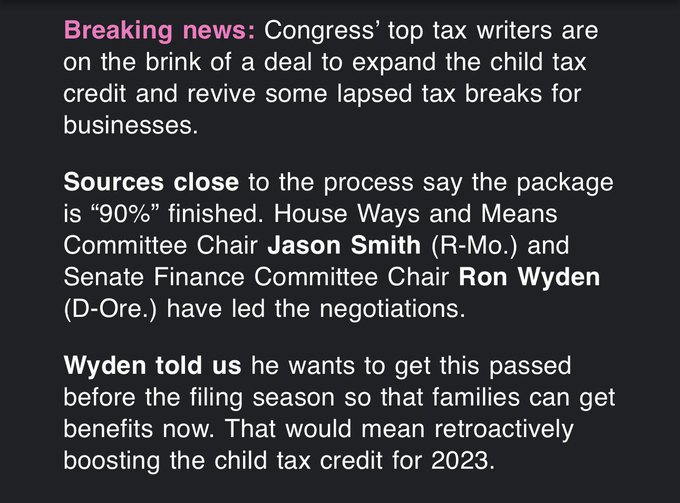

TAX NEWS: Bipartisan tax deal is almost here with Ways and Means staff planning to debrief GOP members on parameters Wednesday.

Wyden told me the deadline is filing season's start on Jan. 29 to expand the child tax credit for 2023.. w/

@LauraEWeiss16

@JakeSherman

@heatherscope

9

57

177

5

40

138

At Economic Club of DC,

@Sen_JoeManchin

called rule that banks report gross flows for accounts to the IRS “screwed up” & said “I think that one's going to be gone,” per CQ’s David Lerman

Rule has been in the mix as option to add hundreds of billions in revenue for reconciliation

8

63

128

.

@brianschatz

says US financial regulators aren’t doing their job because they’re not addressing climate risk as material during speech at UN PRI summit

3

17

85

The rule for NY Republicans’ SALT bill failed in a 195-225 vote today.

It had 18 GOP no’s. 2 notable NJ Dems didn’t vote.

The NYers showed some willingness to fight on SALT, but also the strong opposition in their own party. More in

@PunchbowlNews

PM:

11

21

86

.

@SenatorRomney

told me he’s talking with the White House this week about his plan to overhaul and expand the child tax credit. He said he’ll “see if we have any interest in doing something together.”

More on CQ:🔒

3

14

85

NEWS: Wyden & Smith have a ~$78B tax deal & plan to roll it out this a.m., per source familiar w/ talks

Expected in it:

-biz measures

-child tax credit

-affordable housing

-disaster tax relief

-Taiwan bill

-Ending ERC claims

Details in

@PunchbowlNews

AM

4

32

75

NJ's other senator Cory Booker told

@lindsemcpherson

he supports full SALT repeal: "It's something that is outrageous that they balanced the Trump tax cut on the backs of New Jersey residents."

Asked if he would be open to a two-year repeal, he repeated he's for "full repeal."

3

13

60

.

@SenToddYoung

now on backing Wyden-Smith tax bill:

“I also want it to be know by my colleagues & by leadership that if [Crapo] falls short in the effort to seek changes, we should still move forward. And I want to offer encouragement to colleagues that might join me in that.”

4

13

61

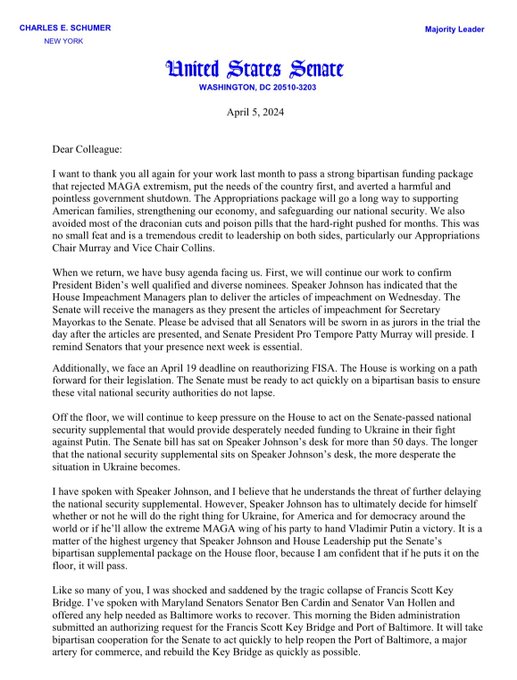

Schumer is taking a key procedural step on the bipartisan tax bill from

@RonWyden

&

@RepJasonSmith

tonight. Doesn't mean a Senate floor vote will happen, but still a necessary move that bill backers were looking out for -

Tax scoop: Schumer will put the House-passed Wyden-Smith tax bill on the Senate’s calendar tonight under Rule 14.

