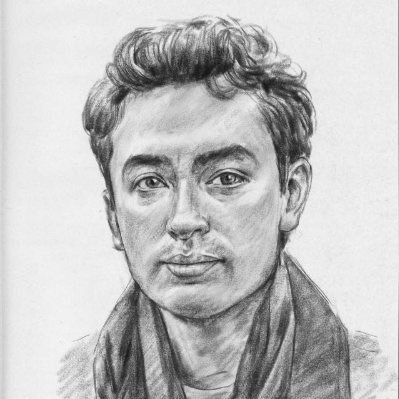

Danny Marques | Investing Informant

@Invst_Informant

Followers

21K

Following

22K

Media

2K

Statuses

15K

Investor Relations @ Orange Group Advisors | Research @Finblueprint | ₿itcoin | @VillanovaU ‘16

👇Institutional-Level Research

Joined August 2021

My $170K+ target for Bitcoin $BTC remains unchanged. Not sure why so many are frustrated with a slow grind of higher lows and higher highs. That IS the bull market, one nobody believes in while it’s happening. Price now sits at a point of maximum asymmetry. Since 2022,

14

54

417

Bitcoin $BTC will be at $500k-$1M in the next few years. Every day that passes it becomes more scarce. What I really don't get is if that's the case, why the hell do people lose their mind on these pullbacks. It literally doesn't matter if you're buying at $125k, $105k or $90k

6

2

49

Where do you see Bitcoin headed in the next 6-12 months? The least likely results of this poll will likely illustrate the correct path

6

1

17

Finished a 25min educational video on how to identify and know if a stock is in a Wyckoff Accumulation pattern. There are a few stocks currently in this schematic $BTBT $RXRX and $EOSE is a clean example of it playing out https://t.co/LV1uYF6G4o

patreon.com

Get more from The Investing Informant on Patreon

1

1

32

What in tarnation kind of chart is this 😆

15

5

71

The least likely result illustrates the correct path for Bitcoin over the next year It’s a near tie between those that think $BTC will enter a bear market and $200k+ Since everyone and their grandmother is fearful and cautious right now, it’s obvious what will probably happen

Where do you see Bitcoin headed in the next 6-12 months? The least likely results of this poll will likely illustrate the correct path

1

0

18

I bought more Bitcoin today. Frankly it’s how I stay sane in a world that’s lost its mind. Sometimes life is that simple.

114

102

2K

The market’s job is to make you do the wrong thing at the wrong time. There's a reason why corrections within bull markets often feel the worst. The backdrop is positive, the narrative is strong, prices are going up, you become conditioned to seeing green on the screen. So, when

6

6

91

Waymo can offer aging adults a safe, accessible mobility option that provides independence without needing to drive.

2

1

8

Whenever you feel like selling in a bull market, you should buy

13

3

77

Where do you see Bitcoin headed in the next 6-12 months? The least likely results of this poll will likely illustrate the correct path

6

1

17

The second that the 4 year cycle narrative fizzles out and dies the better it will be for Bitcoin and broader crypto It is not a thing, just as Bitcoin is not correlated to global M2

3

2

27

Stake your $APT securely with Everstake — trusted by the @Aptos community. • 7% APR • over 17M APT already delegated • Top-3 Aptos validator by performance

0

1

7

It will be funny to see everyone’s worries start to go away once the government opens up again Whenever that happens, I expect it to be followed by multiple weeks of 🟢 candles

3

2

57

My $170K+ target for Bitcoin $BTC remains unchanged. Not sure why so many are frustrated with a slow grind of higher lows and higher highs. That IS the bull market, one nobody believes in while it’s happening. Price now sits at a point of maximum asymmetry. Since 2022,

14

54

417

I wish you all understood Bitcoin as well as market makers understand how emotive ppl can get when they see prices go down Understand the game

2

1

50

Just like that Bitcoin is now at the 55w EMA 🙂

My $170K+ target for Bitcoin $BTC remains unchanged. Not sure why so many are frustrated with a slow grind of higher lows and higher highs. That IS the bull market, one nobody believes in while it’s happening. Price now sits at a point of maximum asymmetry. Since 2022,

3

3

38

On days like today see who consistently publishes their views on the market while sentiment is extremely bearish. These are the accounts you should follow @cantonmeow

@matthughes13

@CrypticTrades_

@MarketMaestro1

@Freedom_By_40

@dannycheng2022

@bitcoindata21

@AlemzadehC

12

2

53

Almost to the target mentioned a few days ago as $BTC breaks below 100k. Exactly as expected. Better have those .35 bids set if you're looking to add here- not sure how long we will last at these levels. Point of maximum opportunity is a couple of candles away imo. $CRV

Yes, if BTC breaks below 100k in the short term then all alts will drop a bit with it on the dip, including $CRV. In my last Youtube vid I talked about how we needed to reclaim the red zone pictured below to confirm our reversal- we haven't done that yet. I also recently said

53

42

526

It’s an opportune time to bring this back to your attention, though 4 days ago seems like 4 months ago already Bitcoin $BTC will be over $170k+ this cycle

My $170K+ target for Bitcoin $BTC remains unchanged. Not sure why so many are frustrated with a slow grind of higher lows and higher highs. That IS the bull market, one nobody believes in while it’s happening. Price now sits at a point of maximum asymmetry. Since 2022,

0

1

48