bitcoindata21

@bitcoindata21

Followers

24K

Following

21K

Media

3K

Statuses

10K

MACRO - BITCOIN - BITCOIN MINERS

The Blockchain

Joined November 2022

Bitcoin / Altcoins / Crypto stocks (including bitcoin miners) INDICATORS below - shared in discord [link in bio through patreon]: *There is more detail, these are just a handful of charts Bitcoin cycle tops and bottoms Altcoin cycle/local tops/bottoms [Also valid for bitcoin]

14

7

117

Bullish. Regardless of whether these headlines have merit long term, they don't get traction at market tops.

2

3

61

Nuke the DXY. 100 Support is now resistance. Previous 2 bitcoin/crypto bull markets happened when DXY dumped from the 100 level.

6

19

178

Nuke the DXY. 100 Support is now resistance. Previous 2 bitcoin/crypto bull markets happened when DXY dumped from the 100 level.

6

19

178

Want to give a shoutout to @bitcoindata21 here. He’s been incredible on delivering data to keep his community sane. Data and macro is one thing I lack on myself, solely from a “having no time” perspective and due to less interest and thus lower on my priority list (although a

4

3

56

BItcoin hit 98.9k perfectly✍️ It was not a coincidence that all other metrics fired 'bottom signals' last week at the same time

11

7

114

Govt schemes happen now, to prop up prices (because politcians owna lot of real estate, so is in their interest). Once these schemes are exhausted, the only release valve is house prices dropping, so that the unsustainable level of mortgage payments as % of income mean reverts.

50 year mortgages are not only a method for buying votes, but also a typical sign that the end of the 18 year real estate cycle is near. *Expecting cheaper housing in the coming years in real terms, probably not so much in nominal terms. 1973...1990...2008...202?

0

1

58

50 year mortgages are not only a method for buying votes, but also a typical sign that the end of the 18 year real estate cycle is near. *Expecting cheaper housing in the coming years in real terms, probably not so much in nominal terms. 1973...1990...2008...202?

8

4

97

Do you think Crypto Twitter sentiment is counter tradeable? If yes, is it bullish/bearish/neutral right now?

4

2

17

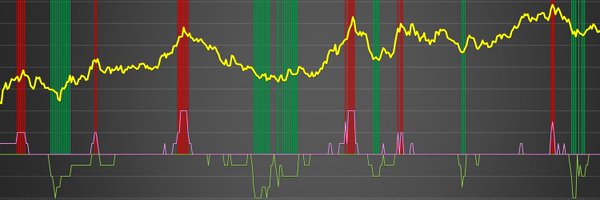

What, you ask? Bitcoin technicals (the ones that actually have a track record) Bitcoin orderbooks Bitcoin onchain capitulation Crypto Fear & Greed Aggregate altcoins technicals Aggregate altcoins onchain capitulation Stock market Fear & Greed Social media sentiment-

One data point in your favour can be a coincidence, or too early. The majority of the best data points all lining up together this week is probably not a coincidence.

3

3

62

There is a reason why the wicks are at the daily bottoms. Books are stacked, and bears are facked.

11

18

201

Bitcoin ETFs are capitulating again. What a track record.

1

9

100

Phrases we are unlikely to hear in 2026: K shaped economy Business cycle doesn't exist anymore Breadth is narrow/weak

3

3

48

The Hindenberg Omen has gotten a lot of eyeballs on social and mainstream media recently. It shows we still have a massive wall of worry. There have been many bullish quant studies in the last 6-8 months, including the Zweig breadth thrust, that didn't get anywhere near the same

1

3

43

Phrases we are unlikely to hear in 2026: K shaped economy Business cycle doesn't exist anymore Breadth is narrow/weak

3

3

48

What a reversal from the crypto/bitcoin equities from earlier today!

2

3

55