This is simply a procedural step & isn’t an indication that Schumer will eventually put the bill on the floor. But notable nonetheless.

w/

@LauraEWeiss16

2

21

124

2

21

58

.

@abigaildisney

told members of Congress today that the company her grandfather built (

@WaltDisneyCo

) could lead on better paying workers but has lacked the imagination to do so. My story on

@rollcall

:

1

15

48

NEW: Sens. Sinema, Hawley & Young are quietly & informally working to get to 60 votes for the tax bill

Some of the changes they’re discussing were talked about on a call w trade groups Monday & include Hawley’s push for RECA

More w/

@AndrewDesiderio

1

17

53

NY Republican D’Esposito says going into the vote on the Smith-Wyden tax bill that he hopes Rules meets tonight on a SALT bill

Garbarino, another NYer, says group has had good discussions with leadership on SALT

NEWS — House Republicans are discussing going to the Rules Committee tonight to prepare a SALT relief bill for the floor, several sources tell

@LauraEWeiss16

@heatherscope

and me.

SALT relief didn’t make it in the tax bill. So this won’t become law or get through the senate…

54

70

313

6

11

48

.

@RonWyden

taking a tougher tone w/ Senate GOP tax deal critics: “It’s time to decide. This has been out there for 5 weeks, and they haven’t even said — these critics — here’s what we want and… we’ll vote for it if we get the following things.”

From AM:

1

16

46

.

@RepJasonSmith

&

@RonWyden

announce their tax deal, which we laid out this morning:

Here's their summary:

3

11

44

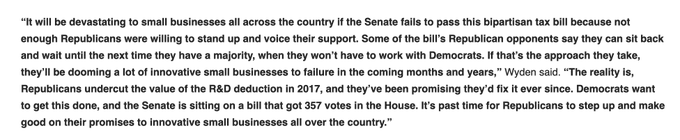

In the latest push for his tax bill, Finance Chair

@RonWyden

released Treasury data saying 3.8M small businesses took now-expired tax breaks in 2021 that the bill would revive

Wyden is hitting R's for blocking the bill. There have also been calls for Schumer to hold a vote --

2

13

45

While

@AOC

has you here, more from today's hearing. Abigail Disney called on the company her family built to do more for workers:

1

2

40

So proud of my former CQ Roll Call colleagues who deserve a bigger voice to represent the FANTASTIC journalism they do.

I'm so grateful for my six years in this incredible newsroom and the fellow reporters who taught me so much. Standing with them!

We’re proud to announce the CQ Roll Call Guild, part of

@newsguild

. Congressional Quarterly has covered Congress since 1945 and Roll Call has been a trusted source of Capitol Hill news since the Eisenhower administration.

12

64

164

0

17

43

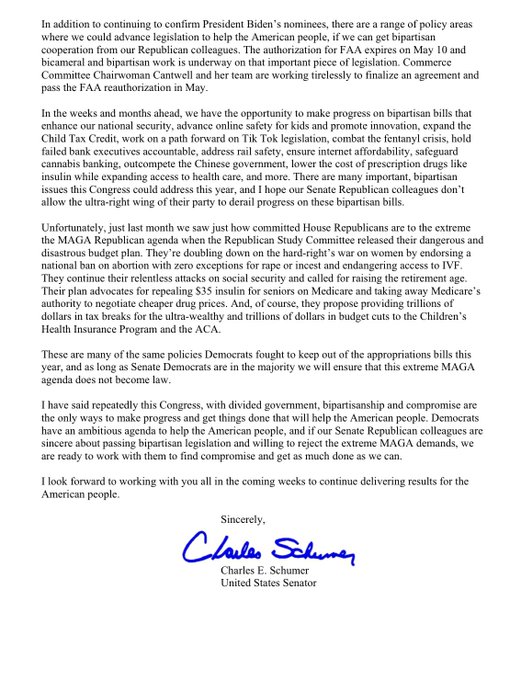

Schumer lists legislation to expand the child tax credit among bipartisan bills that could come up in the "weeks and months ahead"

That mention is significant for the Smith-Wyden tax bill. Backers are pushing for a floor vote in the face of Senate GOP opposition

2

12

39

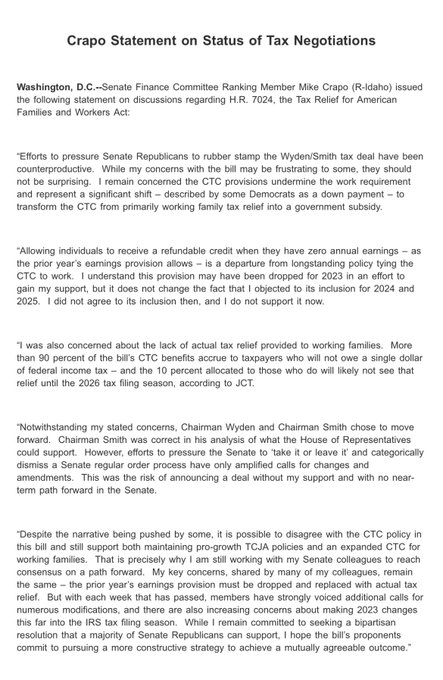

NEW: Senate Finance’s top Republican

@MikeCrapo

with a new statement on the Wyden-Smith tax deal

Says his concerns with bill remain the same - like with CTC lookback - but colleagues’ issues have grown with time including about making 2023 changes at this point in filing season:

5

18

36

New in

@PunchbowlNews

AM: Speaker Mike Johnson hasn’t made up his mind about whether to support the bipartisan tax package that W&M approved last week in a big bipartisan vote

The reason? Grumbling from some of his members about the deal

7

13

37

From today’s

@PunchbowlNews

AM: a look at 2023 in tax policy and what to expect in the new year on child tax credit negotiations, SALT and more

5

8

37

IRS delaying by 1 year the new $600 1099-K reporting threshold for third-party payment platforms like Venmo, Uber & eBay. Lawmakers aiming to lift the threshold say delay gives Congress time to act

@RichardRubinDC

&

@Saunderswsj

first reported

More (🔒):

3

17

35

NEW: Inside the bleak tax convo at GOP lunch

Finance RM Crapo said he doesn’t want to pass a tax bill this year & spoke of persistent issues w/ Wyden-Smith bill after talks broke down, per 3 sources w/ direct knowledge

w/

@AndrewDesiderio

@bresreports

5

20

36

So much tax news in

@PunchbowlNews

Midday!

-Rules approves SALT bill but House GOP believes rule won’t pass on the floor, from

@JakeSherman

& me

-On

@RepJasonSmith

’s big tax deal vote & what it says for 2025

-

@maxpcohen

on Jeffries cheering tax bill wins

4

12

34

W&M Chair

@RepRichardNeal

said he & Pelosi decided to add paid leave back in reconciliation bill this morning: “We can’t always pull back on our proposals because the other chamber doesn’t want to do this & they don’t want to do that. That’s for further negotiation & discussion.”

2

13

31

.

@SenMullin

had stark warnings for Senate GOP colleagues on how their rejection of the Smith-Wyden tax bill could hamper their hopes for 2025

Mullin told me failure to pass the bill will create problems btwn House & Senate in next year's tax debate

More:

5

9

30

The moment I realized I was standing next to

@ParisHilton

👀

2

1

26

I'm excited to announce the first edition of the CQ ESG Briefing, a newsletter covering how companies are addressing environmental, social and governance issues, is out! I'll be writing about all things

#ESG

every Thursday morning. And it'll mean more ESG news featured on CQ

3

6

24

President Biden signed his party’s climate, tax & health care package into law in a White House ceremony, capping off a more than year-long push from Democrats.

Democrats at his side including

@Sen_JoeManchin

&

@SenSchumer

, who cut the deal on what largely became the final bill.

1

6

23

House GOP leadership hasn't yet decided whether to put the bipartisan tax deal on the floor this week. It could come to the floor Tues. or Wed. - or get punted

More on the bill's status/obstacles plus backers' efforts from the

@PunchbowlNews

Sunday Vault:

2

12

22

W&M Chair

@RepJasonSmith

on the Senate taking up his tax bill w/ Sen. Wyden after House passes the package: “The House spoke overwhelmingly. I hope that they want to deliver for the American family, the American worker. That’s what this bill does.”

0

5

23

This is a big moment for United for Respect, which also used last yr's Walmart mtg to push for worker-friendly changes but w/ less of a spotlight. Now, they're working w/ powerful Dems from Bernie to

@SenatorBaldwin

(they support her bill for employees to elect 1/3 board members)

Today at the Walmart shareholders meeting I spoke on behalf of

@forrespect

workers who are proposing to give hourly workers a seat on the board.

@Walmart

: Treat workers with dignity and respect, not with disdain and contempt.

#BernieAtWalmart

112

506

2K

1

2

22

.

@SenWarren

speaking at CAP event now, on 15% minimum tax on corporations' income reported to shareholders: "I believe this is gonna happen," she said of the tax, which is part of Democrats' stalled reconciliation bill. "We've got 50."

0

11

21

TAX NEWS from

@PunchbowlNews

Midday: The tax deal being hammered out by House & Senate negotiators is expected to land in the $50-$80 billion range, according to sources close to the talks

More details w/

@JakeSherman

@heatherscope

@BrendanPedersen

0

8

22

Big news from

@BrendanPedersen

in AM on a new wrinkle in the race to succeed McHenry at HFSC. Another Republican enters the race —

THE VAULT:

@RepFrankLucas

is running to be the next top Republican on the House Financial Services Committee.

@BrendanPedersen

with the details:

0

2

3

1

9

18

For the first time in 6 months, child tax credit checks didn’t go out today to millions of families. Democrats plan to lobby Manchin on the CTC rather than work w/ Republicans, hoping to preserve access added in 2021 for more families

w/

@lindsemcpherson

1

11

18

Senate Democrats are discussing suspending the gas tax, capping insulin costs, antitrust efforts & other measures aimed at cutting costs for Americans amid rampant inflation.

They plan to bring legislation to the floor in March.

w/

@lindsemcpherson

0

4

15

.

@RepJasonSmith

is selling his tax deal - and making headway - in the Senate. But it's got notable opponents too & some made that clear when W&M staff presented at Senate GOP chiefs meeting last week

More from me &

@AndrewDesiderio

in the Sunday Vault:

0

10

18

I joined Washington Journal this morning to talk about Ways & Means releasing Trump’s tax returns. Covered Democrats’ case (below), the Republican response, when we’ll see the returns themselves & more — listen in!

Today |

@LauraEWeiss16

of

@rollcall

on the latest news surrounding the public release of former President Trump's tax returns

"This was about making sure that someone is scrutinizing and putting essentially a check on the President's power"

6

3

12

4

2

17

In our Sunday Vault,

@BrendanPedersen

& I dig into the government funding fight impact on financial regulators & the IRS

Plus, the tax deal latest & a new letter from W&M members taking issue with Treasury's crypto tax reporting rules. Read it all here:

2

5

16

.

@RonWyden

uses opening at today's Finance hearing on manufacturing/tax to push for his tax bill w/ W&M Chair Smith

"I continue to be open to all sides who want to work in good faith to get this done," he says. Adds these policies won't be on the table in 2025 if bill stalls out

2

9

14

A new wrinkle for the Smith-Wyden tax bill:

@HawleyMO

is floating the idea of attaching RECA, his bill aiding radiation victims

Comes as backers are trying to make a push for the tax bill this work period

More from

@AndrewDesiderio

& me in AM -

2

8

17

Biden proposes quadrupling the buybacks tax (which is currently at a 1% rate) in SOTU.

He also urges passage of his “billionaire minimum tax,” which would set a min tax on the wealthiest households based on income & gain in value of assets.

1

4

16

Now on

@rollcall

: a new Toomey-Scott bill aims to open 401(k) plans to a bigger mix of investments.

They’re looking to include it in a year-end tax bill, which - if it comes together - would likely also carry a broader retirement savings package

5

6

12

CBO estimate for IRS funding is net $127B in revenue over a decade, a little above what CBO had based on Biden’s budget. That’s below White House’s net $400B, but that was expected.

Wyden in a statement says that if anything WH number “is too conservative, not too aggressive.”

0

9

16

.

@SenThomTillis

at Finance hearing says he came to explain his opposition to Wyden-Smith bill

Says he's gotten calls from notable CEOs making case for the bill

Tillis adds he doesn't want to set a precedent that tax bills like this need pay-fors. He's railed against the offset

1

2

16

NEW: IRS Commissioner Werfel will be at W&M on Feb. 15 after House R’s requested he testify on 1099-K decision

Plus, Heritage Action will tell lawmakers today they’re making SALT bill a key vote no, with rule vote tomorrow

More in

@PunchbowlNews

Midday -

3

12

16

NEWS:

@RepJasonSmith

is the pick to be the next Ways & Means chairman, a source confirmed

More to come

@rollcall

0

12

16

The $1.7T omnibus spending package passed the Senate,

@QuigleyAidan

reports. Now onto the House.

It includes a section to boost US households’ retirement savings that's widely backed in Congress. W&M Chairman Neal said that's a $53B, fully offset package.

1

8

15

The Smith-Wyden tax bill is scheduled for a vote TODAY

Comes after Speaker Johnson was addressing NYer push for SALT late last night. SALT stand created friction, but bill itself is expected to have broad support

If so, it would be a big deal for long-sought biz/family benefits

☀️ HOUSE COMMITTEE CLEARS MAYORKAS IMPEACHMENT

-

@bresreports

,

@MicaSoellnerDC

and

@AndrewDesiderio

take you inside the impeachment hearing for Mayorkas -- and inside the trouble with the SENATE immigration bill

-

@LauraEWeiss16

and I scoop:

@SpeakerJohnson

will bring tax bill…

34

15

82

0

2

15

Democrats have a possible compromise on a clean energy tax plan for reconciliation: 5 yrs of House plan to expand existing incentives, then moving to Senate proposal to scrap existing tax breaks in favor of new ones tied to results

w/

@lindsemcpherson

0

12

14

ICYMI in the

@PunchbowlNews

Sunday Vault: Senate GOP leadership race dynamics are seeping into tax bill debate

-Thune wants "big, significant" # of R's on board to back bill

-Cornyn won't back it w/o Finance markup, or Crapo getting big edits

Much more:

4

7

14

New in today’s

@PunchbowlNews

AM: Rep. LaLota (R-NY) is circulating a letter to Speaker Johnson saying tax deal shouldn’t be brought up under suspension so members can have SALT debate, according to draft we obtained

Letter:

More:

2

7

14

Now on

@rollcall

: A look at Democrats’ latest push led by

@SenWarren

for the IRS to create its own tax preparing services, more tools for non-filers to claim refundable tax credits & other programs meant to make filing taxes easier

3

6

14

Sen Finance Chair

@RonWyden

’s tax on billionaires’ assets would bring in $557B over a decade, JCT found, per statement from Wyden.

He’s still pushing to add the tax to the reconciliation bill in the Senate. That revenue # is higher than any single tax currently in the package.

1

6

13

Schumer said the Senate is expected to begin consideration of Democrats’ climate, tax & health care bill Saturday afternoon, leaving a short window to shore up Dem support — particularly Sen. Sinema’s crucial vote

Reconciliation update w/

@lindsemcpherson

3

13

13

Senators just introduced a bill to restore the employee retention tax credit for 2021’s final quarter.

Critically the bill has Republican support. It’s from

@SenatorHassan

&

@SenatorTimScott

w/ Dems Warner & Cardin plus Republican Capito.

1

4

13

If it holds, the rate of rejections for corporations' executive pay packages will be at a record-high this year.

“Shareholders have no patience for companies that are insulating executives from the effects of COVID,” said As You Sow's

@LandisWeaver

1

15

12